Platypus Recap: The 2022–2023 Transition

Here’s the scoop on all the stuff that went down in December 2022 and January 2023.

We’ve had a ton of updates over the past two months, so we’ve compiled them all here for your convenience. Keep an eye on the second section to stay up to date on all the technical developments we’re working on!

Product Updates Recap

The Unveiling of USP

Platypus is introducing USP, its own native stablecoin. This USD pegged, over-collateralized coin provides an extra layer of protection from the volatility that other stablecoins may experience. To ensure the price of a stablecoin remains stable, collateral is necessary and USP has this covered.

We’ve found a way to combine stableswap and stablecoins to maximize capital efficiency. It utilizes stableswap TVL as LP collateral and the stableswap algorithm to maintain peg. It also has liquidation routing, allowing it to liquidate collateral to any other stablecoin apart from USP.

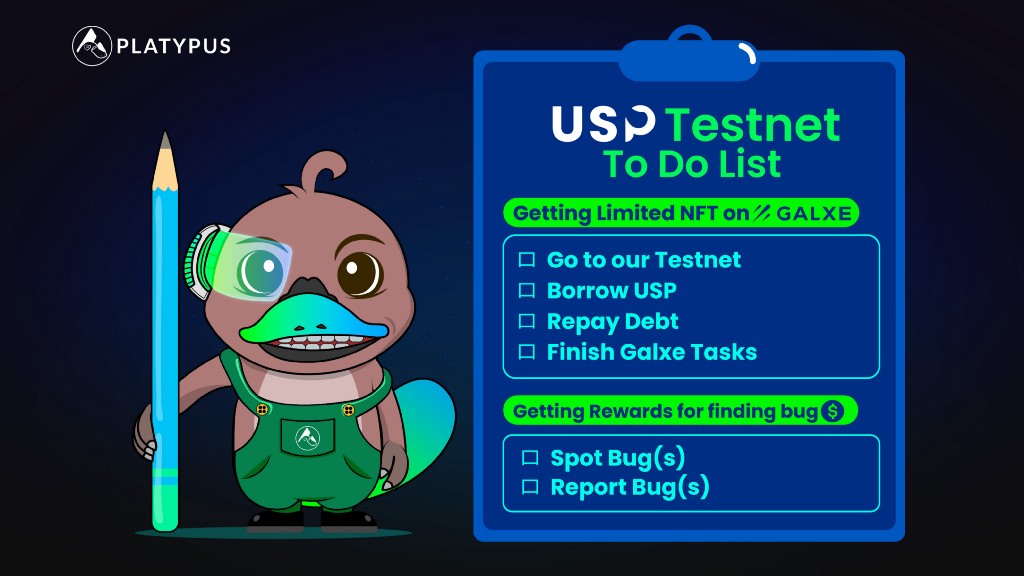

The Testnet Launch

On December 28th, 2022, the USP testnet was officially launched, allowing testers to try out the features of the platform, such as minting, adding collateral, borrowing USP, and repaying debt. Thank you to all of our testers for taking the time to share your valuable feedback and suggestions with us. The input is crucial in helping us improve and make our product even better. As a reward for participating in the testnet, testers were given a limited edition GALXE NFT.

The New Locking Model

A new model has been introduced that allows users to instantly gain vePTP for specific time frames. The max cap for staking has been increased from 100x to 180x, and users can also extend their locking period to obtain more vePTP.

This update allows both new and existing users to benefit from an expansion of services. New users can be onboarded more easily, while existing users can now earn more vePTP by staking for a longer period of time.

Hummus Airdrop Arrangement

Hummus, the Platypus fork, is offering an airdrop to vePTP holders! 10% of the total HUM supply will be set aside for our token holders and will be distributed bi-weekly over the course of 24 months. The first snapshot will be taken on February 6th at 9am UTC and the airdrop’s vesting will begin the following week.

Fee Sharing Plans

As of January 2023, we have accumulated a surplus of two million dollars, which we have not yet distributed to our users in the first year in order to ensure the pool’s financial stability. Now that we are entering the next phase, we have shared our plans for how we will use any remaining funds.

The surplus we have will be split between our pool and our users. 30% of it will stay in our asset contract to make sure the pool is financially secure, and the other 70% will be given out to our users. The details of the airdrop will be communicated shortly.

Listing of ankrAVAX Pool & axlUSDC Pool

ankrAVAX and axlUSDC were made available on our platform. We are confident that they will be great additions to our platform and will provide our users with an even better experience.

Development In Progress

Dashboard Update

On February 6th, 2023, USP will finally be revealed to the world. We’re currently updating the new USP page in dashboard for optimum user experience.

A new page is being created to display the USP market capitalization, daily USP cost, daily USP supply, daily fees generated from borrowing and liquidation, daily collateral value in US dollars, and daily collateral rate.

New Forum

We will begin creating a forum for our community members to converse about various topics with ease.

More to Borrow

Our platform will soon be offering BTC borrowing. This exciting development will give our users the opportunity to take out loans using this popular cryptocurrency as collateral. We are looking forward to providing this new service.

Platypus Recap: The 2022–2023 Transition was originally published in Platypus.finance on Medium, where people are continuing the conversation by highlighting and responding to this story.