Weekly Update 30/03/2022

Core Strategies

We’ll be updating allocation in USDC & WFTM multi-strategy vaults to 40% in the next 24 hours which will provide a nice boost in yield for these vaults while we’ll also be adding our core strategies to our DAI vault.

(Our core strat for USDC has had an APY of 24% the past week & for WFTM an APY of 17% while also only running at a c-ratio of 35% meaning there is still room to further boost these returns )

For reference our keeper has proved to be extremely reliable over the past few weeks, we understand users may be impatient as this approach means we are potentially leaving some opportunities for higher yield untapped, however we are priority security first being cautious with upping the allocations to make sure the risk of the keeper failure is as low as possible.

Here is some analysis on the impact of a failing keeper showing the potential downside.

(note for WBTC & WETH the expected yield for our core strategy is not as high as with USDC & WFTM with our core strat. Instead we’re working on some alternative strategies outlined below which should provide high yielding opportunities for these vaults & also our degen vaults will provide a place for users willing to take a risk on newer / riskier assets to deposit)

Degen Vaults

We’ll be releasing a number of new “Degen Vaults” for USDC, WFTM, FRAX & ETH this week.

These vaults will have a lower TVL cap than our core vaults and be used to roll out new strategies which we’ve been working on before deploying to our multi-strategy vaults & also holding strategies which potentially may be more volatile.

(Strategies deployed to Degen Vaults will be thoroughly tested & reviewed internally however will be deployed prior to any external reviews / audits)

To start with our Degen Vaults will be deploying some combination of the below strategies

Update Lending Optimiser : Our current lending optimiser only uses SCREAM, IRON BANK. We’ll be updating the lending optimiser to include Hundred Finance as currently they are offering the best yields on lending platforms for stable coins. As this is a relatively simple strategy we’ll be moving this over to our core vaults pretty quickly

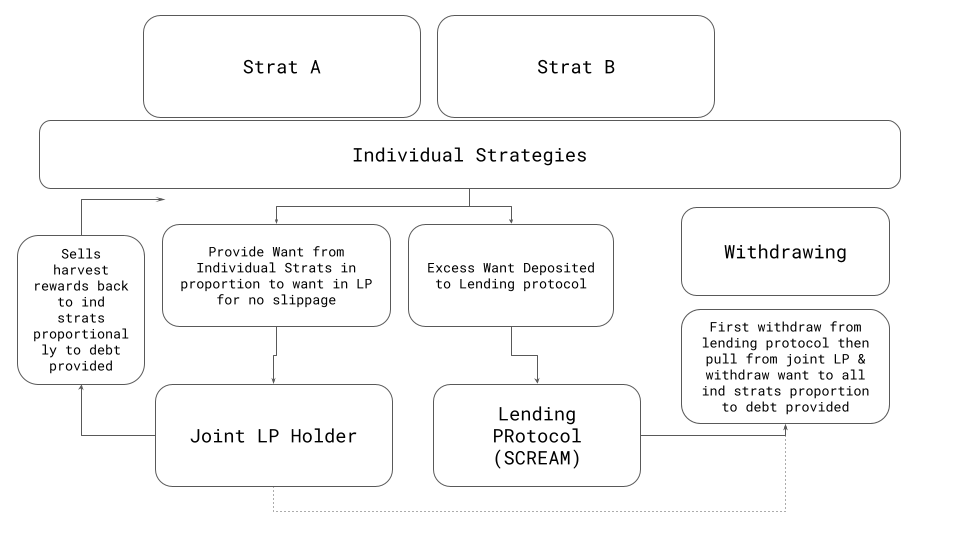

Joint LP Strategies

Volatile Pairs : Our Joint LP strategies extend on our hedged LP strategy mechanics to enable single asset vaults to earn higher yields available from providing LP’s. The Joint LP strategies pull single assets from two single asset provider strategies to create an LP while employing rebalancing mechanics similar to our core strategies to minimise IL as market prices move. Compared to our core strategy this has a number of added benefits. Including :

Improved capital efficiency : due to not using a lending protocol a higher % of the strategies assets can be allocated to LP leading to more upside.

No risk of liquidation : due to not using a lending protocol to get the second asset needed to create an LP but instead joining with a second strategy there is no risk of liquidation.

Less Gas Intensive Transactions : this strategy is less gas intensive when rebalancing than our single hedged LP strategy this means there is less risk of keeper failures (which for the Joint LP strategy can lead to higher exposure to IL if positions aren’t rebalanced in a timely manner)

Initially we’ll be testing our Joint LP Strategy for volatile pairs using our WETH & WFTM degen vaults with the WETH / WFTM pair.

Note to benefit from the capital efficiency both strategies providing assets to the Joint LP will need to have similar amounts of capital also the higher capital efficiency means in the short term these strategies will potentially be more volatile. Although we are confident in the long term the EV will be quite high as our rebalancing mechanics for our core strat have proved to be quite effective.

Stable Pairs : Additionally we can apply the same joint LP structure to stable pairs and even stable LP with 3 or more assets such as CRV LP pairs. To start we’ll be implementing our Joint LP strategies for stable assets using our FRAX & USDC stable vaults. Using Solidly LP’s to earn yields

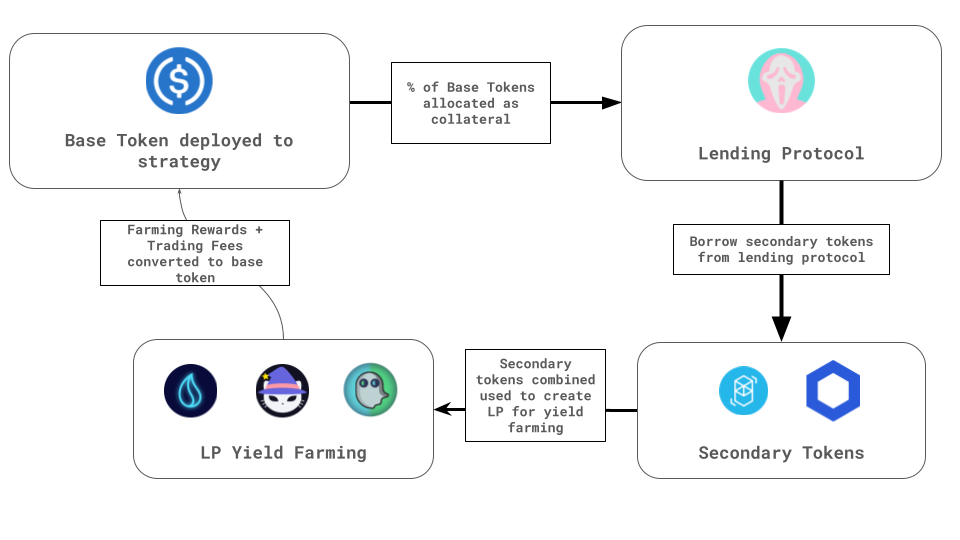

General LP Hedged Strategy

Our general LP hedged strategy works in a similar way to our current hedged LP strategy but instead allows for any two assets to be borrowed against the vault’s base asset to create an LP and farm rewards while constantly rebalancing the position to avoid IL. The first version for our Degen Vaults will use USDC as collateral to borrow LINK and WFTM to create LINK/WFTM LP and farm rewards.

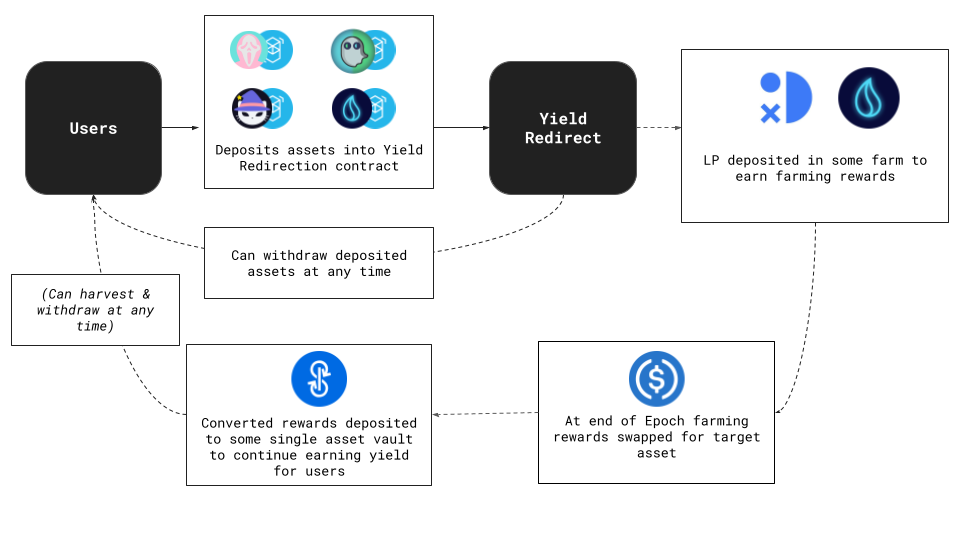

Yield Redirect

We currently have our Yield Redirect deployed to a private version on mainnet. We’ll be monitoring it for a few days while getting our UI and logging ready. Once this is done we plan to release the following versions of yield redirect

SPIRIT/FTM

BOO/FTM

SCREAM/FTM

LQDR/FTM

*note pairs are tentative if you’ve got any other pairs you’d like us to deploy please hit us up in our discord

For each version users will be able to deposit the specified LP with our yield redirect automatically converting farmed rewards to yvUSDC allowing them to automatically convert farming rewards to stable coins which will continuously earn yield without the user having to take any action.

Other Developments

Option R&D : Our Option Architecture for Dojima is coming together nicely. With a flexible permission-less structure allowing anyone to underwrite options and create options represented by ERC20 tokens which can be traded. We’ll be doing a bunch of research into option pricing & also potential secondary markets for options that can be developed on top of our core architecture

Token Release : Outside of the above we’re turning more of our attention over to getting all the relevant contracts ready for our token release. This includes finalising the mechanics for our token including farming mechanics, emissions schedule & incentives for token holders. We’re targeting a launch in late April (but as always things can take longer than expected)