RoboVault Track Record

What is RoboVault ?

RoboVault was founded with the goal of bringing advanced automated strategies to DeFi. Since DeFi summer, we’ve observed the best yields in DeFi come from providing liquidity to Automated Market Makers. Without advanced automation and risk management tools, liquidity providers are often exposed to large losses through Impermanent Loss. Since launching in July 2021, we’ve been successfully running single asset Delta Neutral strategies, proving that our strategies & infrastructure can successfully and safely generate competitive yields throughout various market conditions.

Our goal is to become a market leader in the development of advanced algorithmic strategies for DeFi users. Through advanced automation and risk management tools, we’re able to execute advanced on-chain quantitative strategies, giving users access to strategies which are typically only accessible to institutions within Traditional Finance.

Since RoboVault’s initial launch, vaults have undergone a number of key improvements, such as off-chain infrastructure, security & strategies, in order to improve returns and reliability..

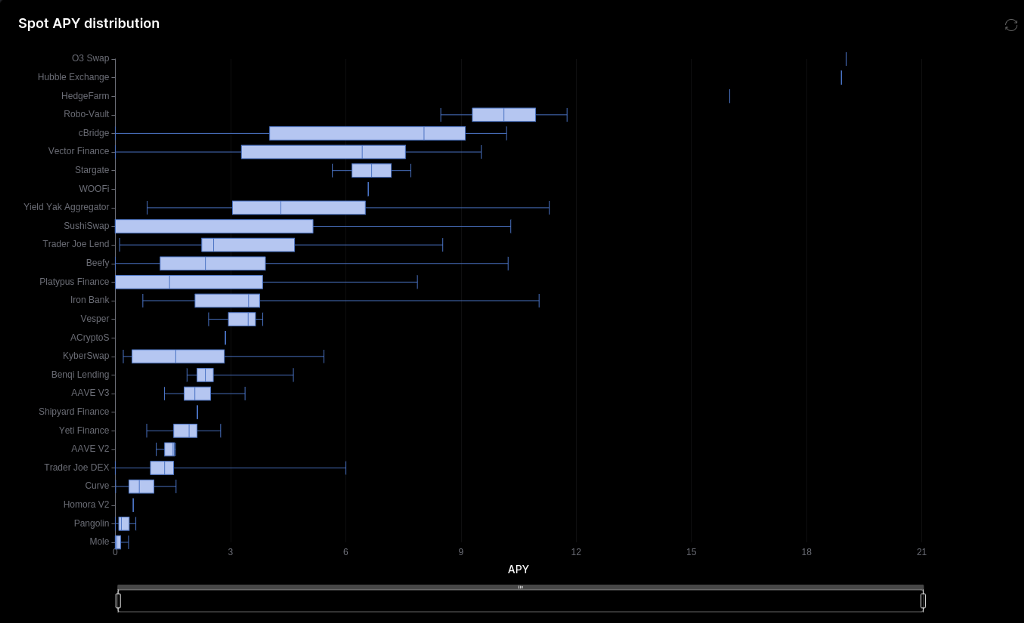

(Summary of Stable Coin Yields on Avalanche, Source : DeFiLlama)

Where are we at now?

In July 2022, RoboVault launched its Pseudo Delta Neutral Vaults on Avalanche, shifting focus from Fantom. This was done for a number of reasons, including the availability of high liquidity on mature protocols such as AAVE & Trader Joe’s, which are Third Party Protocols utilised by our vaults. Since launching, we’ve rolled out vaults for multiple assets on Avalanche, including USDC, USDC, WETH & WAVAX.

For more info on why launched on Avalanche

https://medium.com/@RoboVault/robovault-on-avalanche-9e8541dcfb7c

For more info on our Strategy mechanics

https://medium.com/@RoboVault/delta-neutral-strategy-deep-dive-ae91d309b504

Track Record Data

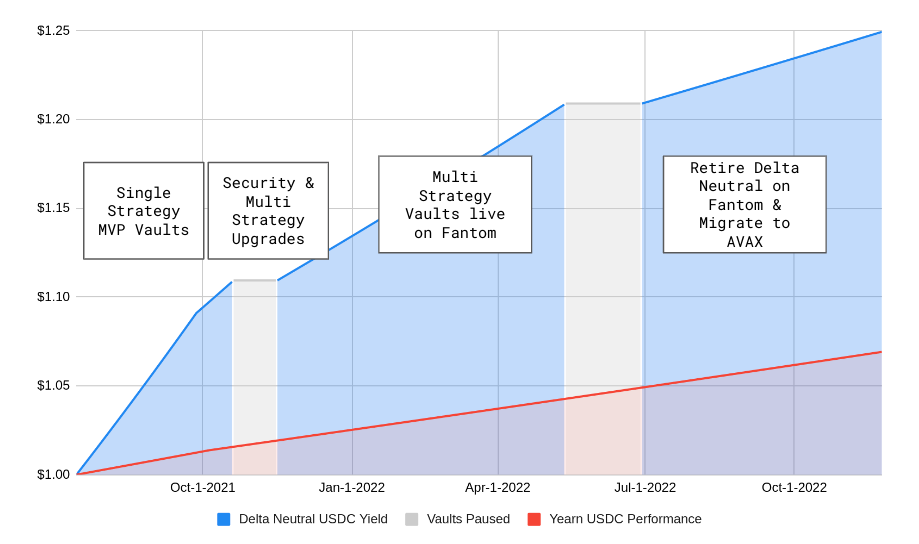

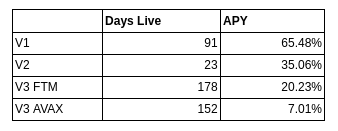

In order to showcase the performance of our strategies & their ability to consistently generate strong yields for users , we’ll be using our Pseudo Delta-Neutral Strategy Vaults from Fantom & Avax, in comparison to Yearn’s Vaults.

Note — Yearn generally focuses on only up strategies & targets extremely low risk strategies, while our strategies do have some exposure to minor drawdowns due to IL exposure,which cannot be perfectly hedged, but we have built-in an Insurance Logic to cover the small drawdowns. So we can expect RoboVault users to be compensated with higher yields due to taking on slightly more risk.

Read more about our Insurance Logic

https://docs.robo-vault.com/security/on-chain-and-smart-contracts/insurance-logic

The above chart compares returns of RoboVault USDC vaults over our various iterations & Yearn’s USDC returns since our initial launch in July 2021. Over this period users would have received a return of ~25% equivalent to a 17.64% APY.

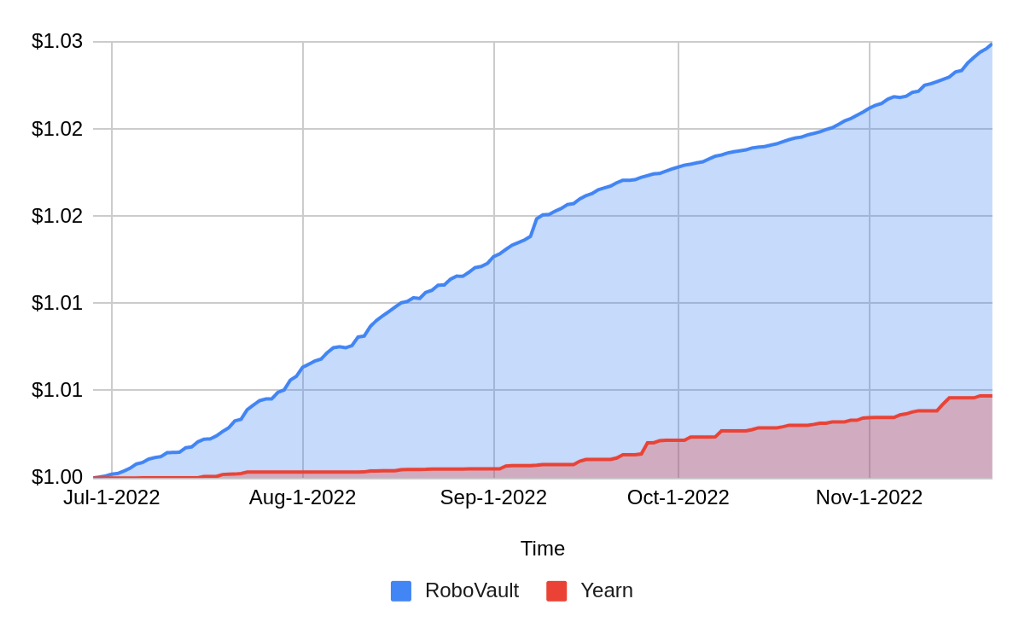

Now let’s take a look at the RoboVault Pseudo Delta-Neutral Strategies on Avalanche, launched on 29th of June 2022 against the same Yearn $USDC Vault as above since the vaults inception dates:

Active since 28th of June, 2022, the vault shares have gone up from $1 to $1.0274250, which have netted 2.7% so far (7% APY).

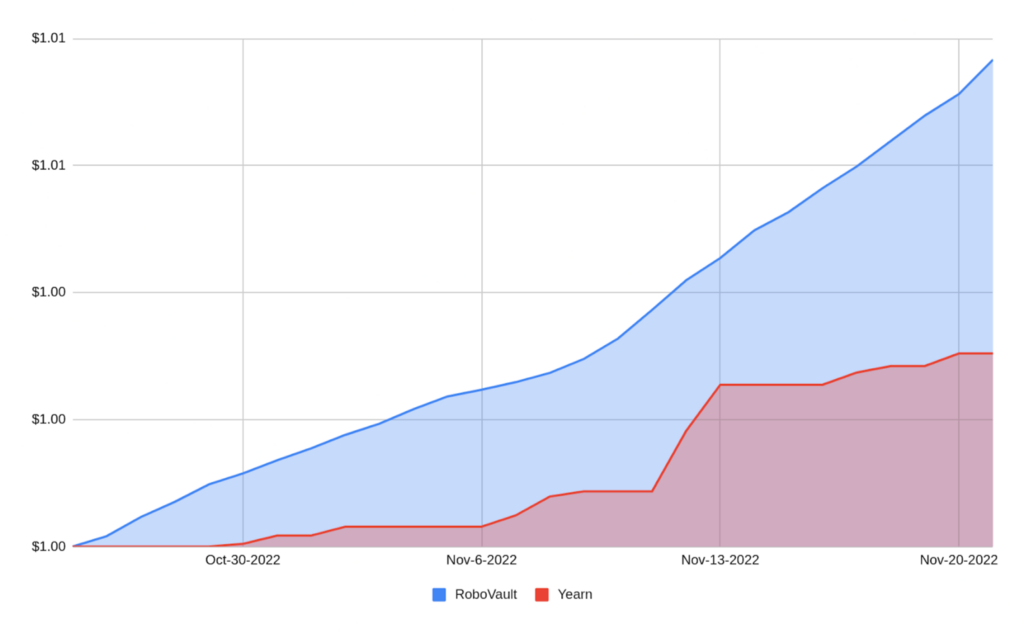

Let’s take a look at the $USDT vaults, comparing them over the same period of time, 25th of Oct 2022 to 21th of Nov 2022 and how they fared so far

Over this period the RoboVault Pseudo Delta-Neutral Native $USDt Vault has performed extremely well despite market volatility from the FTX fiasco. With share price increasing by 0.77%, which is equivalent to ~10.8% APY.

DrawDowns

As mentioned above Yearn generally focuses on only up strategies & targets extremely low risk strategies. In comparison, RoboVault utilised Pseudo Delta Neutral Strategies which are not perfectly up only & can have minor drawdowns in extremely volatile markets.

Since our initial launch, we have implemented a number of mechanics to help reduce the magnitude of drawdowns. The primary mechanic to do this is our inbuilt insurance logic

For our AVAX USDC & USDT Strategies, our largest drawdowns have been 0.05% & 0.01%, with share prices recovering within less than 24 hours following these minor drawdowns.

Users from our Fantom vaults will note that these drawdowns are significantly lower than drawdowns in the previous iterations of our vaults. This is due to a number of factors, including:

- Integration of ChainLink Automation since migrating to Avalanche which has proved to be extremely reliable in managing rebalances

- Lower volatility in AVAX pairs compared to FTM pairs

- Improved insurance logic utilised in strategies to help compensate for potential drawdowns experienced by strategies

- Increased optimisation in parameters used to determine rebalancing logic

One Example of larger drawdowns on our Fantom Vaults was on December the 4th 2021, when there was a “flashcrash” within the entire crypto market including on Fantom, with a 40%+ drop in price over a few hours. During this period there was significant network congestion and our keeper infrastructure was unable to get the required rebalancing transactions on chain, at the time. This lead to multiple vaults suffering losses due to liquidations. (Note at the time RoboVault was only utilising it’s own custom keepers which were significantly less developed than currently & users were refunded for losses incurred)

More details here

More info on our Off Chain Infrastructure with updated improvements here

Further Data on Historical Performance of Vaults can be found at https://analytics.robo-vault.com

More information on updates to our Vaults & Strategies since launch here

Follow us on our socials to stay updated on what’s happening at RoboVault!