Embr Finance: Balancer V2 and You

Embr.Finance has launched and is available for public deposits and trades on the Avalanche Network. Embr aims to provide and maintain a top-level platform to house the multitude of benefits made available by a Balancer V2 AMM powered by Avalanche.

Some advantages Embr provides over traditional outlets include:

- Protocol Vault for all assets

- Improved gas efficiency

- Permissionless, customizable AMM logic

- Capital efficiency through Asset Managers

- Low gas cost and resilient oracles

- Community-governed protocol fees

In this post

The Vault

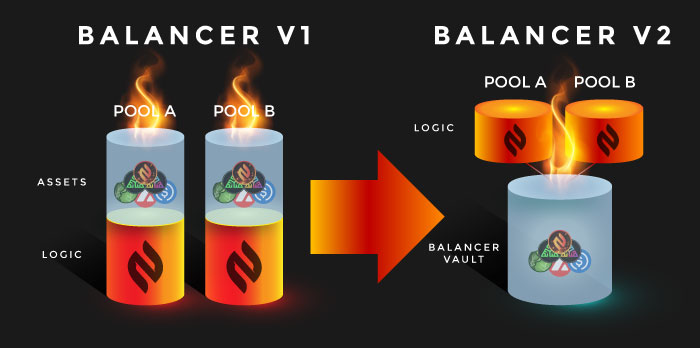

Embr utilizes a single vault that holds and manages the assets added by all of our pools.

So now, what would have been multiple transactions, each with gas fees, now becomes a simple single fee transaction.

Embr allows for the separation of the AMM logic from token management and accounting. This allows the implementation of any arbitrary, customized AMM logic.

Users are now able to hold internal token balances inside the vault, for example, if you are trading AVAX for AUSD but know that you’ll trade AUSD back to AVAX in a few hours, you can keep both tokens in the vault and use them for your next trade without the need for an intermediate useless ERC20 transaction.

Internal token balances are extremely useful for high-frequency trading and are a very advantageous DeFi building block, allowing DEX aggregators to leverage Balancer internal balances in order to provide traders with the lowest gas costs to their users.

Gas Efficiency

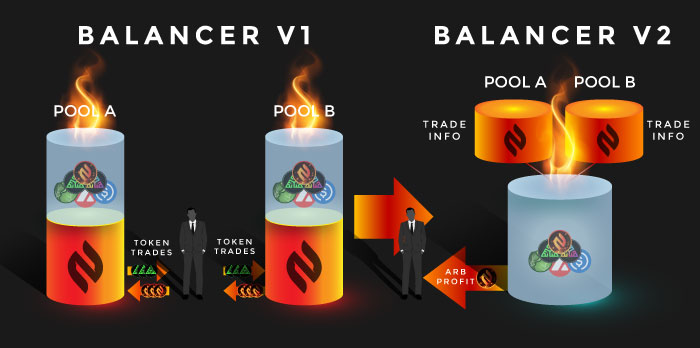

In all other AMMs that we are aware of, trading with two or more pools is gas inefficient because users have to send and receive tokens from all pools.

With Embr’s current protocols, even though trades are carried out in batches against multiple pools, only the final net token amounts are transferred from and to the vault, saving a significant amount of gas in the process.

Since only final net amounts are transferred, arbitrage trades are also significantly easier.

Traditional AMMs are less than efficient with their capital since a large portion of the assets in a pair remain unused.

Asset Managers

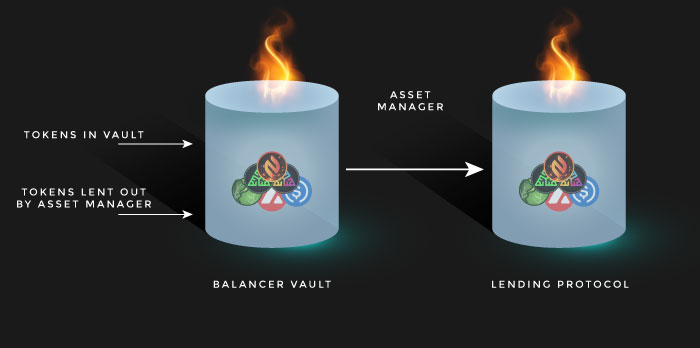

To leverage the potential of these assets, Embr is utilizing a new revolutionary concept called Asset Managers.

Asset Managers — external smart contracts, nominated by pools, that have full power over the pool’s tokens.

Embr provides the asset manager and dynamic fees, both of which will bring LPs additional yield at no extra cost by simply making intelligent use of the pool’s idle liquidity and continuously optimizing a pool’s fees.

Twitter: @EmbrFinance

dApp: App.Embr.Finance

Website: Embr.Finance