Movement Labs & Thala Labs: A Leap Forward for Decentralized Finance

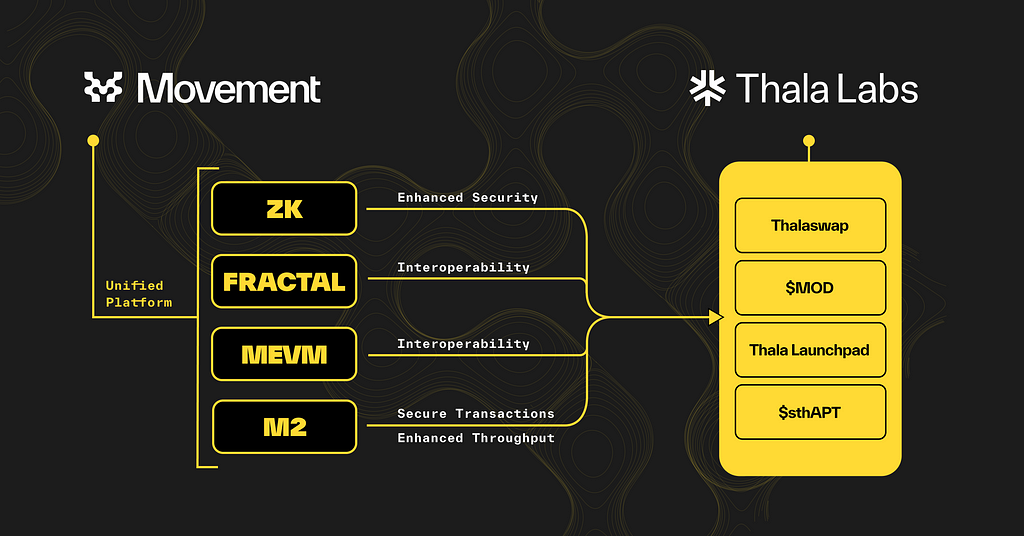

In the rapidly evolving landscape of decentralized finance (DeFi), the collaboration between Movement Labs and Thala Labs stands out as a beacon of innovation and foresight. This partnership has given rise to the creation of the most expansive DeFi platform within the Move ecosystem, leveraging the technological prowess of M2 to redefine the boundaries of scalability, security, interoperability, and user experience in DeFi. This comprehensive analysis delves into the myriad facets of this groundbreaking collaboration, exploring the intricate mechanisms, innovations, and strategic implementations that set this alliance apart in the DeFi space.

The DeFi Colossus: Thala’s Platform on Move

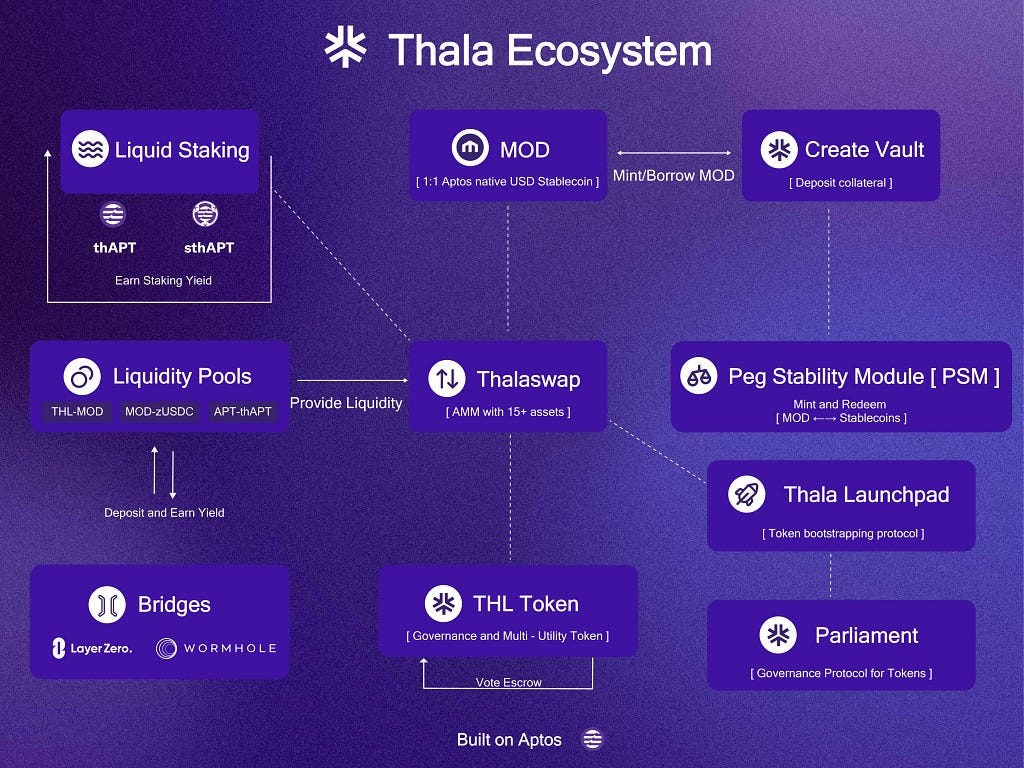

The alliance between Movement Labs and Thala Labs introduces a DeFi behemoth, boasting an impressive $200 million Total Value Locked (TVL) on Aptos. This platform is not merely a collection of DeFi services but a meticulously designed ecosystem that addresses the critical needs of the DeFi community through several key components:

Thala Swap DEX

At the forefront of Thala’s DeFi ecosystem is the Thala Swap DEX, a decentralized exchange engineered to facilitate seamless asset swaps with unparalleled efficiency. This platform harnesses an automated market maker (AMM) model to ensure liquidity and facilitate a diverse range of trading pairs, catering to a wide spectrum of DeFi participants.

Move Dollar ($MOD)

The Move Dollar, also known as $MOD, is the central unit of Thala’s ecosystem. It is a stablecoin that is backed by a diversified asset portfolio. This innovative stablecoin is crucial for dynamic DeFi transactions, as it enables secure borrowing, smooth lending, and other financial activities. The Move Dollar ($MOD) is the backbone of Thala’s DeFi ecosystem, which is supported by collateralized debt positions (CDPs), monetary policy tools, and a dedicated treasury. This stablecoin is more than just a medium of exchange; it is a foundational element that ensures the liquidity, stability, and growth of the ecosystem.

$sthAPT for $APT Staking

Thala Labs is revolutionizing staking mechanisms within the DeFi sector through its introduction of $sthAPT, a unique staking token for the Aptos blockchain. This innovation is designed to boost both liquidity and stability on the network. By staking $APT, participants receive $sthAPT, which represents a staked interest in the network’s growth and performance. This process not only rewards users but also strengthens the overall health of the Aptos ecosystem.

The $sthAPT mechanism is more than just a tool for earning passive income; it’s a strategic initiative that aligns the interests of individual participants with the broader goals of the ecosystem. This alignment incentivizes active participation and investment in the network, fostering a more vibrant and resilient DeFi environment. Furthermore, $sthAPT staking incorporates advanced features like liquidity pooling and yield farming, allowing users to maximize their earnings while contributing to the network’s liquidity.

Vibrant Token Launchpad

The token launchpad of Thala Labs is a pivotal element in its ecosystem, acting as a springboard for Move-native projects to achieve growth and visibility. This platform is structured to ensure fair and equitable distribution of tokens, supporting the principles of diversity and inclusiveness in the DeFi space. By allowing MOVE and MOD to be used in project launches, Thala Labs not only facilitates a vibrant and inclusive DeFi environment but also enriches the ecosystem with a variety of projects, fostering innovation and expansion.

This launchpad is more than just a platform for token distribution; it’s a hub for nurturing new ideas and collaborations within the Move ecosystem, offering a transparent and equitable process for all participants. It promotes a merit-based system where the best and most promising projects receive the support and exposure they need to thrive. This strategic approach strengthens the DeFi landscape under Thala Labs, ensuring a dynamic and flourishing community that contributes to the sustained growth and diversity of the ecosystem.

Thala Swap: A Closer Look at DeFi Innovation

Thala Swap DEX remains at the vanguard of Thala’s DeFi ecosystem with its advanced decentralized exchange, built to enable asset swaps with unprecedented efficiency. At the heart of Thala Swap’s operations is a robust AMM model, which ensures a constant flow of liquidity and supports a diverse array of trading pairs, addressing the needs of a broad spectrum of DeFi participants.

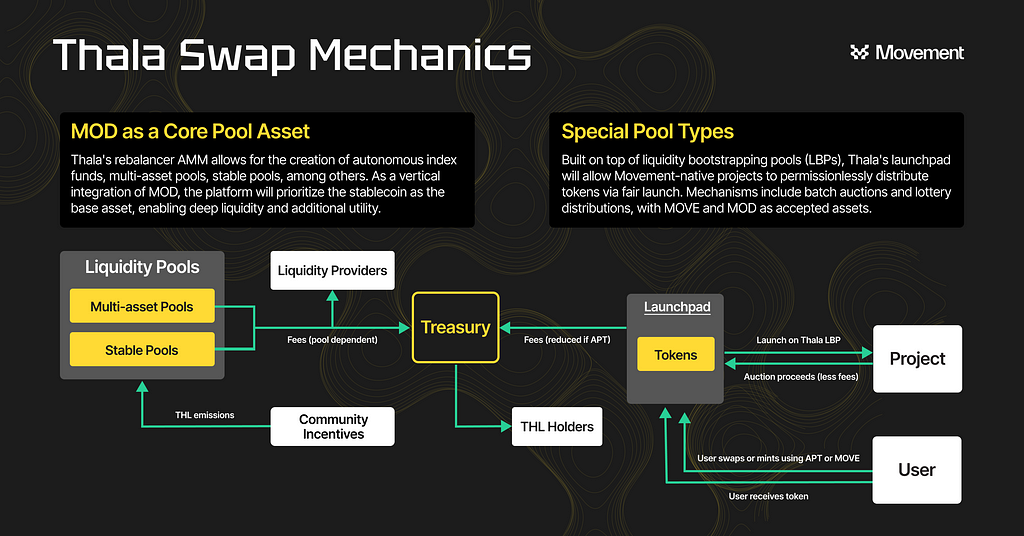

MOD as a Core Pool Asset

The DEX’s ingenuity lies in the integration of MOD as a core pool asset. Thala’s AMM is uniquely designed to facilitate the creation of autonomous index funds, multi-asset pools, and stable pools, amongst others. With the inclusion of MOD, Thala Swap not only provides essential liquidity but also prioritizes its native stablecoin to enhance the platform’s utility further. As a vertical integration within the Thala ecosystem, MOD’s role extends to being a key asset in liquidity pools, which are critical to the functioning of the DEX.

Liquidity Pools and Treasury

The architecture of Thala Swap’s liquidity pools is strategically designed to incentivize liquidity providers through the distribution of fees, which are dependent on pool performance. These fees serve a dual purpose: rewarding providers for their contribution and bolstering the platform’s treasury. This symbiotic relationship creates a resilient economic loop, reinforcing the DEX’s self-sufficiency and encouraging long-term investment and participation within the Thala ecosystem.

Community Incentives and THL Holder Benefits

A notable feature of Thala Swap DEX is the implementation of community incentives such as THL emissions, which are designed to reward and motivate active engagement within the platform. These incentives are a testament to Thala’s commitment to nurturing a robust and dynamic community. In tandem, THL holders enjoy a share of the revenue, aligning their interests with the ecosystem’s prosperity.

Innovative Launchpad Integration

Further to its liquidity solutions, Thala Swap DEX is integrated with a unique launchpad that empowers Movement-native projects through equitable token and NFT distributions. This platform supports fair launches via mechanisms like batch auctions and lottery distributions, accepting MOVE and MOD as assets, thus facilitating a fertile ground for innovation and driving forward the diversity of the DeFi offerings within the Move Ecosystem.

In conclusion, the Thala Swap DEX is a testament to Thala Labs’ innovative spirit, showcasing a finely-tuned orchestration of liquidity provision, community engagement, and project development. This closer look at the DEX’s mechanics reveals a platform poised to revolutionize DeFi, underpinned by the versatile use of MOD, the encouragement of liquidity providers, and a commitment to continuous innovation.

Deep Dive into Move Dollar Mechanics

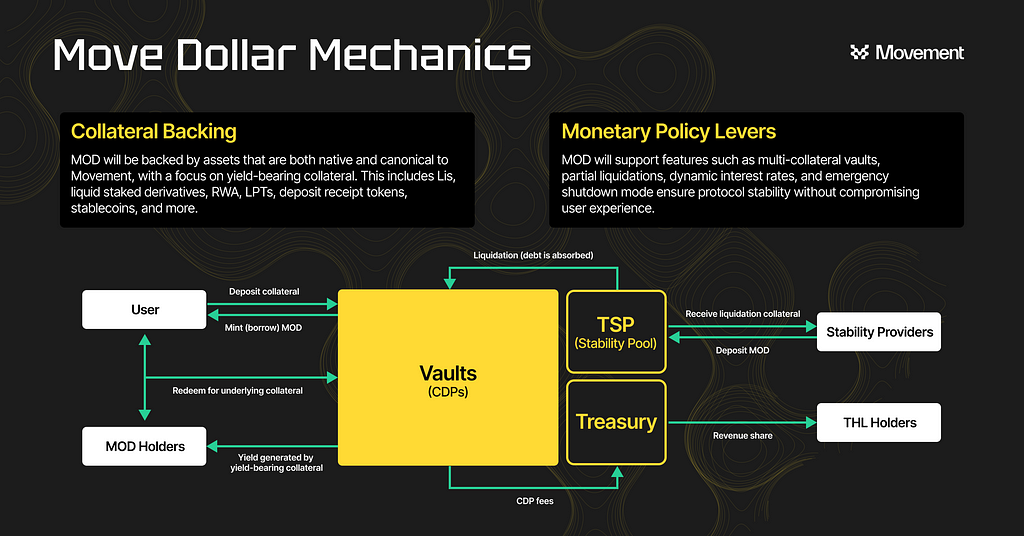

Collateral Backing

At the foundation of the Move Dollar ($MOD) lies a robust collateral backing system. $MOD is supported by a diverse range of assets that are both native and essential to the Movement ecosystem, including but not limited to liquid staked derivatives, real-world assets (RWAs), liquidity provider tokens (LPTs), and deposit receipt tokens. This eclectic mix ensures that $MOD isn’t just anchored by cryptocurrency assets, thereby offering enhanced stability and minimizing risk exposure to volatile market conditions.

User Interaction with Vaults

Users interact with the system by depositing collateral, which can then be used to mint (or borrow) $MOD. This process is facilitated through Collateralized Debt Positions (CDPs), which serve as vaults for the collateral. Users can redeem their underlying collateral through these CDPs, contributing to a dynamic and secure ecosystem for $MOD holders who benefit from the yield generated by the collateral.

Monetary Policy Levers

$MOD’s ecosystem is governed by a set of monetary policy levers that provide stability and reactivity to the DeFi environment. These include multi-collateral vaults, which enhance the flexibility of collateral options, and dynamic interest rates that adjust based on market conditions. Features like partial liquidations and an emergency shutdown mode are critical for maintaining the integrity of the system, especially during market turbulence, thereby ensuring that protocol stability is preserved without sacrificing user experience.

The Stability Pool: TSP and Treasury Interaction

The Treasury Stability Pool (TSP) is central to the liquidity and stability mechanisms of the $MOD. Stability providers deposit $MOD into the TSP and can receive liquidation collateral in return, playing a critical role in maintaining the ecosystem’s health. The TSP interfaces with the treasury, with the treasury also feeding into the Collateralized Debt Positions (CDPs) to ensure the ecosystem’s smooth functioning.

Architectural Synergies: The Role of M2 and Fractal in Thala Labs’ Ecosystem

The partnership between Movement Labs and Thala Labs is more than just a collaboration; it’s a visionary integration of technological advancements that redefine the scope of decentralized finance (DeFi). The heart of this innovation lies in the seamless amalgamation of M2 and Fractal technologies, serving as the backbone for Thala Labs’ robust DeFi ecosystem. This transition into the specifics of M2 and Fractal unveils how their unique capabilities are leveraged within Thala Labs to set new standards in scalability, security, and interoperability within the DeFi landscape.

M2 and Fractal stand as the architectural pillars that empower Thala Labs’ platform, ensuring it not only meets but exceeds the current demands of the DeFi market. The M2 architecture, with its Move-based ZK-rollup technology, brings unparalleled scalability and efficiency, allowing for rapid transaction processing without compromising on security. Fractal, as an innovative EVM bytecode interpreter, bridges the gap between Ethereum and Move ecosystems, enhancing the platform’s interoperability and accessibility.

The integration of M2 and Fractal into Thala Labs’ ecosystem is a testament to the power of strategic technological synergy in expanding the horizons of DeFi. Through this integration, Thala Labs not only optimizes the financial operations within its ecosystem but also sets a precedent for future innovations in the DeFi sector. This section will delve into the intricate details of how M2 and Fractal are instrumental in driving the growth and success of Thala Labs, marking a new era in the realm of decentralized finance.

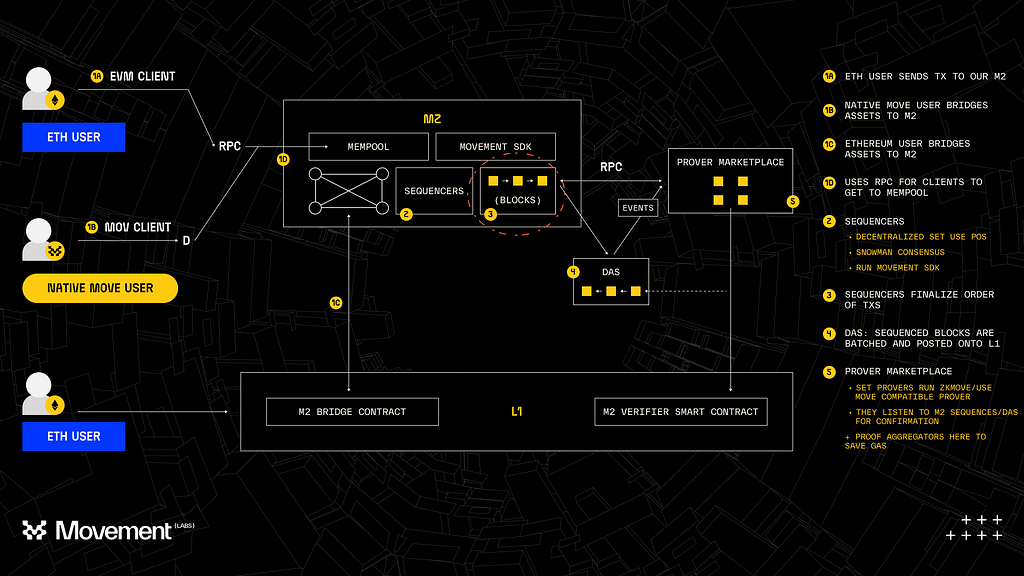

M2’s Move-Based ZK-Rollup Architecture

M2 has introduced a Move-based ZK-rollup architecture, which is a key part of the scalability framework that drives Thala’s DeFi applications to new heights. This architecture makes it possible to process a large volume of transactions by using zero-knowledge proofs for off-chain compression and validation, which significantly reduces the computational overhead on Ethereum’s Layer 1.

The Snowman Consensus mechanism governs a decentralized sequencer network, which ensures rapid transaction finality and high throughput, thanks to its stake-weighted sampling process. This mechanism not only speeds up transaction processing but also strengthens the network’s security and integrity. The Move-based ZK-rollup architecture integrated with Thala’s DeFi platform represents a significant advancement in blockchain scalability and performance. The use of zero-knowledge proofs (ZK-proofs) allows for the efficient compression of transaction data, reducing the burden on the Ethereum Layer 1 and enabling the processing of an unprecedented number of transactions. Moreover, the efficient sequencing capabilities of the Snowman Consensus mechanism ensure near-instantaneous transaction finality and a seamless user experience, even under high transaction volumes.

The strengths of M2’s Move-based ZK-rollup architecture resonate beyond mere transaction processing. They extend to facilitate the onboarding of new participants, ensuring that Thala’s offerings can scale seamlessly. This scalability is a boon for Ethereum projects that plan to bridge over to Thala, allowing them to bypass the limitations of Ethereum’s infrastructure and tap into a broader user base within a robust and expanding DeFi ecosystem.

Furthermore, the scalability benefits of M2’s architecture extend beyond transaction processing. They also apply to the onboarding of new users and the seamless expansion of Thala’s offerings. This enables the platform to grow and evolve without encountering the bottlenecks and congestion that have plagued many Ethereum-based DeFi platforms.

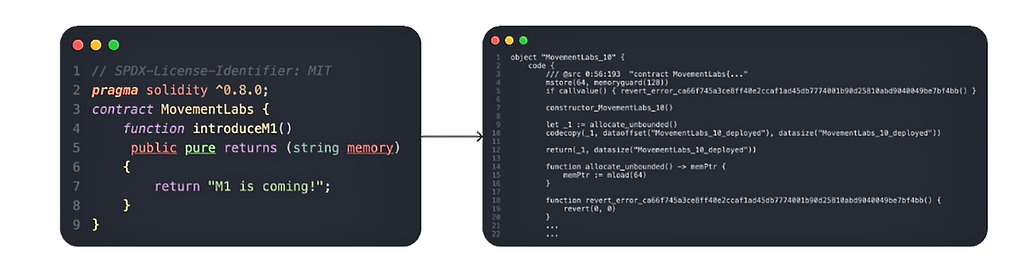

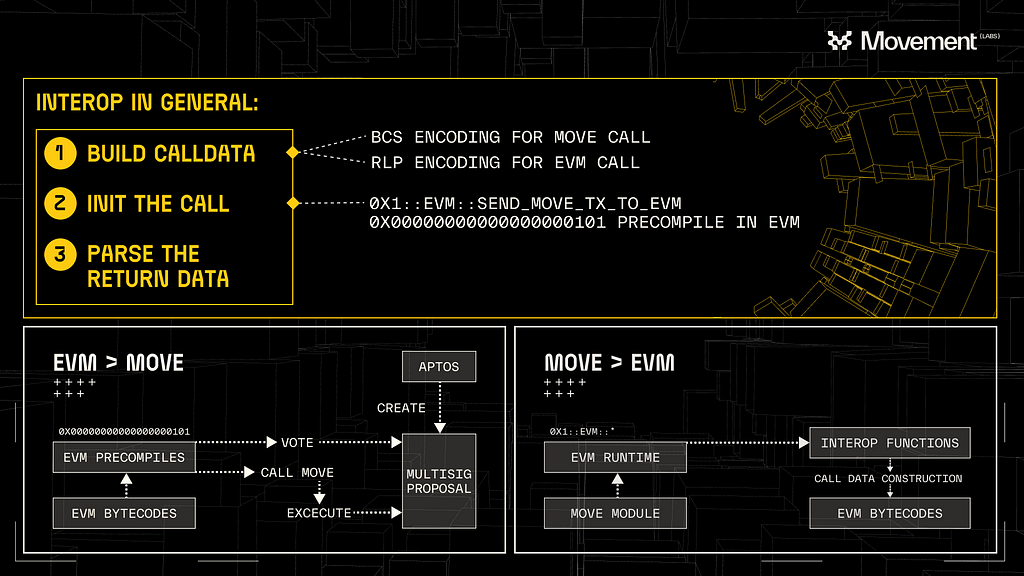

Fractal and Thala Labs: Bridging Worlds for Enhanced Interoperability

Fractal, a keystone within the Movement SDK, provides Thala Labs with a formidable tool to bridge the gap between Ethereum and Move, two powerful blockchain ecosystems. As an advanced EVM bytecode interpreter, Fractal’s ability to translate and deploy Solidity smart contracts directly onto the MoveVM is more than a technical feat — it’s a strategic expansion of Thala’s capabilities in the DeFi space.

This translation mechanism simplifies cross-blockchain development, inviting Ethereum projects to experience the advantages of Move without abandoning the solidity of their existing codebase. The result is a streamlined pathway for Ethereum’s liquidity and user base to merge with Thala’s platform, which is an enormous advantage for Thala Labs as it seeks to cement its place as a leader in DeFi innovation.

Integrating Fractal into Thala’s architecture offers tangible benefits. Developers can leverage the rich features and tools available in the Ethereum space while also enjoying the performance enhancements and novel functionalities of the Move ecosystem. It allows Thala Labs to cast a wider net in the developer community, attracting Ethereum projects that can bring new ideas, users, and capital into Thala’s DeFi environment. This is pivotal for Thala Labs, which aims to create a diverse, multi-faceted financial landscape.

Furthermore, the Movement SDK’s custom adaptors work in tandem with Fractal to ensure compatibility with sequencer networks and DA layers, which is instrumental in creating a cohesive, interoperable, and high-performing ecosystem. This attention to integration points underscores Thala’s commitment to offering a holistic platform that is not only developer-friendly but also forward-thinking in terms of scalability and performance.

Fractal empowers Thala Labs to act as an innovative hub where the conventional boundaries of blockchain technology are redefined. It fosters a dynamic ecosystem where growth, flexibility, and user engagement are paramount. For Ethereum-based projects, this means having the opportunity to be part of a cutting-edge DeFi landscape that offers the best of both worlds: the security and maturity of Ethereum combined with the innovation and scalability of the Move ecosystem.

By embracing Fractal’s interoperability, Thala Labs is positioned to not only accommodate but to also accelerate the influx of projects and capital from Ethereum. This positions Thala at the vanguard of DeFi’s evolution, leading the charge toward a financial future that is interconnected, inclusive, and teeming with opportunities for every stakeholder within the ecosystem.

Enhancing Security in Thala Labs: The MoveVM Advantage

Thala Labs stands at the forefront of secure decentralized finance, largely due to the advanced security features of the MoveVM. This virtual machine, central to Thala Labs’ technological infrastructure, is equipped with formal verification processes that ensure the security and integrity of smart contracts. The MoveVM’s formal verification offers mathematical proofs of correctness, providing a level of assurance against vulnerabilities and exploits that is unparalleled in the DeFi space.

The architectural and operational principles of MoveVM inherently boost its security profile. Thala Labs has enhanced the MoveVM to integrate with the Fractal interpreter and the Plonky2 Zero Knowledge (ZK) proving system. This extension not only fortifies the security mechanisms but also streamlines the integration process, making it more efficient and reliable.

Furthermore, Thala Labs is progressing towards the direct deployment of Solidity smart contracts within the MoveVM environment. This is facilitated through a specialized Ethereum JSON RPC endpoint, which processes EVM RPC calls and converts them into MoveVM RPC calls. This ensures a seamless and coherent interaction with the blockchain, enhancing the system’s overall efficiency and security.

The MoveVM’s integration with Plonky2 and its ability to process Solidity contracts directly through a specialized RPC endpoint are vital components of the Movement SDK. This framework underscores Thala Labs’ commitment to safety and efficiency, particularly in the implementation of ZK proofs, which are crucial for maintaining privacy and security in blockchain transactions.

In conclusion, the MoveVM’s advanced security features and its integration with cutting-edge technologies like Fractal and Plonky2 are central to Thala Labs’ strategy. This approach not only secures the platform against potential threats but also builds trust within the DeFi community, thereby paving the way for broader adoption and acceptance of decentralized financial services.

Conclusion: Redefining the Future of DeFi

The partnership between Movement Labs and Thala Labs represents a significant milestone in the evolution of decentralized finance. By addressing the critical challenges of scalability, security, interoperability, and user experience, this collaboration sets a new benchmark for DeFi platforms. With its comprehensive ecosystem, powered by the technological advancements of M2 and Fractal, and underpinned by the security assurances of MoveVM, Thala is poised to drive the next wave of innovation and adoption in the DeFi space.

As we look to the future, the strategic alliance between Movement Labs and Thala Labs not only signifies a leap forward in blockchain and DeFi technology but also lays the foundation for a more accessible, secure, and dynamic financial ecosystem. Through their combined efforts, they are not just redefining what is possible within the realm of DeFi; they are paving the way for a future where decentralized finance becomes a staple of the global financial system, offering users unprecedented levels of freedom, efficiency, and control over their financial destinies.

Movement Labs & Thala Labs: A Leap Forward for Decentralized Finance was originally published in Movement on Medium, where people are continuing the conversation by highlighting and responding to this story.