5 reasons to be very optimistic about the Pangolin DEX (PNG)

Pangolin is a Community-Driven AMM (automated market maker) in the model of Uniswap that allows users to swap tokens from the Avalanche and Ethereum blockchains with security in a permissionless way.

Bellow I’m going to explain 5 reasons why I’m very optimistic about the future of this Decentralized Exchange:

- Gold standard DEX for the Avalanche Ecosystem

Avalanche had its blockchain launched last September 21, only 2 months after the resounding success of the initial public sale of the$ AVAX, the platform’s native token.

The token $AVAX was sold in the ICO by $0.5 USD and now, only 9 months later, is traded in many different traditional cryptocurrency exchanges like Binance, Huobi and Bittrex at a price of around $27 USD at the moment that I write this article.

Why this huge growth has happened?

This ambitious project wants to create the internet of finance with many projects being built on top of Avalanche, like stablecoins, prediction markets, NFTs, DeFi, ILO and subnets. Subnets have the power to accommodate entire blockchains and also unlock a 700 trillion dollars by tokenizing stocks, derivatives, government debts and real state.

Permissionless blockchains like Ethereum and Avalanche have high demand to trade tokens in decentralized exchanges (DEX), so it’s expected to have these DEX with a high transaction volume, high total value locked, specially with the rise of the DeFi market and here is where the rise of Pangolin seems to be inevitable: Pangolin is becoming the gold standard for DEX AMM on top of Avalanche.

Since it’s launch after only 2 months ago in February, Pangolin has traded more than 1 billion dollars and have a total value locked of more than 200 million dollars.

Promising DeFi projects like Benqi , Avalaunch and Verso that are being built on top of Avalanche has already announced their intention to use Pangolin as a their main DEX.

2. Highly Descentralized

Because of the high fees of the Ethereum network, recently Pancake Swap surpassed Uniswap as the highest 24 hour volume trading DEX, which led us to think, at a first sight, that this AMM that runs on top of Binance Smart Chain could overthrone Uniswap and Ethereum as the standard for respectively DEX and blockchain for the DeFi space.

But wait a minute! Doesn´t DeFi mean decentralized finance?

According to CZ, CEO of Binance, the largest traditional centralized exchange in the world, Binance Smart Chain and its applications like pancake swap, are not DeFi but CeDeFi. The latter would be a kind of centralized DeFi.

Why decentralization matters?

Paraphrasing SEQ, “Decentralization is a key component to what sets blockchain apart from traditional solutions, it increases security, censorship resistance, enables trust and is more inclusive”

In other words, Blockchains that sacrifice decentralization in favor of high speed and low fees might have censorship by governments and regulations as well as remove tokens that one user added.

Permissionless DEX has the great advantage that anyone can list a token.

You can even create your own token and add in a true DEX like Pangolin, if you want.

Bitcoin and Ethereum basically created the current blockchain market relying on decentralization and not by empowering one single entity that can control everything and dictate what can and cannot be done.

Additionally the Binance Smart Chain is a permissioned blockchain that uses a version of a classical consensus protocol , that is known by having high transaction speed, finality of 5s or so but very centralized. Binance Smart Chains have only 20 validators and most of them are controlled by Binance.

Classical consensus can be compromised by an attack of only 34% which makes it very fragile. Just as an example, if nodes that have more than 33% of the stake of a POS blockchain go offline the whole network stops.

The Fantom (FTM) blockchain had an issue like this recently.

Avalanche is built with a new and revolutionary Consensus Protocol.

Unlike the classic consensus protocols, Avalanche can accommodate millions of validators, currently has more than 900 nodes and it’s permissionless.

With the full implementation of the Apricot Upgrade, soon the requirement to run a node of Avalanche will probably decrease from the current 2000 AVAX locked to around 200 or 500 AVAX, which will certainly increase the number of validators for more than 1000 nodes.

3. Quick Finality, low fees and high speed transaction

Avalanche, in addition to being highly decentralized, has a transaction speed of 4500 TPS (transactions per second) in its X-Chain, the exchange chain.

This speed is incredibly higher than that of Bitcoin, with its 7 TPS, or that of Ethereum, with 14TPS.

In fact, Avalanche has even left VISA behind. The card processor reaches approximately 1700 TPS.

Additionally, Avalanche transactions are confirmed in less than 1 second, while in Bitcoin it takes up to 1 hour to be 100% confirmed. Ethereum, at best, takes 14s.

Just try Uniswap on Ethereum blockchain and you will understand why quick finality matters. This AMM sometimes confirms transaction only after one minute with a cost higher than $20 USD for every swap.

Ethereum is struggling to scale because it uses Nakamoto Consensus, like Bitcoin, that is very decentralized but slow by design.

There are many initiatives to improve the Ethereum blockchain like the London upgrade, scheduled for July of this year that will reduce the fees and the full implementation of Ethereum 2.0 that will happen most probably in 1 or 2 years. This implementation will change the network from Prof of Work to Proof of Stake anti-Sybil mechanism and increase the scalability using sharding, that basically will consist of 64 blockchains operating in parallel to increase speed of transaction and have lower fees.

The finality of the transactions, however, won’t be changed and will remain 14s, in the best case scenario.

Another solution to reduce fees and increase scalability that is becoming very popular among the Ethereum community are off-chain solutions that are known by layer 2 because they don’t happen on-chain like the traditional layer 1 of Bitcoin, Ethereum and Avalanche.

Like the classical consensus protocols, layer 2 solutions sacrifice decentralization to achieve high speed, quick finality and low fees.

The most popular layer 2 solution is Optimism, an Optimistic Rollup that will probably be used by Uniswap. However the launch scheduled for march was delayed and postponed to July.

Everyone initially that is using the rollup sends their transactions to a single sequencer who then puts them into a batch and calculates the new state root to be posted on chain.

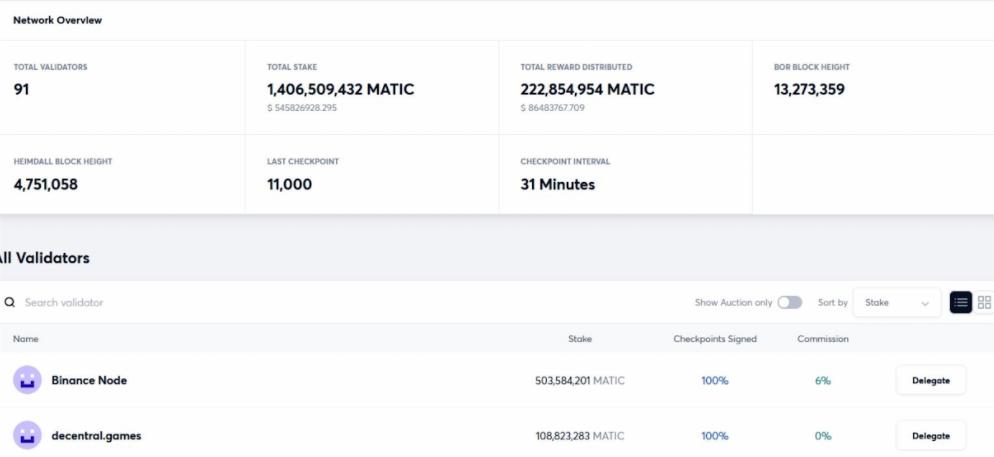

Another layer 2 solution is Matic, now named Polygon, which is also centralized because it uses Classical Consensus, and despite have 91 nodes, Binance node has more than 33% of the stake.

If Binance node goes offline the whole system stops.

What is the Avalanche approach?

The Avalanche DeFi applications run on the C-Chain, the Avalanche smart contracts chain that is full compatible with the Ethereum Virtual Machine (EVM). This chain confirms transaction with less than 3s, with the majority of transactions happening with less than 1 second, 200 TPS speed of transaction and low fees of about $1 dollar. Soon this fee will stay even lower with the implementation of Dynamic fees scheduled for Q2 2021.

These features make Avalanche the perfect blockchain solution to built DEX on-chain (layer 1).

If decentralization really matters I believe we should think always on layer 1 solutions first.

4. PNG token rewards increase

Community driven means that there isn’t one single entity or group as a decision maker of the project.

Pangolin was developed in a joint effort of some developers, including Ava Labs software engineer Connor Dally.

So we can say that Pangolin has the support of Ava Labs, the company behind the Avalanche blockchain.

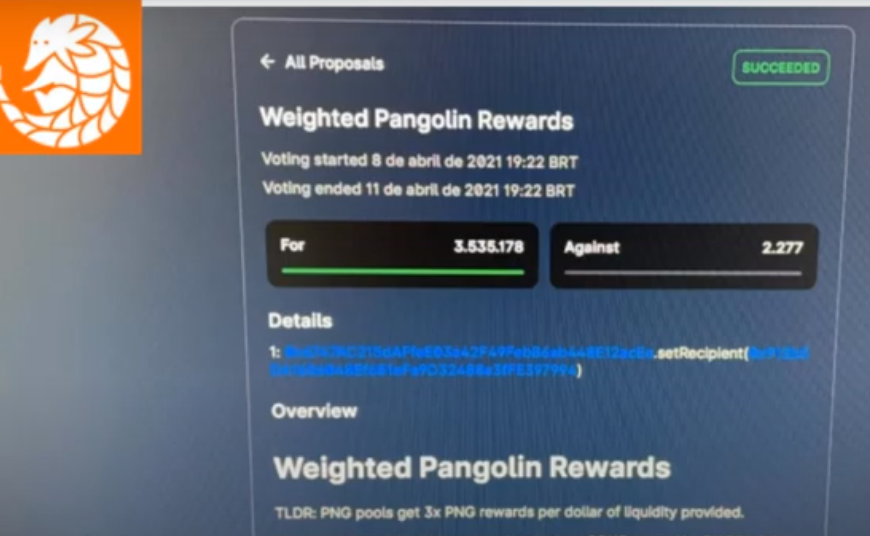

However, only 2 months after launch the governance is live and now the DEX is already governed by the community.

The first proposal was already approved and the pools that have the PNG, the governance token, will reward the liquidity providers 3 times more than pools with non PNG tokens, in order to incentivize people to hold te governance token but also keep attracting more liquidity to the DEX.

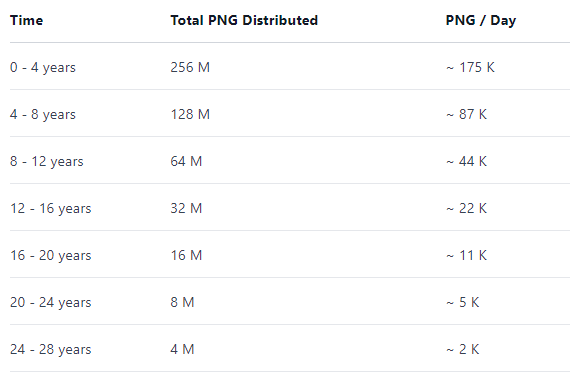

According to the Pangolin litepaper, the incentive for liquidity providers will last 28 years and 95% of the supply is reserved for liquidity mining to incentivize liquidity providers and facilitate the sustainable growth of the DEX.

The total supply of PNG after 28 years will be 538 million tokens.

There is currently around 38 million PNG in circulation but in fact 18 million tokens weren’t claimed during the airdrop period. So, as rule of the litepaper these 18 million PNG is in a treasury held by the community.

Considering the current value of the PNG at around $2 USD, the community has $36 million to use to hire developers, list the tokens in traditional exchanges or whatever be decided and voted by the community through governance.

Currently the only way to purchase the governance token PNG is in the Pangolin Exchange but soon it will be available in many different exchanges.

5. Full compatibility with Ethereum (EVM)

Avalanche has full compatibility with all the tools of the Ethereum, including metamask.

As an example, to use the Pangolin exchange, currently one needs to set up Metamask for the Avalanche blockchain and then connect the browser wallet to the DEX.

It’s also possible to trade ETH and all ERC 20 tokens in Pangolin.

To start swapping on Pangolin you need to send AVAX from the Avalanche C-Chain to the Metamask customized for Avalanche or send the ETH or ERC 20 tokens using the 2 way Avalanche-Ethereum bridge.

Pangolin is on its way to become one of the main DEX of the DeFi space.

Disclaimer: The content of this article is not intended to be financial advice.

The author of this text holds PNG.

![]()

5 reasons to be very optimistic about the Pangolin DEX (PNG) was originally published in Avalanche Hub on Medium, where people are continuing the conversation by highlighting and responding to this story.