Dexalot and Uniswap: A Comparison of the Two Exchanges

by Mahfud Fauzi

Dexalot and Uniswap bring a good Decentralized Exchange (DEX) experience to their users.

Hello, in this article I will explain a comparison of two exchanges, namely Dexalot and Uniswap. Both are among the exchanges that are widely used and, of course, have various advantages and disadvantages among the exchanges. Of course, there are similarities and differences between them as well. For more details, I will divide it into several points of discussion.

What is Exchange?

According to an article written by Pintu, the exchange is a digital exchange that facilitates the sale and purchase of assets with fiat money or other cryptocurrencies. So when you want to buy or sell your crypto assets, you can use an exchange as the platform.

Basically, exchanges can be divided into two, categories: Centralized Exchange (CEX) and Decentralized Exchange (DEX). Centralized Exchange (CEX) is a centralized digital exchange, for example Binance, Tokocrypto, Indodax, etc. Meanwhile, Decentralized Exchange is a decentralized digital exchange, for example, Dexalot, Uniswap, Pangolin, PancakeSwap, etc.

CEX and DEX Similarities and Differences

Centralized Exchange (CEX) and Decentralized Exchange (DEX) have similarities and differences. Even between Decentralized Exchange (DEX) and one another, there are similarities and differences. Each type of exchange has its own uniqueness.

Similarities Between CEX and DEX

When discussing the similarities between them, of course, both are exchanges or digital exchanges that can be used to buy and sell crypto assets. You can buy crypto assets using fiat money or other crypto currencies. For example, if you want to buy Bitcoin (BTC), you can use USDT, which is the most commonly used.

Or you can also use something other than USDT depending on the pair, for example, BTC/USDC, then use USDC, BTC/AVAX then you can buy BTC using AVAX. And of course, there are various other pairs, depending on the exchange that provides them.

The Difference Between CEX and DEX

When discussing the differences between them, of course they have fundamental differences. Centralized Exchange (CEX) is generally centralized, and Decentralized Exchange (DEX) is generally decentralized.

For example, Binance, which is a Centralized Exchange (CEX), generally uses the same concept as other centralized exchanges. For example, Uniswap, which is a Decentralized Exchange (DEX), generally uses AMM (Automated Market Makers) as its fundamentals.

What is quite visible from both of them is the display, or the User Interface (UI) and the User Experience (UX). The appearance of centralized exchanges is generally relatively similar, there are graphs/charts that display information about prices and past price history along with various accompanying indicators. Then there are options to buy, sell, and various available pairs.

The appearance of decentralized exchanges is generally different from that of centralized exchanges. Decentralized exchanges that use AMM (Automated Market Makers) do not display charts, but only display available pairs and options to buy or sell. Sometimes it’s not just buying and selling, but there are options for swaps, stakes, pools, etc, depending on each of these exchanges.

The next difference is generally in terms of selling fees or buying fees when buying or selling crypto assets. In general, selling or buying fees on centralized exchanges are relatively cheaper compared to decentralized exchanges, especially if the decentralized exchange uses a relatively expensive network, such as when transacting using Uniswap on the Ethereum network.

The next difference can also be seen in the transaction completion time. Generally, when transacting using a centralized exchange and buying at the market price, it will be executed immediately. However, if you use a decentralized exchange, you have to wait some time depending on the network used; for example, trading on a decentralized exchange that uses the Avalanche network is generally faster than trading on a decentralized exchange that uses the Ethereum network.

The next difference can also be seen from the account or ownership. If you use a centralized exchange, you generally have to create an account first, including a username, email and password. Sometimes you even have to do KYC (Know Your Customer) first by including your identity in the form of a card and selfie photo. However, it depends on each policy from the centralized exchange.

When using a decentralized exchange, you generally don’t need to register an account and do KYC; you just need to connect a wallet according to the blockchain network used. For example, when using the Uniswap, you must connect your Ethereum wallet to the Uniswap platform to be able to interact with it. If you use Dexalot, you must connect the Avalanche wallet with the Dexalot platform to be able to interact with it.

Next, we will be specific about Dexalot and Uniswap, regarding how they are similar and different, constructive criticism of the UI and UX, the ease of use I found using both from my perspective, what I liked and disliked about both, and feedback to improve Dexalot in the future.

Dexalot

Dexalot is a revolutionary decentralized exchange bringing the traditional centralized exchange look and feel to a decentralized on-chain application. Its mission is to bring a truly inclusive and transparent environment where Dexalot users can trade crypto securely and efficiently, with no slippage or custody risk. It is built on Avalanche, the fastest smart contracts platform in the blockchain industry.

Dexalot

Dexalot brings the feel of a decentralized and centralized exchange into one interface. Because of this, the look and feel of Dexalot feel different from other decentralized exchanges.

Dexalot uses the term “CLOB” (Central Limit Order Book) which has the feel of buying and selling crypto assets like when you use a centralized exchange. Inside there are graphics/charts like on a centralized exchange, and options to buy and sell, which are almost the same as on a centralized exchange in appearance.

After using it several times, I feel that Dexalot is comfortable to use, inexpensive, and fast. when using Dexalot I feel very comfortable because Dexalot presents a display that feels like a centralized exchange with its Central Limit Order Book (CLOB), and cheap because it’s built on Avalanche, which only requires a few fees in each buying and selling transaction, and fast because it’s built on Avalanche, which only requires a few It only takes seconds to complete each transaction.

After Dexalot was built on the Avalanche subnet, of course it’s even better, more powerful, and more scalable. Subnets make Dexalot able to do better and more targeted customization according to the desired development.

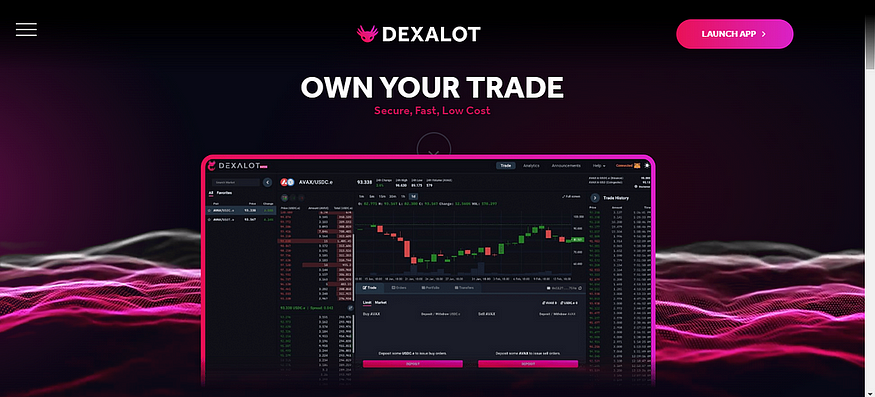

Uniswap

One decentralized exchange that is widely used is Uniswap. Uniswap is the most popular decentralized exchange on the Ethereum network. This is due to the various advantages it has compared to similar exchanges. But currently, Uniswap not only supports the Ethereum network, but also Polygon, Optimism, Artibtrum, Celo, and BNB Chain using the bridge feature.

Uniswap

Uniswap uses AMM (Automated Market Makers), which has the feel of a display like a decentralized exchange in general. For example, when you interact with PancakeSwap, which is a decentralized exchange on the Binance network, the interface will have a different feel than a centralized exchange. This view is also different from decentralized exchanges that use a Central Limit Order Book (CLOB) such as Dexalot.

After using it several times, I feel Uniswap is good. When I swapped from USDT to ETH, it worked fine, of course, with low slippage. And the waiting time is also relatively short — only a few seconds. However, because it runs on the Ethereum network, the fees required for each transaction are quite expensive, and the finalization time for each transaction is relatively slower when compared to the Avalanche network.

Similarities between Dexalot with Uniswap: General

When viewed from their similarities, Dexalot and Uniswap are included in the Decentralized Exchange (DEX) category. Decentralized Exchange (DEX) or decentralized exchange is an exchange that is not centralized, in other words decentralized.

Because both are DEXs, there are many similarities between them. For example, from a decentralized perspective, using both does not require account registration or even KYC, as is generally required in centralized exchanges.

To be able to use it and interact with it, you only need to connect your wallet according to the blockchain network that supports each exchange. For example, when using Dexalot, you need to use a wallet on the Avalanche network, and when using Uniswap, you need to use a wallet on the Ethereum network.

After the wallet is connected, you can use the various services provided and made available by the platform. But before that, you have to prepare a number of native tokens for each network as transaction fees or fees that are charged.

For example, when using Dexalot which is a DEX on the Avalanche blockchain network, you must prepare an amount of AVAX as a transaction fee. But now that Dexalot has launched its subnet, you only need to prepare a number of ALOT which is Dexalot’s native token, as a transaction fee.

Transaction fees will be charged when you do various things, such as sending, buying, swapping, NFTs, etc. So, please, before that, prepare a native token according to the network you want to use.

In terms of finalization time, generally, the Avalanche network provides a faster finalization time compared to other blockchain networks. Generally, only one second or even one per so many seconds.

And because Dexalot is built on the Avalanche network, of course that makes all the advantages of Avalanche applicable to Dexalot, one of which is the finalization time. Especially after Dexalot launched its subnet, it can be more customized and optimized.

In terms of fees or transaction fees, generally, transactions with the Avalanche network are also relatively cheaper compared to other networks. Generally, there is only 1 USD or less for each transaction that occurs; it differs quite a lot when using the Ethereum network, which can be 10 USD or more.

Specifically, in terms of transaction costs, there is a term that should be recognized, namely gas fees. Transaction fees will differ depending on the gas fees used. Lower gas fees will result in lower transaction costs, and vice versa.

However, using gas fees that are too low will have an impact on pending transactions. Therefore, in every transaction that occurs, there will be recommendations for gas fees to be used, for example, in the low, standard, and fast categories.

You can even do customs manually on gas fees, for example, by increasing gas fees more than the recommended gas fees for the fast category with the aim of speeding up the transaction finalization time but at the expense of more expensive transaction fees.

To check the gas fees that are currently being used, or if the term is real time, you can use a gas tracker. Each gas tracker in each network will be different.

For example, https://snowtrace.io/gatracker to find out gas fees on the Avalanche network; https://etherscan.io/gatracker to find out gas fees on the Ethereum network; https://polygonscan.com/gatracker to find out gas fees on the Polygon network; https://bscscan.com/gatracker to find out gas fees on the Binance Smart Chain network; etc.

Please refer to some of these sites to find out the gas fees that are currently required in real time. And advice from me personally: please wait and look for good moments to get cheap gas fees, for example, in the morning or afternoon, so that the transaction costs incurred are relatively cheaper with the same finalization time.

The similarities between Dexalot and Uniswap: UI and UX

UI stands for User Interface. According to Niagahoster, User Interface is a visual display of a product that connects the system with the user. This system can be a website, an application, or something else.

The user interface, or UI, is a display that includes shapes, colors, and writing that is designed to be as attractive as possible. Well, because the user interface is the appearance of a product seen by users, it must look attractive. In short, user interface design must be considered.

Dexalot and Uniswap have slightly different UI. Currently, Dexalot has implemented a Central Limit Order Book (CLOB) that has a feel similar to CEX, even though Dexalot itself is included in the DEX category.

When you use Dexalot, it’s like you are using a centralized exchange with features such as chart features, sell, buy options, and more. The nuance will be very similar to when you use a centralized exchange.

Unlike when you use Uniswap, which uses Automated Market Makers (AMM), it has a relatively different feel from Dexalot. This AMM concept is the most commonly implemented when using DEX.

Each type of display, be it CLOB or AMM, has its own feel. If you are more used to using a centralized exchange in the transaction process, then the CLOB feel on Dexalot will certainly get you more used to it.

While UX stands for User Experience, which focuses more on user experience. Dexalot with the CLOB concept provides a good user experience when frequently interacting with a centralized exchange.

You will be more familiar with the various tools available, for example, when you want to buy or sell your assets. You can also view graphs/charts in real time from any timeframe you like.

You can even place your order to not be executed immediately, which is quite different from the AMM system, where every time you make a purchase or swap, your order will be executed immediately.

If you use Uniswap, you need to set the slippage level first before buying or swapping. Whereas on Dexalot, you only need to place an order directly without needing to set the slippage level.

In terms of function, both are running well and can carry out transactions and the various features offered on exchanges in general. Only when you use Dexalot that is on the Avalanche network can you experience the various conveniences that Avalanche provides, such as fast finalization times and a lower fee.

The Dexalot Similarity to Uniswap: Ease of Use

In terms of ease of use, Dexalot and Uniswap have different characteristics. If you are more used to using centralized exchanges, then using Dexalot will generally be easier.

That’s because Dexalot offers a UI visual display that is similar to a centralized exchange, so you are more used to using it.

Uniswap offers a quite different view from Dexalot because it uses the AMM (Automated Market Makers) concept. The appearance of Uniswap is relatively the same as the various DEXs that you find, for example, PancakeSwap and others.

Both have good use, meaning that if you make a purchase, your transaction will be processed properly. This also applies to other features, such as swaps, pools, NFTs, and others.

Dexalot’s similarities to Uniswap: Likes and Dislikes

Dexalot provides good features, but of course it has its likes and dislikes. In terms of visual appearance, the two are relatively different and, of course, provide different levels of comfort depending on the user.

Dexalot, with a look and feel similar to a centralized exchange with CLOB, makes users more familiar because many people generally use centralized exchanges more often than decentralized exchanges in their transaction processes.

Especially because Dexalot is built on the Avalanche blockchain, which provides fast finalization times and lower costs. Both of these aspects are generally preferred by users over the relatively long finalization time coupled with the higher cost.

Uniswap also provides good features, as well as a section on likes and dislikes. Visually, Uniswap uses a Decentralized Exchange (DEX) appearance in general. You can send, buy, swap, pool, and more with the AMM concept.

For those who are used to using DEX, of course, it won’t be a hassle to use it. Since Uniswap generally uses the Ethereum network, the finalization time required is generally longer, and the required transaction fees are generally more expensive when compared to the Avalanche network.

Feedback on how to improve Dexalot based on your comparison

For me personally, Dexalot is one of the most promising DEXs on the Avalanche network. We know that there are several other DEXs in Avalanche, such as Pangolin, TraderJoe, etc.

The CLOB concept in Dexalot is a point that differentiates Dexalot from other DEXs, and in my opinion, this is one of its strong points.

Especially after Dexalot launched its own subnet, it will certainly be easier to do customization and better scaling.

My hope is that the existing and good features will continue, and one day other features can be improved, such as Avalanche Warp Messaging (AWM). And from a community point of view, IN THE CLOB podcast is still being carried out as a form of education for the community. Hopefully, in the future, there will be more innovations made by Dexalot.

Author: Mahfud Fauzi

Translator: Retno Dwi Andini

Editor: Brad McFall

Original article: Dexalot dan Uniswap: Perbandingan Kedua Exchange

About Dexalot

Dexalot is a revolutionary decentralized exchange bringing the traditional centralized exchange look and feel to a decentralized on-chain application. Its mission is to bring a truly inclusive and transparent environment where Dexalot users can trade crypto securely and efficiently, with no slippage or custody risk. It is built on Avalanche, the fastest smart contracts platform in the blockchain industry.

Website | Twitter | Telegram | Medium |Discord

Dexalot and Uniswap: A Comparison of the Two Exchanges was originally published in Dexalot on Medium, where people are continuing the conversation by highlighting and responding to this story.