YUSD – the newest addition to Avalanche stablecoins

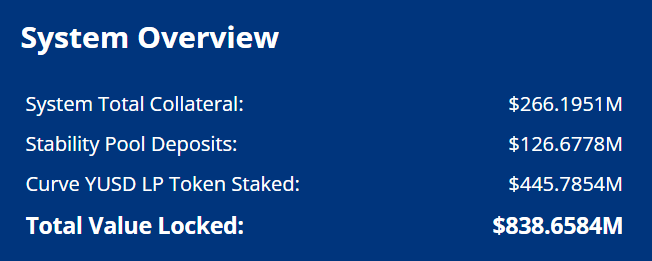

Yeti Finance launched on Avalanche on April 12th has quickly risen to the top and amassed more than $800 million in TVL, generating a revenue of $1.86 million in the first week. But what exactly is Yeti and why did it get so big so fast?

Building off Etherium’s Liquity protocol Yeti Finance allows users to supply collateral in form of interest-bearing (ib) and normal tokens and mint (borrow) their overcollateralized stablecoin – YUSD. Multiple things set it apart from existing landing and stablecoin (read our article on 5 Avalanche’s native stablecoins here) projects on Avalanche, namely zero-interest borrowing, high loan to value ratios, ve tokenomics and cross-margining.

In contrast to protocols like AAVE or BENQI Yeti doesn’t charge interest on the borrowed amount. Instead, users pay one-time deposit fees on their collateral depending on its type (the riskier the asset – the higher the percentage).

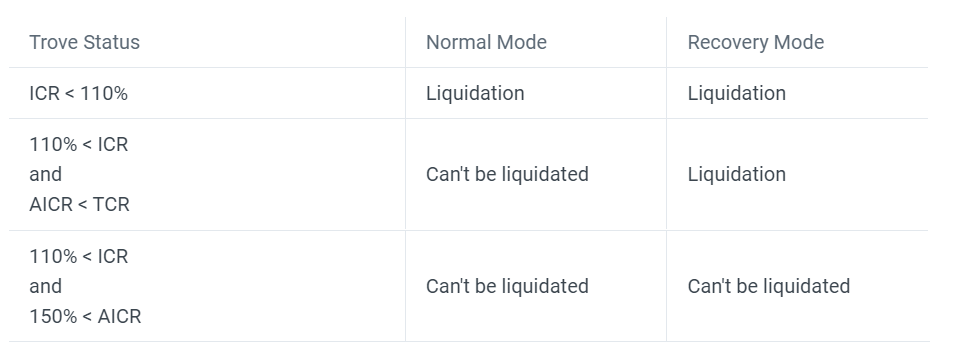

Under normal operation mode, Yeti’s users can leverage their position up to 11 times, by borrowing YUSD against their collateral selling for more collateral and depositing it to mint more YUSD. This is possible because YETI allows an Individual Collateral Ratio (ICR) of up to 110%. That is you can mint 1$ worth of YETI with $1.1 worth of collateral. To increase stability the protocol might enter recovery mode in case the Total Collateral Ratio (TCR) of the whole system falls before 150%. In this mode users with ICR above 110% but with Adjusted ICR (calculated based on the riskiness of each user’s collateral) below TCR will be liquidated.

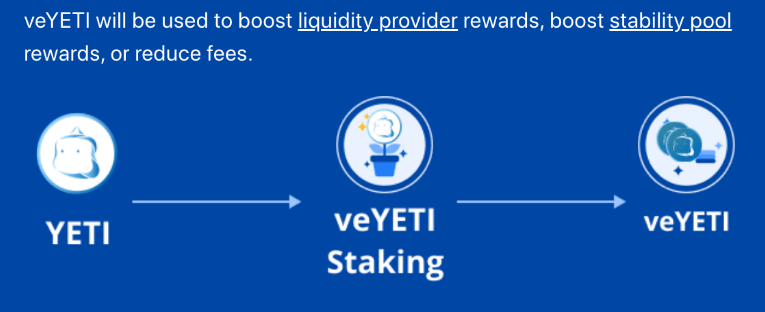

In line with protocols like Platypus and Trader Joe, Yeti has adopted a vote escrow model for their native YETI token. Users can stake their YETI to start acquiring veYETI, which would give them access to several benefits like boosting their rewards for liquidity provision, reducing fees and giving access to special strategies for their collateral.

Even though the basic mechanic of Yeti Finance are close to those of Teddy Cash, it distinguishes itself not only by accepting base-level tokens like WETH, WBTC, JOE and interest-bearing assets like Trader Joe LP positions and Benqi collateral but by providing yield on user deposits through a variety of auto compounding strategies (e.g., staking JOE as sJOE and selling acquired USDC for more JOE). Essentially this allows for self-repaying loans and reduces the risk of volatility and unexpected liquidations.

There is still a long road ahead in front of Yeti Finance, but so far they have shown that they are able to develop a unique product and with the recently announced investment from Avalanche Foundation on top of existing partnerships it seems that they have tools and resources to continue building and making Avalanche ecosystem better and more decentralised.