Platypus Interest Rate Model Is Going Liveâââthe First-of-its-kind Defi Solution That Autoâ¦

Platypus Interest Rate Model Is Going Live â the First-of-its-kind Defi Solution That Auto Rebalances Pool Based On Dynamic Interest Rate

Letâs run back over the concept of interest rate modelââârebalancing Liquidity Pool with Incentives!

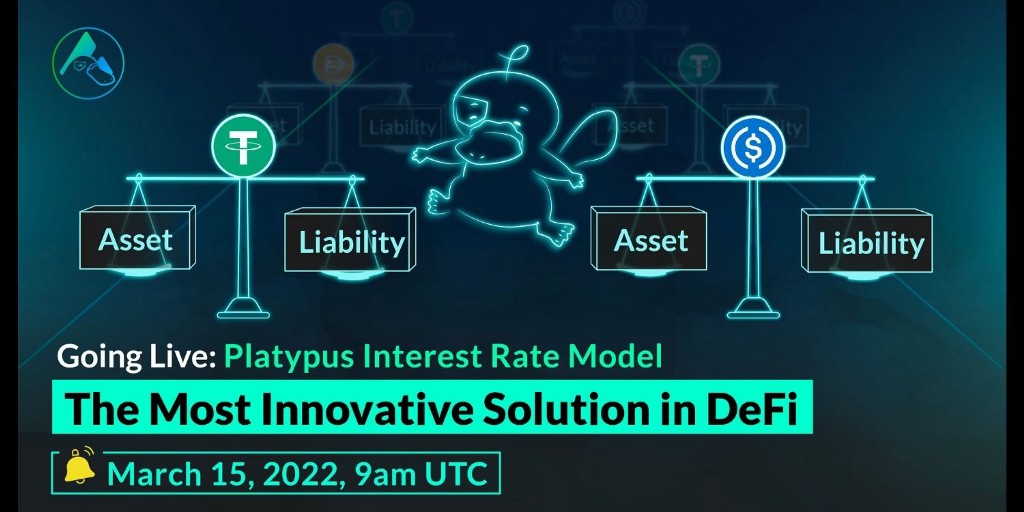

After much anticipation from the community, the new Interest Rate Model is going live on the 15th of March at 9am UTC.

Using interest rates to rebalance pools is the first of its kind in DeFi. The Interest Rate Model opens new opportunities for Platypus users to earn more from their staked assets. This model is audited by Halborn, and it wonât shake up what you already know and love about Platypus, so donât worry! This upgrade will automate the rebalancing of liquidity pools through liquidity mining incentives.

Before we dive into a recap summary of the new Interest Rate Model, it is essential to note that all existing users will have to migrate their funds to the new contract to continue earning PTP emission. At the end of this article, we will also guide you step by step on how to migrate. Without further ado, letâs get right into it!

What is the new Interest Rate Model all about?

As our community already knows, we are hellbent on win-win solutions. Coverage ratio is an important concept in our stableswap. The simplified principle is this: The higher the coverage ratio, the greater the reward emission is to the stablecoin account. The Interest Rate Model protects against coverage ratio manipulation. Most protocols rebalance their pools based on arbitrage activities. We have invented a new way to rebalance the pool based on PTP emission (interest rate of stablecoins). This prevents malicious users from claiming disproportionately huge rewards with abundant capital. The new model incentivizes balance across pools, and all users can enjoy stable yields on their deposits. Platypus Interest rate Model is the FIRST & ONLY DeFi protocol that auto rebalances the pool based on variable interest rates.

Introducing the Interest Rate Model solution unravels perks to Platypus users too. The natural market movement is an opportunity to earn more from your staked assets. This incentivizes existing LPs to reallocate their liquidity while restoring different stablecoin accountsâ coverage ratios back to 1.

How it Works

Letâs take this illustration here as an example. You staked 20K USDT on Platypus, and assume the coverage ratio of USDT at the time is lower than USDC. USDC will have a higher APR than USDT. To reiterate, the higher the coverage ratio, the greater the APR.

Liquidity providers can chase better yields by reallocating their deposits. In this case, you may choose to unstake your 20K USDT, swap it for USDC, then stake that 20k USDC on Platypus. Congratulations! Right now, you can enjoy a higher yield on your staked assets.

LPs get incentivized to maintain equilibrium. There is no actual change in the asset level of USDT and USDC, as the respective amounts remain unchanged. But the liability of USDT decreases by 20K through unstaking, while the liability of USDC increases by 20K by staking. Through this market activity, the coverage ratio of USDT increases, and thatâs how our LPs help rebalance the pool.

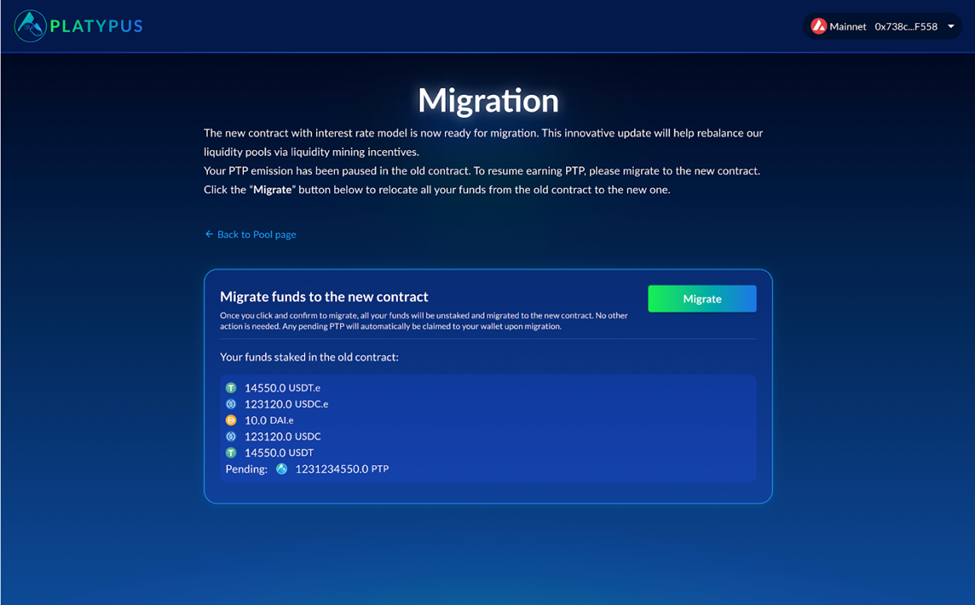

With new models come new contracts. Users will have to migrate funds from the existing contract (a.k.a. old contract) to the new contract. Below is a step-by-step guide on how to do this.

How do I migrate to the new contract?

A step-by-step guide for you when the new contract goes live on 15th of March at 9am UTC.

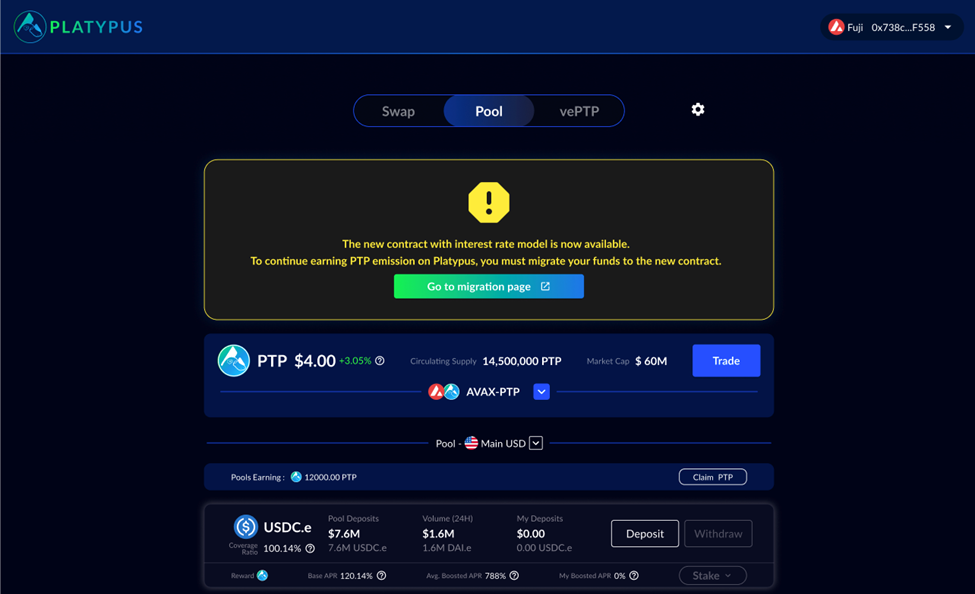

If you currently have funds on our platform, you will see a notification on the top section of your account informing you about the new contract being available.

- Click âGo to the migration pageâ button.

Note: This action will not migrate your funds yet. It will simply take you to the migration page, where more information can be found.

2. On the Migration Page, you will see the total amount of staked stablecoins in the old contract.

3. Click âMigrateâ. All your funds will be unstaked and migrated to the new contract. No worries, we got you covered. Everything will be in place just the same as it was before.

4. Approve the transaction in your wallet and youâre all set!

Follow Platypus

Platypus Interest Rate Model Is Going Liveâââthe First-of-its-kind Defi Solution That Auto⦠was originally published in Platypus.finance on Medium, where people are continuing the conversation by highlighting and responding to this story.