Dexalot X Avalaunch: IDO Announcement

One of the chief tenets of decentralization is the principle of fairness. Significantly lower barriers to entry, inclusiveness, disintermediation and a whole host of self-evident, should-be-inalienable rights are some of the “true Norths” that blockchain has been founded upon. While reality can be vastly different, there is evidence of these most virtuous ambitions as teams continue to strive, traversing uncharted terrain in developing the Web3; though the blistering pace at which it has been built has left something to be desired. The maxim “move fast and break things,” has served crypto quite well but also, it has left some gaping holes in its wake.

The automated market maker represented a breakthrough in trading technologies. Quite swiftly, decentralized exchanges (“DEX”) were generating trading volume on par with their incumbent centralized counterparts. To date though, there has been nothing in the decentralized world where speed did not play a factor, where technology could not be used to game the system and certainly, nothing resembling a central limit order book. Until now.

https://medium.com/media/f8e616da0e3027a738b7eea1910a1043/href

Going where no DEX has gone before, comes a hotly anticipated Avalaunch IDO that needs no introduction to the denizens of Avalanche. This is of course none other than Dexalot.

Project Overview

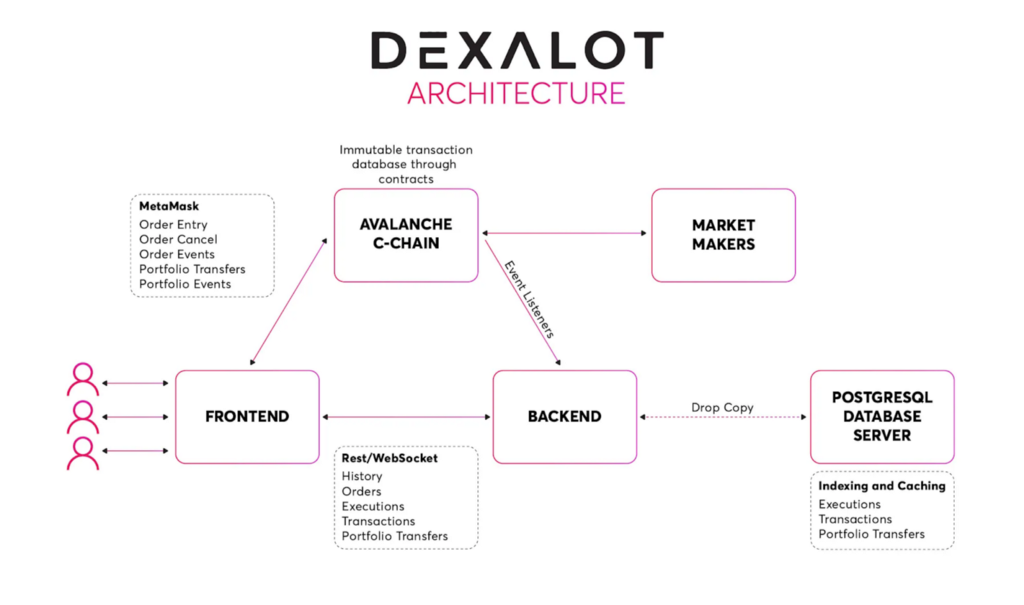

Dexalot aims to be the initiative that will make us all forget centralized exchanges. To frame this some, consider it’s fundamental underpinnings and features:

- Non-custodial, fully open-sourced — high level of decentralization

- Central Limit Order Book — traditional bids and offers

- Order Types — market, limit, stop*

- MEV (miner extractable value) resistant

- Finality — 1.3–3.4 seconds

- Fees — negligible*

- Dexalot will be deployed on an Avalanche subnet (subnetwork), at which point, the exchange will be more robust and flexible.

Consider the difficulties one encounters with centralized exchanges:

- Inexplicable system outages

- Hacks

- Funds concentrated in custodial wallets

- Randomly unable to withdraw or deposit funds

- Frontrunning

- Improper use of customer funds: Staking, leverage etc.

- Improper accounts seizures

Conversely, AMM driven DEX’s are not without their own peril:

- Impermanent loss

- Absence of order books

- Variable and extremely costly gas fees

- Failed transactions

- Bots

These are not difficult lists to populate. Despite the considerable opportunity, scores of experienced traders and well-capitalized outfits have not gained their desire exposure to this nascent asset class simply because there is no seamless way to engage it without being exposed to inefficiencies and/or incompetencies that can prove very costly.

A Pain Point

As previously discussed here, communities have suffered from these aforementioned inefficiencies during new project token listings. The detrimental outcome to users is well documented but the long-term damage it can do to otherwise sound projects is largely incalculable and entirely unreported. It is simply forgotten and something that not every project rebounds from. The cries of manipulation and accusatory stances of outraged communities can have lasting effects. In the bigger picture, it does not advance our collective cause and Dexalot wishes to help solve these problems.

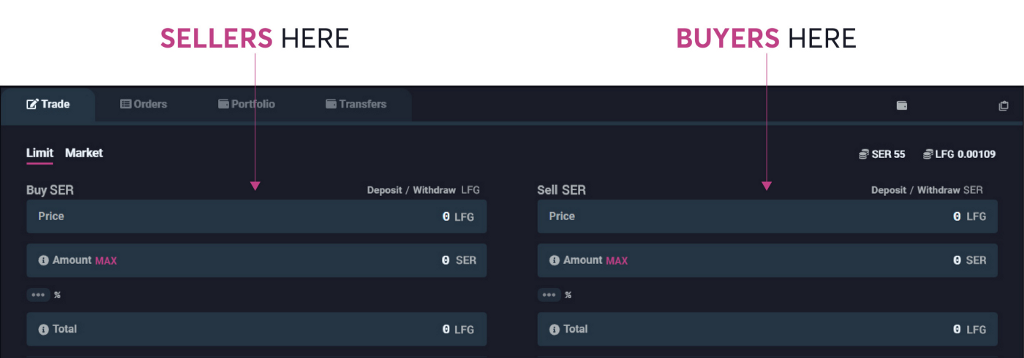

No longer should the fate of a new project be determined by bad actors, (e.g. bots, people with large nodes, etc). While Avalanche DEX’s have done much to make the market more liquid and tradable, malicious price action at the time of listing is deleterious to the point where it outstrips many of the benefits. To date, there is nothing resembling a traditional central limit order book (“CLOB”) where bids and offers can be placed and executed upon. With “Dexalot Discovery,” new projects will have the opportunity to launch in an environment that supports natural price discovery, allow users to place bids and offers and essentially, replicate the very best from traditional finance markets.

Dexalot Discovery:

- Supports limit orders.

- Prevent bots from shutting out users.

- Give users ample time to enter orders and match.

- Create a more orderly and fair price discovery process.

- Following price discovery, AMM listings become safer.

Dexalot discovery will be debuted with their own token. Although it is common in crypto to see first users take on enormous risk with new technologies, Dexalot is not asking anyone to take risk with something brand new.

Some additional Dexalot highlights:

- Dexalot has been on testnet since August 6th, 2021

- Dexalot is a state-of-the-art decentralized exchange with market making and a CLOB.

- Dexalot will be one of the first subnets built on Avalanche

- Dexalot Discovery is intended to replicate regular markets as closely as possible.

Dexalot — Links & Team

Website | Telegram (Discussion) | Twitter | Medium | YouTube | Discord | Github

Partners & Backers:

“Dexalot represents the next logical step for crypto as the marketplace evolves and it’s participants drive towards maturity and institutionalization. TradFi markets lack the necessary transparency, openness and the non-custodial relationship most crypto users have come to desire and Dexalot is perfectly positioned to solve for these requirements without compromising on the user experience aspect.” — Brian Johnson — Head of Crypto, Republic Crypto

Closing Thoughts

Dexalot is not just for buyers or sellers — it represents, for everyone, the opportunity to interact without barriers while removing the technological edges that have a corrosive effect on the ecosystem. While it may not strike as novel at first glance, having something akin to regular trading in a DEX is absolutely groundbreaking. With Dexalot, users can act asynchronously and simultaneously. In traditional finance, this is how markets open and close every day. There are many decades and significant histories of open listings in more mature markets. It is wholly proven and something sorely needed in crypto. Order books bring transparency, and the removal of technological advantages and speed of execution offers long-term benefits that are fundamentally required for any trading environment to be sustainable. New projects are early stage companies with tradable assets. It is the nature of such a thing that the height of speculation comes at a time when a project is most vulnerable. The evolution and maturity of decentralized exchanges, the true next gen, is upon us with Dexalot.

On a personal note, Avalaunch has worked closely with the Dexalot team for some months now and has chosen to integrate with them to offer direct deposit from Avalaunch into the Dexalot exchange. Avalaunch believes their projects and community will benefit greatly from the myriad improvements Dexalot will provide.

“Working with Avalaunch has been an absolute pleasure, and we’ve been thoroughly impressed with their know-how, network, capabilities and most of all their ethics and willingness to assist with any and every challenge we’ve faced as we worked towards our launch.” — M. Nihat Gurmen & Cengiz Dincoglu, Dexalot Co-Founders.

Funding Numbers

- Total Supply: 100M ALOT

- Seed: 4M ALOT for the Blizzard Fund*

- Private Sale: 10.5M ALOT at US$ 0.50 — US$ 5,250,000

- Public Sale: 2.5M ALOT at US$ 0.60 — US$ 1,500,000

- Raise: US$ 6,750,000

*Prior to the formal creation of the Blizzard Fund, The Avalanche Foundation seeded Dexalot more than one year ago in order to fast track this seminal project.

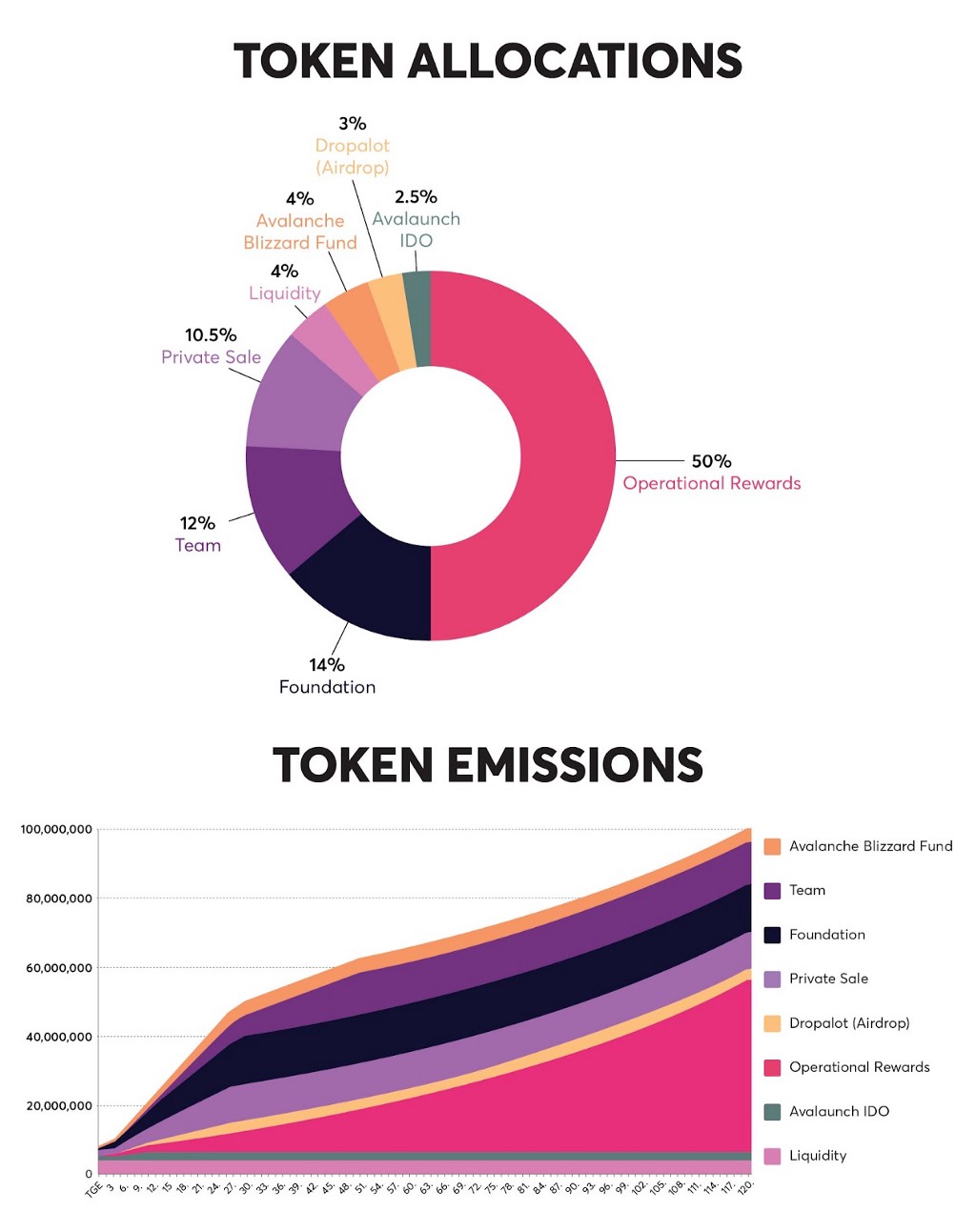

Supply — Breakdown & Vesting:

Total Supply: 100,000,000 ALOT

- Operational Rewards: 50M ALOT (50%)

- Foundation: 14M ALOT (14%)

- Team: 12M ALOT (12%)

- Private Sale: 10.5M ALOT (10.5%)

- Liquidity: 4M ALOT (4%)

- Avalanche Blizzard Fund: 4M ALOT (4%)

- Dropalot (Airdrop): 3M ALOT (3%)

- Avalaunch IDO: 2.5 ALOT (2.5%)

Vesting Following TGE:

- Operational Rewards: Starts 200,000 ALOT/month for 6 months, increases 1.2% monthly.

- Foundation: 30 months linear vesting

- Team: 6 month cliff, 42 months linear vesting

- Private Sale: 15% at TGE, 3-month cliff, 21 months linear vesting

- Liquidity: 100% unlocked

- Avalanche Blizzard: 15% at TGE, 3-month cliff, 21 months linear vesting

- Dropalot (Airdrop): 0–3 month cliff, variable vesting

- Avalaunch IDO: 25% TGE, 3-month cliff, 9-month linear vesting

Other:

- Initial Circulating Supply: 3.3M ALOT (excluding liquidity tokens)

- Initial Market Cap: US $1.98M (at US$ 0.60 and excluding liquidity tokens)

The Dexalot IDO on Avalaunch

- 2.5M ALOT at US$ 0.60 — US$ 1,500,000 (Total Supply: 100M ALOT)

- Sale Size: US$ 1,500,000

Registration Schedule:

- Registration Opens: February 18th at 3:00 p.m. (UTC)

- Registration Closes: February 21st at 6:00 a.m. (UTC)

Sale Schedule:

- Validator Round Begins: February 22nd at 6:00 a.m. (UTC)

- Validator Round Closes: February 22nd at 3:00 p.m. (UTC)

- Staking Round Begins: February 22nd at 3:30 p.m. (UTC)

- Staking Round Closes: February 23nd at 6:00 a.m. (UTC)

Please note: Due to a limitation to Dexalot’s cloud provider, residents of Ukraine are temporarily geoblocked from accessing Dexalot’s website and exchange. We apologize for this inconvenience and working as quickly as possible to resolve this issue.

IDO Recap

- Total ALOT for sale: 2.5M

- Price: $.60

- Size: $1,500,000

- Vesting — 25% TGE, 3-month cliff, 9-month linear vesting

About Avalaunch

Avalaunch is a launchpad powered by the Avalanche platform, allowing new and innovative projects to seamlessly prepare for launch with an emphasis on fair and broad distribution. With its values deeply rooted in the early Avalanche community, we are able to offer projects confident, informed users who are aligned with the long-term goals of the rapidly expanding application ecosystem.

Leveraging Avalanche’s scalable, high-throughput, and low-latency platform, Avalaunch is built by users, for teams, to help grow strong communities.

![]()

Dexalot X Avalaunch: IDO Announcement was originally published in Avalaunch on Medium, where people are continuing the conversation by highlighting and responding to this story.