Alpha Homora Brings Leverage Yield Farming Product to Avalanche

With a powerful leveraging yield farming mechanism, Alpha Homora V2 brings the next generation of DeFi products to the fastest smart contracts platform.

Today Alpha Finance Lab has deployed Alpha Homora V2 on Avalanche, DeFi’s first leveraged yield farming product. Since launching Alpha Homora in October 2020, the product has reached significant user adoption and become a go-to protocol for DeFi. Through a number of unique and useful functionalities built-in to Alpha Homora V2, the new product further establishes itself as the go-to leveraged yield farming/leveraged liquidity providing protocol in DeFi.

With this launch on Avalanche, Alpha Homora V2 will break the gas fee obstacles for many users that can be much cheaper than on the other networks. With almost 900M TVL already on Alpha Homora V2, users will find plenty of opportunity for unique trading possibilities and liquidity in the market.

Here’s how it works.

Leverage Yield Farming

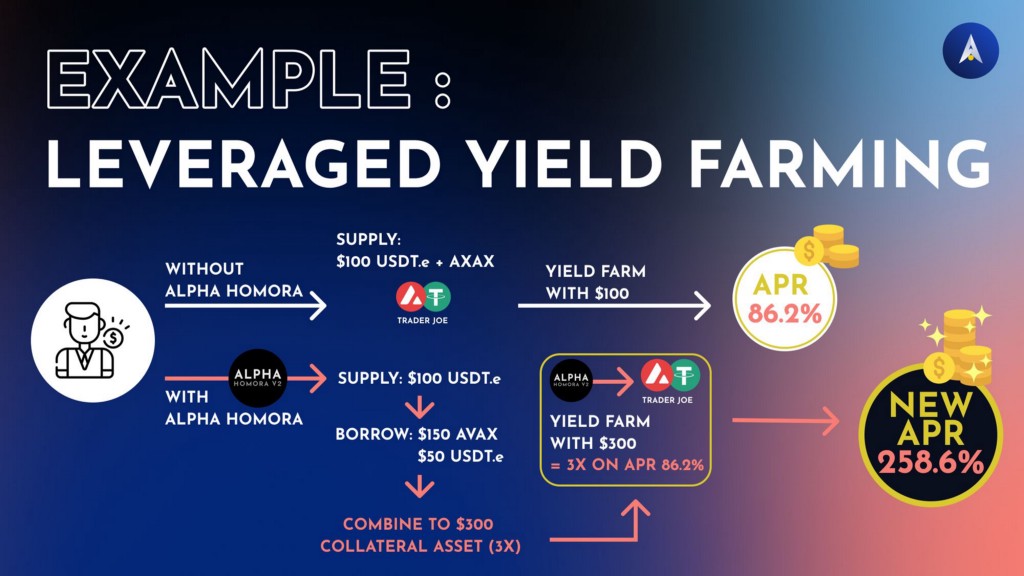

The innovative side of leverage yield farming on Alpha Homora V2 allows crypto farmers to combine their yield farming tokens with borrowed tokens as collateral. So users can earn even higher APR/APY exceeding the limit set by DEX protocols.

For instance, on Alpha Homora V2, you can supply $100 of USDT.e and borrow $200 of AVAX. Therefore, by combining both assets, you will have a total of $300 of collateral assets. This is then used to leverage yield farm, in which the reward is the return on $300, translating into 3X of the original APR/APY.

Trader Joe offers yield farmers 86.2% APR on USDT.e/AVAX pool, by leverage yield farming this pool through Alpha Homora V2, you can earn more, such that 3X on 258.6% APR (86.2 x 3) is possible.

Lenders

For those who prefer to lend their assets out and bear limited risks compared to leverage yield farmers, lending is easy and more beneficial on Alpha Homora V2 than other lending protocols. This is because there is a high demand to borrow these assets on Alpha Homora V2 driven from leverage yield farmers, leading to a significantly high lending interest rate for lenders.

Alpha Homora V2 on Avalanche

With a powerful leveraging yield farming mechanism, Alpha Homora V2 not only redefines what yield farming can be but how it can become.

Click here to watch: Introducing Alpha Homora V2 on Avalanche

About Alpha Finance Lab

Alpha Finance Lab is a DeFi Lab, and on a mission to build Alpha Universe. Alpha Universe includes the Alpha ecosystem, which consists of Alpha products that interoperate to maximize returns while minimizing risks for users, and other ecosystems incubated through the Alpha Launchpad incubator program.

Alpha Homora is Alpha Finance Lab’s first product and DeFi’s first leveraged yield farming product that also captures the market gap in lending, one of the key pillars of the financial system.

Join our Telegram/Discord for the latest updates, follow us on Twitter, or read more about us on our Blog and Document!

About Avalanche

Avalanche is the fastest smart contracts platform in the blockchain industry, as measured by time-to-finality, and has the most validators securing its activity of any proof-of-stake protocol. Avalanche is blazingly fast, low cost, and green. Any smart contract-enabled application can outperform its competition by deploying on Avalanche. Don’t believe it? Try Avalanche today.

Website | Whitepapers | Twitter | Discord | GitHub | Documentation | Forum | Avalanche-X | Telegram | Facebook | LinkedIn | Reddit | YouTube

![]()

Alpha Homora Brings Leverage Yield Farming Product to Avalanche was originally published in Avalanche on Medium, where people are continuing the conversation by highlighting and responding to this story.