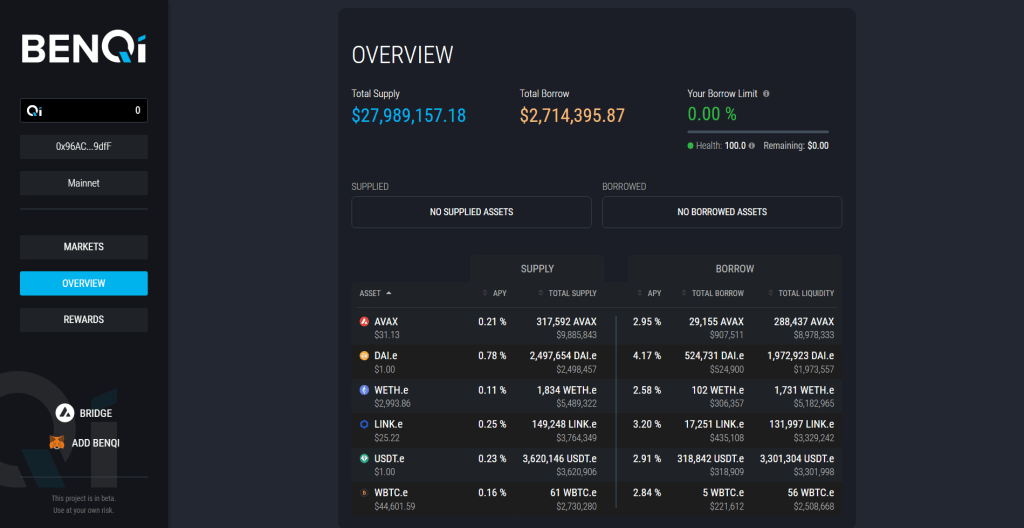

BenQi has arrived. Bringing lending, borrowing, and serious liquidity

BenQi is Avalanche’s long awaited lending protocol. The first in the ecosystem. With it, BenQi is pulling huge swathes of liquidity.

We managed to get a little inside preview of BenQi before launch. And later, an interview with Rome BlockChain labs co-founder, Alex Sulz.

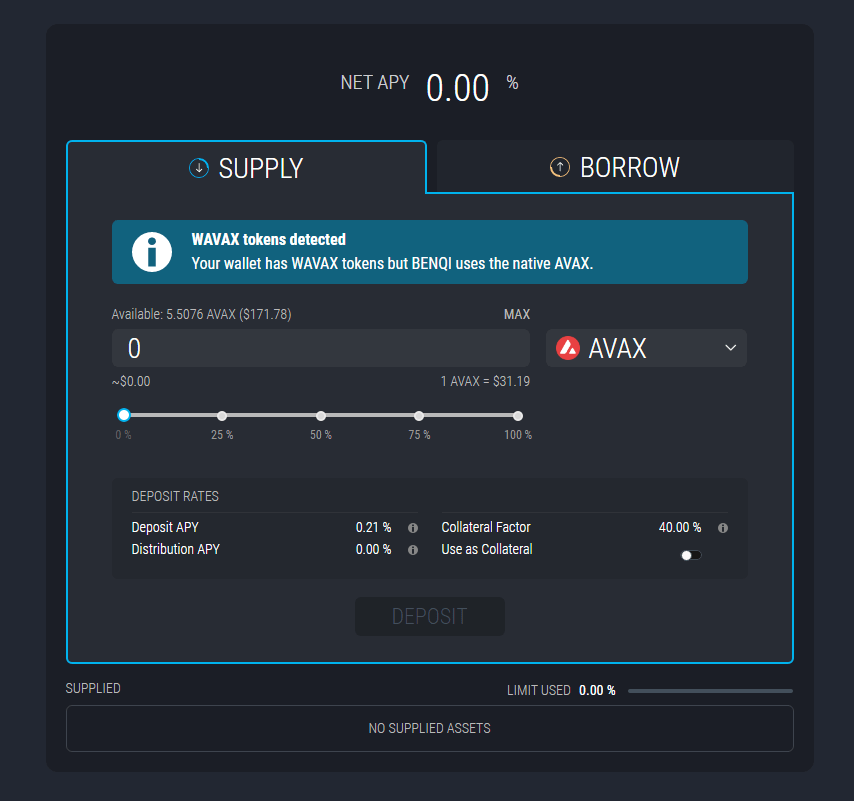

BenQi is pretty simple. You can deposit crypto as collateral. Then, you can borrow funds as per your risk appetite. So you can leverage up on your trades.

By borrowing funds, you can increase your exposure to the up-side of your trades. But, be aware that leveraging your holdings can cause losses too. If your losses begin to near the value of your collateral, you will be liquidated. This protects lenders and borrowers from trades that have gone awry.

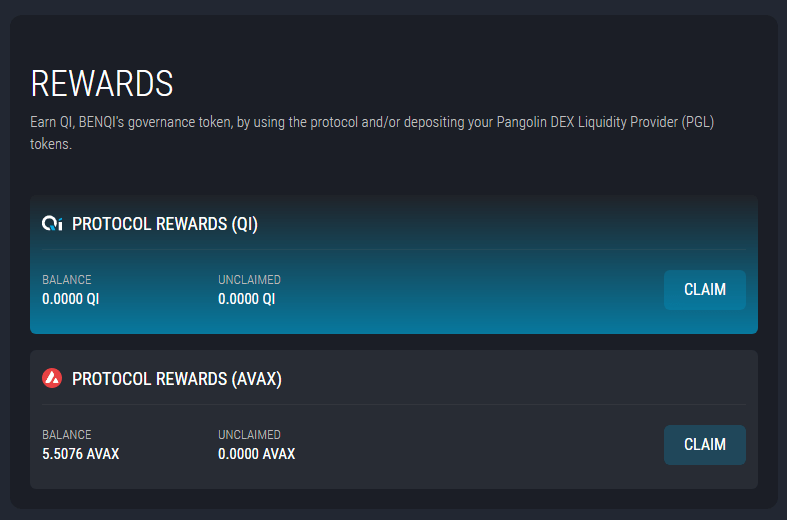

On the flip side, you can also lend your funds to borrowers. And earn rewards by doing so. This process takes in Pangolin liquidity pairs. Which, pay out Qi as a reward.

Note, you can earn Qi rewards by simply using the protocol. Qi tokens are pretty rare at the very moment. There is no liquidity on Pangolin. But, there will be an influx as the protocol generates.

Rewards will be issued soon. You can already lend and borrow assets on BenQi.