Behind Kalao V2: NFT Liquidity

New Features & their Purpose

In our V2 announcement, we already gave you an overview of our newest features and further improvements which will be added later.

Today, we want to dive deeper and show how they help address existing challenges in the NFT space, mainly NFT (il)liquidity.

NFT Liquidity

NFTs by nature are unique. At least this logic applies to the majority of currently traded NFTs (ERC-721). There also are ERC-1155 tokens which can, for example, represent an in-game item with unlimited quantity like a healing flask. For these, liquidity, in the sense of buy and sell orders, can be aggregated more easily, similarly to order books as these ERC-1155 tokens have fungible characteristics. But let’s look at ERC-721 for now.

Liquidity = ease with which an asset or security can be bought or sold (for cash) without affecting its market price

Fungible tokens

Fungible tokens have several holders. The price you get or pay depends on the marginal user on the buy/sell side. If your order size is large, it will be split over several users on the other side of the trade. This is possible as we can aggregate the token amounts and requested prices of all users on the buy and sell side into an order book. In DeFi we have AMMs, but the idea is the same. The only difference is that the AMM automatically sets prices and available amounts on behalf of the users based on a predetermined logic, such as x*y = k.

Order book example

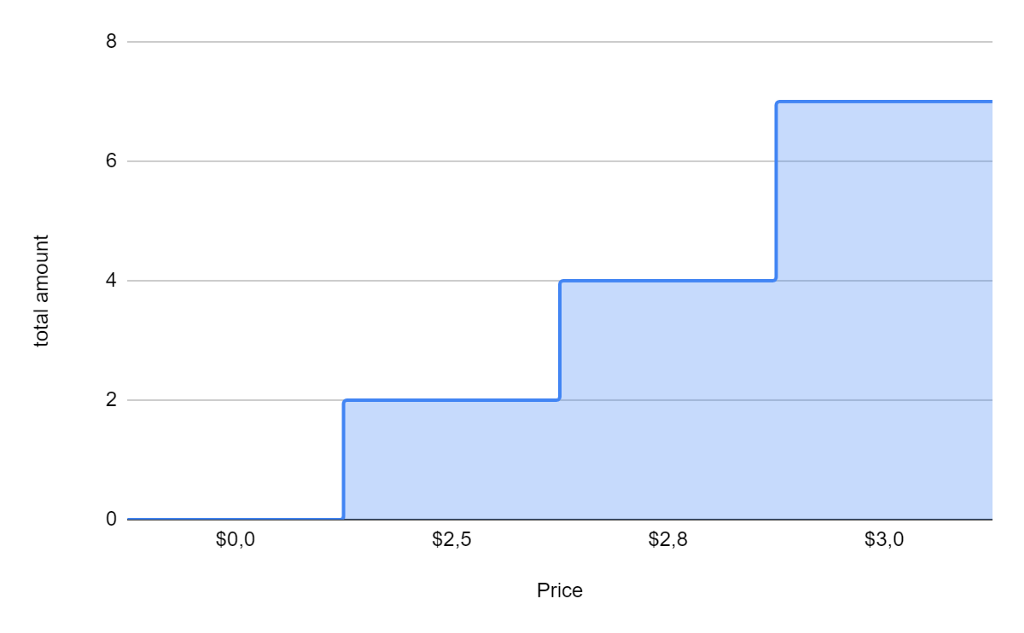

Demand-side:

User A: 3 tokens @ $3 each

User B: 2 tokens @ $2.80 each

User C: 2 tokens @ $2.50 each

The demand curve is the aggregate of individual users and looks like this

A user looking to sell 4 tokens could get a maximum of $11.80 (3 * $3 + 1 * $2,80).

NFTs

NFTs have one holder. The asset is unique and we can’t aggregate the sell side nor the buy side. For sellers, this means the amount of $ received depends on the maximum willingness-to-pay of one buyer, who has enough funds to afford the whole NFT.

The bid price is based on the binary decision (buy or not) of one person. Whereas for fungible tokens, the (average) price depends on the aggregate buy demand over all users, who each make a non-binary decision. Non-binary as they can choose the amount of tokens to buy at different price points. Being reliant on the binary decision of one person will always be more volatile than the sum of non-binary decisions over many people. As a result, sellers face worse liquidity in the NFT market compared to fungible tokens.

The seller also has to make a binary choice, they can’t sell only a share of the NFT. This leads to opportunity costs for them, as they cannot free part of their capital to invest in other opportunities. Buyers have to buy the whole NFT which prices a lot of people out.

On a little side note, this not only impacts liquidity but also the valuation of NFT collections.The question is whether it encourages higher or lower valuations, which we do not have a definite answer for yet. Lower because less people can partake in the market as it’s not possible to buy fractions. Higher because it’s seen as a luxury good that only a limited number of people can afford. For status symbols, empirical data shows that demand can even increase the higher the price. The overall effect on valuation may depend on the price of an NFT collection. Cheap NFTs are already affordable, so the impact is likely limited. For mid-price NFTs, the lower demand likely has more consequences than the luxury good argument, as prices are too low for the NFT to be considered a status symbol. For expensive NFTs, the latter effect may be the strongest at play. Another open question is how the initial price is set and how NFTs reach luxury brand status.

Kalao V2 improves NFT liquidity

Kalao V2 comes with new features that help aggregate NFT demand. Additional features are already on our roadmap for a later release or are currently being explored by the team for product-market fit and feasibility.

Collection offers

With collection offers, users bid on all NFTs within a collection. This essentially allows them to bid on the floor price. Individual collection offers are aggregated, similar to the demand curve in figure 1. This is possible as there is non-differentiated demand in the market. Some users want to buy am NFT from a collection, without having strong feelings about which NFT.

NFT holders looking to sell now have aggregated demand on the other side they can tap into. That’s the minimum price a seller can receive. These are actual bids, not an estimated floor price based on noisy statistics like lowest ask price. Therefore, we can calculate floor price liquidity at price p with quantity q at time t. For example, we can say there’s demand for 3 NFTs at a price of 2 AVAX, and demand for 4 NFTs at a price of 1.8 AVAX.

Trait bidding (coming soon)

While collection offers help aggregate liquidity for floor NFTs, trait bidding combines demand for rarer NFTs. Users can bid on all NFTs with a specific property. Demand of all users is aggregated, which holders of NFTs with this trait can tap into. Compared to collection offers, the demand here is more differentiated, but still shares similarities which we can use for aggregation.

Trait bidding allows us to create a trait-based floor price. Compared to collection offers, trait floors will have lower liquidity as there’s less aggregated demand. On the other hand, there is also less supply (all NFTs vs all NFTs with a specific property).

Collection offers and trait bidding enable demand aggregation, making NFT trading more order-book-like. This also results in a better user experience for buyers, as they can set bids for their favorite NFTs more easily.

NFT recommendations (planned)

With the exploding number of NFTs launches, exploration and curation become increasingly important. Getting the right NFT in front of the eyes of a user increases the likelihood of them setting a bid. In aggregate, this means more demand and therefore liquidity. Kalao will be working on an algorithm which analyzes what NFTs you own and like, what NFTs other collectors who are similar to you hold and what the current market trend is.

Analytics

NFT traders are always on the lookout for new information to gain an edge. Kalao V2 provides advanced insights so traders can better evaluate opportunities. Check rarity scores, NFT collection rankings, top traders or sales histories of collection or individual NFTs. The easier users can explore collections and find the right NFT, the more demand, which has a positive effect on NFT liquidity and trading volume.

Streamlined UX

Another way we are hoping to bring increased trading volume to the platform and the whole Avalanche NFT ecosystem is by providing users with an effortless experience.

- New, completely revamped UI

- Mobile responsive design and a native mobile app coming later

- Express checkout (add-to-cart)

New distribution formats for NFT creators

Launching an NFT collection is a lot of work! With Kalao Go, we already helped tens of creators and teams run successful mints.

In June, we released a new update for Kalao Go, allowing NFT creators to launch with a Dutch auction. V2 makes them available for every user on our marketplace!

Dutch auctions enable better price discovery and prevent gas wars. Moreover, creators rather than speculators can capture most of the buyers’ willingness-to-pay compared to fixed price mints.

Every format comes with their own trade-offs, such as whether there is price exploration, who captures most of the users’ willingness-to-pay (creator or speculators), the risk of not selling out, time sensitivity, how broad the user base or how exciting the mint is. Dutch auctions for example are time sensitive, meaning that users have to be online at one specific time to buy an NFT at their preferred price. They can also lead to lower volumes on secondary markets as the primary sale already captured a lot of demand, leaving less speculative value to flippers. The issue is less pronounced for NFTs with utility, as they have internal value besides a speculative premium.

As all sales mechanics have pros and cons, we want to provide creators with different alternatives so they can find an option that best fits their needs. That’s why we are exploring other distribution formats to release at a later time, such as fixed price auctions with randomized winners and no reserve auctions.

If you are interested to learn more about NFT launches, check out this article by Paradigm.

Kalao V2 is now live.