IntDegen Vaults

Introducing Degen Vaults

We’re excited to announce our much anticipated Degen Vaults. Our priority over the past few months has been to provide core, multi-strategy vaults that have extremely low risk profiles, allowing our users to earn yield on otherwise idle assets with higher peace of mind.

For those looking for a higher risk, higher reward option, we have thought carefully about how we can implement an option that caters more optimally to the Degens out there. This is where our DegenVaults come in. Our DegenVaults will be far less risk averse, containing strategies that push the boundaries and experiment with a much wider range of approaches that come with broader risk profiles — targeting the highest potential yield..

You can find this broader suite of riskier options under the “Degen” tab on the RoboVault website.

Disclaimers

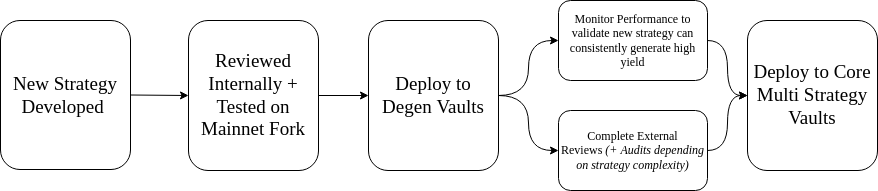

- DegenVaults will contain experimental strategies that have only undergone internal reviews and testing.

- If there are any losses resulting from the use of the DegenVaults, there will be no reimbursement plan.

- DegenVaults Contain higher risk delta-neutral strategies with higher Expected Value (EV) — at the cost of increased volatility and exposure to short-term losses through potential IL (impermanent loss)Degen vaults will wind up the risk profile on our known and loved core strategy with the collateral ratios being ramped up to within 10% of the maximum threshold. This will improve returns while the market is slow, though it increases the risk of liquidations during extreme volatility & comes with heightened potential risk from the potential failure of our keepers. Liquidation events can lead to losses of approximately 1% — 3% . (Link to keeper medium article)

- As these strategies are likely to be quite gas intensive & have high costs for the keepers to manage the strategy, if a DegenVault does not return a profit for the protocol, RoboVault reserves the right to temporarily pause management of the vault or retire it indefinitely.

Initial DegenVaults

- USDC

- FRAX

- WETH

- WFTM

Let us know in the discord what else you would like to see!

Strategies

Some initial strategies that will be deployed in the DegenVaults:

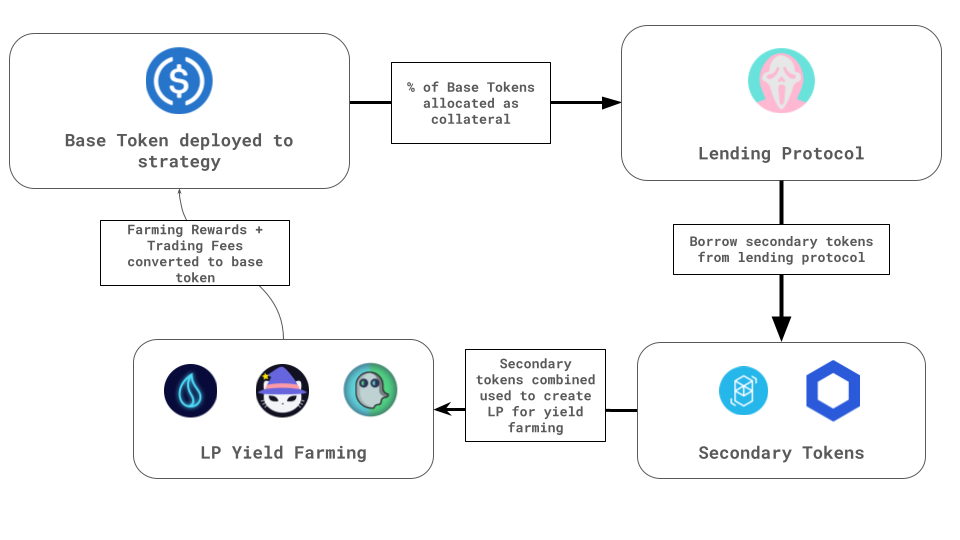

Core Strategy

Our known and loved core strategy will be deployed within the coming weeks. We will roll out the strategy with a higher allocation and also will be upping collateral ratio to squeeze more returns for our degen users.

Joint LP Strategies

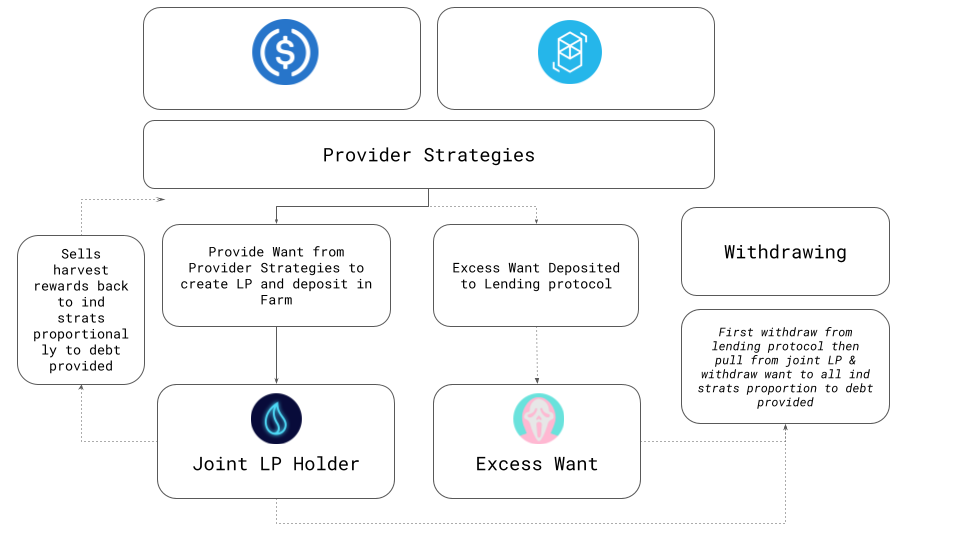

Joint LP Stable

The Joint LP Stable strategy combines funds from two stable vaults (USDC & FRAX initially) to farm trading fees and emissions.

Joint LP Variable

The Joint LP Variable strategy combines the Joint LP Stable concept with our core strategy (Hedge-farming), where two vaults contribute to a variable farm (WFTM/WETH). Our keeper monitors the debt ratios of the LP and rebalances the position as needed to maintain a delta neutral position and minimise exposure to IL. This can be considered a more capital-efficient version of our core strategy. The EV will be higher but the returns will be more prone to swings, so we expect short-term losses from this strategy during volatile market conditions.

General LP Hedged Strategy

Our general LP hedged strategy works in a similar way to our current hedged LP strategy, with one major exception — it allows for any two assets to be borrowed against the vault’s base asset to create an LP and farm rewards while constantly rebalancing the position to avoid IL. The first version for our DegenVaults will use USDC as collateral to borrow LINK and WFTM to create LINK/WFTM LP and farm rewards.

Other Strategies

We will be using the DegenVaults as the final step in our lengthy scrutiny process that strategies go through before being deploying to the Core Vaults. These will be lower risk strats, for example, testing new lenders for our generic lender strategy.