Alternative Pool 101

So, youâre into drilling down to first principles, eh? Hereâs all you need to know about the Alternative Pool.

We have recently announced the launch of our new Alternative Pool with a quick rundown on what it is and some examples. If you want to know more, youâre in the right place! Before we can truly appreciate the function of the Alternative Pool and the problems it solves, letâs do a quick recap of our previous pool design.

Platypusâ Asset-Liability Management (ALM)

Asset-liability management was introduced to stablewaps by Platypus as a solution to various shortcomings of AMM protocols at the time. Being the pioneer of this concept in DeFi, we are the first to provide an advanced system that our users enjoy today.

Unlike other stableswaps where liquidity providers (LPs) are required to invest a pair or a bundle of tokens, our design made way for the single-sided liquidity provision where users can reap returns with just one token. Platypus is the first of its kind to use a single-variant slippage function instead of invariant curves. This eradicated problems users faced, such as impermanent loss and high slippage.

As we continue to build on this excellent foundation, we aim to diversify the pools on our platform to expand your choices and opportunities.

So, what is the new pool for?

Platypus is expanding, and for the first round, we are listing trending coins such as MIM, UST and FRAX. Our community can expect to see more additions in the future.

Stablecoins are not all created equal. Compared to other cryptocurrencies, stablecoins do not suffer from a rollercoaster of volatility like Bitcoin or Ethereum, since centralized stablecoins are backed by fiat currencies, commodities, or cryptocurrencies. However, some stablecoins are decentralized. They use algorithms and smart contracts to maintain value, and thus, there are differences in terms of the risk of being thrown off its peg.

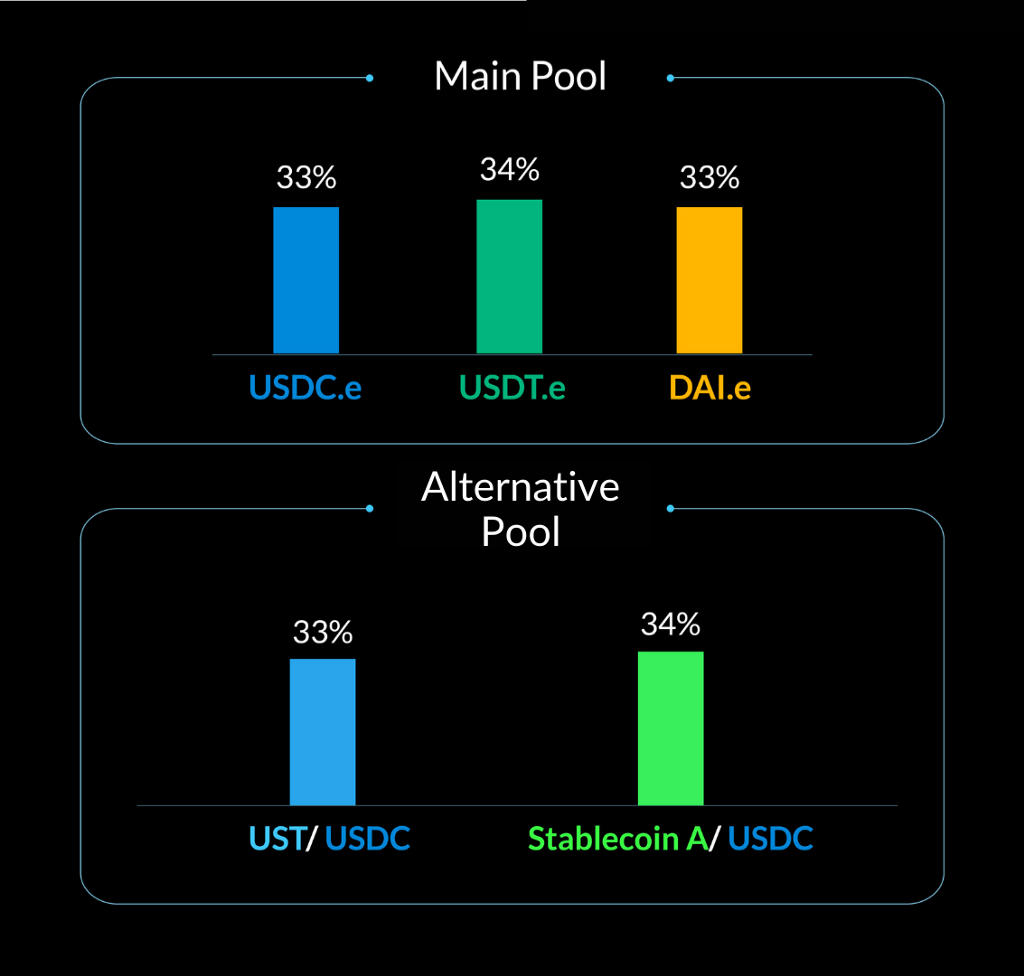

Differences in risk levels can affect other stablecoins within a pool. If we put all assets together in one pool, managing risks would be quite a challenge. Currently, we only offer established and time-tested stablecoins in our pool, namely, USDC, USDT, USDT.e, USDC.e, and DAI.e. We call this pool the Main Pool.

Adding new tokens to the pool (possibly more volatile ones) could adversely affect established and time-tested stablecoins. To protect our users rooted in the Main Pool, we have devised the new Alternative Pool, and thatâs where the newcomers will live.

What kind of risks are we talking about?

As mentioned previously, some stablecoins are more volatile than others. There are chances of one asset being briefly pushed off its peg, as with the panic with Abracadabraâs MIM algorithmic stablecoin back in January 2022. Luckily, MIM got back to its feet and is now working its magic again.

Platypus is always on top of issues within the world of DeFi. We constantly finetune our protocol to address adversities and protect our users.

The Alternative Pool is designed to add new stablecoins for users to enjoy while protecting the whole pool if one of the tokens falters temporarily. The goal is to keep assets from being thrown into flux in case one of them collapses.

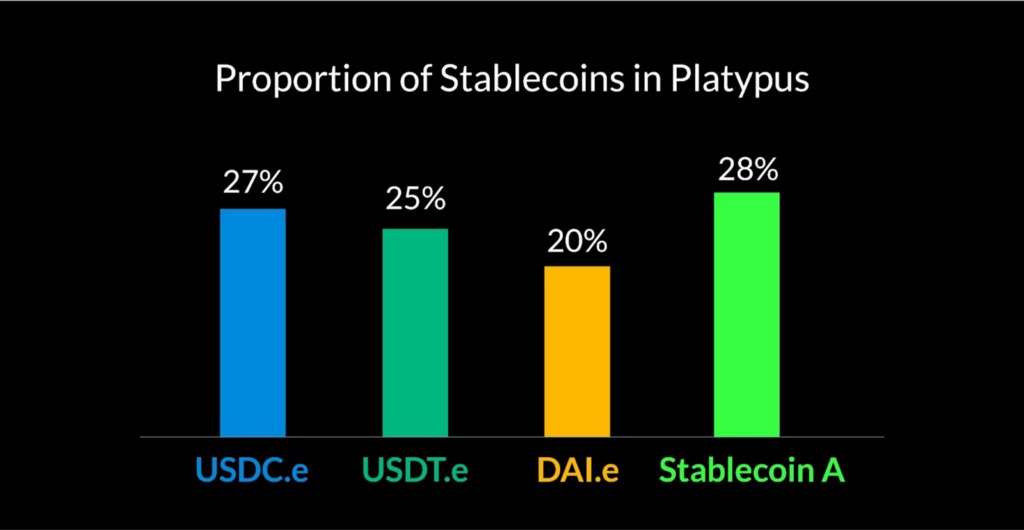

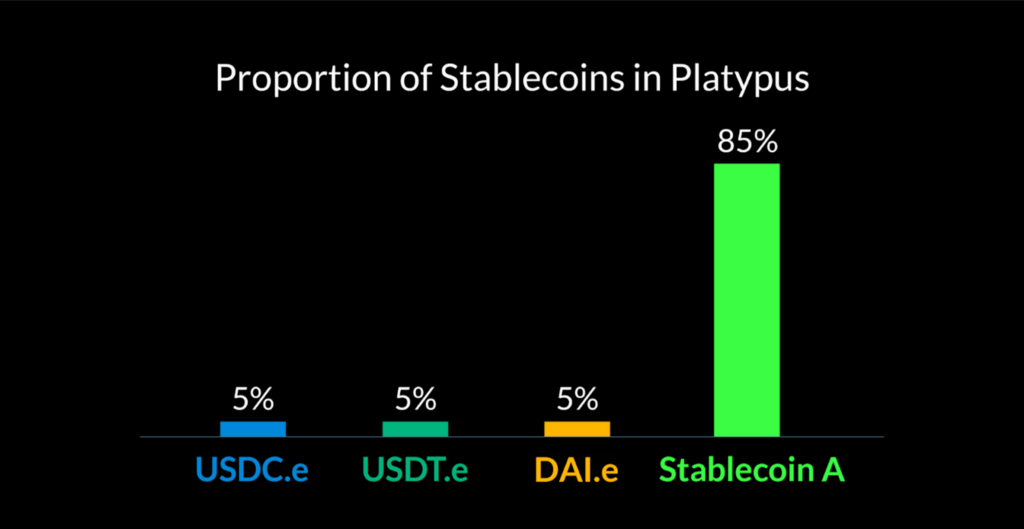

Letâs portray it visually, shall we? Below is an illustration of stablecoin proportion on Platypus.

In the unfortunate event that Stablecoin A loses its peg, chaos would naturally happen. Users will start swapping Stablecoin A for other stablecoins that remain pegged. This will create an unhealthy imbalance and put users in jeopardy.

This is one of the worst-case scenarios that we prepare for. With you in mind, we continually innovate our protocol.

Platypus Antidote: The Alternative Pool

Stablecoins on Platypus will be grouped into different pools depending on their depegging risks so that the main pool would remain healthy should smaller stablecoins take a wild swing. New stablecoins will be in the Alternative Pool, separated from the time-proven ones in the Main Pool. Ultimately, this solution protects the funds of all Platypus users.

With this, users can become LPs depending on their accepted risk. This opens doors to more opportunities to profit.

What else do I need to know when the Alternative Pool launches?

The Alternative Pool will take on a paired design and maintain the Main Poolâs single-sided liquidity provision and open-liquidity structure. Although you see these new stablecoins are paired, liquidity providers do not have to deposit pairs of assets to the pool to be an LPâââjust one will do.

As you can see from the illustration, each new stablecoin is paired with USDC. USDC here is the routing asset, which weâll explain more in the next segment of this article.

Being in a separate masterchef, the recently introduced Interest Rate Model does not apply to this pool.

Can I swap tokens that are in two different pools?

Yes. As mentioned above, each new stablecoin contains USDC. It will be the asset that links all other assets together to make a swap between different liquidity pools possible. Think of USDC as the routing element. It allows you to swap your tokens for any other tokens within the platform.

For example, you want to swap your DAI.e to MIM. Because they are in separate pools, Platypus will help you swap DAI.e to USDC (the routing asset), then swap USDC to MIM.

The swapping process is straightforward for the users. You donât have to go through the complicated process of swapping to a routing asset then to the token you want. Simply choose the tokens you want to swap, and Platypus will perform the rest for you on the back end. The costs (i.e., gas fee, slippage, price impact) will be higher than swapping within the same pool, as two swaps are happening in one go.

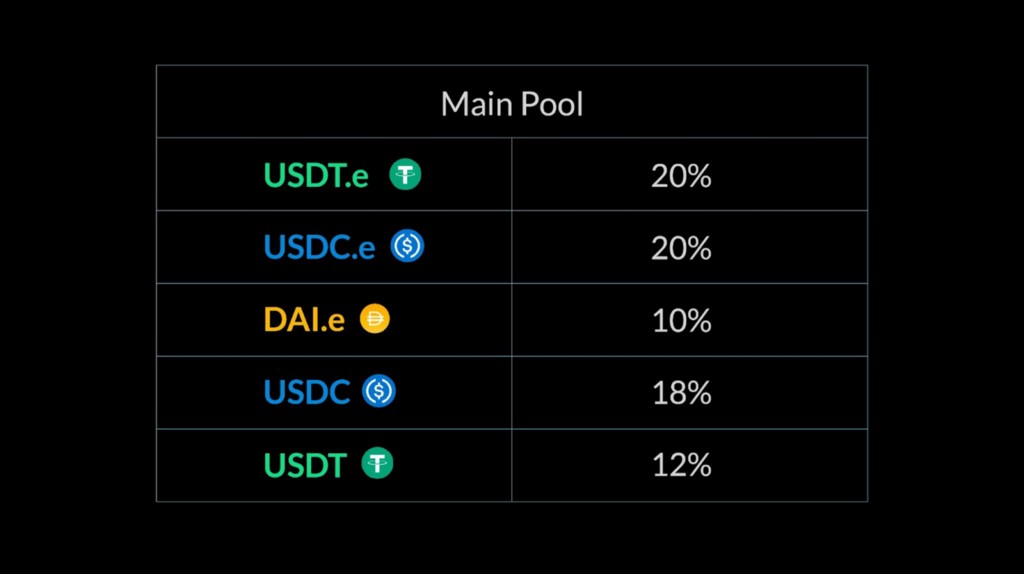

New Emission Allocation

After the launch of the Alternative Pool, the adjusted emission market weights will be as follows:

Note that since the Alternative Pool is a paired design, the emission allocation stated above is the total for the pool. The emission rate is split between each asset 50/50. This is crucial to note if you have provided liquidity single-sidedly.

For example, you have provided liquidity for UST in the UST/USDC pool. Its emission allocation is currently at 12%, where 6% is for UST and 6% for USDC. The emission rate for your deposit is 6%.

Follow Platypus

Alternative Pool 101 was originally published in Platypus.finance on Medium, where people are continuing the conversation by highlighting and responding to this story.