Off Chain Infrastructure

A key component to our delta-neutral strategies is our off chain infrastructure, this ensures we can reliably manage our Delta Neutral Strategies in all market conditions. If not, failures can result in losses to users from high exposure to market movements through IL & also potential liquidations for strategies that utilise lending and borrowing.

Keepers

As our delta-neutral strategies require active position management, appropriate gas pricing, up-time and reliability are extremely important to ensure the hedge functions and users do not experience unexpected drawdowns. We achieve this by utilising the best in off-chain automation available leveraging ChainLink and Gelato’s keeper products in addition to our own custom keepers. Using three independent keeper technologies provides the redundancy and performance needed. Finally, to ensure on-chain safety, our smart contracts include a number of logical key pieces, to ensure no approved keeper can execute malicious attacks.

Monitoring & Alerts

To aid in maintaining many concurrent delta neutral strategies, we have built out a suite of infrastructure tooling, including customised monitoring, visualisation and alerting for on-chain activity. This allows us to track real time on chain data, visualise it on a dashboard and receive real time alerts based on custom rules. Here are some examples of how this has worked extremely well in the past:

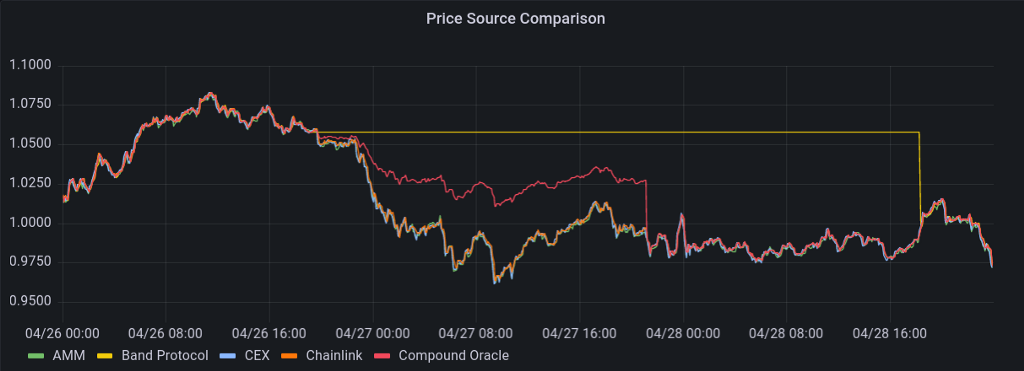

Monitoring Oracle

To mitigate lending market 3rd party risk, we actively track oracle prices used in any of our delta-neutral strategies and compare them against DEX and CEX prices. Previously on the 26th April 2022 while running our delta-neutral strategies on Fantom, we were able to identify an issue where SCREAM’s price oracle was not updating correctly, such that a large price movement could have left the protocol with bad debt. We were able to alert the team to ensure they intervened.

SCREAM Incident

On the 10th May 2022 SCREAM incurred a significant amount of bad debt due to some adjustments in the protocol, more info here. At the time, our strategies on Fantom utilised SCREAM and ~$10M of TVL allocated to SCREAM. Due to our active monitoring of protocols we utilise in our strategies we were able to secure these funds before they potentially became locked due to the bad debt incurred by SCREAM.

Rebalancing

A key component of the delta neutral strategies is rebalancing the position during market movement. To ensure the keepers infrastructure is performing and contracts are executing as designed, we have deployed strategy health monitors which monitor the debt ratio and collateral ratios of the strategies. If either metric is out of range for more than a configured period (default is 120 seconds), the team is alerted with a push notification. This was particularly helpful during the alpha prototype stage, though fortunately this alert has yet to be triggered on our Avalanche deployments.

Rebalancing Active Management

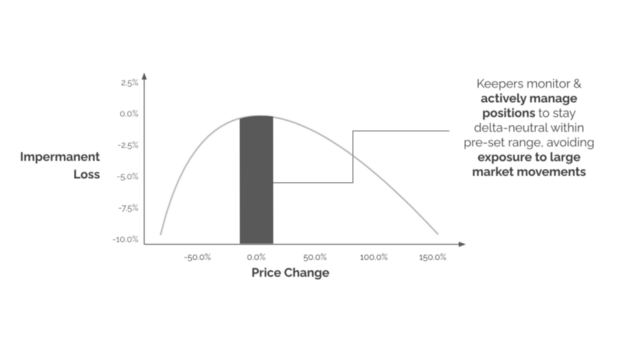

In terms of how the active management works, we are constantly monitoring a metric which we refer to as the Debt Ratio. This metric looks at the ratio of secondary assets borrowed vs assets held in the liquidity position on the AMM. For example in the USDC strategy pictured above we’d be monitoring the ratio of AVAX borrowed from AAVE vs the amount of AVAX we have in LP. Our smart contracts are then programmed for rebalances to only occur when this ratio goes outside of some threshold. In this case a rebalance would involve some small swap to stay within the target range.

Due to the non-linearity of Impermanent Loss, losses get exponentially larger the more prices move away from the price when the position was entered. By actively rebalancing and staying within this range, we are able to maintain a position where trading fees + liquidity rewards are typically greater than any impermanent loss, generating positive returns for users.

The below examples illustrate how this works in practice. (link to simulations)

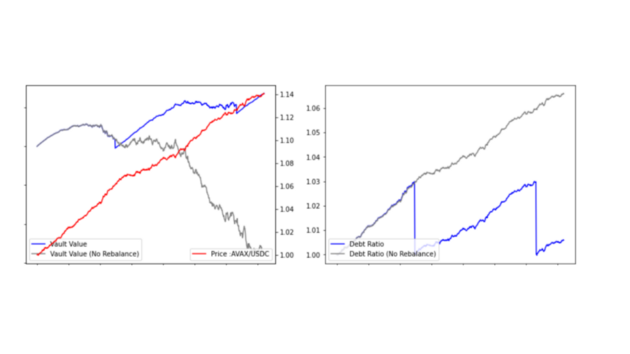

Example 1

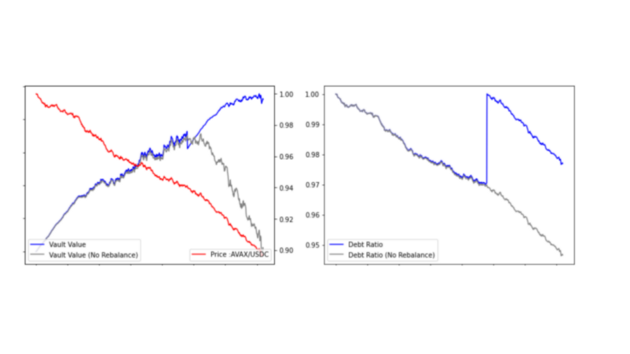

Example 2

In the first example, if the price of AVAX increases, the value of our debt grows, while the value of our LP also grows. However, we will also hold more USDC & less AVAX due to the y*x = K relationship used in AMM’s. If we don’t rebalance (grey line) as the AVAX price continues increasing, we will start to take bigger losses from IL compared to trading fees & liquidity rewards. While if we rebalance the (blue line) position such that the amount of AVAX borrowed vs the amount held in LP (the debt ratio) stays within a certain range, we have much less exposure to the continued increase in price of AVAX. In this case a rebalance would involve the strategy swapping a small amount of USDC for AVAX.

As shown above, rebalancing in a timely manner is extremely important during periods of high volatility in order to maintain Delta Neutral positions and minimise risks for users.

What’s Next ?

Vault & Strategy Optimisations

Currently within each of our vaults each strategy’s allocation is set manually by vault governance. However this means returns for the user are not 100% optimised. With multiple Delta Neutral Strategies live across multiple chains manually managing these allocations will result in returns not being 100% optimised. In order to optimise returns for users similar to how our keepers currently rebalance positions we can have keepers automatically manage allocations to various strategies.

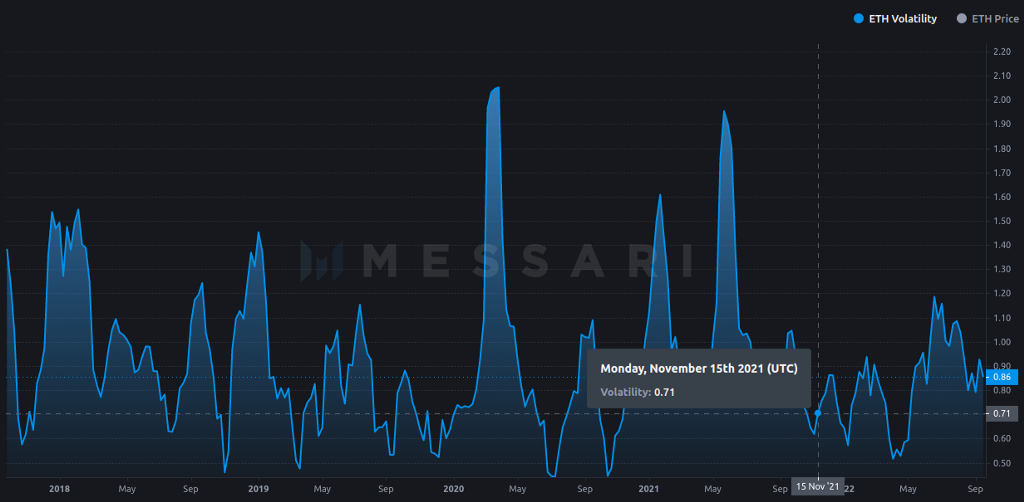

As our Delta-Neutral strategies are not 100% hedged & have some minor exposure to IL, predicting expected yield & therefore optimising returns in a short period can be quite difficult as it is dependent on market movements. However from observing historical market trends there is generally some correlation between current volatility (at time t) and future volatility (at time t+1) as a result, using volatility observed over the last X hours can potentially be used as a metric to pause / unpause Delta Neutral strategies. Temporarily reallocating funds to other less complex strategies in order to avoid periods of high volatility where IL is likely to outweigh fees / LP rewards.

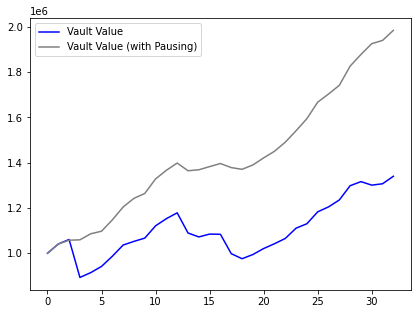

The example below shows the comparison in returns over a 20 month period between our Core Delta Neutral Strategy, utilising Concentrated Liquidity with no pausing vs the same strategy with additional logic for pausing the strategy if the market volatility over the past 12 hours exceeds some threshold. We note that this additional logic can improve returns by a factor of >2X. (40% return on USDC vs 100% return on USDC)* . Looking at the chart we can clearly see that pausing in periods of high volatility avoids potential for high drawdowns when IL is likely to far exceed fees + LP rewards.

About RoboVault

Automate your earnings with RoboVault Single Asset Delta Neutral Strategies to earn above market returns in a safely manner & with an Impermanent Loss Protection Mechanism backing you up!

0% Fee for Withdrawals & Deposits

20% Performance fee off earnings

Learn more about RoboVault

Socials: