BENQI — Next Steps

BENQI — Next Steps

From inception, BENQI’s goal is to bridge the gap between Decentralized Finance (DeFi) and Traditional Finance. Crucial elements involved in this were prioritizing security, stability, usability and reduced barriers of entry into Decentralized Finance for the masses.

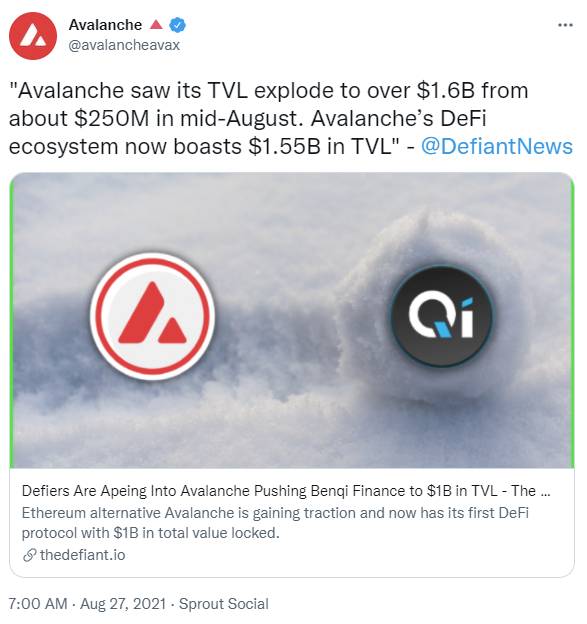

The first step of this vision was with the launch of the BENQI liquidity market protocol on the most scalable and regulatory compliant blockchain network — Avalanche. Since the launch of the protocol on August 19, BENQI has achieved:

- 1st protocol to hit the $1 billion Total Value Locked (TVL) mark on Avalanche

- $2 billion worth of supplied assets in the first 2 weeks of launch

- 13,000+ total unique users

- Peak of 3,000 daily active users

- $1.2 million in 30-Day Protocol Revenue

- 1st recipient of the Avalanche Rush initiative

- 1st protocol on Avalanche to adopt Chainlink’s decentralized price feeds

BENQI’s lending and borrowing protocol filled a crucial gap within the Avalanche DeFi ecosystem by providing a safe, secure and user-friendly solution for users to supply assets to earn interests and/or borrow assets in an over-collateralized manner. With over $2 billion in total assets supplied, and the catalyst for bringing significant TVL into Avalanche, BENQI’s first product has shown clear product market fit.

As DeFi matures and creates inroads into the institutional and traditional financial world, it is imperative that additional decentralized financial solutions are created. This enables diversified yield options, improved risk management, and greater capital efficiency, while building on DeFi’s promise of financial transparency and trust-minimization.

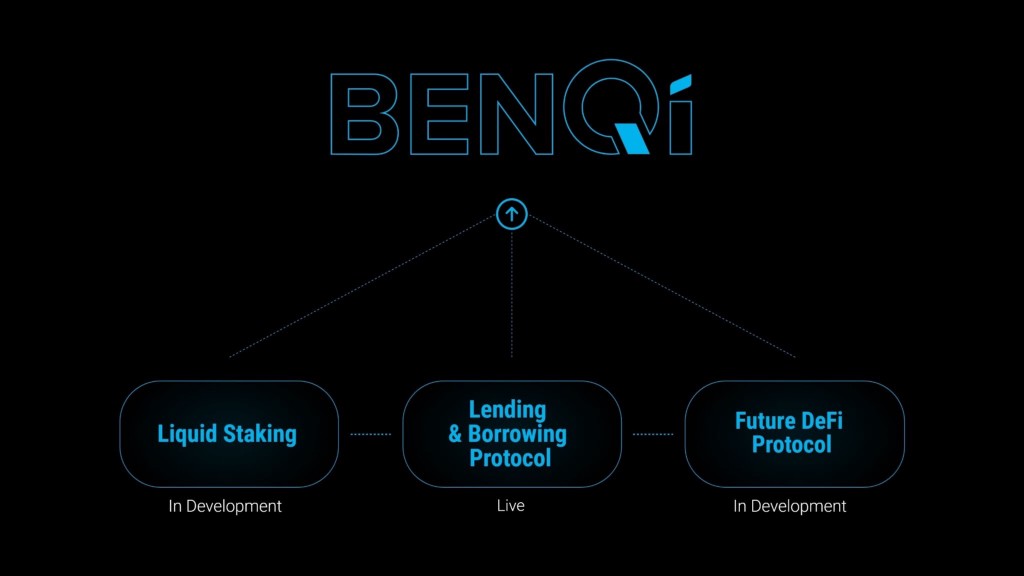

BENQI outlines a vision of enabling further democratization of financial products with additional protocols and improvements that align with our goals and vision.

Liquid Staking — In Development

The evolution of sybil resistance mechanisms for blockchains transitioning from Proof-of-Work (PoW) to Proof-of-Stake (PoS) has enabled a shift in barriers of entries for users seeking passive returns in exchange for securing networks.

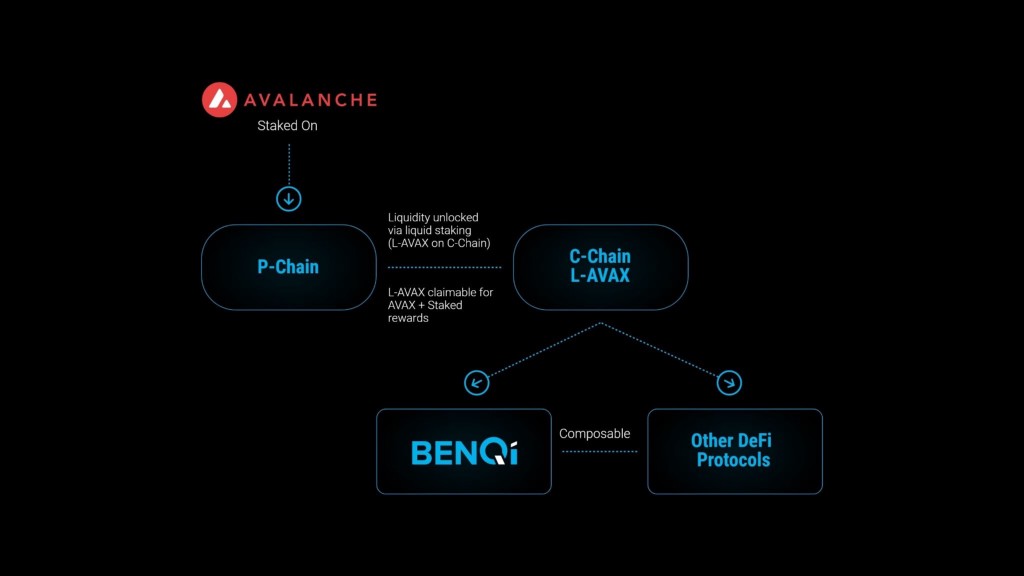

Avalanche is a PoS network that generates fixed returns for users “staking” their assets to secure the network. This is done by staking the native Avalanche token, AVAX on validator nodes. While this provides users with rewards, it also bonds their tokens to the nodes essentially locking it up for a predetermined time. Additionally, PoS and DeFi are not inherently designed to be compatible with each other.

Liquid Staking provides a solution for capital efficiency in PoS networks, offering users the opportunity to unlock their “staked” capital to be used on Decentralized Financial platforms. This provides users the benefits of passive returns on their staking rewards, while also being able to use their staked capital on Decentralized Financial applications seamlessly to manage their risk exposure and/or earn additional returns based on their strategies.

BENQI will launch a Liquid Staking solution for users of the Avalanche network, providing the seamless unlocking of staked assets to be used on the Avalanche C-Chain. The liquid asset (sAVAX) will gain instant utility by being supported on BENQI’s live lending markets. Further, the composable nature of the Avalanche C-Chain enables users of the liquid staking protocol a variety of options to utilize sAVAX, improving capital efficiency and providing a wealth of strategies to both users and developers of the Avalanche ecosystem. The exact architecture of BENQI’s Liquid Staking solution, along with the QI token’s role within it, will be released in the coming weeks.

Lending and Borrowing Protocol — LIVE

BENQI first launched on Avalanche when the ecosystem TVL was at roughly $250 million (the current TVL is ~$3.6 billion). Due to the lower network activity and thinner liquidity at the time, the solvency of the protocol was prioritized for the worst case scenario of a market-wide crash. Therefore, the initial protocol parameters, such as the collateral factor, were set at conservative values to enable the efficient liquidation of under-collateralized loans, ensuring solvency of the protocol.

While the current total supply on the protocol is at a healthy $2.4 billion , the utilization rates of the protocol itself can be further improved, leading to better capital efficiency. A priority for the improvement of the protocol is the engagement with Gauntlet on continuously reviewing parameters and risks involved in increasing the utilization rates for the protocol itself, while protecting the protocol from insolvency.

Additionally, the team is reviewing the addition of a Risk Management system and providing incentives (generated through the protocol itself) to QI token holders who participate in securing the protocol. Details of this will be announced in the coming weeks.

Future DeFi Protocol — In Development

With Liquid Staking plans being rolled out, BENQI has plans to launch an additional DeFi primitive that builds on top of the current lending and borrowing market. This primitive is currently being built, and will offer additional yield/risk strategies to users of DeFi on Avalanche.

Governance

Governance remains one of the most debated and discussed topics in DeFi. It defines a framework of rules and procedures that regulates conduct of all participants of a protocol. It also offers a path to decentralization by distributing power and control to the community. But the role of governance cannot be an afterthought, as control over critical protocol parameters, treasury and additions is something that can make or break a protocol.

BENQI’s approach with governance is through progressive decentralization. While users of the protocol view BENQI’s liquidity mining incentives as yield, there is also a macro proposition behind the roll out of the liquidity mining incentives. It distributes the tokens across more wallets, offering decentralization of the tokens and the control of governance that will eventually be placed on it.

As BENQI and its token distribution is currently in its infancy, the founding team will be bootstrapping the development of the protocol with the feedback and advice from the community. This provides the team agility on shipping improvements and protocols that matter the most to both the user of BENQI and Avalanche.

Governance will eventually be introduced through a Decentralized Autonomous Organization (DAO) when the distribution of tokens across wallets is sufficient and BENQI at the protocol level has achieved significant stability. From there, QI token holders will be able to propose, vote and steer the protocol on key parameters such as economics, security and improvements.

Subnets

Exploration of BENQI’s long-term plans include onboarding the BENQI suite of DeFi products into Avalanche Subnets.

Avalanche Subnets offers developers and builders superior customization of their blockchain. It can support multiple custom virtual machines such as the EVM, WASM and can be written in popular languages like Go, Rust or Solidity. These subnets may potentially serve users as regulatory-compliant blockchains that cater to specific government or institutional needs, with the added advantage of having Avalanche Validators ready to bootstrap and run these Subnets.

By onboarding the BENQI protocol into regulatory-compliant Subnets, both users and developers have the opportunity to integrate real world assets with Decentralized Financial products, which remains one of the toughest challenges within the space today.

Closing remarks

BENQI’s roadmap for the future remains as strong as ever as the protocol cements itself into the Avalanche C-Chain as the go-to platform for DeFi activity. By bootstrapping growth and liquidity on the C-Chain, BENQI positions itself to establish new features that cater to users seeking to utilize DeFi to unlock liquidity and earn yield in a permissionless manner.

About BENQI

Built on Avalanche’s highly scalable network, BENQI’s vision of bridging decentralized finance (DeFi) and institutional networks starts by launching BENQI on the Avalanche C-Chain. Through BENQI, Avalanche users will be able to earn interest on their assets, obtain credit through over-collateralized loans and earn QI governance tokens as rewards for providing liquidity on the protocol and Pangolin. For more information about BENQI, please visit: benqi.fi

Website | Twitter | Telegram | Documentation | Github | Email