Maximus is coming for the crown

Maximus; new generation yield farming aggregator & optimizer. Built by the Lydia Team. Focussed on maximising your earnings.

In this post

The metrics we know

- Token: MAXI

- Chain: Avalanche

- Max supply: Uncapped*

- Lanuchpad: Lydia Finance

- When: soon

Launch

MAXI will be an Avalanche native token. Launching via Lydia Finance’s launchpad. Fitting for a Lydia project.

The IFO will see 1.2m~ MAXI distributed.

What does it do?

It’s a yield optimizer. A compounder. Like YieldYak, Cycle, Penguin Compounder. But with some unique features:

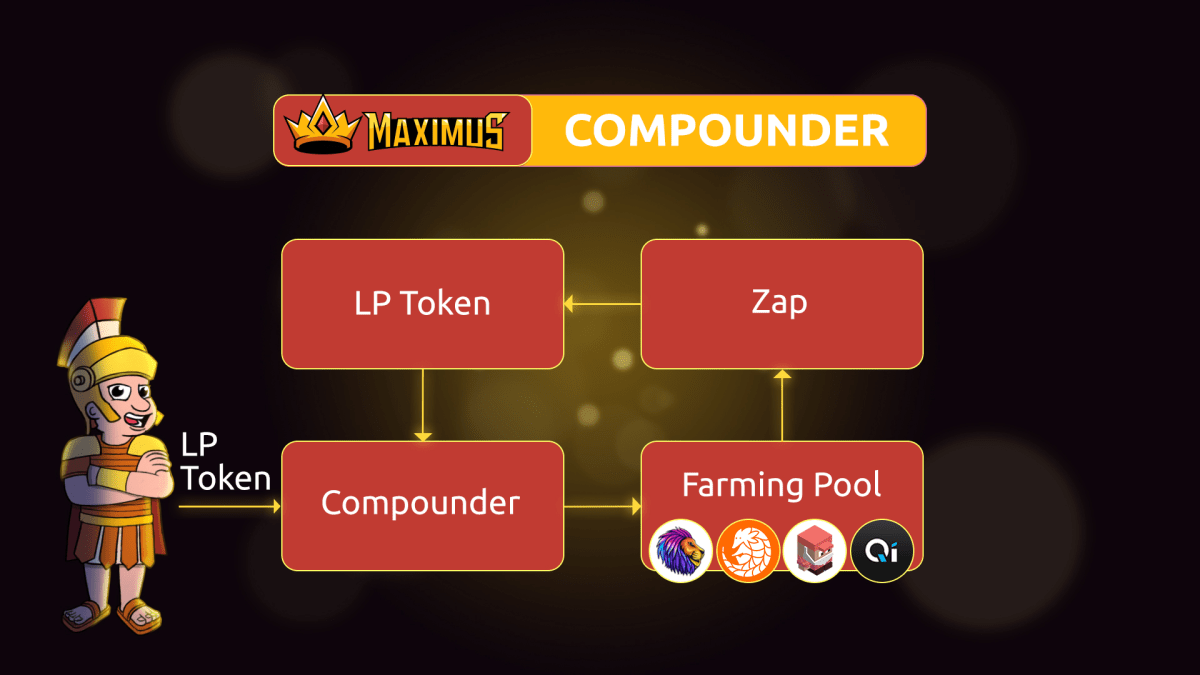

The compounder

Commonly seen on other optimizers. LP farm rewards are compounded to buy more LP.

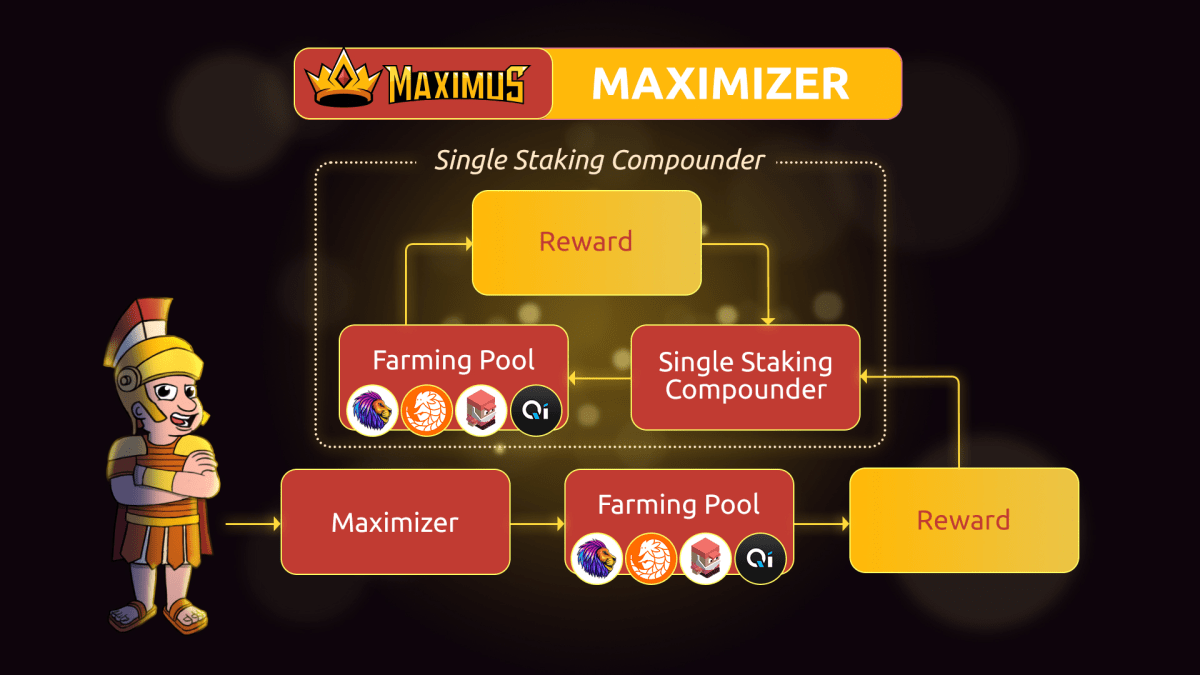

The maximizer

Unique to Maximus.

They farm LP rewards and compound the rewards in single staked pools. Maximizing exposure to rewards tokens, with the additional compound earnings factor.

Unlike normal compounders that increase LP. The maximizer forwards rewards to the single staked pools. Where they’re compounded. Mentioned next.

The single staked pools

No impermanent loss, just raw single staked token compounding.

There will be two key single staking pools we know about:

- MAXI staking to earn AVAX

- MAXI staking to earn MAXI

Addressing the uncapped supply

But it’s unlimiiteeddd…

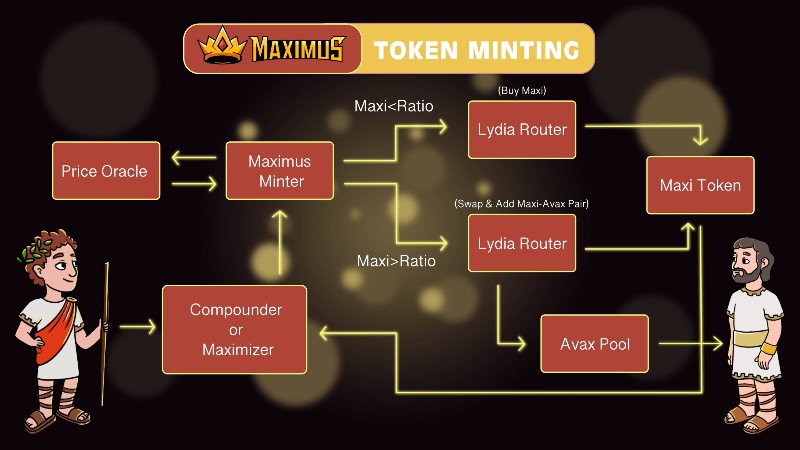

Dynamic usage emissions

The more we collectively use Maximus, the more tokens are emitted. This rewards more as more people use it. But there are some interesting balancing acts.

Floating rate emissions

They’re using a “floating rate emission”:

- 1 AVAX earned in performance fees mints 10 MAXI.

This is done in a controlled manner. And ensures the following pros:

- Rewards never end

- Users are rewarded fairly

And, there’s a mechanic to ensure the price valuation floor. The main aim is to peg the floor relative to AVAX’s price.

Buy backs

This isn’t a manual effort. Like many projects implement. Burning and buying as and when they can be bothered. Rather, there are two protocol states:

- MAXI price falls below 1/10 AVAX. The system buys MAXI, and redistributes performance fees aqcuired to users. Using the Lydia router*.

- MAXI price exceeds 1/10 AVAX. The system mints MAXI as performance rewards. No buy back.

*State 1, below 1/10 AVAX, will generate automatic volume for Lydia pairs sided with MAXI.

Summary

Maximus is a yield optimizer. They’ll have 3 features; compounder, maximizer, single staking.

IFO is launching on Lydia Finance soon.

Tokenomics are unique, with floating emission rates, dynamic usage fees, automated buyback mechanisms.

Maximus – Lydia Finance – Maximus Twitter – Maximus Telegram