The Alternative Pool Launch Announcement!

More stablecoins are coming up in our brand new Alternative Pool!

How is it going, Platypuses? Weâre on something big. Itâs an exciting time for our community as we are launching the Alternative Pool, which will bring in more stablecoin options for our users! The official rollout will be on the 6th of April, 2022.

Which stablecoins will be included in the Alternative Pool?

The Alternative Pool is the latest addition to the platform, bringing trending coins such as MIM, UST and FRAX to Platypus!

We aim to diversify the pools on our platform to expand your choices and opportunities. Apart from the abovementioned stablecoins, our community can expect to see more additions in the near future!

Thatâs exciting! But hang on a second⦠will these new additions affect the current pool?

No worries there, buddy. We got you. Below weâll briefly explain the workings of this new Alternative Pool. An in-depth explanation is coming soon as well if youâre into drilling down to first principles. But to answer your question, nope, it wonât affect the current pool at all.

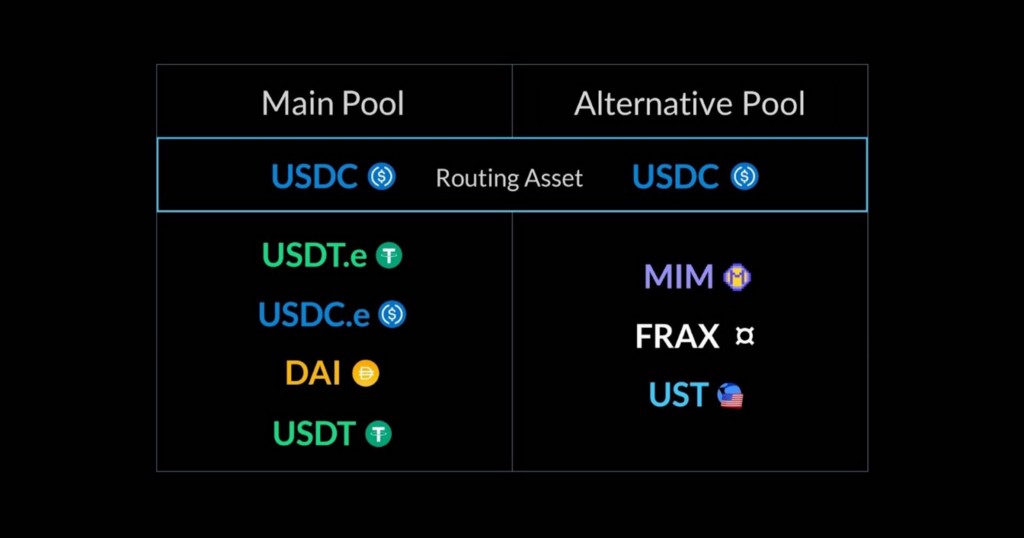

Since these trending stablecoins have diverse risk levels, we separated them from the current pool containing established and time-tested stablecoins. Letâs call that good old pool the Main Pool. The new Alternative Pool is where the newcomers live.

A paired design eliminates the risk to other pools when pretty volatile stablecoins are brought into the platform. Although you see these new stablecoins are paired, we still maintain our single-sided liquidity provision and the open-liquidity design of the Main Pool. Ergo, liquidity providers do not have to give pairs or bundles of assets to the pool to be an LPâââjust one will do. Each asset still has its own coverage ratio and vePTP boosting is also applicable in Alternative Pool. This concept is what makes our innovative algorithm a cut above the rest. Being in a separate masterchef, the recently introduced Interest Rate Model is not applicable.

Can I swap stablecoins from different pools?

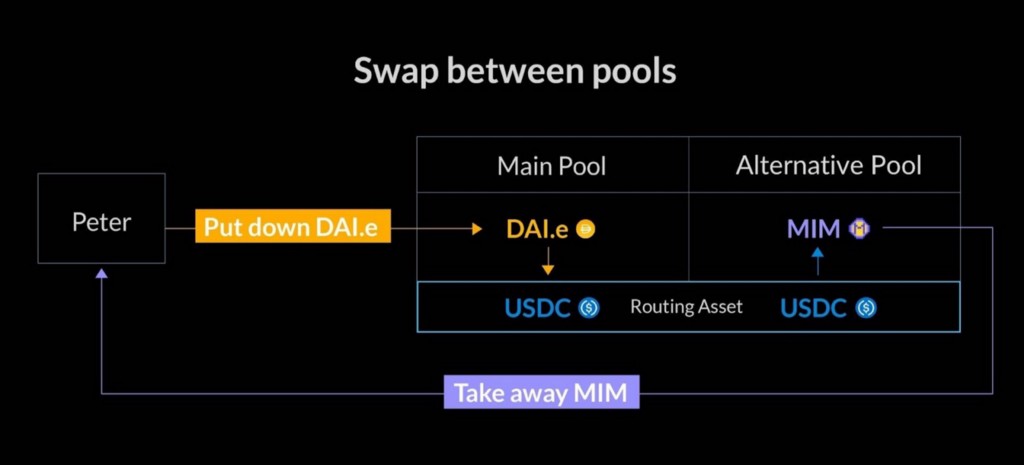

Smurf yeah! This is where the power of routing comes in. This allows you to swap your tokens for any other tokens within the platform.

As you can see from the illustration, USDC is the routing asset. Meaning, each pool contains USDC, which will be the asset that links all other assets together to make a swap between different liquidity pools possible.

For example, you want to swap your DAI.e to MIM. Because they are in separate pools, Platypus will help you swap DAI.e to USDC (the routing asset), then swap USDC to MIM.

The swapping process is straightforward for the users, while Platypus performs the routing process on the back end. The costs (i.e., gas fee, slippage, price impact) will be higher than swapping within the same pool, as two swaps are happening in one go.

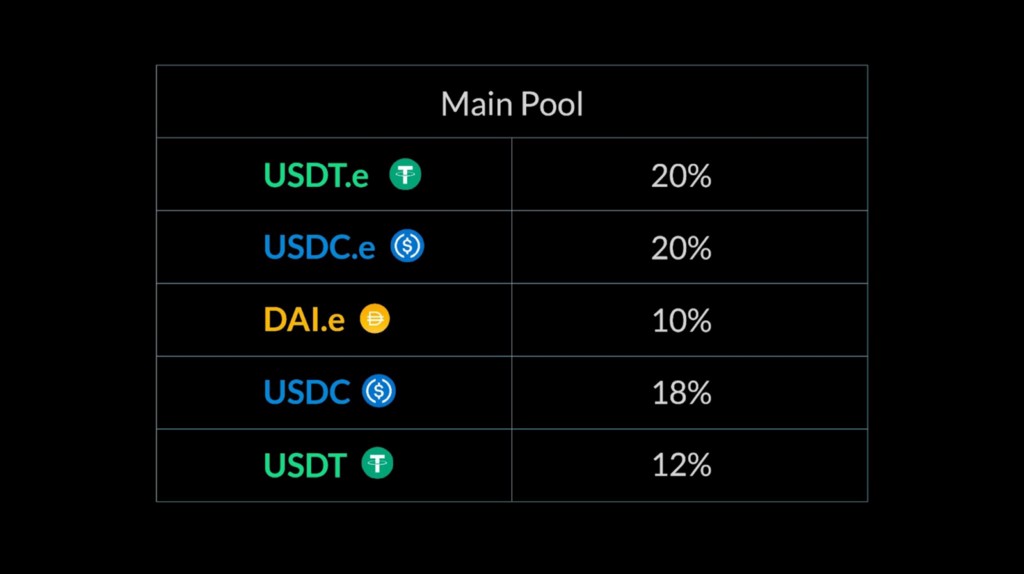

New Emission Allocation

After the launch of the Alternative Pool, the adjusted emission market weights will be as follows:

Follow Platypus

The Alternative Pool Launch Announcement! was originally published in Platypus.finance on Medium, where people are continuing the conversation by highlighting and responding to this story.