An *INSIDER* Look at BenQI

The name has been thrown around quite a bit recently. BenQI …

Lending. New Defi. *Magical*. But, the app has been reserved for Beta testers thus far. And, although BenQi’s homepage has a big launch app button, it doesn’t actually send you anywhere. Well …

A little investigative journalism never hurt anyone. “Someone who isn’t me” sent in some images from inside the app. Source: can’t remember.

BenQi Lending

In this post

This is the BenQi magic people are raving about. Here’s what we got a look at.

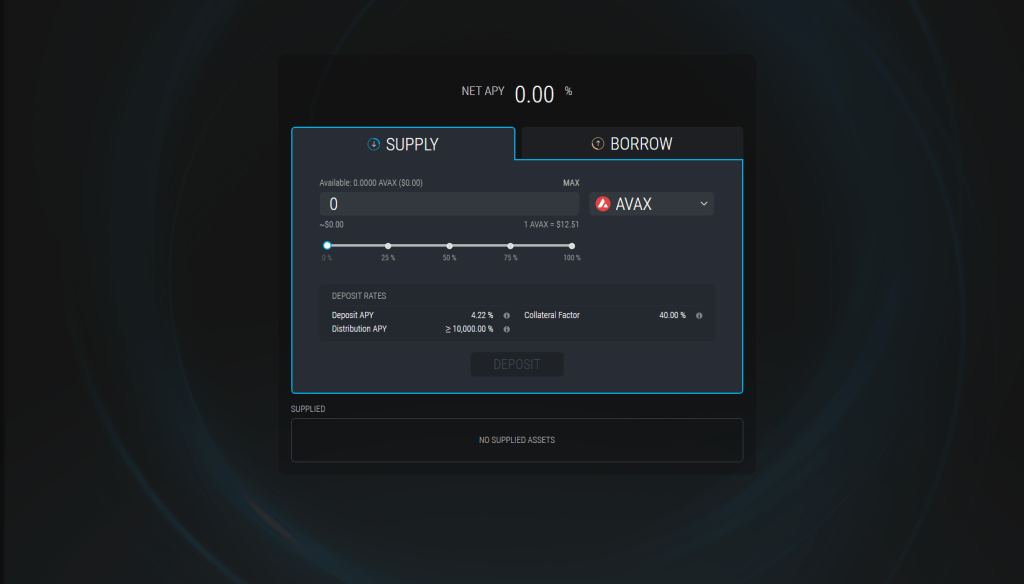

Supply panel

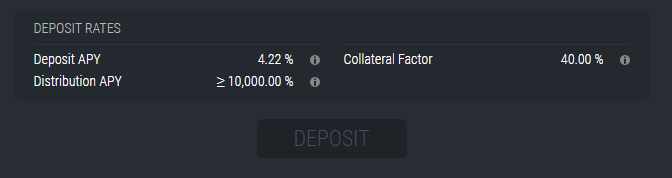

BenQI requires you to supply assets as collateral. The collateral factor indicates how much you can borrow with your collateral.

The above rates are only figurative. BenQi is yet to launch. But, gives some indications on expectations.

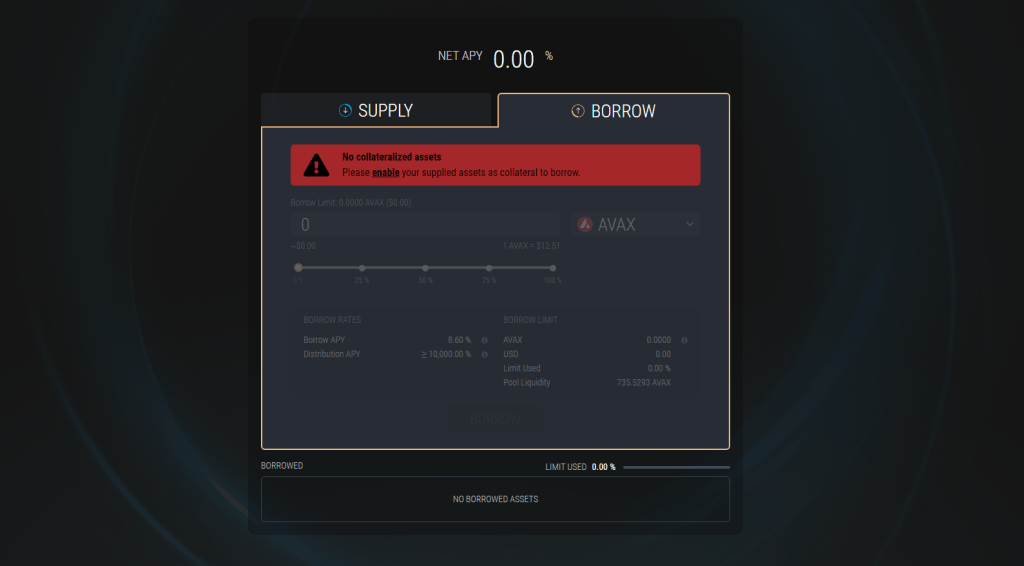

Borrowing Panel

This is where users will be able to borrow cryptocurrency. It will require some collateralization. Supplied in the previous supply panel.

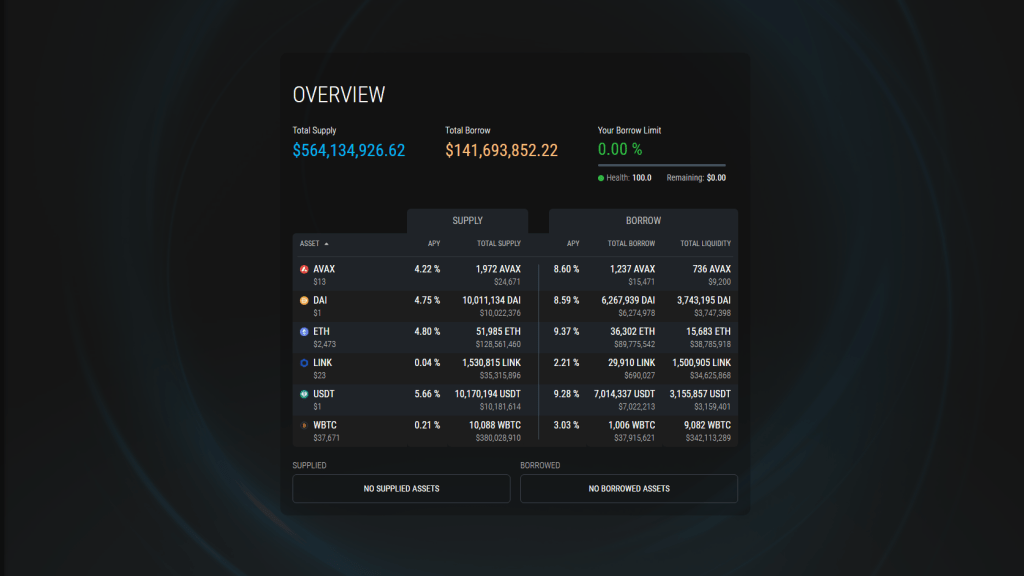

Overview section

Markets supported by BenQi. There will be AVAX, DAI, ETH, LINK, USDT, and WBTC. All wrapped by BenQi. Introducing new tokens qAVAX, qDAI, and so on.

This also gives you a simple way to view which assets you’ve borrowed.

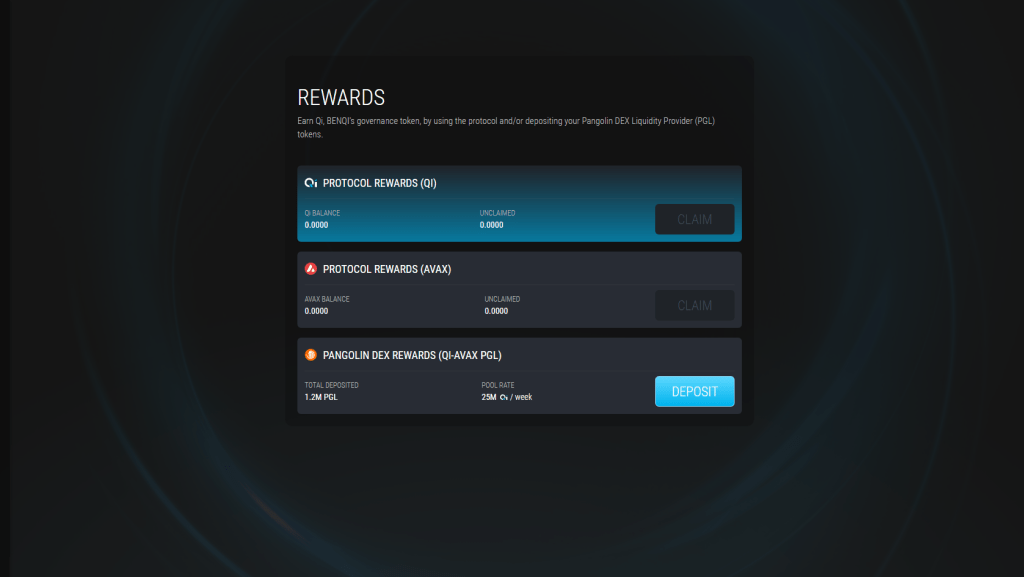

QI Farming

QI rewards. QI rewards will be paid out to the users. Of which most QI will be released through liquidity mining rewards. 45% rewards are allocated for this. QI, if you aren’t already aware, will be BenQI’s native token.

AVAX rewards. Clearly, AVAX will be paid out too.

Pangolin LP rewards. It’s interesting that there’s a PGL farm already mentioned here. Pangolin looks as if they’ve already partnered.

Got any more juicy info on BenQi? Be sure to reach out to us and let us know!