Roadmap & What’s Next

This is the second in a three part article series

Part 1 : Prototype Phase & Where we are Now

Part 2 : Roadmap & What’s Next

Part 3 : Token Launch & Tokenomics

Roadmap & What’s Next

In Part 1 we showed how we now have developed a catalogue of advanced strategies, strong security practices along with a well developed infrastructure that can safely and reliably automatically manage our delta-neutral strategies. Although this has been a somewhat slow process by purposely taking our time in making sure our strategies are secure and our off chain infrastructure is extremely robust we can now confidently start scaling out our strategies across multiple chains. While also rolling out a number of new products which we’ve been building & testing in the background.

Multi-Chain

Up until now our vaults have only operated on Fantom, the Fantom DeFi ecosystem has provided us with a great place to develop and iterate going from MVP to the products we have today.

To further grow our offering and provide more users with the opportunity to earn yield using our unique strategies over the coming months we will be deploying vaults on a number of new chains.

This also provides the opportunity to develop new and innovative strategies on top of a number of protocols which are currently not deployed on Fantom.

Chains we’re currently testing on & investigating

- Polygon

- Aurora

- Optimism

- Avax

- Arbitrum

- Cronos

- Moonriver

From the smart contract side as our strategies utilise protocols which are based on either uniV2 & compound integration to protocols on new chains should require limited development time. With the majority of time spent testing the strategies, reviewing protocols used in strategies to ensure they are safe & making minor adjustments where needed.

However as our delta-neutral strategies rely on keepers to complete rebalances in order maintain delta-neutral position, certain chains may not be suitable for certain strategies either due to

- Unreliable RPC infrastructure (This is essential to ensuring keepers can reliably maintain our delta-neutral strategies)

- Prohibitive Gas Costs (rebalances may be too costly on certain chains meaning delta-neutral strategies may not be viable)

- Lack of back up Keeper options (in part 1 we discussed how having back ups such as Gelato, Chainlink or Keep3r ensuring even if our own keepers experience issues strategies are still able to rebalance)

New Products

In addition to spending the past few months focussing on improving keeper reliability, testing the hell out of strategies and developing we’ve built a number of prototypes for additional products to add to the RoboVault suite.

(Let us know if you’re keen to help with testing / reviewing code of these new products)

Yield Redirect

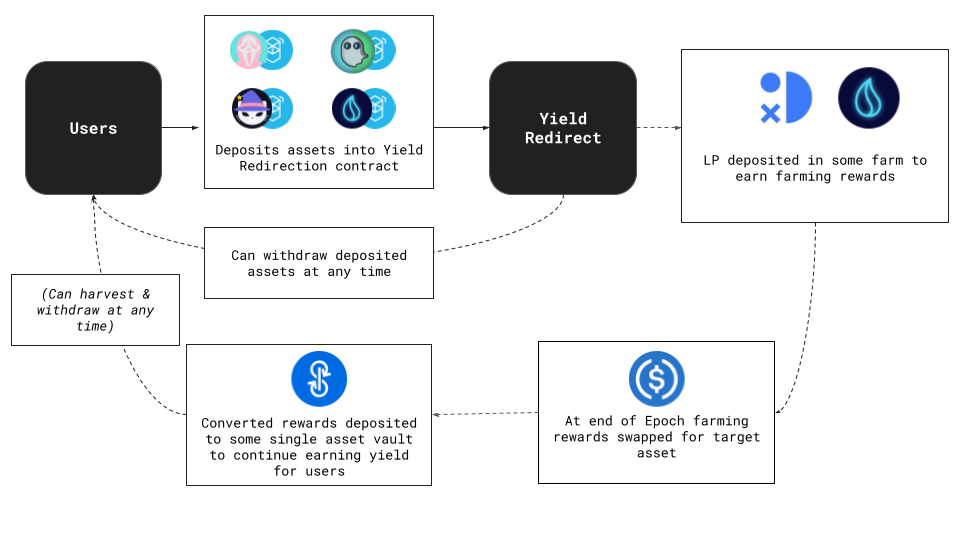

Yield Redirect is an ambitious addition to RoboVault’s arsenal of tools. It unlocks a wide range of new strategies and gives users greater control over their revenue streams.

A fundamental problem that users face in the defi space is being unable to capture (and then, additionally, to retain) value from yield farming — in the form that they desire. High yield strategies often come with exposure to extraordinarily volatile assets, as these yield streams are often based on novel tokens, sometimes created just for the purpose of bootstrapping initial protocol emissions.

In order to solve this, RoboVault’s powerful Yield Redirect product enables yields to automatically be converted into a pre configured token such as USDC while also being deposited to a yield bearing vault. This means users can lock in their yield in the desired asset while earning ongoing yield in that asset without any intervention. Initially, this feature will be available for deposited LP (liquidity provider) positions, but over time can be expanded to enable applications for single asset deposits. It will also be possible to adapt Yield Redirect to various other use cases, such as automation of treasury management for DAO’s, and giving various protocols the ability to offer “farming as a service”, enabling users to potentially farm their assets with a variety of different deposited assets.

You can find a complete, detailed overview in the launch medium for Yield Redirect, here.

Dojima Finance

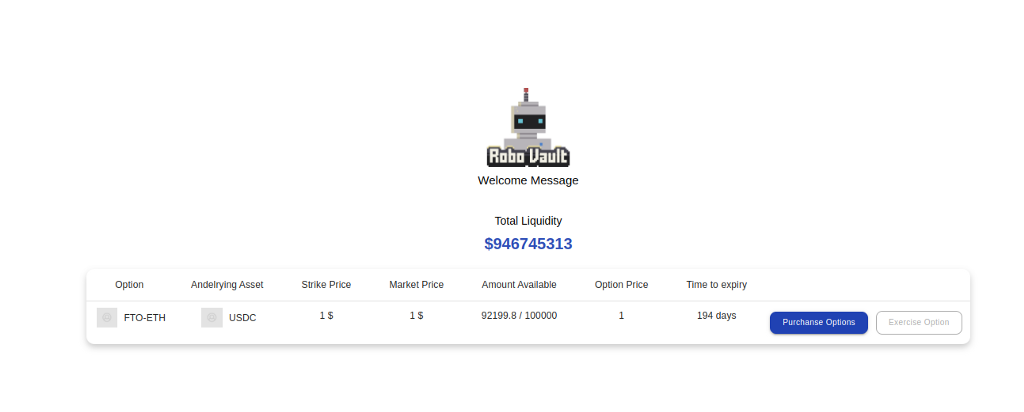

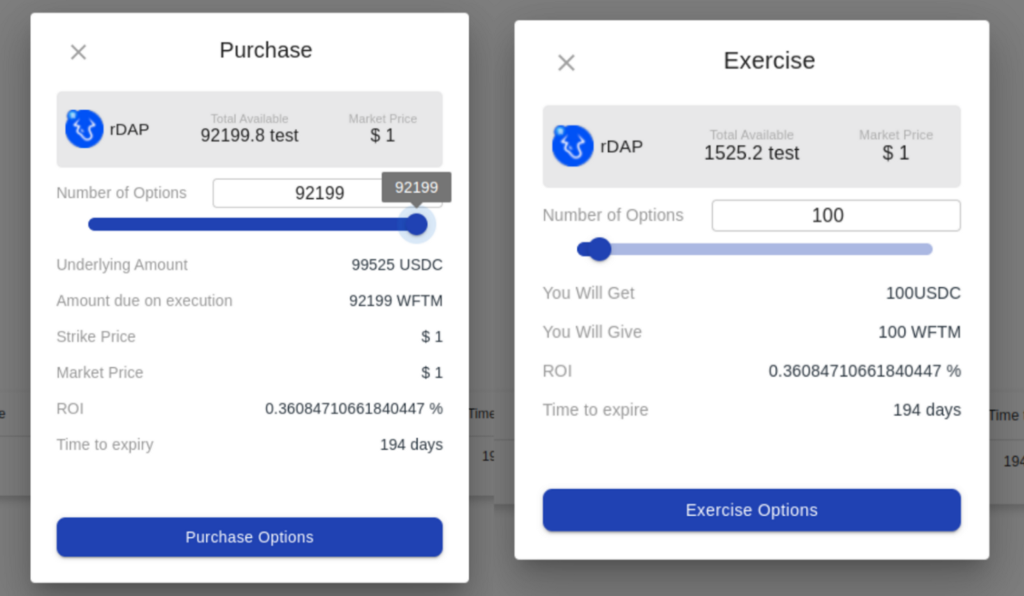

Very Early Prototypes of Dojima have won a number of prizes in hackathons including

DeFi Track of Cronos Hackathon

Upon launch, Dojima will extend the capabilities of RoboVault by utilising the option factory to launch a number of additional features to be built on top of our vaults.

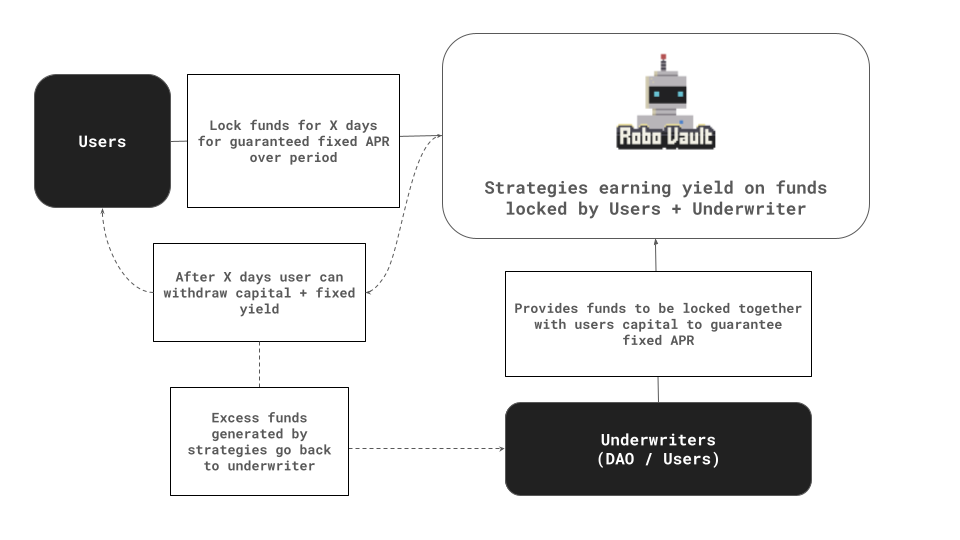

These will include the ability for users to purchase / underwrite insurance on our vaults. Fixed rate products will allow users to generate fixed yield over fixed periods while other users or the RoboVault treasury can take the position of the underwriter for the fixed yields having the potential to generate excess income as long as the strategies utilised are able to outperform the guaranteed fixed yield over the period.

By providing fixed rates together with locking mechanics on top of strategies this potentially allows for more advanced strategies to be used that may not be suitable to the current vault structure.

This structure also allows users of varying risk profiles to either take a guaranteed fixed yield or to take the position of underwriter leveraging funds allocated to a strategy and earning a higher yield as long as the strategy utilised can outperform the fixed yield.

Additionally our options factory opens up the possibility for options strategies utilising covered calls, covered puts or other option strategies to be developed.

As the products have been built from the ground up we will take a cautious approach with TVL limits initially applied and products being rolled out gradually.

Dojima will fall within the suite of Robovault products with and will not have an independent token. However, the Robovault DAO has the power to launch a Dojima token in the future.

(some more detailed information on Dojima is available here & here)

Expanding Strategies

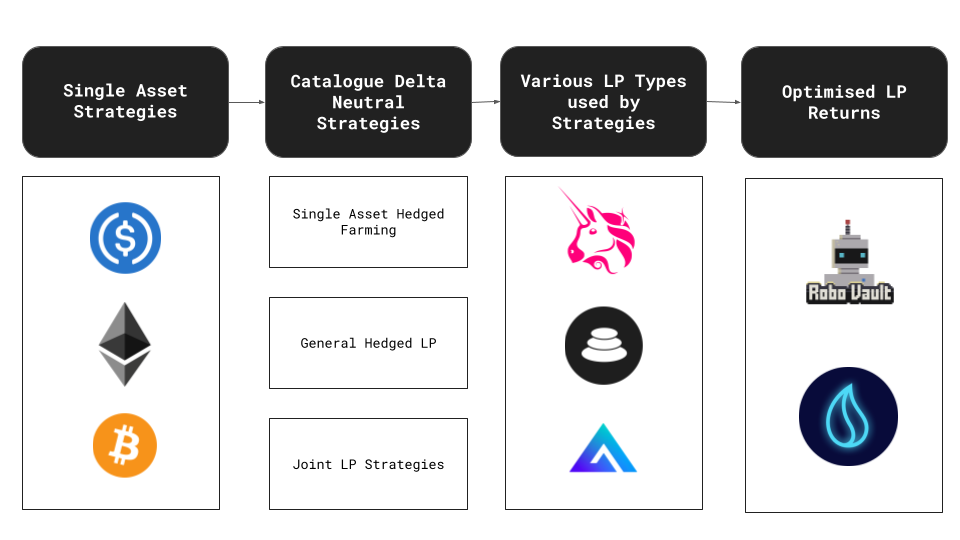

In Part 1 we showed some of the new strategies we have developed which are currently being tested in private vaults including Joint LP strategies & General LP strategies.

The current iterations of our delta neutral strategies primarily utilise Uni V2 LP’s. The architecture we have built provides for flexibility allowing delta-neutral strategies to be built on top of other LP types. We are currently testing versions of our joint LP and general LP strategies that utilise both Curve and Balancer LP’s while conducting some R&D into how we can adapt our strategies to use other protocols such as Uni V3 & GMX.

This will allow us to have a large catalogue of delta-neutral strategies that can provide highly competitive yield for users adaptable to plug & play into various protocols using various assets.

Additionally as mentioned in Part 1 we are developing LP strategies to optimise yields for LP holders. As our delta-neutral strategies all hold some portion of assets in the form of LP we can further optimise single asset strategies by having the LP held in these strategies deposited to an LP vault for optimal returns.

Vault & Strategy Optimisations

Currently within each of our vaults each strategy’s allocation is set manually by vault governance. However this means returns for the user are not 100% optimised. In the future when we have various vaults across multiple chains running various strategies manually managing these allocations will result in returns not being 100% optimised. In order to optimise returns for users similar to how our keepers currently rebalance positions we can have keepers manage allocations to various strategies

This approach will be quite complex to implement as requires a number of different pieces to be implemented

Reliable estimates of future yield for our strategies

As our Delta-Neutral strategies are not 100% hedged & have some minor exposure to IL. Predicting expected yield in a short period can be quite difficult as it is dependent on market movements. However models such as GARCH can provide some assistance in modelling volatility & better deciding when to potentially limit exposure to IL due to expected upcoming volatility

Having optimisations done on chain vs off chain

Building optimisations at such as high level may end up being far too complex to be done on chain and instead require the optimisation modelling to be done off-chain this would then require additional security measures to be put in place

Strategy complexities

Each strategy has various complexities associated with in when adding and removing liquidity. For example certain strategies may see significant drops in yield when more liquidity is added, while other strategies may incur some slippage when entering / exiting positions. Therefore any optimisations to automatically reallocate funds to strategies would need to accurately take into account these factors.

Additionally we have seen the development of a number of protocols that enable the development of cross-chain communication within dapps. This opens up a number of interesting long term possibilities where we can potentially have vaults allocating & optimising for yield across multiple chains.

Wrap Up

In Part 1 we showed how we’ve spent the last few months developing extremely reliable keeper infrastructure in addition to digging deep into our delta-neutral strategies to ensure they are secure. The next phase of RoboVault will see us expand on this foundation by

- Deploying vaults on multiple chains

- Launching new products to expand use cases (Yield Redirect + Dojima)

- Expanding Delta-Neutral Strategies to utilise various LP types

- Further Vault & Strategy Optimisations