Vee Finance Hack, and what we know

For all those that were unfortunate enough to have slept through this, my condolences.

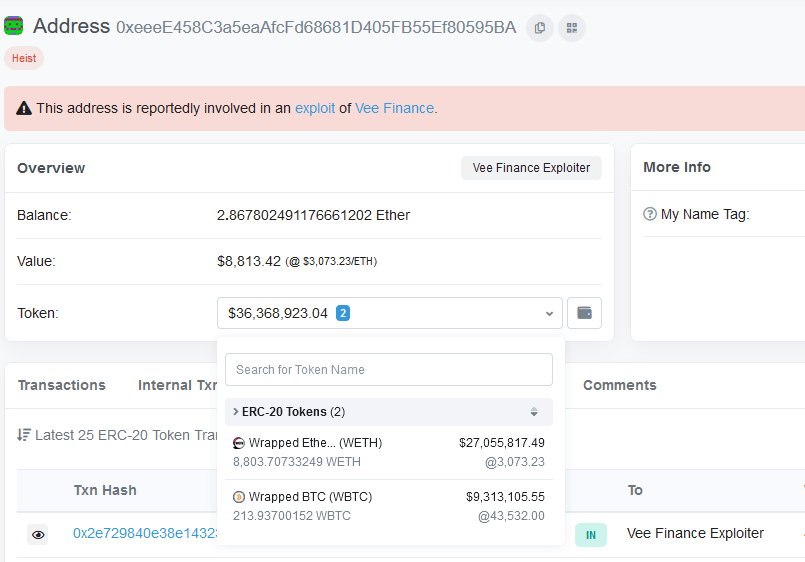

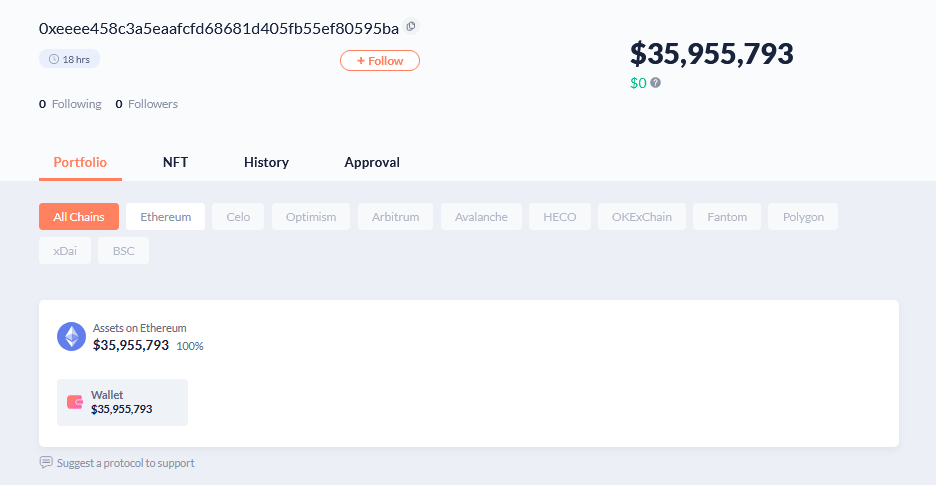

Fortunately, they were a somewhat new project, but, they still had $300m TVL. With the attacker taking off with approx $35m~ in crypto.

In this post

Brief Overview

- Vee Finance’s borrowing contracts were drained.

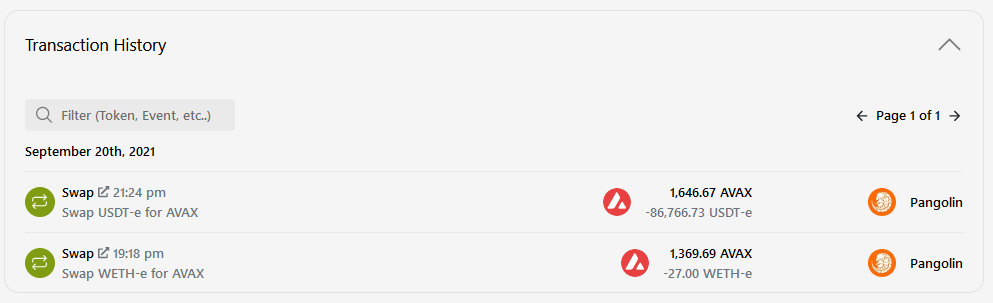

- The attacker drained the BTC & ETH pools.

- The funds were then bridged to Ethereum.

- Vee Finance team were unresponsive during attack.

- All contracts have been suspended since the attack.

Concerns raised prior to attack

Yield Yak was contacted to integrate Vee’s farms. At which point, YY expressed concerns about Vee’s contracts.

The contracts were closed source. Unlike most in the space. More worryingly, they took “strange steps in their approval process,” according to a developer.

The hack begins

Hackers made $36m+

And all in a matter of moments.

Stablecoin sector is safe for now

According to Vee, the stablecoin farms are unaffected.

Vee launches a potential bounty program

Hopefully the hacker will come around, return funds, and collect their bug bounty. No one likes a party pooper.