Delta Neutral Strategy Deep Dive

Deep Dive into RoboVault’s Delta Neutral Crypto Strategies

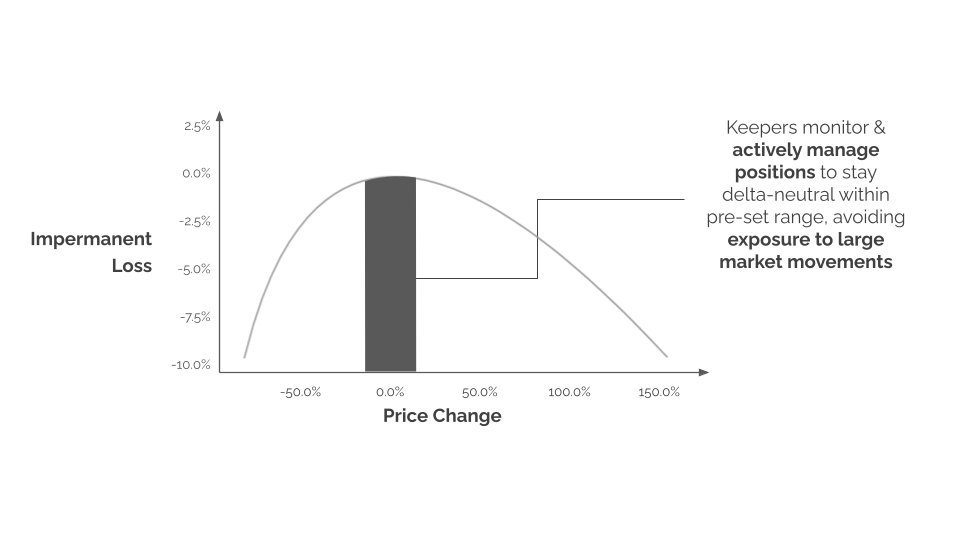

The Delta Neutral Strategies utilised by RoboVault act as an IL (Impermanent Loss) protection mechanism, while also giving users the upside of higher returns available to liquidity providers on AMM’s (automated market makers).

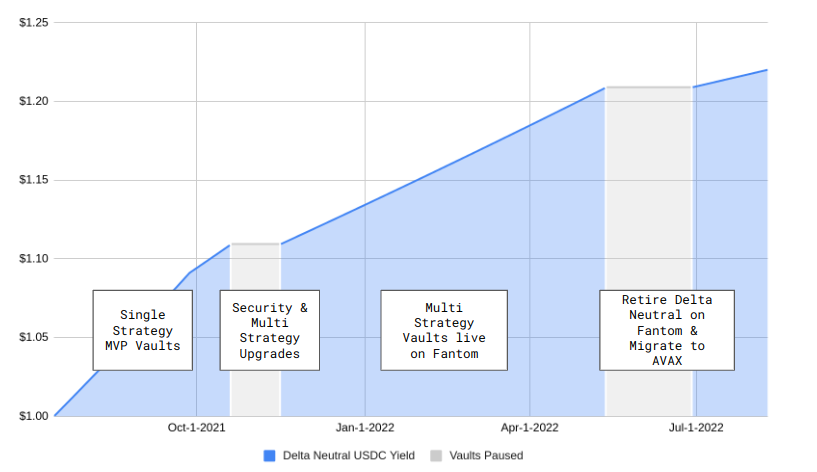

Track Record

Since launching in 2021 we’ve generated over $2M in value for users that have deposited in our vaults, including >20% APY on USDC over for users of our delta neutral strategies over the past 12 months. We’ve also faced a number of challenges (more info here). This has led us to put a significant amount of effort into building out the off chain infrastructure to support these strategies, in addition to developing rigorous processes to keep funds secure.

Mechanics

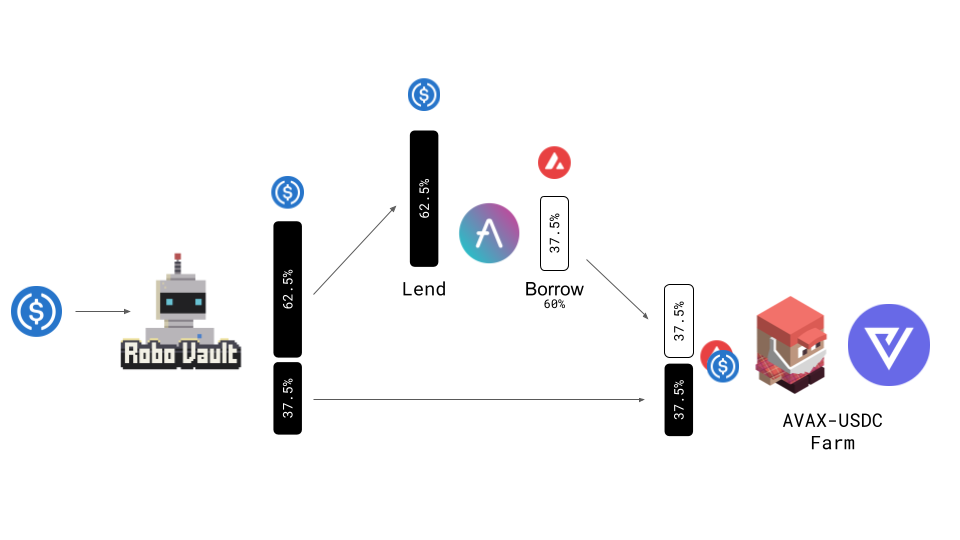

Our current Core Delta Neutral Strategies utilise AMM’s in addition to lending protocols to construct an LP position (pictured below). Once this position is constructed, we actively manage this position in order to minimise exposure to Impermanent Loss & provide users with positive returns on their assets.

In concrete terms, our USDC vault live on AVAX utilising our core delta neutral works as follows

- USDC allocated to strategy

- Portion of USDC deposited to AAVE

- USDC in AAVE used as collateral to borrow AVAX

- Remaining USDC paired with AVAX to create an LP position on Trader Joe

- LP Position deposited in Vector for higher rewards

Once this position is created, our keepers actively manage the strategy in order to minimise the exposure of market movements & ensure there is no risk of liquidation from the borrowing component of the strategy.

(Additionally as mentioned in our article “RoboVault on AVAX” a similar approach can be extended to other LP types.)

In terms of how the active management works, we are constantly monitoring a metric which we refer to as the Debt Ratio. This metric looks at the ratio of secondary assets borrowed vs assets held in the liquidity position on the AMM. For example in the USDC strategy pictured above we’d be monitoring the ratio of AVAX borrowed from AAVE vs the amount of AVAX we have in LP. Our smart contracts are then programmed for rebalances to only occur when this ratio goes outside of some threshold. In this case a rebalance would involve some small swap to stay within the target range. Due to the non-linearity of Impermanent Loss, losses get exponentially larger the more prices move away from the price when the position was entered. By actively rebalancing and staying within this range the we are able to maintain a position where trading fees + liquidity rewards are typically greater than any impermanent loss, generating positive returns for users.

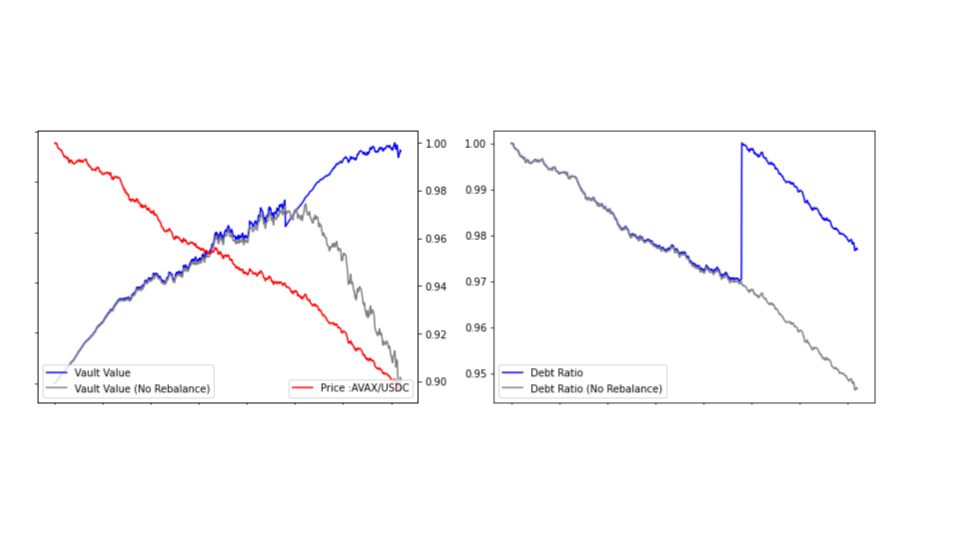

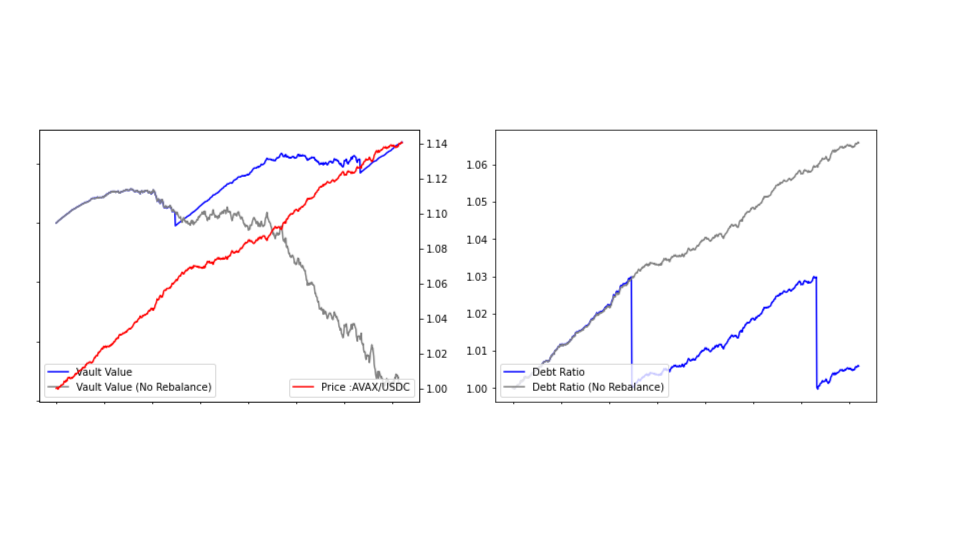

The below examples illustrate how this works in practice. (link to simulations)

In the first example if the price of AVAX increases the value of our debt grows, while the value of our LP also grows however we will also hold more USDC & less AVAX due to the y*x = K relationship used in AMM’s. If we don’t rebalance (grey line) as the AVAX price continues increasing we will start to take bigger losses from IL compared to trading fees & liquidity rewards. While if we rebalance (blue line) the position such that the amount of AVAX borrowed vs the amount held in LP (the debt ratio) stays within a certain range we have much less exposure to the continued increase in price of AVAX. In this case a rebalance would involve the strategy swapping a small amount of USDC for AVAX.

The second example shows what happens if the price of AVAX decreases. This is essentially the inverse, where as prices decrease the value of our debt decreases however we suddenly have more AVAX in our LP position vs USDC. So we must rebalance in order to ensure we do not have large exposure to further price decreases in AVAX. In this case a rebalance would involve the strategy swapping a small amount of AVAX for USDC.

Note that our current strategies use debt ratio thresholds of 102% and 98%. Additionally we currently rebalance only half the way back to 100%. For example if Debt Ratio goes to 102% we will complete a rebalance such that the debt ratio after rebalancing is ~101%. This helps minimise slippage & fees incurred by rebalancing.

Insurance Logic

As our strategies do not have a perfect hedge against IL but instead apply an approach which is akin to statistical arbitrage, extremely high volatility can lead to minor drawdowns for users. In order to help protect against this in addition to protecting against any interruptions to our off-chain infrastructure we have built in some insurance logic to our strategies. This logic essentially builds up some reserves from the gross yield at each harvest to cover up to 0.5% losses in the strategy, if there is a period where the strategy has a minor drawdown these reserves will be used to cover these losses. Note the 0.5% number was chosen based on looking at historical data of our strategies in addition to backtesting & simulations to understand how large drawdowns could get in the events of very large price movements, together with some interruptions to our off-chain infrastructure.

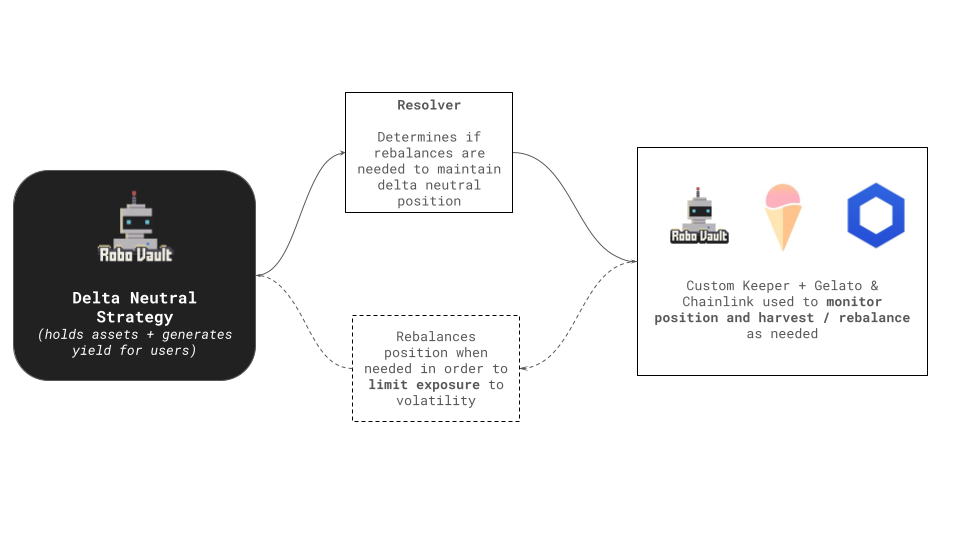

Off Chain Infrastructure

Another key component of our delta-neutral strategies is ensuring that the keepers are extremely reliable and can complete rebalances when required. If not, failure of keepers can result in losses to users from high exposure to market movements through IL & also potential liquidations for strategies that contain some borrowing component.

As our delta-neutral strategies require active position management, ensuring we can have 100% confidence in their up-time is crucial for keeping users’ funds secure and not exposing them to large drawdowns. We do this by utilising the best in off-chain automation available leveraging ChainLink Keepers, Gelato Automations in addition to our own custom keepers.

Security

As our strategies are relatively complex and contain an active element to ensure users funds are safe we also apply a number of rigorous processes to ensure the strategies are secure. More details on our security approach here.

Extending Our Strategies

Utilising our Off Chain Infrastructure together with our Delta Neutral mechanics we are developing a full catalogue of Delta Neutral strategies which can provide Real Yield to users. This includes improved mechanics for higher capital efficiency alongside integration with various AMM’s such as GMX & Concentrated Liquidity AMM’s. More details in our RoboVault on Avalanche Article.