Why Proof-Of-Work Is The Worst Method Of Distribution For Any Cryptocurrency

Proof-Of-Work has one good usecase, and thats for being an anti-sybil mechanism that works regardless of the asset-class being transacted. Proof-Of-Work as a consensus mechanism however is extremely inefficient, and as a distribution system, is extremely centralizing.

Proof-Of-Work Is Inefficient

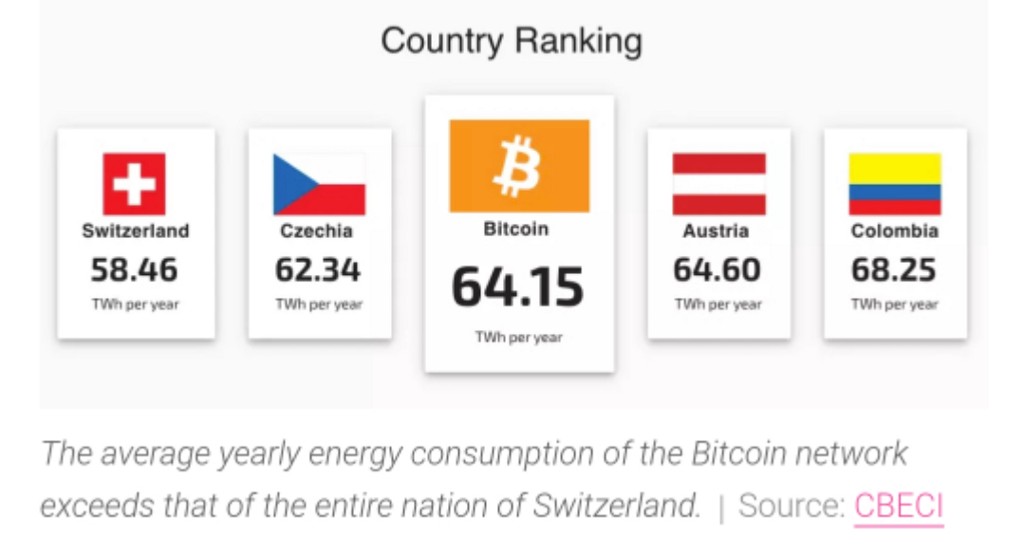

Proof-Of-Work requires a regularized high-volume payout system to incentivize powerful and specialized hardware to run highly specialized code, and as a consequence burns an enormous amount of electricity. The amount of energy burned scales proportional to the price of the asset used in the payout mechanism.

Proof-Of-Work isn’t just physically or environmentally inefficient, it is economically inefficient too. The consequence of using POW as your consensus mechanism is that hashpuzzle solvers have to sell a large portion of the payout they receive to cover electricity and other expenses, creating perpetual sell pressure on the market. This of course is harmful to the holders of this asset.

Proof-Of-Work Is Centralized

The Economic effects of Proof-Of-Work create a scenario where only people with a lot of capital and access to extremely cheap electricity are able to afford hashing, and due to the highly competitive nature of it, it’s profitability for most people is almost always zero or negative.

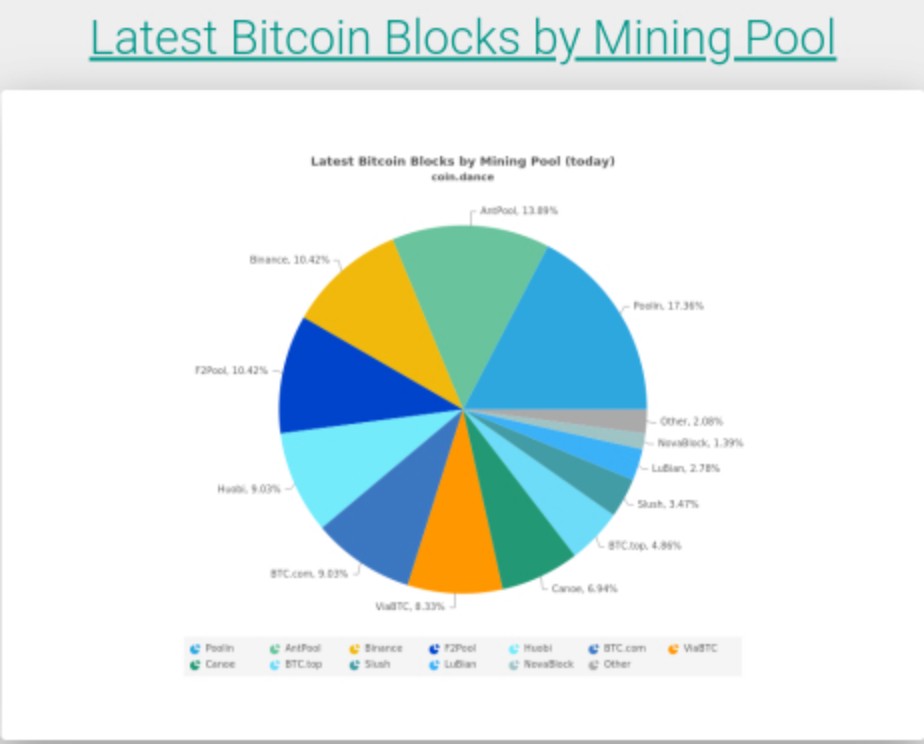

In practice, only about 4 mining pools at any one time control 51% of the hashrate on the Bitcoin network. These pools are capable of banding together to manipulate transactions on the network or even affecting some of the rules on the network. Throughout Bitcoin’s history, there has even been times where two or even a single pool had over 51% of the hashrate.

If you want a cryptocurrency to be decentralized, than there needs to be more than a single-digit number of meaningful nodes on the network. This isn’t a significant improvement over networks where only a single node is in control of the network, in fact this is far inferior to some classical consensus algorithms where dozens or even up to a hundred nodes all participate in a consensus process. Nakamoto consensus offers some robustness, but the Proof-Of-Work aspect of it works against the core value of decentralization.

Proof-Of-Work Isn’t About Work

Proof-Of-Work has nothing to do with real-life “work", but merely describes the hashing function that creates sybil resistance for the Bitcoin network. Falsely equating the hashing function to real-life work is a common fallacy made by bitcoiners. It is assumed that since its hard to profitably mine Bitcoin, it must be based off of meritocratic prowess. There is no factual underlying basis for this assumption, its just propaganda used to glorify the Proof-Of-Work process.

The actual reason that its hard to become a profitable miner is because mining is centralized and over-saturated with people who have unfairly cheap access to electricity and resources. The miners in control of Bitcoin are people with access to free or extremely cheap electricity, government subsidies, and other benefits that others do not have access to, usually created by government itself. Effectively, government leeches are in control of mining the Bitcoin network.

Proof-Of-Work Has A Broken Governance Model

The Governance Model of Proof-Of-Work is broken beyond repair, and its all because of the poor incentives as well as the class-based system used in Proof-Of-Work. For the incentives, miners are apathetic actors in it for short-term and medium-term profit, with no guarantee of loyalty to the network. Miners can mine on any Proof-Of-Work network and does not have to stay loyal to Bitcoin. You therefore cannot trust miners to govern the network with healthy incentives in mind, at least on minority Proof-Of-Work chains. On majority Proof-Of-Work chains the loyalty is still questionable however, since miners are short-term actors.

Proof-Of-Work also creates a class-based governance mechanism. Since the miners are the vast minority of nodes on the network, in the case of a contentious chain split, the miners and the nodes might not be in agreement with each other, creating disharmony and chain safety issues. Since nodes are not inherently part of the Proof-Of-Work process, they are like on a different class than miners altogether, kinda like nobles and serfs.

Due to this split in power, the power of both miners and nodes on the network are diminished, giving more power to the developers in the face of a lack of a superior method to determine chain legitimacy. This further centralizes the already centralized network. Take Bitcoin Core for example, and how they are a centralized development group that unilaterally makes decisions for Bitcoin.

Proof-Of-Work Is Terrible At Distributing Coins

Proof-Of-Work is often heralded as the best way to distribute coins, since no person is in charge of distribution, making it seem “decentralized.” However Proof-Of-Work is objectively the worst way to distribute coins, especially for newer cryptocurrencies.

In Proof-Of-Work its not enthusiasts, firstcomers, or loyalists that are most benefitted by the POW-based distribution. It is also not the developers, builders, or businesses that are most benefitted. It is greedy corporations that live off of subsidized electricity that get basically all of the network rewards.

For newer cryptocurrencies the Proof-Of-Work coin distribution model is catastrophic, as an already large miner can just redirect their hashrate and resources at the small cryptocurrency, eat all of its rewards, and leave nothing left for anybody else. This is why basically all cryptocurrencies created recently are based on Proof-Of-Stake, because Proof-Of-Work is bad at distribution, and isn’t very secure either.

Proof-Of-Work Is Insecure

Proof-Of-Work is heavily dependant on inflation and redistributed wealth in order to keep the system incentivized and churning. For this reason, any Proof-Of-Work coin without long-term inflation or wealth-redistribution is doomed to a future of insecurity and 51% attacks. Take Ethereum Classic for example, which is 51% attacked like every week. Proof-Of-Work is a vastly insufficient security model, even cryptocurrencies like Ethereum Classic with a market cap of over half a billion dollars are regularly 51% attacked.

The difference in security between a Proof-Of-Work coin and a Proof-Of-Stake coin is the difference between building new hashing hardware, and buying up half of a cryptocurrency’s coins available on the market. The former is always possible with enough money, but the latter is impossible if there is more money staked than what is circulating. Usually, its far more expensive to attack a Proof-Of-Stake network than a Proof-Of-Work network, usually by hundreds of times.

Proof-Of-Work charlatans will argue that POW is more secure than POS because it requires continuous and ongoing cost to 51% attack, but they are wrong because being able to 51% attack the network at all means that both safety and liveness on the network is violated, and the chain can be split. If you can 51% attack a chain at all, all the assumptions you make about safety on the network should be thrown away, because after this point there are numerous efficacious attack vectors.

Proof-Of-Work Is Not The Only Permissionless System

It is often repeated by Proof-Of-Work charlatans that Proof-Of-Work is the only way to have a permissionless system, because its the only way to distribute coins without a person involved. This is a rather literalistic and semantically prude definition of “permissionless", and I could just as easily say Proof of Work is not permissionless because you have to ask people’s permissions to buy the hardware or get the electricity. Furthermore, in Bitcoin, there aren’t enough blocks to go around for everyone in the world to get a share of the “permissionless" block reward, without using a permissioned mining pool.

In reality, permissionlessness is a property of the ability for a user to send and receive coins on the network without there being someone to censor them. In either case (POW or POS), obtaining coins require buying or earning them, and getting them from the network itself requires an initial investment. Needing an investment in order to earn from the network goes against literal permissionlessness in either case, but in practicality a person can buy or earn coins from anywhere, and using them after this point is completely permissionless.

Fairness Is Subjective, Distribution Is Objective

“Fair Distribution" is one of the many tired anticoncepts repeated by Proof-Of-Work charlatans, and it doesn’t make any sense. Fairness is a subjective and social concept, and if its attributed any moral value at all than it is false altogether (as it can’t be immoral to voluntarily run transparent opt-in code). Distribution is an objective concept, that measures how much power in a network is spread across the members or nodes of the network. “Fair Distribution" as a concept doesn’t exist, because it doesn’t make any sense.

As for “Good Distribution,” this is determined by how many addresses hold a common number of coins, or how many nodes there are (if they have equal hashpower or stake), depending on if you are talking about distribution of power or money. Distribution of power and money are different, but are both important for the health of the network, the former giving it censorship resistance, the latter giving it price stability confidence.

As for this distribution, Bitcoin has absolutely terrible power distribution (as do most Proof-Of-Work networks), and the monetary distribution is average for its size. Proof of Stake networks do not inherently have poorer power or monetary distribution, and all depends on how the network is configured.

Conclusion

Proof-Of-Work is inefficient, centralized, unmeritocratic, has broken governance, terrible distribution, and is highly insecure. Proof-Of-Work is especially bad at distribution because only highly-subsidized corporations can afford to profitably mine, and this centralizes the network into the hands of government leeches.

A far superior anti-sybil mechanism that does not have the problem of centralizing the network is Proof of Stake, as it is more efficient, more secure, and allows for a properly decentralized network. As for distribution of coins, the best way to distribute coins is just for the creator of the network to distribute them far and wide, preferably to as many contributing actors as possible, and avoid having too many coins in one place.

Proof-Of-Work is simply unfit for a decentralized cryptocurrency and has not been proven to be useful for consensus. Its also a huge waste of resources to pay people for burning electricity when you could be paying them to build on the network. Proof-Of-Stake, when implemented properly, is far superior to Proof-Of-Work.

![]()

Why Proof-Of-Work Is The Worst Method Of Distribution For Any Cryptocurrency was originally published in Avalanche Hub on Medium, where people are continuing the conversation by highlighting and responding to this story.