Oh! Finance AMA — Project Overview with Rick Seeger (Recap)

Oh! Finance AMA — Project Overview with Rick Seeger (Recap)

On 10/22/2021 at 12:00 p.m (PST), an AMA session was held on Avalaunch with special guest Rick Seeger, Co-Founder of Oh! Finance. Below we present to you an excerpt from AMA with questions and answers.

Dave Donnenfeld| Avalaunch

Hello and welcome everyone to our first AMA with Oh! Finance.

I hope you all have your popcorn ready and seated comfortably.

Today, we are fortunate enough to have the co-founder of this heavily anticipated project with us, Rick Seeger and rumor has it that Mason Schuler, one of the directors of Oh! will also attend. Either way, welcome to our active, vibrant and lovable Avalaunch community.

How are you today @RickOhFinance

Rick Seeger| Avalaunch

Doing great!!!

Dave Donnenfeld| Avalaunch

Let’s get right into it and hit the ground running — To begin with, please give us a bit of background on yourself. What did your career and education look like before crypto, and how did you end up focusing on blockchain technology, and specifically DeFi?

Rick Seeger| Avalaunch

I was an electrical and computer engineering dual major, with minors in math and business. I come from a background that is deeply appreciative of code, technology, specifically emerging technologies, as well as, how does technology integrate with business. Enter blockchain. I’ve been in the crypto space in some way shape or form since 2011 — writing trading bots, different trading algorithms, yield algorithms, and having just a general appreciation of public ledgers etc. As blockchain started entering mainstream I joined the Azure Blockchain and Technology team and immersed myself even further. At that point DeFi was just a natural progression of everything that came before it — technology, business, and math = DeFi. DeFi is a way to bring power to the people which is the ultimate empowerment and embodiment of technology!

Dave Donnenfeld| Avalaunch

and you’re a speed typer to boot.

Rick Seeger| Avalaunch

Tech my whole life!

Dave Donnenfeld| Avalaunch

How did such a technically strong team with backgrounds as diverse as Amazon, Microsoft and Oracle consolidate, and how did you come to unify your vision as Oh!Finance?

Rick Seeger| Avalaunch

Mavis would be proud.

I hope you get that reference.

Like crypto, the technology world is small. The venn diagram gets even smaller when you include crypto and blockchain. So we’re a couple sets of “IRL” friends who were all working in the PNW / Bay Area / SoCal who were intro’d through mutual friends. We had been talking about launching a token for the most of the past bull run and after talking with friends, family, advisors, and just taking our own opinion and passions into mind — Oh! was born! Our entire team is technologists who are blockchain savvy. We were fielding way too many questions on “how to break into” crypto and that’s when we knew the space was still too immature and the right product did not yet exist to bring in the “normie” — ie — our friends… aunts — uncles — etc!

Dave Donnenfeld| Avalaunch

That’s ambitious to be sure

What was the decisive point to build something as ambitious as Oh!Finance, and why leverage the power of blockchain to achieve this?

Rick Seeger| Avalaunch

Great question!

She’s proud

This makes me so happy that you found this.

I could answer this two ways. 1) When my uncle asked me for the hundredth time how to buy ETH and what is metamask (the ‘fox thingy’) and he’s heard people are making “5%” on their money and how can he do that too!

The typical return on a ‘safe’ investment is around 2.7% depending on your benchmark.

So the other way I could answer this would be 2) after using Curve for the two hundredth time and realizing that while being an incredible product — institutional grade…

It’s simply too hard to use and way too hard to explain to really anyone that isn’t deep into blockchain. It’s a _very_ hard interface. I guess most simply — user experience matters.

Dave Donnenfeld| Avalaunch

What is the uniqueness of Oh!Finance, and how does this set it apart from its competitors?

Rick Seeger| Avalaunch

Apart from what we hope is some excellent (and fun!) branding?

We think our docs do an excellent job explaining our differentiators — so I’ll link them here docs.oh.finance

But I want to call out a couple points / highlight a couple of points…

“Earn more with your DeFi Dollar by using a Yield Index. Deposit stablecoins and gain yield-generating exposure to multiple DeFi Protocols. Minimal gas fees and automatic compounding.”

What does that mean? For us, it means earn yield and a safe and efficient way.

We call out specifically our “Yield Index” which we call our “DeFi” index

It takes the complexity out of yield. USDC goes in and USDC comes out. Simple. Safe. Secure without a complex interface or any of the confusion that comes with all the various products, interfaces and yield opportunities.

The “normies” are overwhelmed by “yield farming” and even the degens are exhausted by all the different options. Heck, I’m exhausted by all the options. Sometimes even myself wants to just set and forget and revisit.

So harkening back — user experience matters and easy of choice matters which I think really sets us apart!

Dave Donnenfeld| Avalaunch

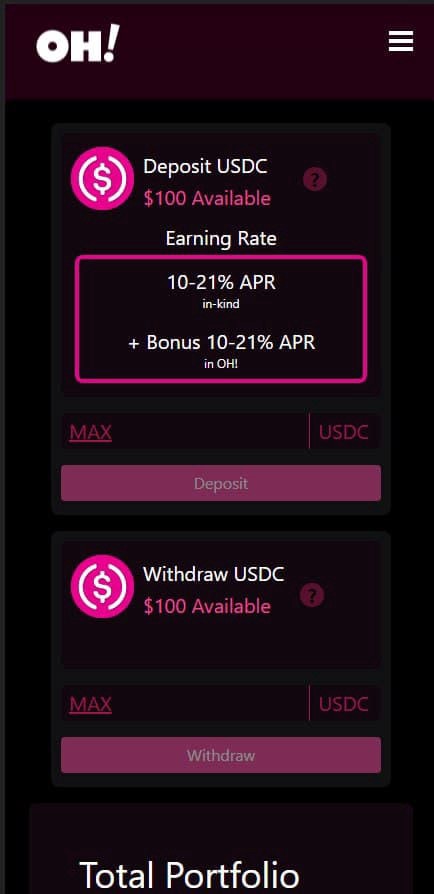

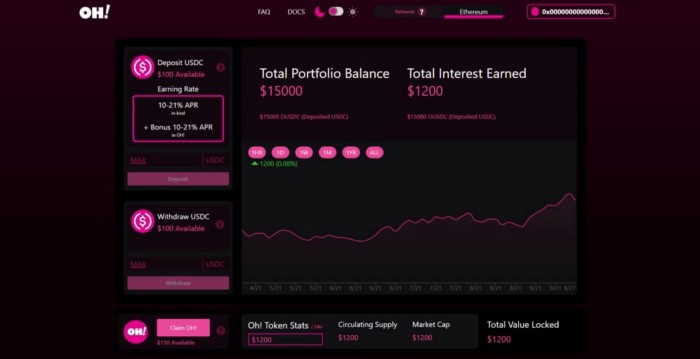

Nicely addressed. Oh!Finance is built around the idea of people being able to get more for their own money. How does the protocol work to achieve the competitive rate of 10–20% APY return on stable coins (USDC)?

Rick Seeger| Avalaunch

This one is a complex yet rather simple answer. The power of the DeFi index. By rotating on multiple protocols and rebalancing on multiple protocols you a) ensure you don’t have a single point of failure and b) you are able to squeeze out maximum yield as well (in a SAFE and SECURE way!)

Additionally, just being flexible and aware. There’s new protocols nearly daily — understanding what they bring to the table is critical — whether that’s a impressive new yield strategy that we can work on top of — or a really great idea in terms of how to rebalance — the defi space is full of a ton of bright minds. Ensuring our protocol is ‘out in front’ will keep those yields impressive.

Dave Donnenfeld| Avalaunch

Flexible and aware. This is a differentiator.

In the world of DeFi, where smart contracts control most of the operations, security is a big challenge. Can you talk about the measures taken to achieve high-level security of your protocol?

Rick Seeger| Avalaunch

This is we internally call the “normie defense protocol”

and what we mean by that is — no one (aunts, uncles, brothers, etc) will put money into anything that isn’t safe. There’s still an enormous ‘cloud’ over DeFi andn crypto most broadly.

So this is something we took extremely seriously.

And I know this sounds like “every other protocol” out there, but it has to be stated all the same.

Top quality audits. We’ve had a completed audit by an industry leader in Halborn (https://halborn.com/) who owns nearly every award in the opsec and contract security space (Ava Labs is a partner with them — that should tell you something!)

And we’re undergoing another one by industry leader Quantstamp. It really doesn’t hurt that Don Ho from Quantstamp sits on our advisory board!

Dave Donnenfeld| Avalaunch

Good stuff Rick and Don Ho is definitely a good guy to have on board.

Since we are on the topic of security, are you able to elaborate in more detail about the partnership with Bridge Mutual to provide protocol insurance, or at least talk about how this will work from a user perspective?

Rick Seeger| Avalaunch

Almost as good as having Avalaunch as our IDO partner ?!!

That’s what we call the “normie defense protocol 2”

I’m half kidding, but not really. Insurance is a really big deal for feeling “safe and secure” and specifically defi insurance will be very important as DeFi becomes more mainstream.

If you’re in the US — you can liken it to being FDIC insured — it’s an additional peace of mind.

It’s an integration that is planned for Q4 — ie we’ll be working on it shortly after launch. Mike from Bridge sits on our advisory board and BMI will be covering our insurance for our Ethereum product. From an end user perspective they’ll be a widget where a user can deposit their USDC and insure it on deposit! Candidly, we’re still sources and researching Avalanche insurance providers and hope to have an integration partner soon!

Dave Donnenfeld| Avalaunch

Nicely covered. Since we are on the topic of security, are you able to elaborate in more detail about the partnership with Bridge Mutual to provide protocol insurance, or at least talk about how this will work from a user perspective?

Rick Seeger| Avalaunch

(Also if you happen to be an Avalanche insurance provider and reading this AMA — please reach out! We’ve got a couple meetings in the next days/weeks — but going back to an earlier answer — we pride ourselves in keeping our ear to the ground!)

I think we answered that one!!

BUT

I think this is a good point I didn’t mention in the previous answer

Dave Donnenfeld| Avalaunch

Well it was unintentional but glad to have the segue back from you.

Rick Seeger| Avalaunch

That ETH has many obvious challenges — gas fees being paramount — that’s exactly why we’re launching on Avalanche (on Avalaunch!) and why we’re such stark believers in the broader Avalanche ecosystem!

Insurance on Ethereum is important but we very much plan to be the “Bank of DeFi” and that starts with having incredible blockchains backing our product (and insurance providers too)

Dave Donnenfeld| Avalaunch

Excellent. Appreciate the added thoughts. Now that I’m ready to stop repeating myself — Can you talk about the utility of the token for the project? What roadmap milestones should token holders be excited to see in the near future?

Rick Seeger| Avalaunch

Ahh! The roadmap question! It’s one that probably excites us the most.

But I guess I should start with utility first.

Like the entire Oh! Mantra — our token utility is simple. Be your own bank. I don’t remember the exact metric but something like 99% of bank profits do not go back to those that actual perform banking services

The OH! token is a true governance token. OH holders will have a say from everything from protocol fees to buyback percentages to adding new strategies. As I just said, we liken holding the OH token as being a shareholder in your own bank.

The mechanisms for OH are as follows (again borrowed from our docs.oh.finance ):

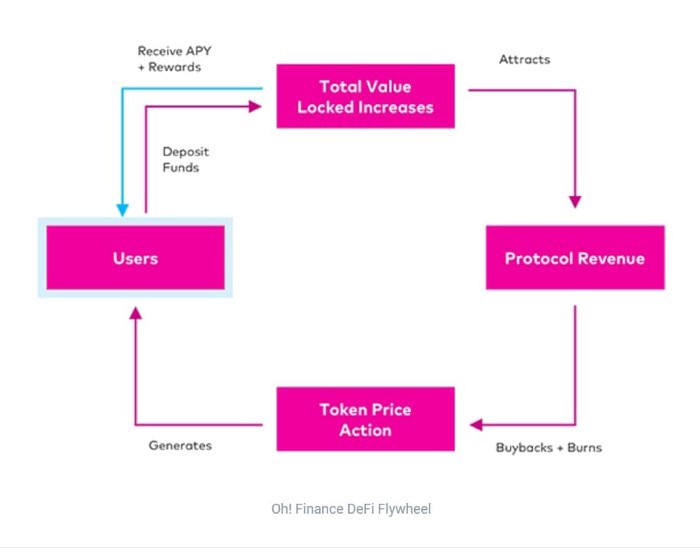

Oh! Finance is designed to bring value back to the protocol through Profit Share. 20% of protocol profits are retained to buyback and burn the Oh! Finance Token.

It makes a rather nice ‘fly wheel’

Let me grab that image really fast

So it’s really intended to be simple. TVL goes into the system and the profit generated from that TVL buys back the token.

The “Banks” profits are returned to the token holders.

So in addition to having a say into the protocol the holder is rewarding with constant buybacks and burns (capital destruction)

As for roadmap milestones — outside of finally catch up on sleep — it’ll be launching the beta app on launch day to instantly allow users to start earning yield on their USDC then it’ll be a big site overhaul from v0.9 to v1.0 and finally it’ll be OH emissions and staking as well as future strategies and potentially even more chains.

We’ve also got some fairly incredible ideas about packaging up “DeFi tranches” or “bonds” that can be mutable across chains which again plays nicely into that “be your own bank” mantra and providing asset tranches (defi asset tranches) to the “normies”

Dave Donnenfeld| Avalaunch

This is going to do work over time. People tend to overlook functions like this until it’s too late. A heavily used network can burn through a ton of token if you can look around the corner.

What does the long-term vision for the project, post-IDO look like? What should token holders be looking forward to in 3, 6, or 12 months from now?

Rick Seeger| Avalaunch

Exactly. High emissions benefits no one. Organic growth is best — bridging TradFi to DeFi here really unlocks enormous potential because their expectations of “high” yield are completely different from ours.

I’ve touched on this a bunch, but we’ve got some very ambitious plans. We want to be the “Bank of DeFi” — and as I literally just stated we are aggressively partnering with TradFi firms to bolster our reputation (and thus TVL), as well as, introduce TradFi to the powers of DeFi (Macrohive is on our early investors who is helping to aggressively bridge that gap and has immediately seen the power of DeFi). And while Avalanche will always be our “first” home we’ll be sourcing other chains too, as well as, onboaridng new yield protocols (and tokens! USDT, DAI, etc) into our DeFi index. For example, just today Alpha Hormora launched on Avalanche — that’s going to be an exciting protocol for us to look into and integrate with our platform!

Dave Donnenfeld| Avalaunch

Avalanche is a close knit community that is rising really fast. How does Oh!Finance fit in the Avalanche ecosystem? What were the deciding factors to build here?

Rick Seeger| Avalaunch

So many reasons. The community is probably the number one reason. I haven’t seen a crypto community quite like avalanche in my years in the DeFi space.

But there’s also just the actual protocol itself.

The consensus algorithm is second to none, the subnets offer some flexibility as regulation becomes more spelled out and known, and from an end user perspective (again remember how important UX is!) the time to complete a transaction is critical. 45 seconds is a LONG time for a transaction to process and that’s one of the reasons Ethereum is such a hard sell.

Also — our algorithm is more efficient when it can compound more frequently. Cheaper gas transactions means more compounding which equals more yield!

Dave Donnenfeld| Avalaunch

The Avalanche advantage is real. Actually before we transition to Twitter questions, let’s do a few questions on the tech side. A bit of a deeper dive since we have you here.

As a software engineer and somebody with financial innovation experience, what would you say have been the biggest hurdles in developing the protocol on the blockchain as opposed to building it on the traditional finance infrastructure?

Rick Seeger| Avalaunch

You’re going to out me as a ‘dev’ aren’t you. I can speak towards some of this and I’m sure Noah could go much much much deeper. But the development tools and available information come to mind.

The EVM ecosystem is still relatively new and small compared to other development sectors, such as Javascript or C#. There are only a few options for scaling contract projects, so you are left to build most everything.

It’s also much more difficult to find information about solidity or how the evm will behave in a particular situation (the docs are still being built out — very much ‘testing in prod’)

There aren’t archives of stack overflow answers to go through and most of the time it’s a ton of trial and error running tests or going through other code repos.

But that is one of the biggest reasons why top tier audits are critical. Testing in prod is an important defi concept but security should never be overlooked!

Dave Donnenfeld| Avalaunch

That is thorough. I think you’re officially outed

How long has the project been in development? Was there a long research and ideation phase before work began?

Rick Seeger| Avalaunch

I prefer the biz dev side of the house, but we all get our hands dirty!

So months in defi are equivalent to dog years, right?

It does FEEL like it’s been forever, but truthfully, This project has been in the works for just over 1 year. DeFi summer of 2020 was a huge motivator for OH and yes, the research and ideation phases were quite a bit longer than anticipated.

You’d be shocked at how people (normies) interact with the web and what people consider to be incredible yield (>5% is HUGE). We had to strip away all our assumptions and knowledge to try to build something that institutions will hopefully want to invest in — and those regression sprints are STILL ongoing and we’re sourcing our final feedback from partners such as Macrohive. It’s exactly why we’ve built our release around a stripped back beta to a quick final iteration sprint for the final ‘UI/UX’ and then Staking/Emissions. Those ‘final’ changes we’re making are very very important!

Dave Donnenfeld| Avalaunch

What does the core development team look like? How many people are dedicated to building this protocol?

Rick Seeger| Avalaunch

We have 4 core devs (2 solidity engineers, 2 web3 developers), a core front end team who’s sole mission is make DeFi easy (see my response above!) 2 dedicated community managers, 1 dedicated turkish community manager, advisors aligned to both crypto and the real world, and even advisors very much aligned to ‘just’ crypto.

The entire team “gets their hands dirty” and we almost all come from tech backgrounds — we do a little bit of everything!

Dave Donnenfeld| Avalaunch

Everyone is infused with energy when hearing about Oh!Finance, and we are thrilled to be able to offer it to the Avalaunch community. Can you give us a bit of history about your interest in the Avalanche community and technology?

Rick Seeger| Avalaunch

I touched on this a little bit above, but since we’re doing more a deeper tech dive…

I’ve been personally enamored with Avalanche since the ICO and specifically the consensus protocol. We think it’s far more scalable than Ethereum, Fantom, and the L2s by comparison.

When you think Visa level throughput and financial transactions such as yield farming and aggregation, there really isn’t a better blockchain to be operating on.

Finally — and this is the ‘based in the US’ fears — Avalanche subnets will be extremely powerful when regulation starts coming.

Love it or hate it — it’s coming and Avalanche will be uniquely positioned to differentiate and ensure many protocols can stay running in a legal manner

Dave Donnenfeld| Avalaunch

The regs point is a good one. Final question and we can move on to the good people of twitter — Is there anything you can share about the project that the community might not know yet? Any “alpha” you are willing to reveal?

Rick Seeger| Avalaunch

I feel like I used up my alpha!

So I’ll retouch on some of it!

We’re having very real conversations with very real hedge funds and ‘heads of business’ who are exploring DeFi and who love the “Grow with OH” mantra

Think 60/40–40% is that ‘bond’ money that is safe but barely earning and negative in some cases

1% of that bond money going into DeFi is billions of dollars.

Macrohive is coming on as a formal advisor and will open some massive doors for the Oh! team and help bridge TradFi to DeFi

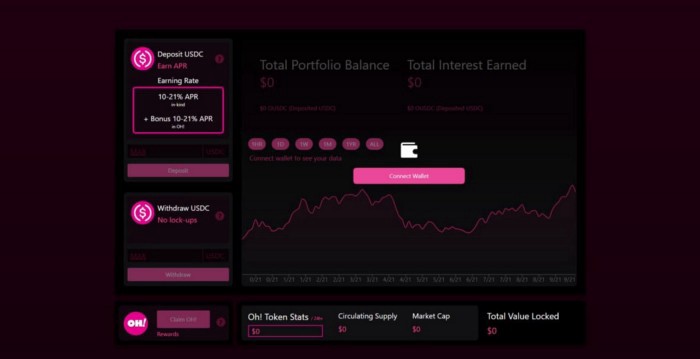

Finally! I’ll just share some upcoming screenshots ! Since we haven’t shared too many yet!

That’s the v1.0 coming out shortly after launch! In testing with our tradfi friends 🙂

Twitter Questions

@DngGiaPhong2 I could notice OH! Finance will focus only on fiat backed stable coins, but what about algorithmic stable coins or cryptocurrency backed stable coins? Do you think they are not stable or secure enough yet? Do you plan to incorporate them in the future?

Rick Seeger| Avalaunch

At launch it’ll be ‘just USDC’

with USDT and DAI likely shortly thereafter.

Algorithmic is where it gets far more difficult an answer. internally we ‘battle’ over this

We’d have to do a ton of due diligence and if the stable isn’t full collateralized it presents risk. Our platform is about low risk. Simple. Safe. And secure. So while I don’t want to rule it out entirely

I would guess the algo stables we’d likely not introduce.

@NgocCam0110 In recent time, there are many DeFi lending -borrowing platform attacked, so how Oh! solve this problem to make users feeling safe when choosing Oh! Platform?

Rick Seeger| Avalaunch

Really great audits for one.

Halborn is ‘best of the best’ and as I’ve stated Don Ho sits on our advisory and will ensure a full Quantstamp audit as well. Trust the auditors more than the platform. They are seriously smart and it is their job to ensure smart contract safety.

Also, learn from others mistakes

For example — how you rebalance funds is critical — Belt finance comes to mind of a protocol that was exploited because of how they rebalanced. The auditors help with this, but we are also ‘scholars’ in the space — so we’re constantly reading and ensuring we’re staying up to date

@sarmadoludondu1 What is the meaning of the “Oh!Finance” I thought that “Oh thank gosh at least there is a finance that I count on.”

Rick Seeger| Avalaunch

LOVE THIS QUESTION.

I mean we’re going to get so many memes for our first meme contest

but for us — it was the ‘a ha’ moment

the “OH! This IS what finance is supposed to be like and “OH! DeFi CAN be easy and accessible”

@tulong890 Oh! Finance aims to deliver a consistent 10–21% APY, but it may seem strange if your target is too high. Do you have strong arguments to remove this hesitation, how will you make it possible to return 2 times more than other alternatives?

Rick Seeger| Avalaunch

- catching peaks and valleys of stable arbitrage. It’s how we rebalance and generate the yield.

ANd candidly if borrowing down, yield will also be down

for example during the ‘peak’ of the mini-bear we ‘underperformed’ at around 8% however were still better than the market average — for in-kind yield no including native token emissions

and not including chain emission events such as Avalanche Rush or others!

and then 2) Ear to ground.

Great new protocols launching daily; intelligent rebalancing and folding will keep our yields near or hopefully in-line with our estimates!

@Lekha8812 I’m still new to crypto, how do you make Your project easy for anyone? Including those who don’t understand crypto will also use Your project?

Rick Seeger| Avalaunch

Favorite question of the entire AMA

That question is literally WHY we built Oh

We are trying our best to bring “normies” into DeFi. So yes, we’re hoping you’ll be able to use our project!

But it starts with really excellent tutorials which will be launching this weekend as well as a welcome bot that helps triage issues and get you set up with USDC and metamask.

ONboarding in crypto and yield is hard — we intend on making it easier!!

That question makes me so incredibly happy

I’m a huge degen — not even going to lie.

Minted a bunch of Bridging Bears — jump into all kinds of yield farms — you name it. But onboarding NEW users is literally why we hope Oh is successful.

Dave Donnenfeld| Avalaunch

Thanks for enduring so many questions and glad we got to the feel good stuff too

Final leg of the journey…

Telegram Questions

Almost 80% investors have just focused on price of token in short term instead of understanding the real value of the project. Can you tell us on motivations and benefits for investors to hold your token in long term?

Rick Seeger| Avalaunch

Not sure where the 80% metric came from, but Oh! is literally built for the bear. Earning simple safe and secure yield is something that will always be desirable and should for the foreseeable future outpace all traditional markets. As for motivations — our motivations are to literally merge tradfi and defi. If we can accomplish even .01% of that we’ll be quite successful!

So many projects just like to speak about the “long term vision and mission” but what are your short terms objectives? What are you focusing right now?

Rick Seeger| Avalaunch

I thought this actually played nicely off the previous question. The ‘right now’ is securing TVL and letting the protocol work. We’ll have protocols working on both Ethereum and Avalanche and will be adding new yield opportunities as the market allows (see: comment about Alpha Homora)

Tuyen Trab☺️☺️

Many projects have problems with UI / UX and this one turns off new users. How do you plan to improve the interaction with new users and with users outside the crypto space?

Rick Seeger| Avalaunch

The UI team we brought in is very “normie” and what I mean by that is they aren’t in any way DeFi focused. We had to teach them everything from “wallet connect” to “TVL” to other important metrics. It ensured that our product and UX was being viewed at from an entirely different persona. So many of us are too closely interwound into crypto that we forget what a good experience should look like.

Security and anonymity are always prioritized by BlockChain projects in the development of project platforms and technologies. So, does you have any technological solutions or plans to enhance user trust in these issues?

Rick Seeger| Avalaunch

We’re the opposite of anonymous. A team with decades of experience from FAANG companies and who are putting our faces out there. We’re also leaning incredibly heavily on our security partners such as Halborn and Quantstamp as well as more traditional OpSec / PenSec security which our advisory has been doing for decades more

My question is about your long term marketing plans. How, or through which big partnerships do you plan on utilising to pass your product onto the normal — especially non-crypto people?

Rick Seeger| Avalaunch

I think the majority of our longer term marketing plans will be around those ‘real world’ partnerships. We aim to be one of the first yield projects bridging yield to Traditional finance. Think of when a celebrity grabs a ‘hot new NFT’ — well a hedge fund invested in a yield protocol and backing it with significant TVL helps our protocol function and acts in a very similar function to the ‘protocol flywheel’ except it’s more a ‘marketing flywheel’

Dave Donnenfeld| Avalaunch

Rick, you’ve been an absolute solider and thank you for taking the time to come here today. We covered a lot of ground and it’s great to see awareness for Oh! growing at such a rapid clip. DeFi for normies is ambitious but you’re making it look possible. Our community appreciates your work and we look forward to the upcoming IDO.

Any parting words for our community or a shameless plug?

Rick Seeger| Avalaunch

Shameless plug — We hope your Grow your USDC with OH! and are excited about our platform launch in the coming days as we are!! That TVL will make the entire protocol work better and I hope my words here help you believe in our mission!

Finally, thank YOU to the entire Avalaunch community

I’m incredibly excited about our IDO and the entire community, platform, and experience from start to end has been incredible!

About Avalaunch

Avalaunch is a launchpad powered by the Avalanche platform, allowing new and innovative projects to seamlessly prepare for launch with an emphasis on fair and broad distribution. With its values deeply rooted in the early Avalanche community, we are able to offer projects confident, informed users who are aligned with the long-term goals of the rapidly expanding application ecosystem.

Leveraging Avalanche’s scalable, high-throughput, and low-latency platform, Avalaunch is built by users, for teams, to help grow strong communities.

![]()

Oh! Finance AMA — Project Overview with Rick Seeger (Recap) was originally published in Avalaunch on Medium, where people are continuing the conversation by highlighting and responding to this story.