Platypus Stablecoin Yellowpaper Digest

Can’t be bothered to read USP’s yellowpaper? Here’s something way easier to digest!

Platypus was launched with risk management and capital efficiency in mind. We designed an efficient stablecoin swap and helped over $50B and countless swappers to find their best stable asset opportunities for the lowest cost. We did this by adopting the asset-liability model (ALM) from actuary science, with the vision that individual asset pools would allow capital in the pool to be utilized better. So now we are presenting you USP, the next-generation stablecoin that aligns with the goal to achieve our vision.

What is USP?

USP is an overcollateralized stablecoin backed by capital deposited on the Platypus stableswap. It will be built based on the Platypus stableswap, expanding the swapping mechanisms with a different borrowing mechanism.

Why is Platypus launching USP?

Capital efficiency is what we continually strive to improve. USP tackles precisely that. But what is capital efficiency?

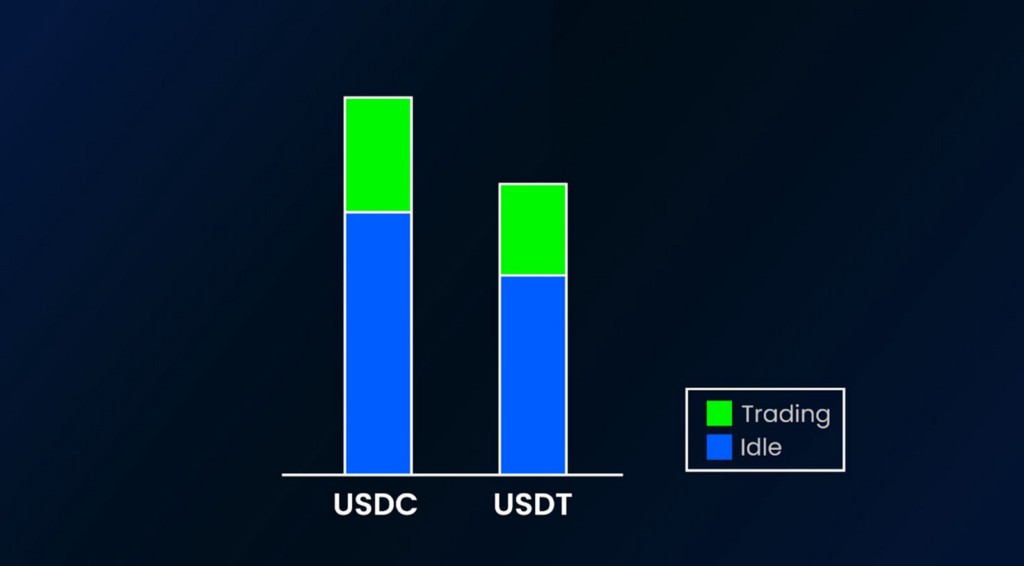

Capital efficiency measures how much of a pool’s liquidity is actually needed. It is low when there is idle money not doing anything. At the time of writing, over US$20M of stablecoins was deposited in our main pool. But not all of these are always used, with only the 30%-40% at the top utilized to facilitate trading usually. That means the other 60%-70% are sitting idle in the pool, doing nothing but to just assure us the pool can facilitate big trades. This means the capital efficiency is low.

This graph illustrates how some pool liquidity is currently wasted. The exchange activities only occur for the total pool size’s black portion. Still, we need the idle part to ensure the protocol won’t go insolvent when extreme situations deplete the black funds.

USP helps us put this idle capital to use. Depositors can now borrow stablecoins, unfreezing their money back to the market.

It is a healthy step for Platypus. There are several clear benefits of issuing USP:

- Get extra revenue from the associated fees

- Attract more users to deposit on Platypus as the money is no longer frozen

- Provide a bridge to connect with other protocols using USP, which vePTP holders would eventually enjoy as fee sharing gets implemented after the launch of USP.

But we also care about the Avalanche ecosystem. Launching USP is significant progress for everyone. Previously, if you deposit on Platypus, you are only supplying your capital to facilitate stableswap trades. Now you can put it to use in other protocols, for example, Trader Joe, to allow lower slippage for everyone in the market because the liquidity becomes deeper.

It is a win-win-win situation: Protocols enjoy a higher TVL, traders get a better exchange rate, and depositors receive rewards from more sources.

How does USP work?

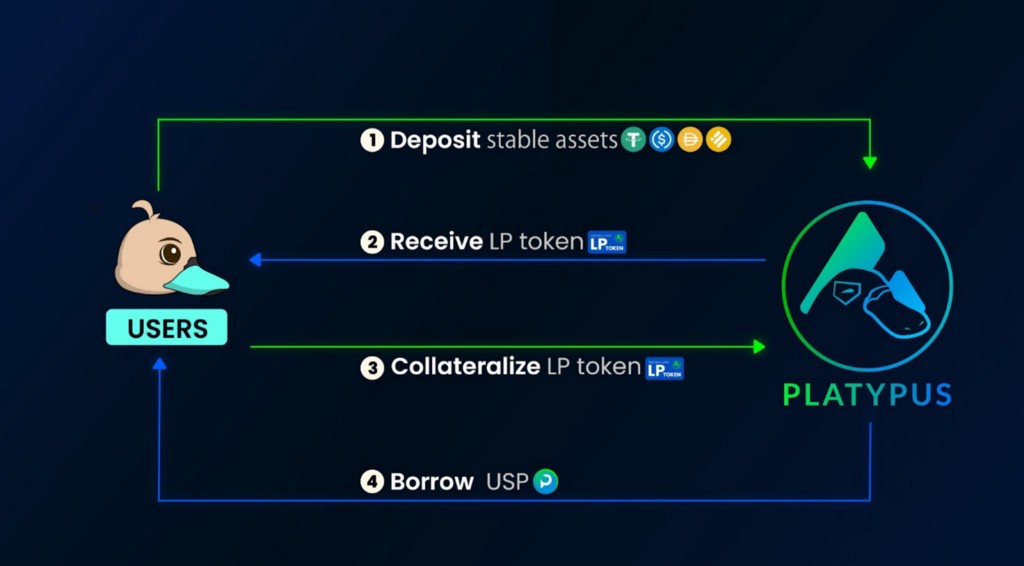

We took a lot of references from existing stablecoins, so we must thank the Maker Protocol for their pioneering works. Essentially, there are several steps for a user who wants to use USP:

- Deposit stablecoins or other cryptocurrencies into our stableswap, and receive LP-tokens representing his / her fraction of the pool

- Borrow USP from Platypus interfaces by locking the LP-tokens as collateral

- Put their USP to use: deposit USPs directly on our main pool, swap it into another stablecoin through the pool, or anything else

- Repay the USP borrowed later with some interest rates, or keep their USP after liquidation

There are significant benefits for you to do so. You can re-deposit the liquidity in Platypus or elsewhere to earn more rewards and leverage your positions. This is done by swapping USP back to your selected token if you collateralize non-stablecoins.

Now let’s deep dive into each step:

Borrowing

There is a collateral factor for each token that you can collateralize to borrow USP. For example, suppose the collateral factor is 95% for USDC. In that case, you can borrow a maximum of 950 USP if you deposit 1000 USDC. Doing so opens a position for that specific collateral, and any subsequent actions will be performed based on this position.

There is a minimum borrowing limit of 200 USP, which can be adjusted later. The limit is set to ensure actions like liquidation can generate enough profit to at least cover the gas fee required.

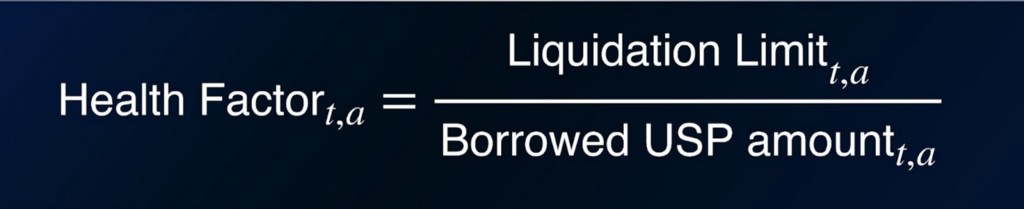

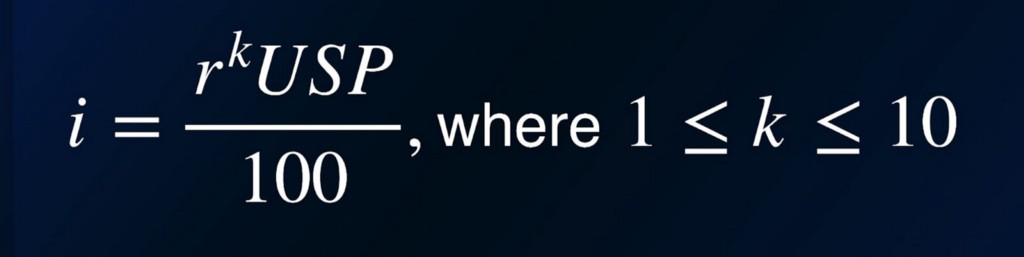

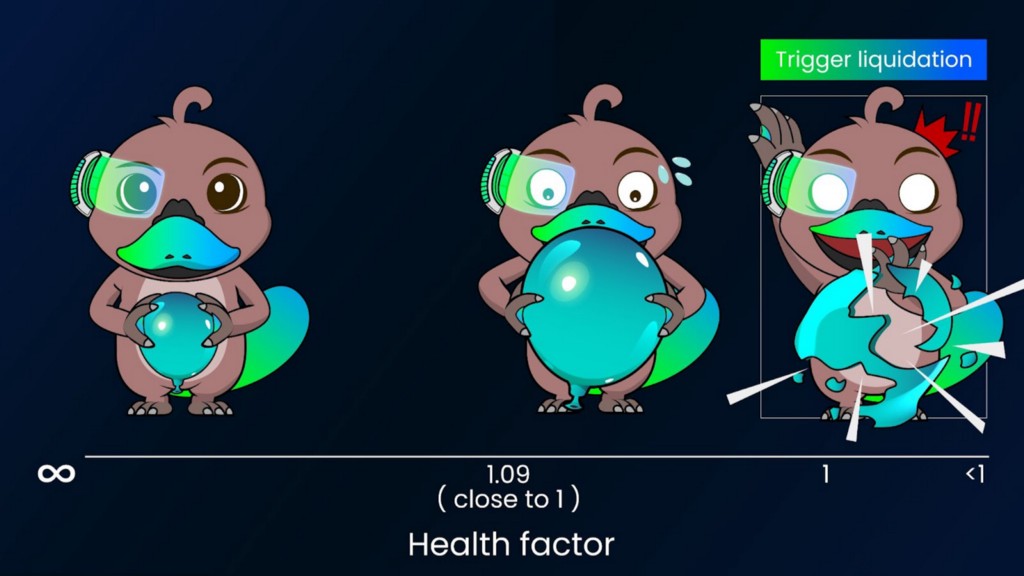

A health rate would be calculated based on your borrowed amount compared to a liquidation threshold for your selected collateral token. The liquidation threshold must be higher than the collateral factor to ensure users do not borrow and are liquidated immediately. Similar to platforms like Aave, the lower the health rate, the more dangerous the position is. Check out the calculation below:

An interest rate, called the stability fee, will start to accrue after USP is borrowed. The rate is variably charged based on the coverage ratio of USP on the Main Pool. A higher coverage ratio means an excess supply of USP, so the stability fee will go up to remove these supplies from circulation. In other words, USP’s coverage ratio affects the function and ultimately adjusts the stability fee accordingly.The exact fee will be displayed in the system. The accrued interest will be added to the amount of borrowed USP for other calculations.

This function encourages pool balance by incentivizing swaps that lead to a more balanced pool and stronger peg.

There is also a variable borrowing fee, but it will be set to 0 initially to encourage everyone to try to use USP. So what are you waiting for?

Withdrawing Collateral and Repaying

You will only be able to withdraw your collateral if the amount withdrawn does not make your health rate go under 1. If you want to withdraw more, you can repay your debt first.

Repaying is easy. You will be indebted to some USP borrowed when you have a position. You can reduce this debt by sending back some USP to the system or remove the position entirely by repaying everything.

It is advised to repay some of your debts if the health rate is approaching 1. Do not make it extremely close to 1, because the slightest market action and the stability fee would immediately liquidate your position.

Liquidation

If your position’s health rate goes below 1, someone can kick in and liquidate your position. Liquidation means someone else in the market can buy your collateral at a discount by USP and help you repay your position. You will lose parts of your collateral until your debt is repaid and the health rate exceeds 1.

However, positions do not get immediately liquidated under our model. We use a Dutch Auction model, where the price of your collateral will gradually decrease until someone decides it is cheap enough to buy and repay your debt. A percentage of the repaid USP will be penalized and sent to the system. During this time, you can still repay to avoid getting penalized.

Example

Bob deposited 100 AVAX at $100, so his collateral value is up to $10,000. He decides to borrow some USP. The collateral factor is 75% at the moment, the liquidation threshold is 80%, and the liquidation penalty is 5% to be retained by the system and later open to vePTP holders.

The maximum amount he can borrow would be $10,000 * 0.75 = $7,500. He decided to not borrow all of them, but only $6,000. At this moment, his health rate would be $8,000 from the liquidation threshold, divided by $6,000, equalling 1.333.

1 month later, the AVAX price increased by $10 to $110, but he accrued a 0.1% interest equalling $6. This $6 is added to the debt. His total AVAX value is now $11,000, with the health rate equaling ($11,000 * 0.8) / $6,006, which is 1.465. Good news for him.

Another month had passed. Suddenly AVAX suffered from macroeconomic factors and dropped quickly to $75. His liquidation limit is now just ($75 * 0.8 * 100) = $6,000, but he now has $6,012 in debt after interest. Someone kicks in and initiates the dutch auction.

Initially, someone else can buy at most $6,012 worth of collateral, roughly 80.16 AVAX. The liquidator would also have to help pay the 5% penalty, so the price is 6,312.6 USP. But it does not make much sense to buy at this price because it is above the market price plus gas. So he waits.

Now the price, including the penalty to buy, is only 5,500 USP for 80.16 AVAX. The liquidator thinks it is a good deal, and he does it. He got 80.16 AVAX at a low price, at the expense of the liquidated position!

It’s still acceptable to the position owner because the debts are repaid in full. That person still has 100–80.16 = 19.84 AVAX left and the 6,000 USP he borrowed initially. They are only worth $7,488 in total now.

How does USP keep its peg to the US Dollar?

We believe user confidence is the most important factor in keeping a peg. This can be from many sources: general trust in the creator, a public balance sheet, a deep liquidity to ensure the ability to exchange for other stablecoins or USD directly, and more.

Public Balance Sheet

This is used to show that the protocol is solvent and that we can satisfy all withdrawal requests if they come all at the same time. The asset side will contain all LP-token collateral deposited and stablecoins owned by Platypus. The liability side includes USP backed by LP-tokens and USP backed by protocol-owned stablecoins. This will be published on the website and updated live, so everyone can check if the asset is enough to fill all liabilities.

Liquidity to Exchange

This is where the stableswap and the stablecoin work well together. As USP will be listed on the main pool, it is connected to other main pool tokens and their backings. Users can swap between them at the lowest slippage possible at any time.

Adaptive Peg Stabilizer

By balancing supply and demand, the stability fee maintains a stable exchange rate. USP stablecoins are listed in the Main Pool, and one of the major factors that affect USP’s price is its coverage ratio in the said pool.

When USP’s coverage ratio in the Main Pool rises above 100% due to swapping actions, the price of USP will slightly fall below $1. The increase in USP’s coverage ratio will then trigger the rise of the stability fee for borrowing USP. Users will naturally swap back other stablecoins to USP to repay their more expensive loans. As USP assets in the Main Pool decreases, the coverage ratio also decreases, thus pushing USP’s price upwards back to $1.

In reverse, lower USP coverage ratio triggers a decrease in stability fee. This will incentivize users when borrowing a larger position and swapping to other stablecoins. In turn, the increase in USP assets will push its price back to $1

Autonomous Coverage Optimizer

The autonomous coverage optimizer automatically retains part of the revenue from non-USP stablecoins to mint USP and supply the Main Pool. And this is to reduce USP’s price fluctuations, increase the Main Pool’s TVL, reduce PTP inflation, and lower the risk of bank run.

Final words

Platypus was born to bring you the best stableswap experience you can ever find. USP complements the Platypus stableswap and we can’t wait to bring our users the next level capital efficiency. We are grateful for the support of our community, and we take it as an inspiration to continuously build and innovate!

Platypus Stablecoin Yellowpaper Digest was originally published in Platypus.finance on Medium, where people are continuing the conversation by highlighting and responding to this story.