Platypus x Yeti: The Launch of YUSD-USDC Pool

Yeti Finance decided to shift all incentives from Curve Finance to Platypus gradually.

Whew, Platypus expansion is going really fast. Today, weâre thrilled to announce our collaboration with Yeti Finance! This collaboration will bring so much value to Platypus users and Yeti users alike, and we are simply ecstatic about having a plethora of choices for you to grow your investment. The launch will be on the 10th of May 2022.

Platypus x Yeti Collaborative Development

Our visionary teams came together with one thing in mind: users. This strategic collaboration between two of Avalancheâs top native protocols aims to create a mutual gain for users of both protocols, which brings the YUSD-USDC pool to our platform.

Yeti Finance had analyzed many different stableswap solutions, and decided to partner with us due to the capital efficient stableswap design and capacity to support major protocols like Yetiâs. Yeti Financeâs conviction in Platypus manifests in their decision to gradually shift all incentives from their 400M YUSD Pool on Curve Finance to Platypus, a major win and privilege for our users! By staking YUSD and USDC in this pool, users can enjoy greater incentives brought by Yeti and Platypus to the YUSD-USDC pool.

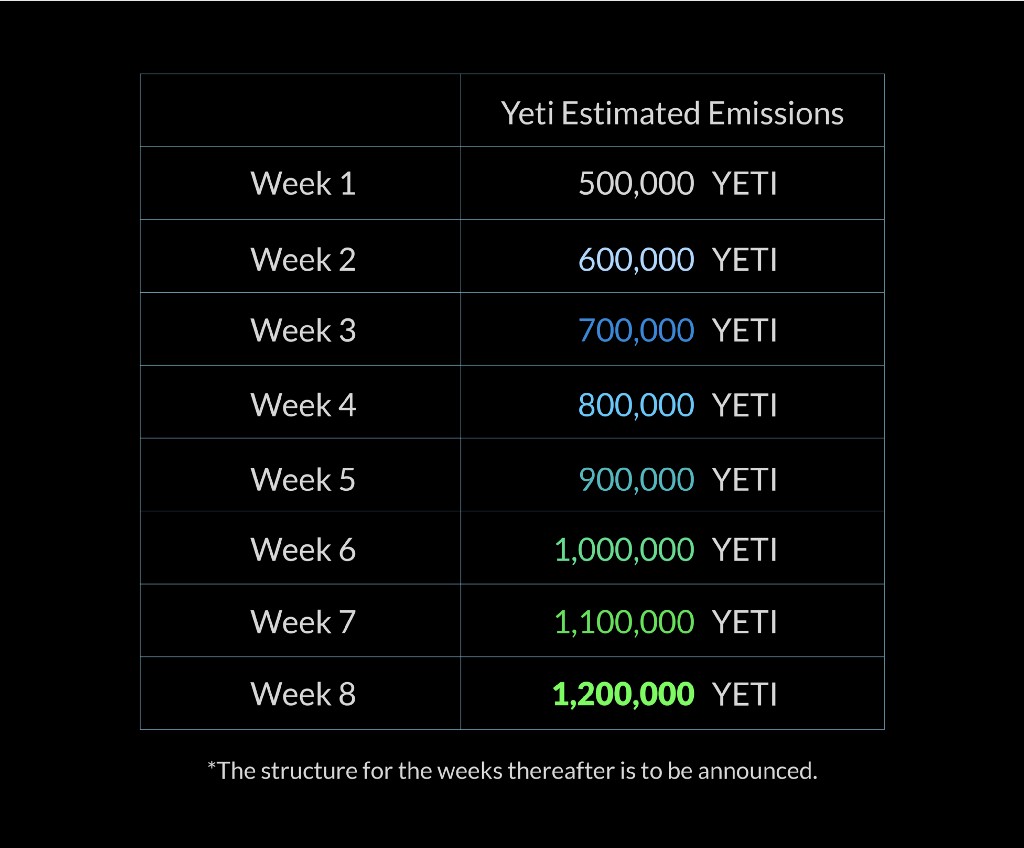

Emission Structure

Yetiâs emissions will increase weekly, starting from 500,000. On top of that ,we will jointly provide 12% of PTP emission to this pool. Below is the estimated emission structure for the first eight weeks.

Mark your calendar now, so you donât miss it at launch!

About Yeti Finance

Yeti Finance is a decentralized cross-margin lending protocol built on Avalanche that allows users to borrow up to 21x against their portfolio of LP tokens, staked assets such as sJOE and sAVAX, and yield-bearing stablecoins in a single debt position for 0% interest.

Yeti Finance launched April 16th on Avalanche Mainnet, and has quickly grown to one of the top protocols in DeFi, surpassing 850M TVL in its first week. Among other accomplishments, it currently maintains the large Curve pool on Avalanche with $400M of TVL which it will now be transitioning to Platypus.

About $YUSD

YUSD is an over-collateralized stablecoin that is backed by a diverse basket of high-quality, yield-bearing assets deposited in the Yeti Finance protocol. To mint 1 YUSD, users must deposit a minimum of $1.05 in yield-bearing stablecoins or $1.10 of liquid collateral (e.g. AVAX or Trader Joe LP tokens) into Yeti Finance. Alternatively, YUSD can be minted for $1.02 in USDC.

YUSD has a price floor of $1 and a price ceiling of $1.02, anything above or below can be quickly corrected through simple arbitrage opportunities:

If YUSD trades below $1âââUsers profit by buying YUSD on the market and redeeming it for $1 in underlying collateral at any time.

If YUSD trades above $1.02âââUsers can profit by minting 1 YUSD by depositing $1.02 in USDC and selling the minted YUSD on the market.

This creates what is known as a hard-pegged stablecoin: YUSDâs peg does not depend on the Yeti Finance team or any other controlling entity.

Follow Platypus

Platypus x Yeti: The Launch of YUSD-USDC Pool was originally published in Platypus.finance on Medium, where people are continuing the conversation by highlighting and responding to this story.