Everest DAO, Options Trading, and The Latest Avaware Partnership

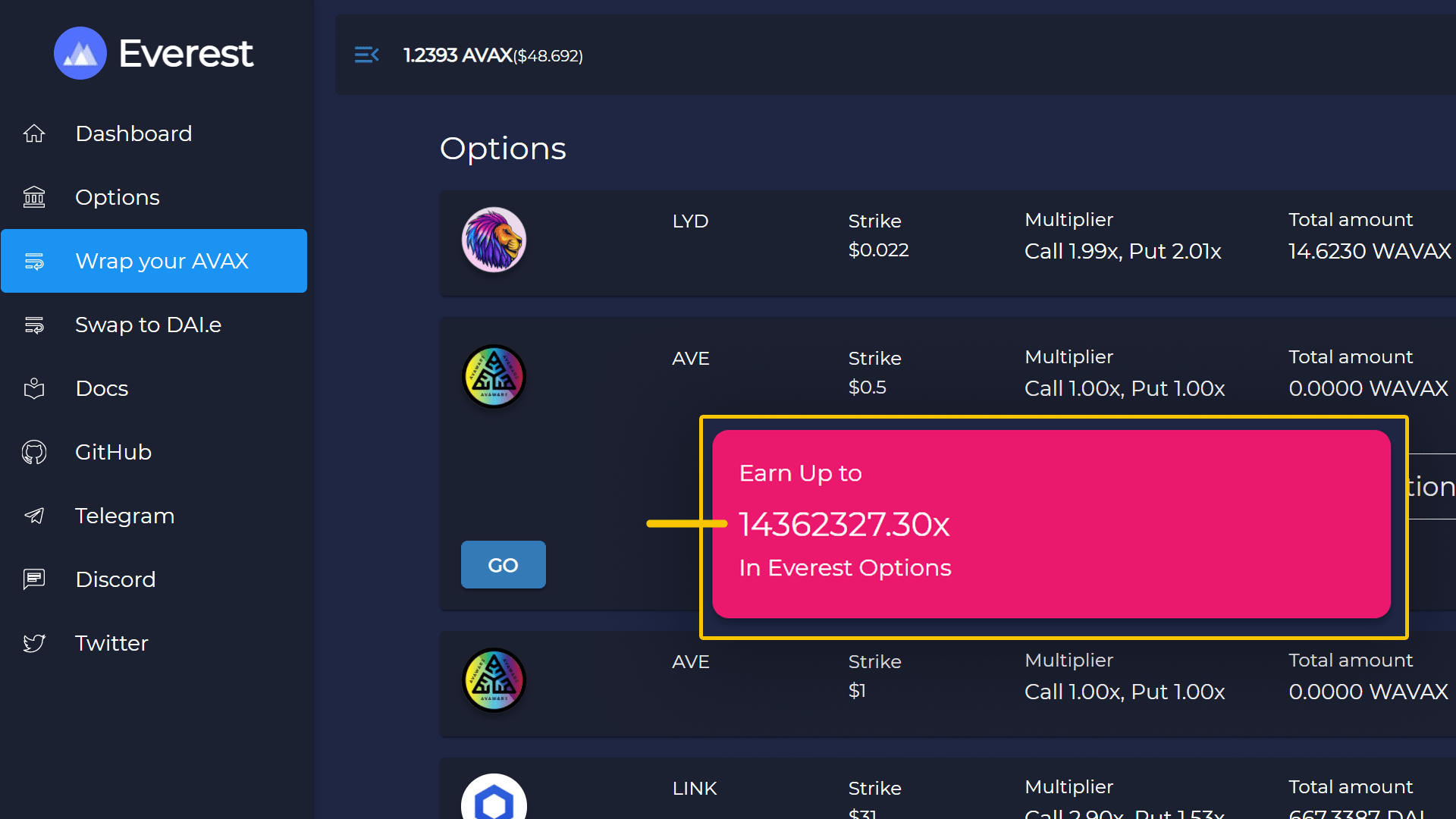

We recently wrote about Everest DAO’s options app. It’s in beta but an exciting premise. Nevertheless …

There’s more …

Take a look under the hood, and get up to speed with Everest DAO. And be sure to check out the official Avaware partnership article on Medium.

In this post

A brief summary

- Everest DAO is one the first Avalanche DAOs.

- They don’t have a token yet.

- The Everest DAO IDO/IFO is coming very soon.

- They’ve partnered with Avaware.

- Everest DAO will be launching Avaware options.

Important Links

A little background info

- Options are leveraged financial instruments.

- You guess the direction of a token’s price.

- If you’re correct, you get paid.

- Options have expiry dates, and can be trade before expiry

On the Avaware partnership

There will be AVE options launched by Everest DAO. Meaning you can buy CALLS and PUTS on Avaware’s native token: AVE.

If you’re smart about it, you might find some hedging opportunities for AVE farming, and more.

Not sure what we’re talking about? Don’t worry.

Options made simple

Not everyone will be familiar with options. So here’s a basic run through.

Strike price

The strike price is the “benchmark”. The future price that will be measured against.

At a given date, after a certain period of time, the options will expire.

Expiry dates

Expiry dates will be biweekly and quarterly. Once again: options last for a set period of time.

In our case; there will be two periods:

- Biweekly options = 2 weeks

- Quarterly options = 12 weeks.

Now you understand the time periods. You need to understand the two types of options you’ll have access to.

Puts, calls, … whaa~ ?

There are two basic option types:

- CALL options; used when you think the price will appreciate.

- PUT options; used when you think the price will fall.

Use each one as and when you please. Just note the end goal: be correct about your decision. You’ll profit if you are.

A simple example

You go for an AVE quarterly option. The strike price is $1. You think the price is going to close higher, so you buy CALL options–options where you profit if the price appreciates.

You pay some WAVAX. Wagering on your belief that the price will appreciate.

The option expires in the money. You profit.

More on Everest DAO options process

You’ll use WAVAX to buy options. Everest DAO is an Avalanche project so this makes sense.

In their own words: “the reason we use WAVAX as the underlying asset is to not make the option potentially neutral or circular, and also make it more reliable for delta strategies.”