Project Degis Naughty Price Protection

Project Degis, the cryptocurrency insurance project on Avalanche incubated by the Hong Kong University of Science and Technology, has launched its first initial product Naughty Price Protection, aiming to protect users from highly fluctuated token prices.

Degis mainnet launched on April 1st with #AVAX as the first token and more #Avalanche project tokens are expected to come soon.

In this post

Working Mechanism

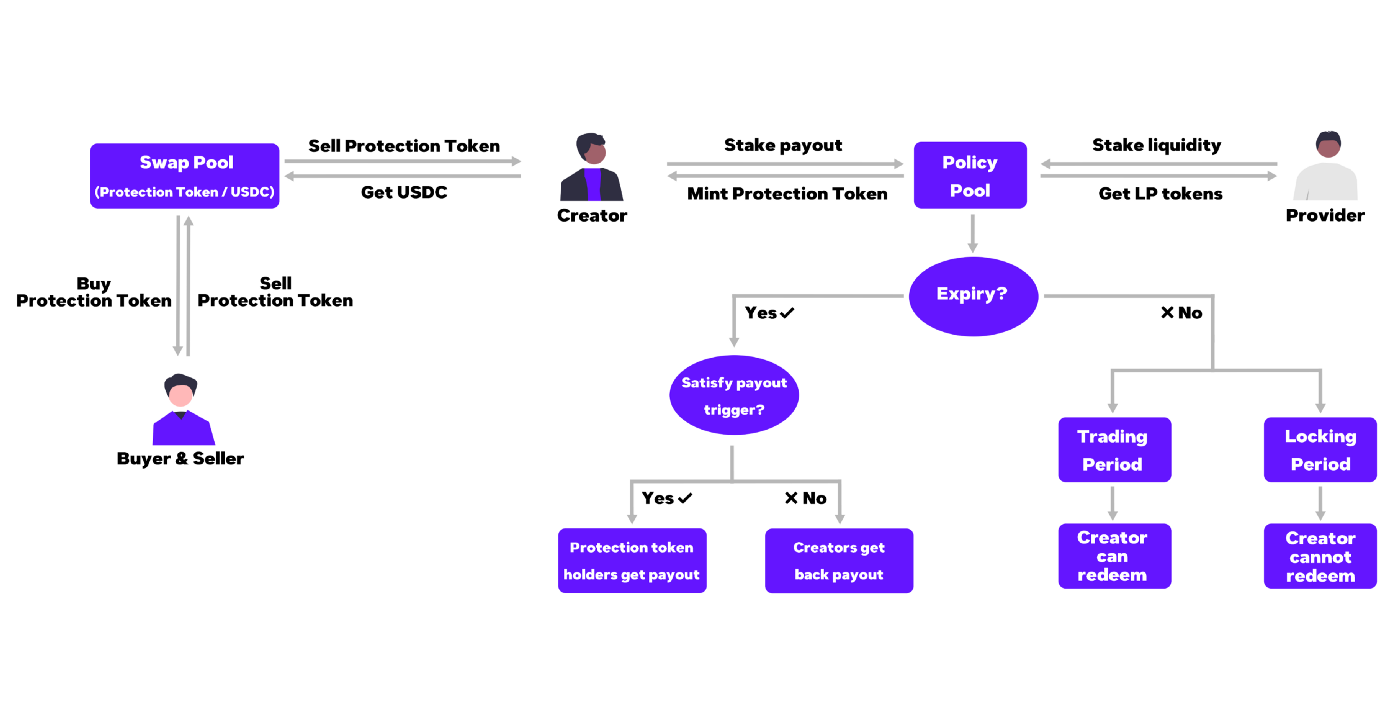

Look at the workflow of the naughty price system below:

The major roles are creator, provider, buyer & seller

- Creator stake USDC into the policy pool as collateral and mint protection tokens proportionally. After creating protection, the creator can sell protection tokens to the swap pool before the expiration date. The swap pool is an AMM-based capital aggregation pool where trades between buyers and sellers (protection tokens and USDC) are constantly happening. When protection hits its expiry date, the payout is only determined by a certain event (AVAX price below $100). If a certain event occurs at the expiry date, the protection holder receives all collateral. Else, the creator gets the collateral back.

- Provider deposits USDC-Protection Token pairs in the swap pool to provide liquidity, getting LP tokens proportionally, which can be staked to farm $DEG tokens. LPs will also earn all transaction fees in the swap pool(The fee is 5%).

- Buyer & seller are users who want to protect their assets from the highly fluctuated market. They can buy protection tokens in the swap pool directly. For sellers, if they create a protection token and then sell it into a swap pool, they can get a certain USDC back. When the expiry date comes, if a certain event does not happen, the seller can redeem all the currently staked USDC.

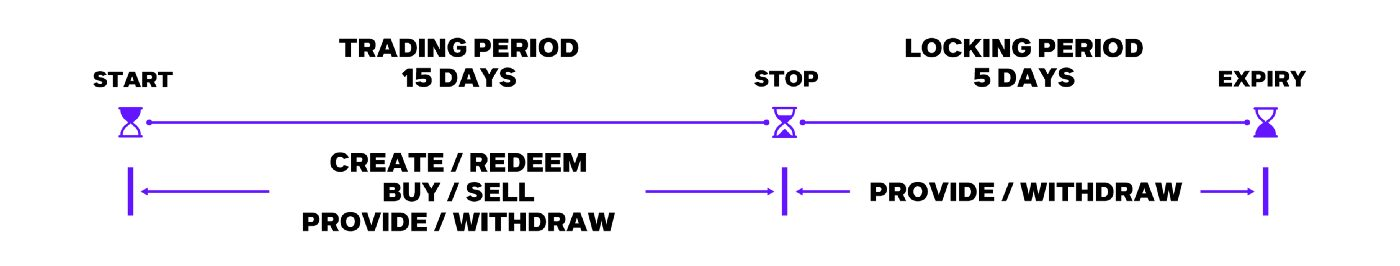

Time Cycle

During the trading period, there are 15 days for users to create/redeem protection tokens, buy/sell protection tokens in the swap pool, and provide/withdraw in the liquidity pool. The last 5 days before the expiry date are called the locking period, in which only liquidity providers can provide/withdraw their position in liquidity pools.

An Example

This is an example to make the process clearer. You use 1 USDC to create a protection token which is executed if the price of AVAX is lower than $90 at the expiry date, then you sell it to the swap pool for 0.5 USDC. When the expiry date comes, if the price of AVAX is lower than $90, the person who bought your protection token with the price of 0.5 USDC will get 1 USDC payout. Else, you will get 1 USDC back.

About Degis

Degis is the next generation all-in-one protection protocol, 1st on Avalanche. Degis offers complete protection to users, building the decentralized protection market and ultimately making an impact on the whole Crypto world.

Source :

https://degis.medium.com/naughty-price-intro-db957c77e772

Website | Discord | Twitter | Medium | Telegram Chat | Whitepaper