Degis AMA #1 — Project Overview with Andy (CEO) & Oliver (CFO) (Recap)

Degis AMA #1 — Project Overview with Andy (CEO) & Oliver (CFO) (Recap)

On 3/2/2022 at 4:30 p.m. (PST), an AMA session was held on Avalaunch with special guests Andy (CEO) & Oliver (CFO), from Degis. Below we present to you an excerpt from AMA with questions and answers.

Dave Donnenfeld | Avalaunch

Once again, it’s on. Today we are elated to host another outstanding AMA with the good people from the Degis Project. The Degis Project is one that Avalaunch has a long history with and to be candid, never have we seen an initiative gain so much momentum in a short period of time. This speaks to the importance of the initiative and the hard work of the team. To think of things like impermanent loss protection coming to Avalanche, it’s hard not to get goosebumps. At any rate, let us welcome @oliveryoung to kick things off and @AndyDegis will be joining later on as well. Welcome Oliver, how are you today?

Oliver Young | Degis

Hello everyone, really nice to meet you all!

Really excited today to see our project start registration!

Dave Donnenfeld | Avalaunch

Good to have you of course and registration is well underway. Much hype. To get everyone acquainted, could you give us an introduction about yourself, who you are, what’s your background, education, and how did you end up with this career?

Oliver Young | Degis

I studied in HKUST and leanred Mathematics and Physics.

Then I worked in tranditional fiance as an analysy, and started doing research on DeFi and blockchain since 2020.

In July 2021, I joined Degis team and became a builder in Web3.0

Dave Donnenfeld | Avalaunch

Thank you for that.

Given your background, you are well suited for the industry.

Let’s dig in to Degis a little — Degis is known as a DeFi protection protocol that encompasses a matrix of products. Can you expand on this matrix for us please?

Oliver Young | Degis

NP. In our whitepaper, we propose four types of protection in DeFi. Token model, NFT model, Meta model and DAO model, which describe different protection mechanisms.

Specifically, we have token price protection, impermanent loss and smart contract protection.

And will continue deveop more kinds of protection in the future.

Dave Donnenfeld | Avalaunch

That’s fascinating actually and a big departure from what you normally see in the realm of blockchain/crypto insurance.

To focus — One of the mechanisms called Token Price Insurance supposedly covers both upside and downside risk. Can you elaborate on this structure and how it may work to reduce this dual risk for crypto users?

Oliver Young | Degis

High volatility has always been one of the reasons that keeps users from getting in blockchain, DeFi and GameFi projects.

Users are facing many problems like: assets liquidated, price dropping sharply after attack, missing good investment opportunities.

Degis creates a token price protection. If the price of subject matter goes above or below a certain price, the protection will trigger payouts.

ake the assets liquidated problem as an example, Andy stakes $100 worth of Etherum to get 80 DAI. He is worried about 20% decreasing to cause assets liquidated. He can buy a ETH price protection whose trigger price is 20% lower than the current price.

If his assets are liquidated, he will get payout and keep some property at last.

Give another example, Andy likes GameFi a lot, and he buys many props in one project. But he is afraid that the project might be hacked and he lose all his money.

He can buy token price protection of this project at a low trigger price, since the token price of the project are very likely to decrease a lot after hacking. If that happens, it will trigger payout, and Andy can save his assets.

Dave Donnenfeld | Avalaunch

That’s pretty clear and the big takeaway is the ability to hedge your own positions with an insurance product. That’s very inventive.

And I also realized that Andy can be saved.

Being an agnostic token insurance provider which specifically targets Avalanches’ beaconing ecosystem, one may say that Degis has somewhat of a competitive advantage in this space alone. With a myriad of tokens available in the ecosystem, I’m curious about what factors are at play to determine which tokens you provide an insurance for?

Oliver Young | Degis

Of course we will do AVAX protection first :), then we will build our protection related to our partners. At last, the decison right will be given to our community.

Dave Donnenfeld | Avalaunch

Short and sweet. Thank you — As a native crypto insurance provider on the Avalanche blockchain, one has to ask at some point if there are any future plans to extend into different ecosystems, and if so how will you expect to be dealing with existing DeFi insurance protocols?

Oliver Young | Degis

Our goal is to be universal. But all starts from avalanche. We will focus on avalanche for a long period of time. After everything is mature, we may extend into different ecosystems.

Dave Donnenfeld | Avalaunch

Protecting peoples’ funds, inadvertently means that you as a provider yourself would have to have pretty tight regulatory as well as security system/s in place. What does this infrastructure look like?

Oliver Young | Degis

Just now I mentioned our 4 types of protection model. Token model, NFT model, Meta model and DAO model. We develop the token model and NFT model at first.

Token price protection is an example of the token model. Creators stake 1 USDC to mint one protection token which is a ERC20, they can sell it in the AMM pool, or be LP of the AMM pool. If the event corresponding to the protection happens, the staked USDC will be paid to protection holders. This mechanism makes sure that every protection is 100% backed by assets and both sellers and buyers can trade at a fair market price.

As for the NFT model, LP is acting as a seller here. They stake their USDC in the protection pool, and the pool will cover some similar events. Our actuarial model will pricing different protection and create profits for LPs. The pool will not sell protection when the potential total payout exceeds TVL. So every protection is also 100% backed.

Dave Donnenfeld | Avalaunch

I think so. The NFT of a pool payout not exceed 100% rings obvious otherwise you might need additional insurance ?but the LP as seller is fascinating.

Can you describe to us the protection buying process? Other than having a range of crypto assets to choose from, are there any other factors relevant, and what are the requirements for taking out this insurance? How much of an upside/downside protection will this provide?

Oliver Young | Degis

For token price protection, you can choose the crypto asset, trigger price and above or below. Then you can buy the protection in the AMM pool.

All users can create, buy and sell protection in the AMM pool. Later, we will give more convenience to our token holders. They can mint at a lower mortgage rate if they hold DEG tokens.

The trigger price we officially set will be plus or minus 20%, but later users can use DEG to open protection at different trigger prices. Users are free to choose the trigger price and protection amount according to their needs.

Dave Donnenfeld | Avalaunch

Well stated. What are the use-cases of the native token that drives the Degis ecosystem?

Oliver Young | Degis

The basic utilities of DEG token are insurance income sharing & governance.

Regarding income sharing, the treasury box is specially designed for DEG holders to share profits from the insurance pools while having fun with the lottery.

For the governance part, DEG is not only used for simply voting but can also be staked to create veDEG tokens to decide insurance pool liquidity shares which will come soon. As the project develops, we will continue to empower DEG tokens.

Dave Donnenfeld | Avalaunch

Who are you looking next at to form collaboration or partnerships with, and how will these relationships help achieve the high-level goal that Degis is after?

Oliver Young | Degis

We will announce our partnership with trader joe soon. And will build collaboration or partnership with Pangolin and Benqi. As a protection provider in eco, we want to build strong partnership with all the projects and provide our services to all users.

Dave Donnenfeld | Avalaunch

Look forward to it as I know you’ve already gained some real traction inside Avalanche.

What was the reason behind providing this solution on the Avalanche blockchain? Were there any immediate advantages other than perhaps being the first of its kind at least on this chain?

Oliver Young | Degis

Special thanks to Avalaunch! You have always been one of our strongest partners and helpers.

Thanks to the unique 3 built-in blockchains, Avalanche is the most suitable chain to build a protection protocol.

For now, it has fast transaction speed, large capacity, and low gas. But I want to talk more about the future.

C chain is compatible with multiple virtual machines including EVM, which can support Degis to establish our Meta model protection. In the meta-model, we want to aggregate all protection protocols on multiple chains. Multiple virtual machines can help us to achieve our ambition.

X chain supports multiple assets including some real-world resources. This will help us develop diversified kinds of protection in the future, especially those related to the real world.

P chain supports activating subnets. This can help us to develop transactions between businesses, like cooperating with traditional insurance companies. Also, the subnet can help to cope with possible regulations.

So we firmly believe that we can grow together with Avalanche, and fully utilize its market and technical advantages!

Dave Donnenfeld | Avalaunch

Appreciate that and the compliments. You all have been great to work with. Final question before we move on to the Twitterverse…

How would you envision the next 2–3 years of Degis to be like? What would be the ideal milestones reached?

Oliver Young | Degis

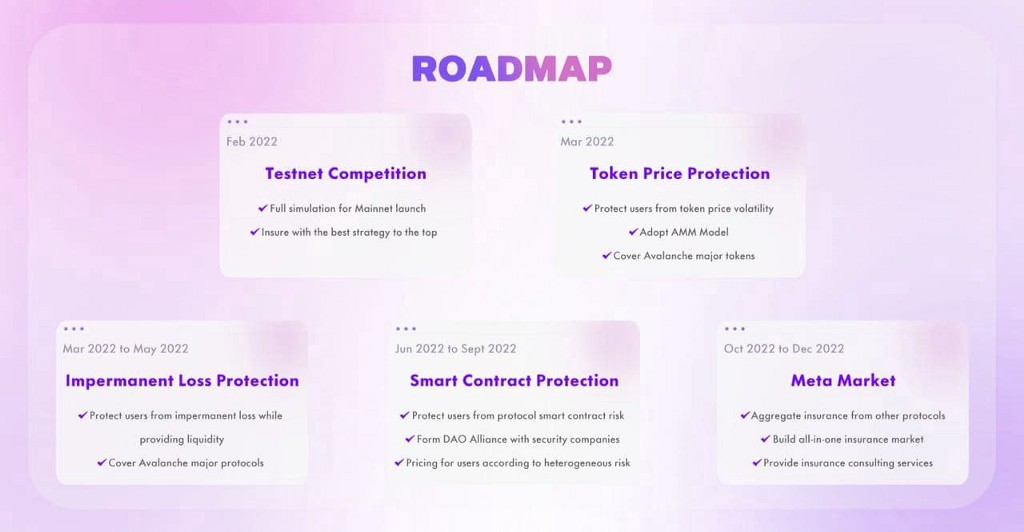

The roadmap describe our goal in 2022.

For further time, we will build our meta market and protection aggregator in 2 years.

Our final goal is to integrate traditional insurance with blockchain in the future

Dave Donnenfeld | Avalaunch

Well done Oliver. Thank you for all this information and insight.

Oliver Young | Degis

Thanks! Really honor to chat here!

Twitter Questions

@mast__balak who asks — I tried your testnet but I think there is so much difference in working on testnet and mainnet? My question is when we see Degis on mainnet? Also what new features we expect from the team on the mainnet?

Oliver Young | Degis

Thanks for your question. Yup. The team is continuing to build our project. If you participate in Testnet both phase 1 and phase 2. You could already find much difference.

I think you will see a much more improvement in our mainnet. The launch time of mainnet will be around early April.

Dave Donnenfeld | Avalaunch

On a personal note, I’ve seen your testnet and think it’s pretty close to mainnet material. Not sure I’ve seen a project mature as quickly as Degis.

That’s pretty soon. Didn’t mean to ask the next question prematurely.

@AndikaA25245812 Do you plan to increase the utility of DEG?

Oliver Young | Degis

Of course. DEG token is critical to our ecosystem and we will do all our efforts to make it stronger. Not only simple profit sharing, DEG will also be cleverly used in each protection products. You can expect that.

Dave Donnenfeld | Avalaunch

Expectations are high as it is. Looking forward to that

@BoycaIsBack — Where do you see Degis go in the next 5 to 10 years

Oliver Young | Degis

I think in long term, we will provide more protection related to the real world. And become a true worldwide protection project with the growth of Web3.0

Dave Donnenfeld | Avalaunch

@AndyDegis in the building. He had to tear himself away in order to be here and certainly, better late than never. How are you Andy?

Andy | Degis

Doing good! Hey everyone, this is Andy, CEO of Degis. Pleasure to connect with all of you here

Dave Donnenfeld | Avalaunch

Good to have you — I’m sure @OliverYoung wouldn’t mind if you fielded a question or two and very much appreciate your time.

@waybesuricata asking — Looking at your roadmap, we see that the Impermanent Loss Protection feature is planned for March-May 2022. Can you give information about this feature?

Andy | Degis

Yeah thanks for the question from @waybesuricata! Impermanent loss protection is our major focus in Q2, serving as a powerful weapon to insure against the risk of IL loss for liquidity providers.

Basically you just need one click to buy insurance for your position on DEX!

@Lopyou54804819 You have an impressive set of advisors on your website, many of whom are team members on Avalanche. Can you explain the respective implications of these advisors?

Andy | Degis

Our advisors is consisted of DeFi OGs, legal and academic professionals. We take their advice from different aspects, which also leads to our innovation in products as well as efficiency in execution.

Also our investors are helping a lot. Special thanks to all our investors, advisors and partners!

Dave Donnenfeld | Avalaunch

Your advisors are an amazing group. Not just the gratuitous group you often see. I don’t know who all has been formally announced and who all is still to be announced but it is worth a look for sure.

This has been a confidence inspiring AMA. Don’t sleep on Degis.

Telegram Questions

How will your “incentive lending and Liquidity pools” different from all the others at the moment? What ideas do you have to make these pools more attractive than others?

⭕️ At the moment we see lots of Defi project why people choose Project DEGIS?

Andy | Degis

@Iqballeo08 Thanks for the question. Degis is an insurance protocol that servers to protect other protocols and bring safety for users in the DeFi space. Our buyer incentive is an amazing innovation on how we incentive insurance buyers to participate in the ecosystem. Also want to mention that we use AMM pools for liquidity aggregation!

Almost 80% investors have just focused on price of token in short term instead of understanding the real value of the project. Can you tell us on motivations and benefits for investors to hold your token in long term?

Andy | Degis

This is a critical one. When we on-board investors, we make sure they are bring value as long as they are long term holders. Also, we set the locking period to 12 month to make sure they are in the game for long.

hi @OliverYoung You mentioned on Medium Degis “Reward Most Loyal DEG Holders”, so Can you explain How will DEG Holders redeem their Rewards? Will the prize be sent automatically to the holder’s address? and is there a minimum and maximum limit for DEG holders to get this great Prize?

Andy | Degis

Also a good one @jlaudybell We make sure all DEG holders can share the insurance pool income by staking DEG tokens. Also, lucky tickets are the ones that can boost your APR and there are even surprises waiting for you!

On your website you don’t mention that you have done any internal or external audit of your smart contract, so can you give us details if you have done any audit before? And in case you haven’t, would you plan to perform any review of your smart contract in the near future?

Andy | Degis

You are very sharp on the auditing part. We have been collaborating with slowmist since Jan and auditing report will be ready soon.

Did you consider community feedback/requests during the creation of your product in order to expand on fresh ideas for your project? Many projects fail because the target audience and clients are not understood. So I’d like to know who your ideal consumer is for your product?

Andy | Degis

@Leola_fenner_2001 Community is the most important thing that we value. Degis is built by all of our community members and we will do listen to their opinion for sure. That’s also why we are keep making innovation. It’s all because of amazing communities and we will keep growing with them!

Yeah finally! again, thanks so much for the passion here!

Dave Donnenfeld | Avalaunch

Boom! You’ve done it. You ran the gauntlet. @AndyDegis thanks for coming on and tackling some questions.

Good to have you and @OliverYoung very much appreciate your time here today.

I am honored to see how quickly Degis has progressed and you two deserve to take a bow, along with the rest of the team. Honored to be hosting your IDO and look forward to our future together. Many thanks.

Andy | Degis

Yeah thanks a lot to Avalaunch team and the amazing community here!

About Avalaunch

Avalaunch is a launchpad powered by the Avalanche platform, allowing new and innovative projects to seamlessly prepare for launch with an emphasis on fair and broad distribution. With its values deeply rooted in the early Avalanche community, we are able to offer projects confident, informed users who are aligned with the long-term goals of the rapidly expanding application ecosystem.

Leveraging Avalanche’s scalable, high-throughput, and low-latency platform, Avalaunch is built by users, for teams, to help grow strong communities.

![]()

Degis AMA #1 — Project Overview with Andy (CEO) & Oliver (CFO) (Recap) was originally published in Avalaunch on Medium, where people are continuing the conversation by highlighting and responding to this story.