Introducing Yield Redirect

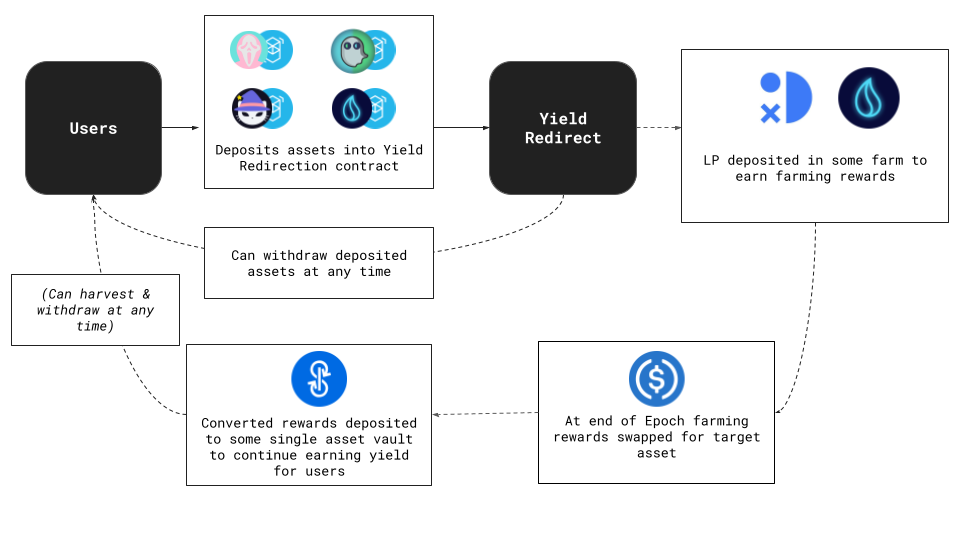

The Yield Redirect product has one, core intention — to minimise the volatility of the yield being returned to users. Initially, users will deposit an LP (Liquidity Position) — for example users might deposit a SCREAM / FTM LP. Then, our yield redirect contracts will deposit this LP into a farming position — but the key is that we will then automatically convert the rewards to USDC, which protects the earned yield from market volatility. We then go a step further and deposit the less volatile USDC to an interest bearing product, such as a Yearn Vault. This means that users can continuously earn yield on their converted rewards without needing to withdraw, giving them the maximum return on their initial deposit.

What problem are we looking to solve?

As alluded to earlier, the core motivation for building the Yield Redirect feature is to provide a better way for users to earn a less volatile return on their precious LPs. Farming rewards for many LP pairs often have very high rewards on initial inspection, often in the 100%+ APR range. However, the tokens earned from yield farming on LPs often come with a high degree of price volatility. converting these rewards to a stable asset allows users to “lock in” these potential higher yields, as it removes their exposure to volatility.. Additionally,the underlying LPs that users deposit are often vulnerable to big market movements and the potential for impermanent loss — which means that auto-compounding rewards into the LP, as some protocols do as an alternative to yield farming volatile tokens, still exposes the user to a high degree of unpredictability and volatility on their potential earnings.

How is the Yield Redirect structured?

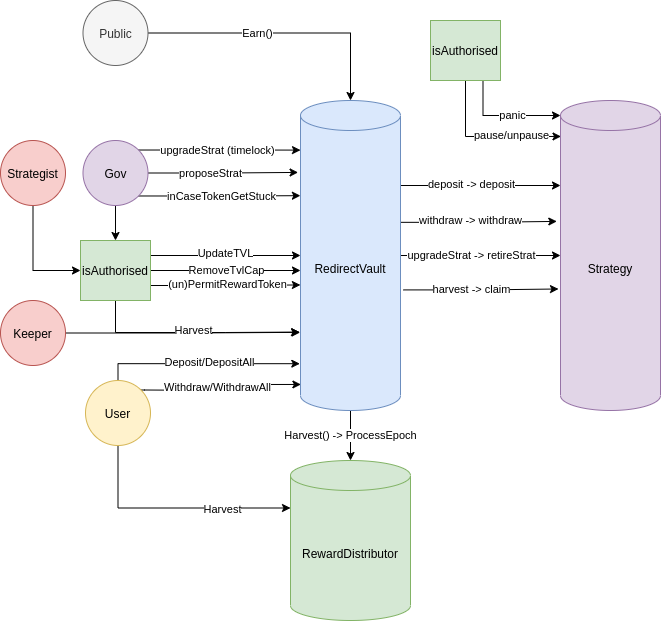

Our Yield Redirect product uses a modified version of Yearns V1 / Reaper Vault architecture to manage the deposited assets. There is an additional module, the RewardDistributor, which is built on top of the original architecture and manages the redirected yields of users.

How are rewards emitted

The Yield Redirect uses an Epoch system to track and disburse user rewards. Each time the Yield Redirect harvests the farming rewards are automatically converted to the target token. The RewardDistributor then splits the target tokens that were converted to users balances who are eligible to receive rewards that epoch. In order to ensure users cannot manipulate this system when users first deposit they won’t be eligible to receive the redirected rewards until the next Epoch. This is done in order to stop users milking rewards by depositing & withdrawing right before and after harvests.

Future Iterations

Our initial release will allow users to deposit a number of LP’s and have the farming rewards redirected to yvUSDC. Future iterations of the product will enable for single asset deposits along with more advanced strategies to be utilised with yields being redirected to various assets. Also the structure can be utilised to to offer Farming as a Service products for various DAO’s allowing various assets to be used to farm a DAO’s native token (without emissions)

When Release ?

We’ve currently deployed private versions of the Yield Redirect to mainnet so we can make sure it behaves as expected based on the testing we’ve already completed. We’re also making some final tweaks to our UI to integrate the Yield Redirect Contracts. We expect to go live in the next week starting with the following LP Pairs

SPIRIT/FTM

BOO/FTM

SCREAM/FTM

LQDR/FTM