RoboVault on Avalanche

Recently we launched USDC & WETH vaults on Avalanche. So far these vaults have performed well with USDC at 10% APY & ETH at 6.5% APY over the past 7 days. Over the next few weeks we’ll be ramping up activity within the Avalanche Ecosystem pushing out a number of new vaults while also diving deep into some research into new delta-neutral strategies on Avalanche.

Why RoboVault

Firstly for any new users a quick overview on why we built RoboVault and what if offers for users.

Quite simply our goal is to consistently provide users above market yields on their assets through advanced delta-neutral strategies while hedging away market exposure.

How do we do this ?

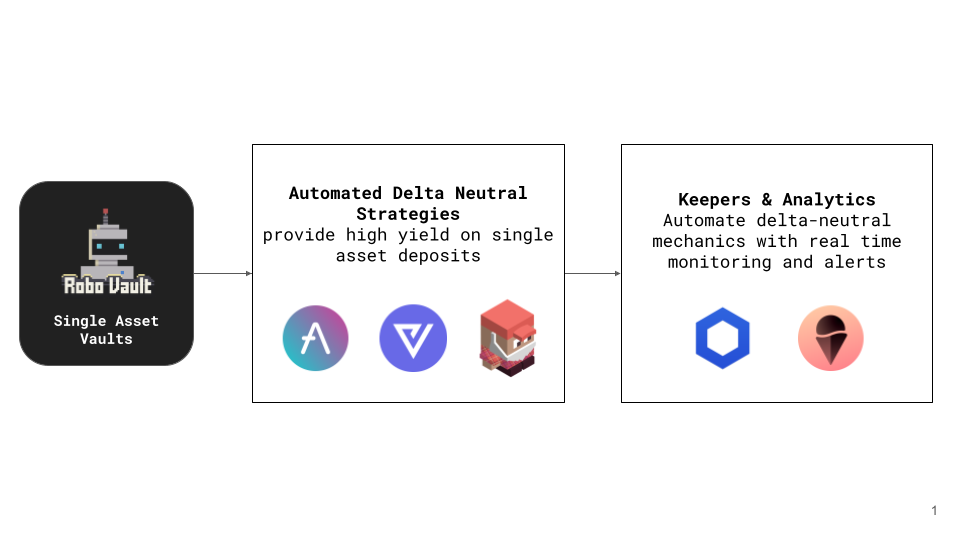

Since DeFi summer and up until now the highest returns available to users come from providing liquidity to Automated Market Makers (AMM’s). However due to the nature of Impermanent Loss it’s extremely difficult for users to manage their positions in a way that they aren’t exposed to large losses due to market movements. By leveraging DeFi’s composability together with off-chain automation we sought out to develop a solution where users can deposit single assets, generate above market returns by building strategies on top of AMM’s while utilising reliable off-chain automation along with delta-neutral mechanics to minimise exposure to market movements.

Why Avalanche

We’ve chosen to focus our current efforts on Avalanche due a number of factors described below.

Mature Ecosystem

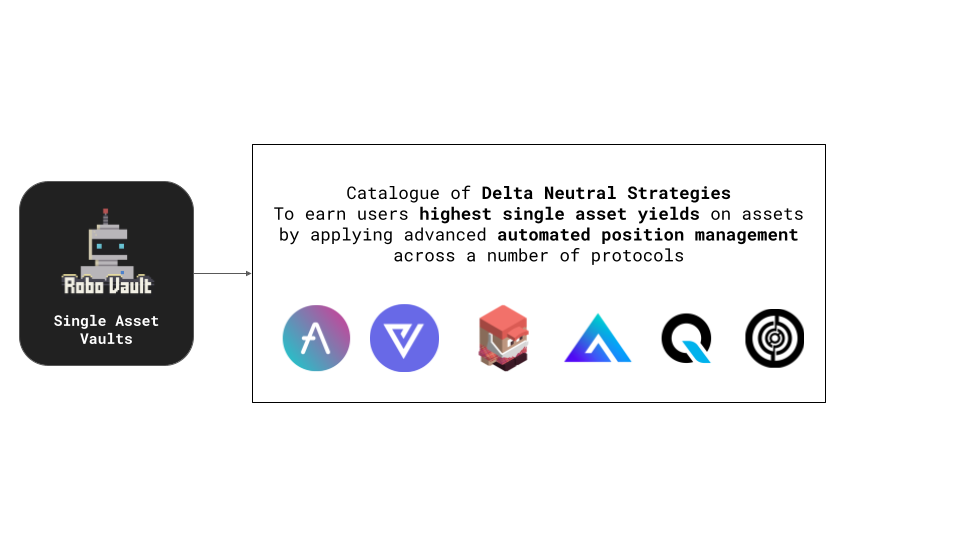

As our delta-neutral strategies require developing strategies on top of third party protocols such as Automated Market Makers & Money Markets having a set of trusted protocols to build on top of is essential. Our current strategies utilise AAVE, Trader Joe’s & Vector Finance which have all proven to be trusted protocols. While other protocols such as BenQi, GMX & Pangolin present opportunities to further iterate on.

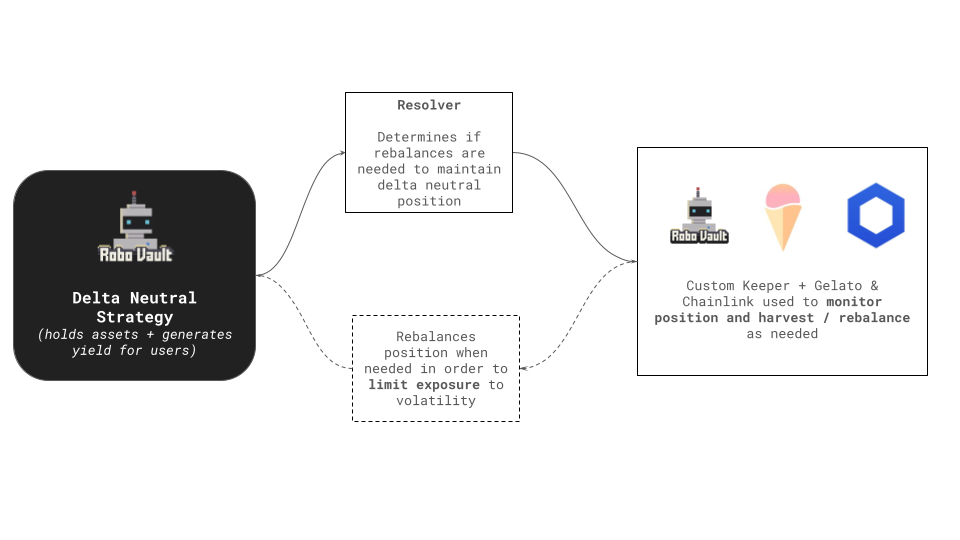

Additionally as mentioned in our Prototype Phase article one essential component in the success of our delta-neutral strategies is having reliable keepers to actively manage positions. Avalanche has both ChainLink Keepers & Gelato live which we are able to utilise in addition to our own custom keepers ensuring maximum reliability in our strategies actively rebalance & maximise returns for users.

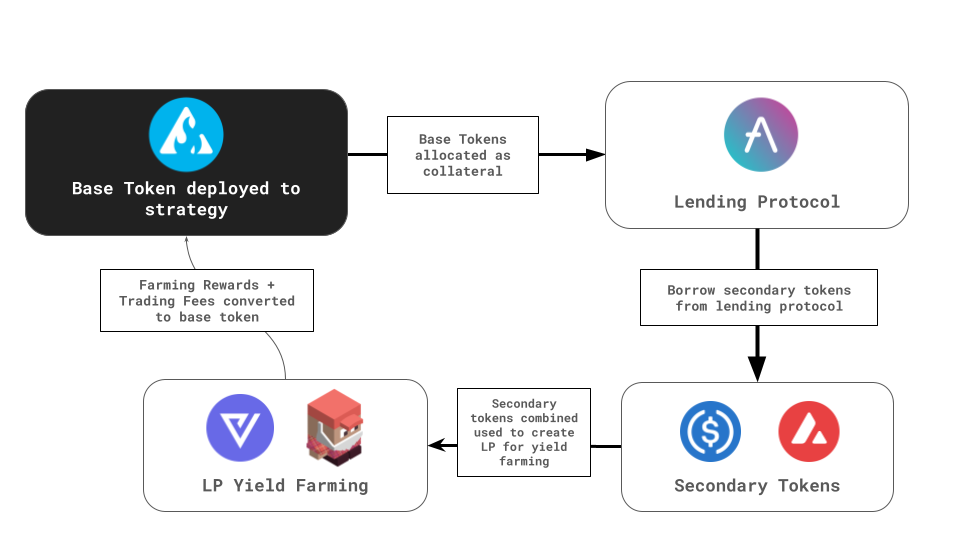

Deep Liquidity on Money Markets

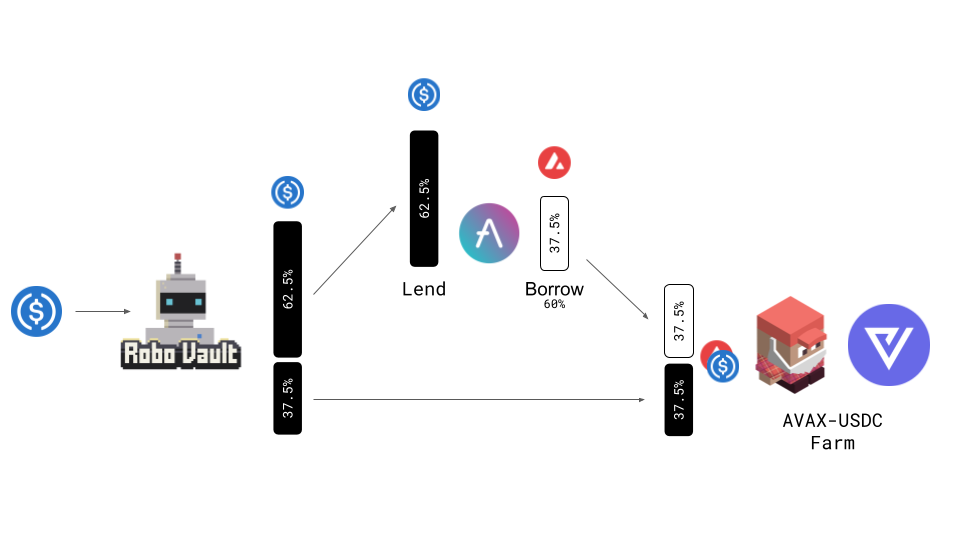

Our Core Strategy utilises money markets to borrow secondary assets which are then used to create an LP position which is actively managed by our keepers in order to minimise exposure to market movements. As a result having deep liquidity which we can borrow helps ensure borrow rates are stable over time. By integrating with AAVE which has around $1 Billion of liquidity on Avalanche we can be much more confident in the borrowing rates for our core strategy.

Innovation Opportunities

A number of recent and upcoming releases from various protocols also present a number of interesting opportunities for us to research & develop new iterations of our existing delta-neutral strategies providing users additional opportunities to earn high yields on single asset deposits.

Benqi recently launched their own Liquid Staking (BLS) protocol on Avalanche. With BENQI Liquid Staked AVAX (sAVAX), an interest bearing version of AVAX being implemented as collateral on both AAVE & Benqi lending markets a number of interesting strategies are available to maximise yields on sAVAX such as our General Hedged LP strategy (currently in test)

GMX offers users high yields for depositing GLP, however holding GLP means users are exposed to market movements from multiple assets. As our existing delta-neutral are designed to provide users high yields available from LP’s a natural extension will be adapting these strategies to also utilise GMX’s GLP on Avalanche. We’re currently scoping out how an actively managed GMX delta-neutral strategy will work but some adaptation of our current strategies should provide the opportunity for users to deposit multiple assets and earn high yields utilising GLP.

Hubble Exchange is launching Perpetual Futures on Avalanche. Their vAMM structure provides a number of interesting opportunities to develop delta-neutral strategies. We’ll be doing some research into potential mechanics we can use to build on top of Hubble Exchange.

Trader Joe’s Concentrated Liquidity Our current strategies utilise Trader Joe who are currently working on their own Concentrated Liquidity solution. Once released this will present another opportunity to expand our delta-neutral strategies.

What’s Next

New Vaults

Over the next two weeks we’ll be releasing vaults for BTC.b, USDT, AVAX & sAVAX. BTC.b, USDT & AVAX vaults will utilise our existing core strategy built on top of AAVE, Trader Joes & Vector Finance. While our sAVAX strategy will utilise a lending optimiser while we conduct final testing

New Strategies

We’ve had a number of new strategies that we’ve been testing for some time. The plan will be to roll these out to our AVAX vaults after we’ve released the above vaults. These strategies include

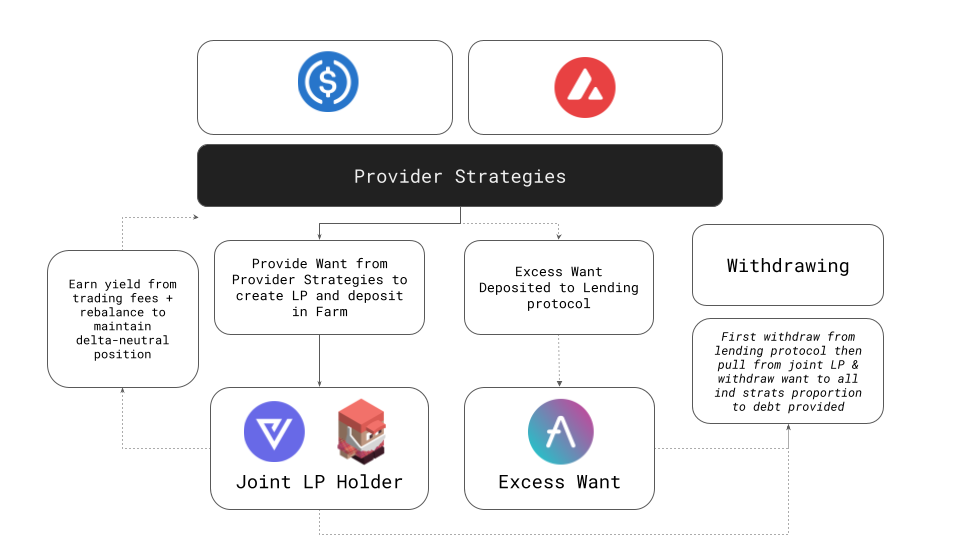

Joint LP Strategy

Our Joint LP strategies use similar mechanics to our core strategy to maintain a delta-neutral position. Instead of borrowing a secondary asset, two provider strategies from single asset vaults pool funds to create an LP position which is managed within the Joint LP Holder contract. The LP position earns yield for both provider strategies from trading fees and yield farming rewards. While our keepers monitor the LP position and rebalance as needed to maintain a delta neutral position and minimise exposure to IL. This can be considered a more capital-efficient version of our core strategy with higher expected returns. The Joint LP strategies also solves a number of key limitations of our current core strategy

Capital Efficiency : Allows for a much higher portion of the strategies assets to be allocated to LP (although is dependent on the other provider strategies also combining to create the joint LP)

Liquidation Risk / Borrowing Costs : By pooling funds from another strategy to create the joint LP, as opposed to using a lending protocol, we avoid any liquidation risk

Gas Costs : Again by not using a lending protocol’s rebalances to maintain the delta neutral position, strategies are much less gas intensive. This is important as it reduces operational costs of running the strategy & lowering gas costs improves the reliability of the keeper.

Additionally through our Joint LP Strategies we have the flexibility to utilise various types of LP’s that potentially hold more than two assets such as GMX & CRV.

General Hedged LP

Our general LP hedged strategy works in a similar way to our current delta-neutral strategies, with one major change. It allows for any two assets to be borrowed against the vault’s base asset to create a LP and farm rewards while constantly rebalancing the position to avoid IL. This allows us to gain exposure to high yielding LP pairs on any asset that can be used as collateral and also to potentially borrow pairs which are more correlated to minimise exposure to IL. On Avalanche in particular this will allow us to utilise sAVAX in delta-neutral strategies by using sAVAX as collateral to borrow two assets such as USDC and AVAX which can be deposited in Trader Joe & Vector Finance with our Keepers actively managing these positions to minimise market exposure.

What This Means for Fantom Users

Our Fantom vaults will remain live however for the immediate future they’ll be using simple strategies such as lending optimisers / auto-compounders. While our more complex & higher yielding strategies such as our core delta-neutral strategy will be live on our AVAX vaults. Additionally we’ll be focusing our R&D efforts on the Avalanche ecosystem for new strategies and products.

More info on why we decided to go cross chain here.

Finally as mentioned previously we do plan to launch a token with airdrop for past users. We will still be honouring this when we release the token. We’re still working on finalising the details of the token launch with our first priority being getting a full suite of vaults & strategies live on Avalanche before pushing forward with our token launch.