Platypus x Avalaunch—IDO Announcement

DeFi, despite its highly publicized setbacks, continues to march forward in a truly trailblazing fashion. The total value locked (“TVL”) across all decentralized finance platforms continues to eclipse previous highs at a blistering pace. According to analytics platform DeFi Llama, TVL first crossed the 200 billion USD mark in early October, and reached a most recent high of ~277B on November 9th. Perturbations in the market aside, we are bearing witness to the future unfolding before our eyes. The advent of automated market maker, borrowing and lending protocols and most recently, the algorithmic stable coin has set the table for the future of finance.

https://medium.com/media/3e8a9ea6665046773e5a8d2565467385/href

As capital remains slave to the contract in which it is locked, users are forced to contend with an outmoded model where liquidity pools seek the “lowest common denominator,” saddling users with high slippage costs and limited flexibility. The first generation of automated market makers (“AMM”) left much to be built upon. At the core of their limitations, is the current framework for StableSwaps.

StableSwaps are important not only for pegged assets, but also to solve the fragmented liquidity problem due to the existence of multiple bridges. It is also the building block for enabling more synthetic assets and algorithmic stablecoins.

Here to tackle this challenge comes a project that Avalaunch is truly honored to have for its next IDO: Platypus Finance

Overview

Platypus Finance’s design makes for a compelling StableSwap DEX that represents a bonafide innovation.

“Platypus has devised a whole new kind of StableSwap for enhanced capital efficiency, scalability and user experience. This pioneering protocol will be Platypus’ first major step in driving DeFi innovation in the Avalanche ecosystem.”

One only has to cursorily explore DeFi in order realize that, experientially, it is tantamount to being handed a new operating system for one’s computer every time a user goes to a new website. Even the most successful protocols such as Uniswap and Compound function independently of each other.

While their functions are different, the absence of shared liquidity forces users to choose or split their resources versus sharing them. Moreover, slippage remains a consistent issue and we are getting to a place where the literal costs can outweigh the benefits. The swapping of stable coins remains, well, unstable.

A Reimagined Automated Market Maker

Platypus removes existing StableSwap limitations, offering critical benefits to the Avalanche ecosystem:

1. Shared Liquidity

Closed liquidity pools are first-generation AMM—separated and not shared, giving rise to liquidity fragmentation.

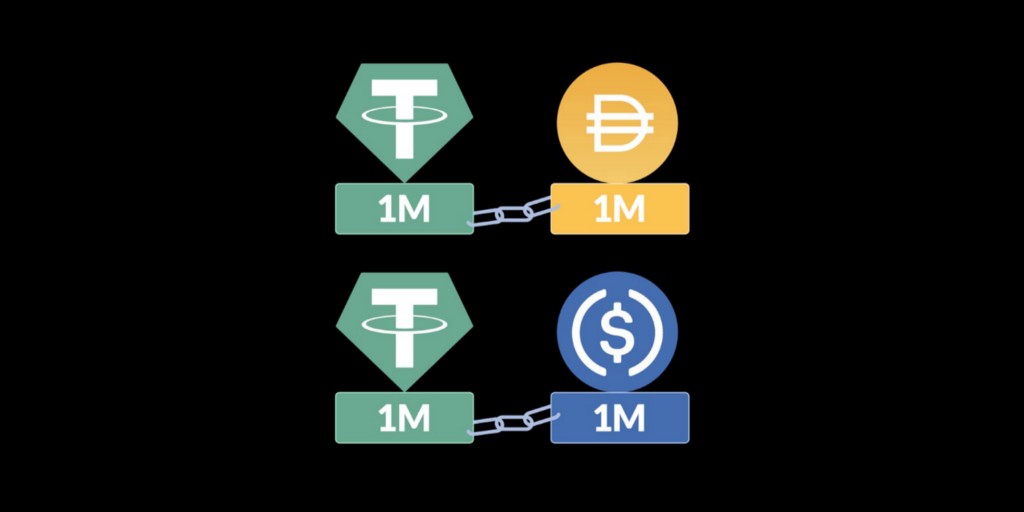

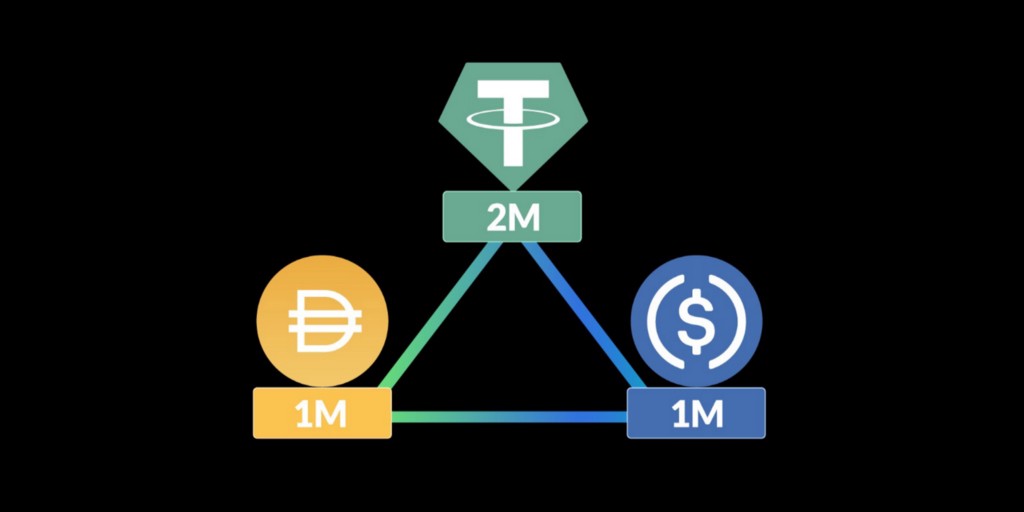

Consider a typical stable coin pool:

Users who swap USDT to DAI, for example, will experience slippage, calculated by holding the invariant between the liquidity in the USDT-DAI pool. Using a traditional StableSwap invariant and assuming A = 100 will create 0.05% slippage. By sharing the tokens, the pool in Platypus will look like:

With this mechanism in place, the slippage drops to 0.01%. Although handpicking parameters can make slippage look lower, the liquidity in Platypus between the two closed-pools is now shared, resulting in lower slippage.

2. Flexible Pool Composition

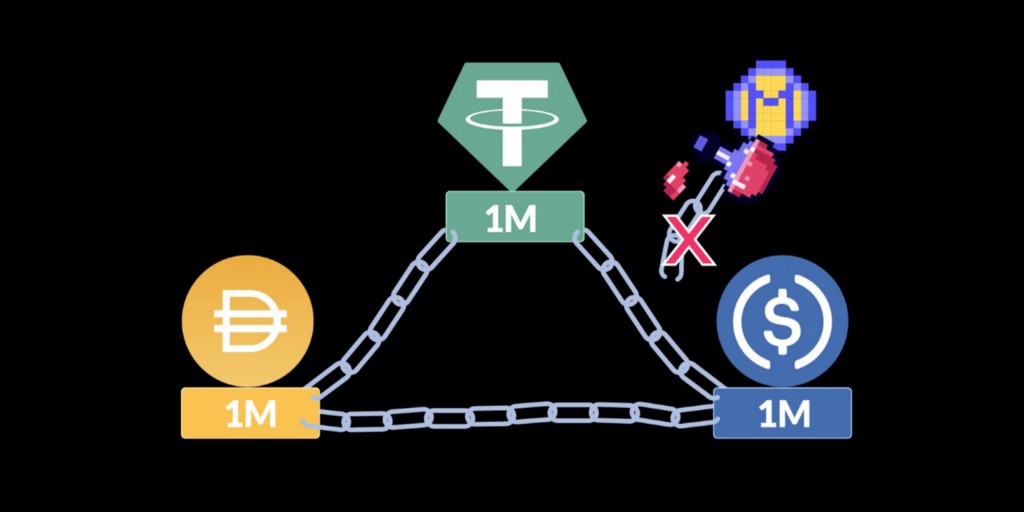

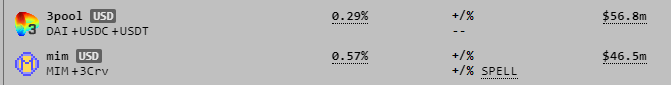

First-generation StableSwaps did not allow for the integration of multiple assets, e.g.—the base 3 CRV token cannot extend beyond USDT, USDC and DAI. The relative rigidity of these offerings requires the pools to have the same amount of liquidity. Should one lose size relative to the others, the entire pool’s equilibrium liquidity is pulled down with it.

This design is limited and makes it very difficult to add more tokens to the pools. Resultant to this, Curve has pool compositions comprised of pairing up the 3CRV LP tokens with the new token (e.g.: MIM), adding an additional layer of complexity.

The Platypus liquidity pool composition allows for flexibility.

“Our equilibrium state is defined by the same coverage ratio instead of the same liquidity. Assets in the pool are allowed to scale naturally based on its organic supply and demand.”

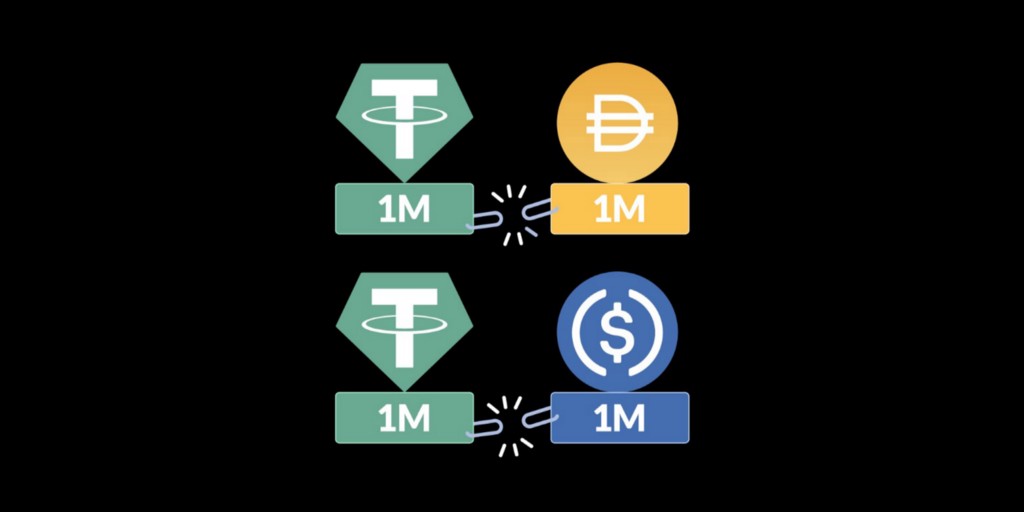

3. Single-Sided Token

In Platypus, users can deposit and withdraw tokens of the same kind without concern of pool compositions or size, or even the difference between token and LP token.

Platypus Value Proposition

Trading in Platypus means lower slippage, higher capital efficiency and greater asset scalability.

1. Lower Slippage—single-sided open liquidity pools promote capital efficiency, resulting in significantly lower slippage.

2. Higher Scalability—The Platypus liquidity pool composition gives room for flexibility and scalability.

3. User Experience— The simplified UX is easier without complicated pool compositions and users can deposit and withdraw tokens of the same kind without concern.

Conclusion

Without shared capital and as long as each protocol remains an island unto itself, existing stableswaps must continually rebalance in the isolated universe that they occupy, remaining inefficient. This fragmented liquidity is inefficient as dollars are “landlocked,” resulting in the higher costs and a compromised user experience.

Platypus Finance intends to usher in the next great innovation in DeFi by allowing for true capital efficiency. Platypus themselves have been bold enough to say they are here to “rewrite the rules of DeFi.” The Platypus mission calls for a merger of DeFi verticals into a single, unified system where locked capital can be shared across functions.

Platypus — Links

Website| Telegram (Discussion)| Twitter |Medium |Discord

Partners & Backers

The list above represents a pedigreed group of backers that is notably Avalanche-influenced in recognition of this “homegrown” protocol.

Final Thoughts

For supporters of Avalanche, it does not get much more exciting than this. Platypus has the makings to be something truly special—a seminal protocol that can propel DeFi forward. As a fee sharing protocol, the PTP token’s utility is straight-forward and potentially quite lucrative. For those lucky enough to witness the creation of Curve or the meteoric rise of Aave, we at Avalaunch feel that Platypus is similar in feel, scope, innovation and ambition.

Funding Numbers:

- Total Supply: 300,000,000 PTP

- Private: 42,000,000 PTP at .08 USD—3,360,000 USD

- Public: 10,500,000 PTP at .10 USD—1,050,000 USD

- Avalanche Foundation: Grant and funding totaling 114.8K USD

- Hard Cap: 4.5248M USD

Supply Breakdown

- Total Supply: 300,000,000 PTP

- Liquidity Incentives: 120,000,000 PTP (40%)

- Treasury: 60,000,000 PTP (20%)

- Sale (Private & Public): 52,500,000 PTP (17.5%)

- Team: 45,000,000 PTP (15%)

- Exchange Liquidity: 10,500,000 PTP (3.5%)

- Advisory: 6,000,000 PTP (2%)

- Avalanche Foundation: 6,000,000 PTP (2%)*

*Platypus received a grant from the Avalanche Foundation.

Vesting Following TGE:

- Liquidity Incentives: Reserved for liquidity mining*

- Treasury: 5% at TGE, 6-month cliff and subsequent 36 months linear vesting

- Private Sale: 10% at TGE, 3-month cliff and subsequent 18 months linear vesting

- Public: 10% at TGE, monthly vesting for 12 months (7.5% per month)

- Team: 12-month cliff and subsequent linear vesting for 30 months

- Exchange Liquidity: 50% at TGE, 6-month cliff and subsequent 6 months linear vesting

- Advisory: 12-month cliff and subsequent linear vesting for 30 months

- Avalanche Foundation: 10% at TGE, 3-month cliff and subsequent 18 months linear vesting

*The unlock is discretionary and contingent upon a number of factors that the team has identified. Any incentive unlocks will be announced.

Other:

· Initial Circulating Supply: 8,850,000 PTP (excluding liquidity tokens)

· Initial Market Cap: 885,000 USD (excluding liquidity tokens)

· Initial Liquidity: To be determined based upon yet to be finalized listing plans

The Platypus Finance IDO on Avalaunch

- 10,500,000 PTP at .10 USD (Total Supply: 300M PTP)

- Sale Size: $1,050,000 USD

Registration Schedule:

- Registration Opens: December 9th at 3:00 p.m. (UTC)

- Registration Closes: December 12th at 6:00 a.m. (UTC)

Sale Schedule:

- Validator Round Begins: December 13th at 6:00 a.m. (UTC)

- Validator Round Closes: December 13th at 3:00 p.m. (UTC)

- Staking Round Begins: December 13th at 3:30 p.m. (UTC)

- Staking Round Closes: December 14th at 6:00 a.m. (UTC)

Avalaunch Sale Distribution

- Stakers of the XAVA token will receive 95% or more of the sale.

- The allocation for validators of the Avalanche network is to be determined at the time of the sale.

IDO Recap

- Total PTP for sale: 10,500,000

- Price: .10 USD

- Size: $1,050,000

- Vesting — 10% at TGE, monthly vesting for 12 months

About Avalaunch

Avalaunch is a launchpad powered by the Avalanche platform, allowing new and innovative projects to seamlessly prepare for launch with an emphasis on fair and broad distribution. With its values deeply rooted in the early Avalanche community, we are able to offer projects confident, informed users who are aligned with the long-term goals of the rapidly expanding application ecosystem.

Leveraging Avalanche’s scalable, high-throughput, and low-latency platform, Avalaunch is built by users, for teams, to help grow strong communities.

![]()

Platypus x Avalaunch—IDO Announcement was originally published in Avalaunch on Medium, where people are continuing the conversation by highlighting and responding to this story.