Chainlink Automation Case Study

How RoboVault Integrated Chainlink Automation For Delta Neutral Strategies

Link to Recording RoboVault’s of Deep Dive into Chainlink Automation at SmartCon

What is RoboVault?

RoboVault was founded with the goal of bringing advanced automated strategies to DeFi. Since DeFi Summer, we have observed that the best yields in DeFi come from providing liquidity to Automated Market Makers (AMMs). However, without advanced automation and risk management tools, liquidity providers are often exposed to large losses through Impermanent Loss (IL). Over the last 12 months, we have been successfully running single-asset Delta Neutral strategies, providing users the ability to access the higher yields available to Liquidity Providers on AMMs while using our own custom off-chain infrastructure to protect users from IL.

What are Delta Neutral Strategies?

The Delta Neutral Strategies* utilised by RoboVault act as an IL protection mechanism, while also giving users the upside of higher returns available to AMM liquidity providers.

* Note our Delta Neutral Strategies are not perfectly hedged, with the biggest dradown on our USDC vault on Avalanche equal to 0.05% & recovering within less than 24 hours for more info see our Medium Article describing strategy mechanics

How RoboVault uses Chainlink Automation

A key component of our delta-neutral strategies is ensuring that the automation is extremely reliable and can trigger rebalances when required. Delta-neutral strategies are highly dependent on high-performance and reliable automation. Failure of automation can result in losses to users from high exposure to market movements through IL and also potential liquidations for strategies that contain some borrowing components. Chainlink Automation provides reliable automation for our Delta Neutral strategies, helping keep users’ funds secure and mitigate exposure to large drawdowns.

Mechanics

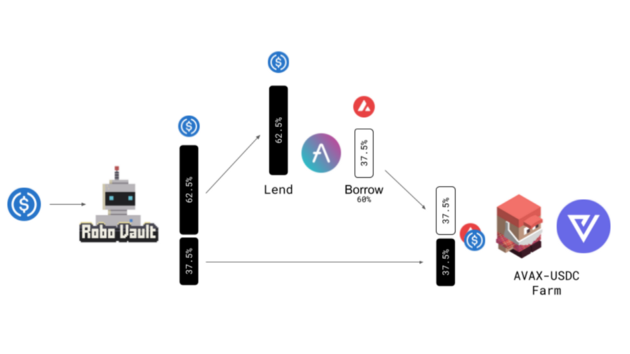

Our current Core Delta Neutral Strategies utilise AMMs in addition to lending protocols to construct an LP position (pictured below). Once this position is constructed, we actively manage it in order to minimise exposure to IL and provide users with positive returns on their assets.

In concrete terms, our AVAX-based USDC vault that utilises our Core Delta Neutral Strategies works as follows:

- USDC is allocated to the strategy

- Portion of USDC is deposited into AAVE

- USDC in AAVE is used as collateral to borrow AVAX

- Remaining USDC is paired with AVAX to create an LP position on Trader Joe

- LP Position is deposited in Vector for higher rewards

Once this position is created, Chainlink Automation Nodes actively manage the strategy in order to minimise exposure to market movements and help ensure there is no risk of liquidation from the borrowing component of the strategy.

(Additionally as mentioned in our article “RoboVault on AVAX” a similar approach can be extended to other LP types.)

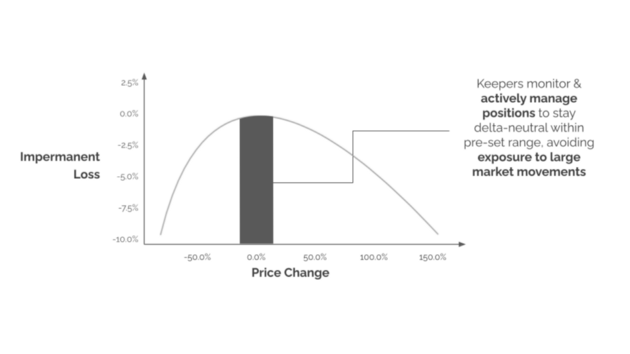

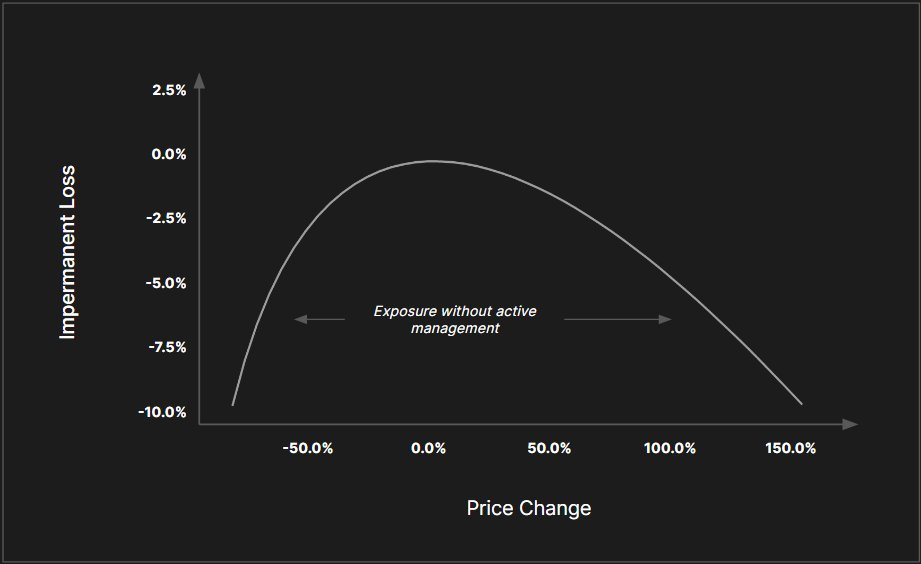

As part of our active management, we are constantly monitoring the Debt Ratio. This metric looks at the ratio of secondary assets borrowed vs assets held in the liquidity position on the AMM. For example, in the USDC strategy pictured above, we’d be monitoring the ratio of AVAX borrowed from AAVE vs the amount of AVAX we have in our LP position. Our smart contracts are then programmed for rebalances to only occur when this ratio exceeds a predetermined threshold. In this case, a rebalance would involve a small swap to stay within the target range. Due to the non-linearity of Impermanent Loss, losses get exponentially larger the more prices move away from the price when the position was entered. By actively rebalancing and staying within this range, we are able to maintain a position where trading fees + liquidity rewards are typically greater than any impermanent loss, resulting in positive returns for users.

What results were achieved from your integration?

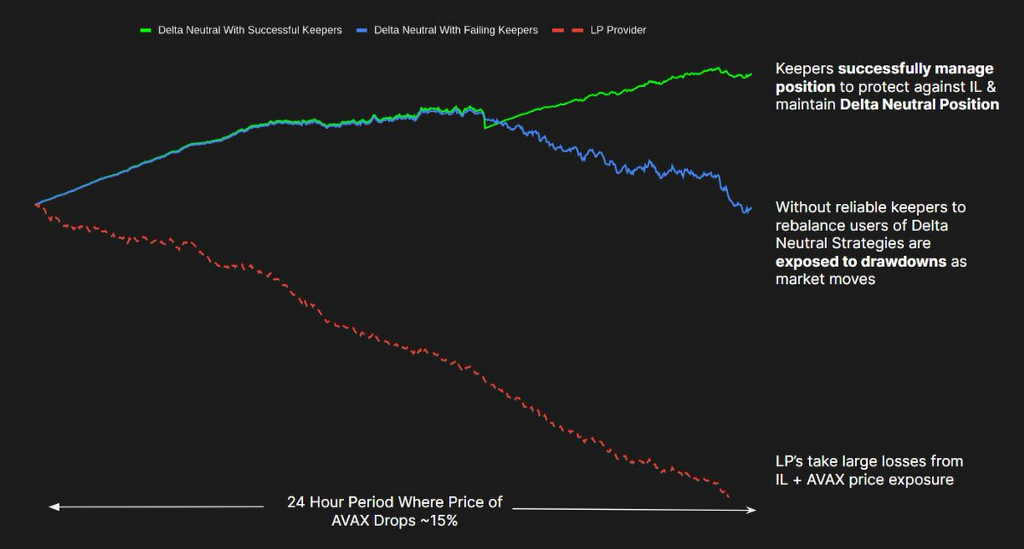

As a result of integrating Chainlink Automation, we have increased the reliability of our Delta Neutral Strategies.

These charts showcase how Robo Vault Delta Neutral strategies leverage Chainlink Automation in order to help automatically rebalance and protect users from Impermanent Losses (IL).

After 4 months of operation and 190 automated transactions, testing showed that Chainlink Automation was highly performant at identifying eligible automation jobs and confirming transactions on chain in a timely manner.

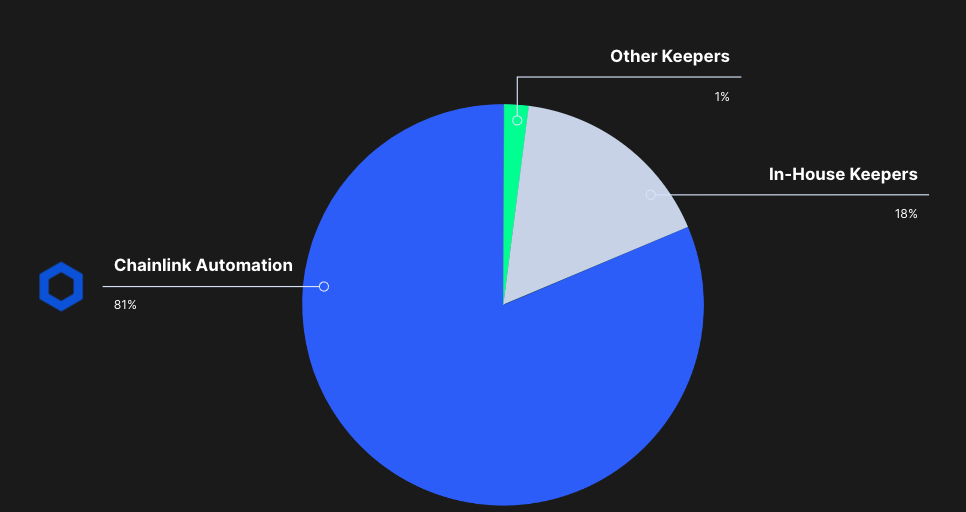

Why RoboVault chose Chainlink Automation (Previously named Keepers)

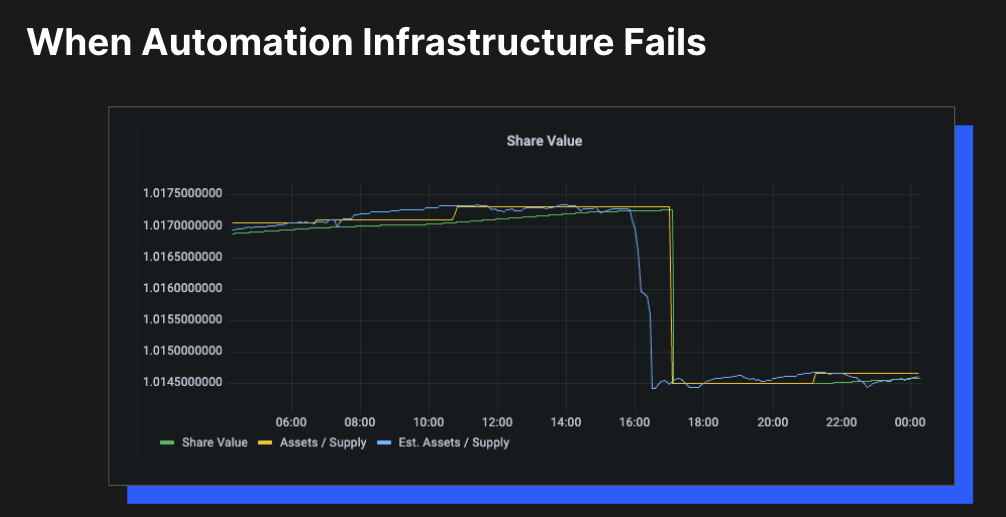

Without reliable automation, Delta Neutral Strategies are exposed to drawdowns as the market moves.

Risk increases significantly during times of network congestion, and the role of Chainlink Automation to ensure safe and timely rebalances becomes more important than ever because large drawdowns are inflicted by increased volatility.

Earlier in 2021, when we were running our own custom keepers, our vaults experienced times where our keepers were unable to reliably rebalance, leading to some losses for users.

Learn more details about how and why it happened in our medium article.

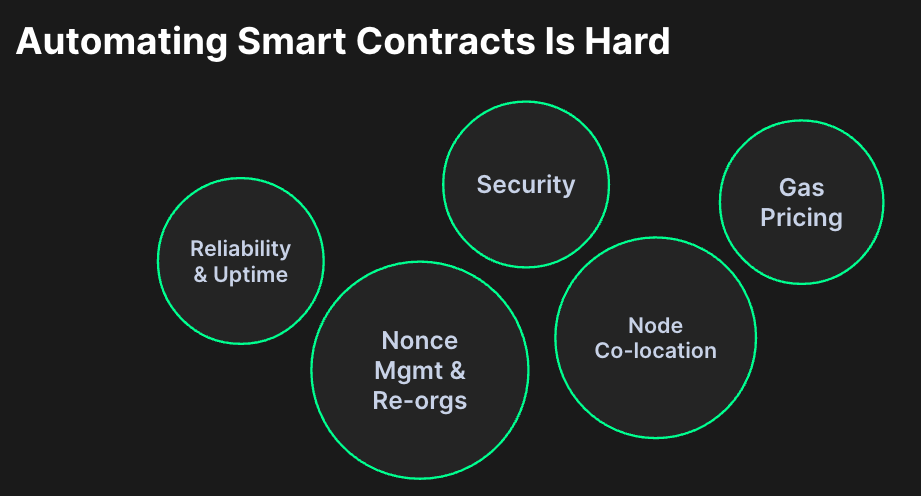

Building and maintaining highly reliable smart contract automation infrastructure is a time- and resource-intensive task.

Integrating Chainlink Automation provides us with extra confidence that our strategies will reliably work as designed throughout all market conditions and ultimately allows us to focus on what we’re good at: Building more strategies and giving our users positive returns.

About RoboVault

Automate your earnings with RoboVault Single Asset Delta Neutral Strategies to earn above-market returns in a safe manner, with an Impermanent Loss Protection Mechanism backing you up!

Try the App : https://www.robo-vault.com/

Socials:

https://twitter.com/Robo_Vault

About Chainlink Automation

Chainlink Automation enables Web3 developers to seamlessly automate key smart contract functions in a decentralized manner.

Learn more https://chain.link/automation

Try the App: https://automation.chain.link/

Documentation: https://docs.chain.link/docs/chainlink-automation/introduction/