Cross Chain Plans & The Hunt for Yields

Over the past few weeks due to a number of factors we’ve been unable to run our core-strats while also being blocked on deploying a number of other strategies which we have in the pipeline. A number of these issues seem to be due to the current state of the DeFi within Fantom.

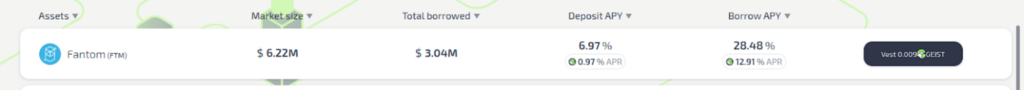

Borrow Rates — Recently we’ve seen quite a large drop in FTM liquidity available to borrow along with quite high borrowing rates. Likely driven by a combination of dropping prices, potential high amounts of shorting. For our core strat for assets other than $FTM these high borrowing rates greatly reduce the profitability of our core strat.

* Liquidity of FTM on GEIST, where utilisation is almost 50% with only $3M of available liquidity meaning if we were to borrow more the borrow rate could easily get pushed up to 40%

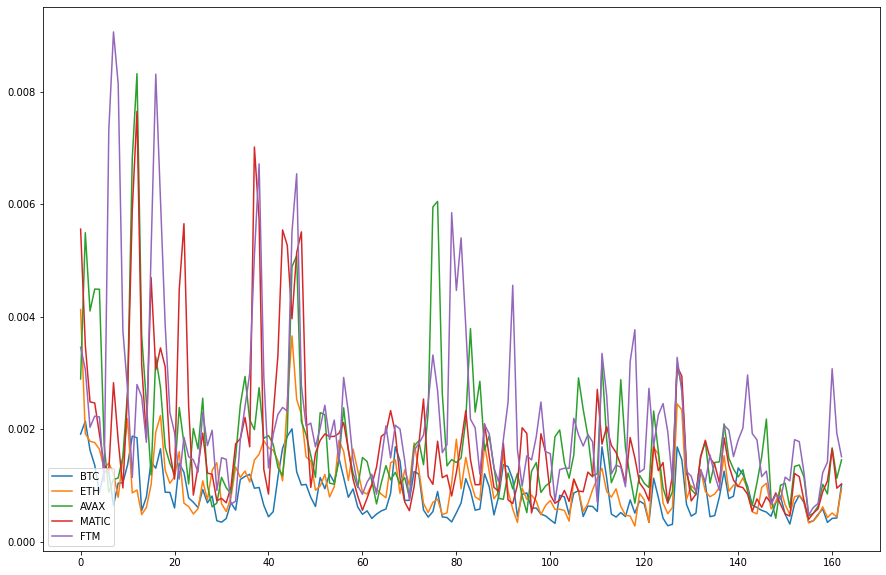

High Volatility — As shown in our modelling and simulations our strategies are not perfectly hedged but instead are pseudo delta-neutral. With some minor exposure to IL during very volatile periods.

* comparison of volatility of different assets (taking running se of prices over 7 day period for past 18 months)

The above shows that $FTM has much higher volatility than other assets such, with volatility being quite correlated but $FTM having much higher spikes. This means during volatile periods delta-neutral strategies which utilise $FTM are at higher risk of drawdowns.

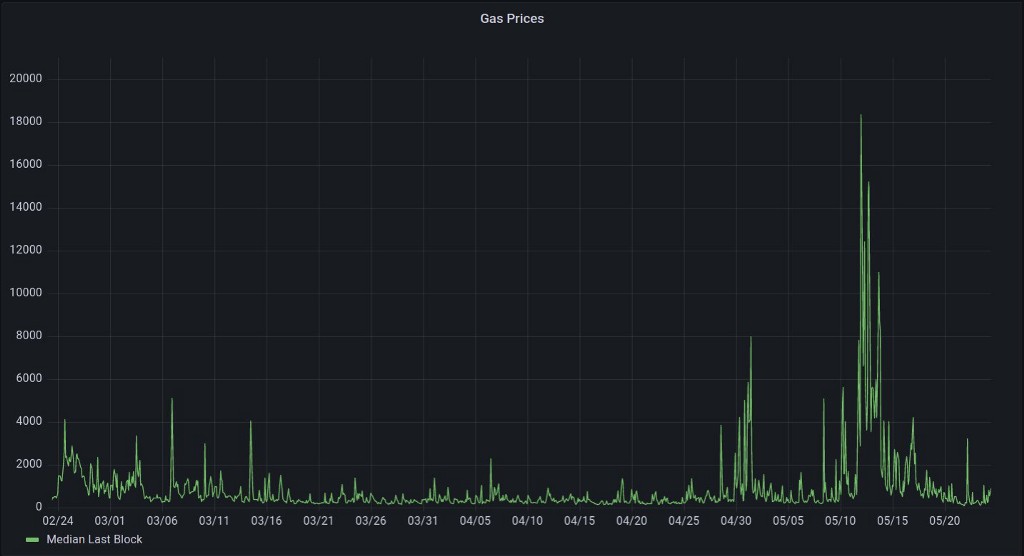

Gas Spikes — Finally from our experience gas spikes on Fantom can be quite extreme during extremely volatile periods. With gas prices reaching over 100X the gas price during normal periods. This makes it quite costly for our strategies to rebalance in addition to adding more risk of rebalances not being finalised due to extreme spikes in the gas prices.

Cross Chain Experiments

Over the past few weeks we’ve been testing the waters on other chains running our delta-neutral strategies in test USDC vaults on Avalanche, Arbitrum, Optimism and Polygon.

We’ve had some quite promising results from these tests especially given the extreme volatility experienced in this period.

Gas Spikes — The first takeaway being that the gas spikes during the volatility were quite moderate relative to Fantom. Possibly due to less leverage and less competition for liquidations & battles for arbitrage opportunities that follow. This is quite promising in terms of confidence in ensuring our keepers can reliably rebalance positions when needed on these chains.

(note this is from a relatively small sample so is no means definite & as conditions change this may no longer hold)

Volatility / Borrow Rates — As shown above the volatility of AVAX, ETH & MATIC are all lower than FTM. As our delta-neutral strategies which we’ve been testing on other chains utilise one of these assets paired with USDC less volatility means less exposure to risk of drawdowns. Additionally for these assets the borrow rates are much lower & less volatile reducing the cost of running our core strat.

L2 Quirks — We’ve discovered some quirks with how the L2’s adopted the EVM spec, which will require some upgrades to our custom keeper and logging infrastructure. The First thing we needed to do is deploy API nodes to improve the RPC throughput. We have an optimism node live and the Arbitrum node is in progress. The nodes and upgrade will need testing, we expect public L2 deployments to lag the Avalanche, Polygon and other L1’s.

Returns — Over the period which we’ve tested results have largely been positive despite the extremely high volatility over the past few weeks. With some interesting results.

On Avalanche when the price of AVAX dropped from $22 to $15 the vault experienced minor drawdowns, then quickly recovered as volume picked up when prices stabilised. This primarily was driven by quite high volume leading to high fees on the LP component of our strategy. Interestingly over the past week when ETH dropped from $1200 to $900 our vaults didn’t see such large drawdowns but also didn’t see high bounces. This is likely due to the L2 AMM’s not actually accounting for much volume and largely just following the market price while on Avalanche the LP’s we are using account for a massive share of AVAX / USDC volume.

Overall given the volatility we’ve experienced over this testing period the APR’s we’ve observed have been quite promising ranging from 5–10%+ while operating at a safe collateral ratio of 35% meaning there is room to increase these yields as we allocate a higher proportion of the strategies funds to providing LP.

What’s Next

Given the above our plan is to focus on deploying our delta-neutral strategies on these chains. To start we’ll be deploying on Avalanche (aiming to go live in the next few days with a USDC vault running our core strat with a $1M TVL cap to start / we’re just doing final checks to be confident everything is safe & robust before making these vaults public) followed by Polygon while we also do some development work to make sure our keepers can function reliably on both Arbitrum and Optimism given the additional complexities involved. For our vaults on Fantom given the current market conditions we’ll continue operating these vaults primarily with less complex strategies until market conditions become suitable for us to deploy our delta-neutral strategies.

One great takeaway is that as we move to other networks with less volatile LP pairs along with what appears to be less volatile gas prices we can be much more confident in how robust our strategies and keepers are having built up both to handle periods of high volatility and high network congestion on Fantom.

Other Strategies

Outside of the core strat we’ve also got a number of other strategies which are very close to going live

Joint LP : Our joint LP strategies are ready to be deployed however similar to our core strat the high volatility over the past few weeks has meant we’ve put deploying these strategies on hold. However given the promising results we’ve had with our core strat on other chains we’ll be looking to deploy our joint LP strategies on these chains. Additionally we’ll be looking to finalise a version of our joint LP strat which utilises Curve LP’s for stable assets

General Hedged LP : For the same reasons as our Joint LP we’ve also held off on deploying this strategy, however once we’ve had our core strat up & running on the other chains we’ll look to start running this strategy where it can potentially outperform our core strat.

(more info on joint LP & general hedge LP strats here)

Proxy Vote : We anticipate vested escrow models to continue in popularity, to allow our users to participate in ve models we have built a simple voter proxy, inspired by Yearn’s VoterProxy. Our Proxy has an additional feature, multiple strategies can deposit and benefit from the boosted rewards. The multi-strategy voter proxy will allow us to collaborate and partner with other protocols. Exactly what this looks like is still in the works but we will have a lot of flexibility. Let’s kick this off with veHND: https://github.com/RoboVault/hnd-ve-proxy, deployments coming to chains near you!