There’s a reason why Yaks are used to scale mountains

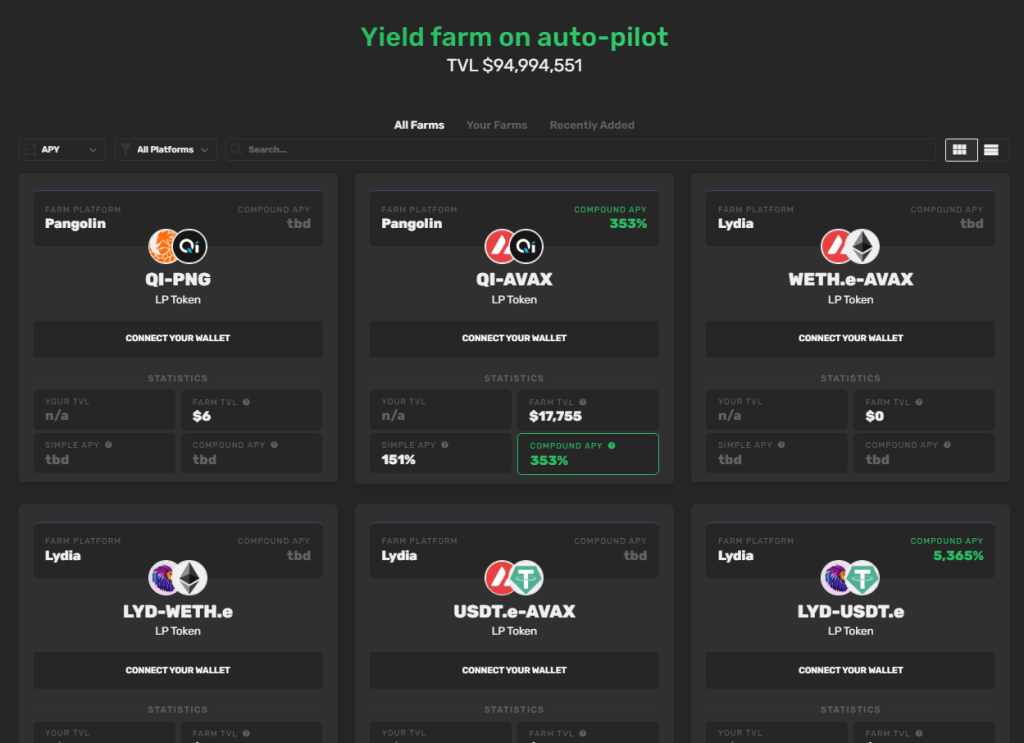

Simple: They’re pretty good at it. See, Yield Yak is nearing $100m in TVL. Over triple it’s TVL before their token launched.

Yak’s token has skyrocketed

In this post

Yield Yak’s token price has also flown up in value. With lows of approximately 400-500$ growing up to over $8000. All in a under a fortnight.

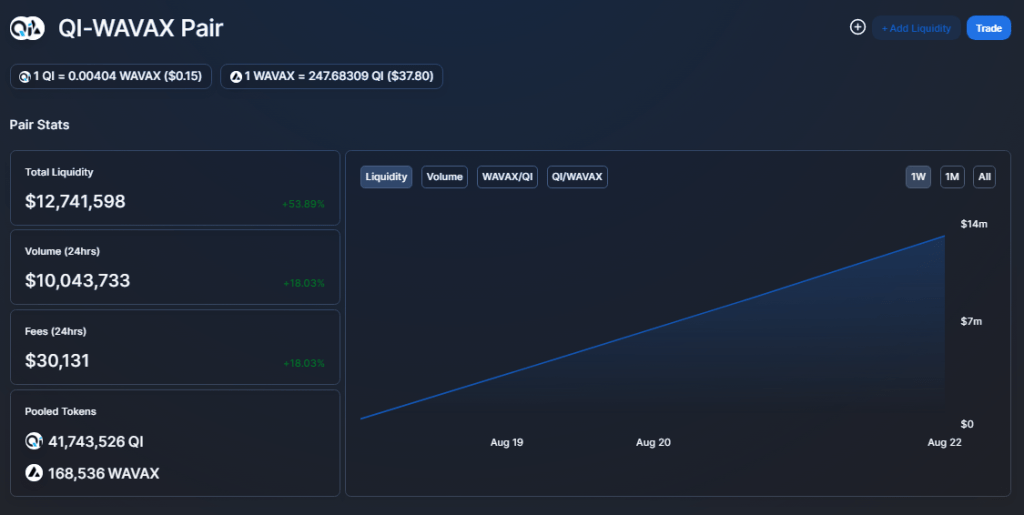

QI pairs?

There were rumors’ that the TVL will further skyrocket for Yield Yak. As the word “QI” was thrown around a lot.

Yak, whilst this article was being written, just integrated BenQi‘s Pangolin liquidity pairs.

Though, they’re yet to react. And farm rewards will be high for first entrants.

Not sure what Yield Yak is?

If you’re stuck, and don’t know what we’re talking about: Yield is the main “auto-compounder” on Avalanche.

They take in LP tokens, distributed from multiple Avalanche exchanges; Pangolin, Trader Joe, and Olive, to name a few.

Then, they pool them, together, and automatically compound them as one. Reason being:

It reduces fees for everyone involved. And, everyone with tokens in the compounder earn more.

Yield Yak’s growing competition

Well, they aren’t the only ones fighting for the compounder space. There’s Cycle, Penguin, Lydia (somewhat), and Snowball.

All of whom are doing bits to claim their share of the Yield Optimizer market on Avalanche.

In other news

Trader Joe smashes through 50m$ TVL

Huge growing support for JOE as ETH money flows in.