Dexalot vs Binance: The Little Guy Challenges the Giant

by Luffy1123

Dexalot is a new decentralized exchange (Dex) with an order book built on the Avalanche blockchain. It is designed and developed to provide users with a familiar trading experience while ensuring decentralization and transparency.

On the other hand, ask anyone involved in the crypto market, and they will be familiar with Binance, the world’s largest centralized exchange (Cex) with billions of dollars in daily trading volume and a wide range of cryptocurrency pairs.

Today, we will explore the differences between these two exchanges: one being well-established and the other being a newcomer.

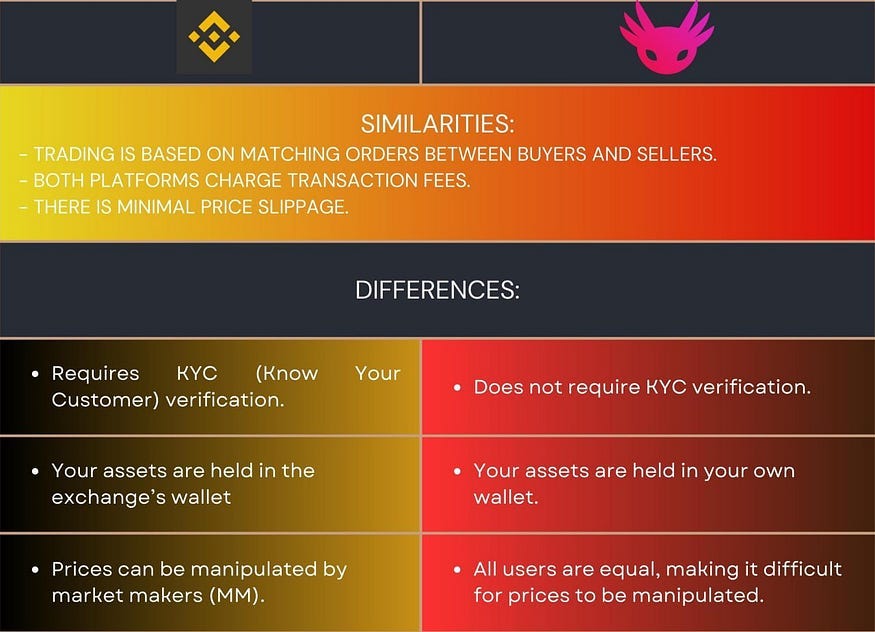

1. DEX and CEX: Different yet Similar

Dexalot is a decentralized exchange (DEX) that also incorporates some characteristics of a centralized exchange (CEX). Below are some fundamental comparisons between these two types of exchanges:

Therefore, Dexalot possesses both the characteristics of a DEX and a CEX. This is a unique aspect of Dexalot. Now, you can maintain your anonymity and protect your personal information. Your assets will be securely stored in your own wallet. You no longer have to worry about another FTX incident. Additionally, you will enjoy a trading experience similar to traditional CEX platforms, with a user-friendly Central Limit Order Book (CLOB). You don’t need to be concerned about price slippage; all you have to do is place an order at your desired price and wait for it to be matched.

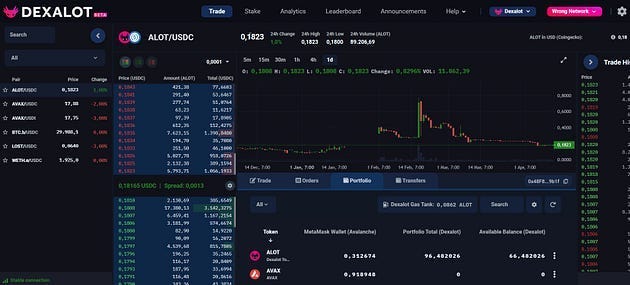

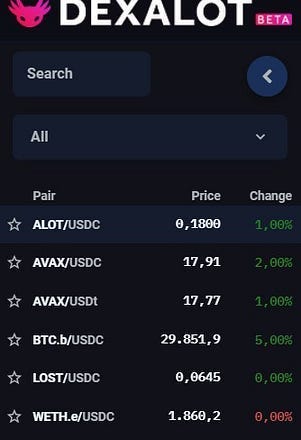

2. UI/UX

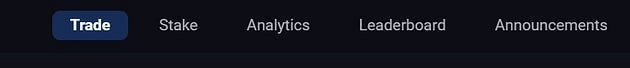

In terms of the user interface (UI), Dexalot has a relatively simple design with limited functionality. The displayed sections include trading pairs, open orders, filled orders, price charts, and your portfolio. There are also additional features such as staking, analytics, rankings, notifications, etc., but there haven’t been many opportunities to use them extensively.

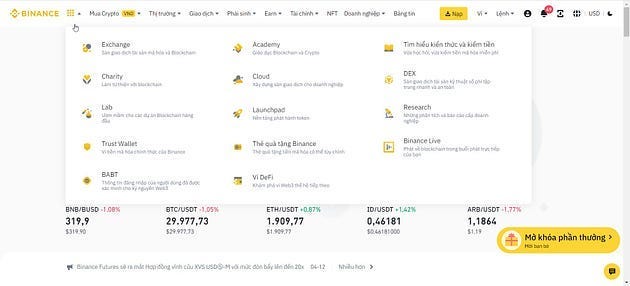

With Binance being a CEX, it offers a wide range of features, from crypto trading and NFT marketplace to various earning opportunities and integrated news. This allows users to easily access the entire Binance ecosystem without the need for extensive navigation or switching platforms.

In terms of UX, the trading experience on Dexalot is quite good. Placing orders is relatively easy, although you may need some time to familiarize yourself with the different types of orders that are unique to DEX platforms compared to CEX exchanges.

The new order types include:

Good till cancel: The order remains active until it is canceled by the user or executed. This order is used when a user wants to buy or sell at a specific price they believe the coin will reach.

Fill or kill: This order is used when a user wants to immediately buy or sell their entire quantity of coins, or the order will be canceled.

Immediate or cancel: The order is executed immediately for the available amount of assets at that time. The remaining portion is canceled.

Post only: The order is placed on the order book as a limit order but cannot be matched with existing orders.

One thing that I don’t like but have to accept is that whether placing or modifying orders, it needs to be confirmed on the wallet and incurs a fee in ALOT, although it is negligible.

As for Binance, there is indeed a multitude of features, and for first-time users, it can be a bit overwhelming. It’s a trade-off one has to accept when aiming to have everything in one place. However, the experience of placing and executing orders on Binance is very smooth, with minimal latency (if any, it is likely due to your own network), despite the large volume of orders processed by Binance per second.

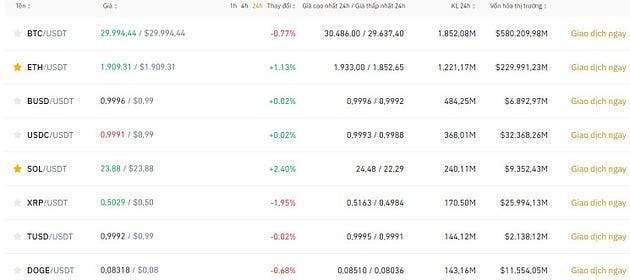

3. Number of Trading Pairs and Liquidity

As Dexalot is a relatively new exchange, it is understandable that there are not many trading pairs available. Currently, the exchange offers only 6 trading pairs, including:

This will limit user accessibility to the exchange due to the lack of necessary trading pairs. Additionally, liquidity is also a concern for the current state of the exchange, with a relatively small number of trades and a low volume of matched orders.

In contrast, Binance, as the world’s largest cryptocurrency exchange, offers a vast number of trading pairs, with hundreds of pairs available, and handles trading volumes reaching tens of millions of dollars every day.

4. Additional services

Currently, users can download and use the Binance platform on all devices, including computers, iOS or Android phones, with beautifully designed interface apps. Additionally, the platform offers various accompanying services such as futures trading, earnings, NFT marketplace, Launchpad, and a dedicated support team available 24/7 to provide continuous assistance.

Currently, Dexalot exchange is only available on the web platform and solely supports spot trading, without futures trading capabilities. Additionally, the exchange offers limited functionalities in other areas. Apart from trading, the platform currently includes features such as Stake, Analytics, and Leaderboard.

5. Areas for Improvement for Dexalot

Add more trading pairs. Currently, having only 6 trading pairs is insufficient to attract more users.

Introduce futures contract trading feature. This is a lucrative opportunity as there are very few DEX platforms capable of futures contract trading. If Dexalot can enter this market early, it can attract a significant number of users and generate substantial transaction fees. With the recent incident involving the FTX exchange, user trust in centralized exchanges (CEX) is wavering due to concerns about transparency and security. This presents a great opportunity for DEX platforms to attract users to their platforms.

Develop and launch a mobile app. The future trend is mobile devices, so having a mobile app is essential. It will enable users to easily access the platform from anywhere and at any time.

Organize additional competitions to attract more users. Currently, there are only the “Bug Bounty Program” and the “Dexalot Trading Cup.” It is necessary to expand the scale and offer more attractive rewards to attract a larger user base and raise awareness about the platform.

6. Conclusion

In summary, Dexalot is a new DEX platform with a unique Central Limit Order Book (CLOB) that allows users to trade easily, similar to traditional CEX platforms, while ensuring the security of their assets. As a new platform, there are still areas that need improvement to attract more users and increase liquidity. The current timing provides both an opportunity and a challenge for Dexalot to make a breakthrough and establish a significant market share in the crypto market, competing with traditional CEX platforms, with Binance leading the pack.

Author: Luffy1123

Translator: Houy Aoi

Editor: Brad McFall

Original article: https://medium.com/@nguyennd511/dexalot-vs-binance-ch%C3%A0ng-t%C3%AD-hon-th%C3%A1ch-th%E1%BB%A9c-ng%C6%B0%E1%BB%9Di-kh%E1%BB%95ng-l%E1%BB%93-c4d2aa12d3c3

About Dexalot :

Dexalot is a revolutionary decentralized exchange bringing the traditional centralized exchange look and feel to a decentralized on-chain application. Its mission is to bring a truly inclusive and transparent environment where Dexalot users can trade crypto securely and efficiently, with no slippage or custody risk. It is built on Avalanche, the fastest smart contracts platform in the blockchain industry.

Website | Twitter | Telegram | Medium | Discord

Dexalot vs Binance: The Little Guy Challenges the Giant was originally published in Dexalot on Medium, where people are continuing the conversation by highlighting and responding to this story.