Avalanche 101: An Overview of the Internet of Finance

With more people than ever interested in Avalanche, this overview will help new community members get up to speed and ready to dive deeper.

Avalanche is a platform that enables people and enterprises around the world to build decentralized solutions at scale. Now with Avalanche running on mainnet, we wanted to compile a deep overview of the platform to help you get up to speed on how the Avalanche platform works.

Within this article, you’ll learn:

- What is Avalanche?

- What is the Avalanche (AVAX) Token? What is its function?

- What makes Avalanche’s consensus protocol unique?

- How does the Avalanche platform work?

- How does staking work on Avalanche?

- Who is the team behind Avalanche?

- How is Avalanche different from Bitcoin & Bitcoin Cash?

- How is Avalanche different from Ethereum?

- How is Avalanche different from “Ethereum Killers”?

- Avalanche resources

What is Avalanche?

Avalanche is an open-source platform for launching decentralized finance (DeFi) applications and enterprise blockchain deployments in one interoperable, highly scalable ecosystem.

It is the first smart contracts platform that confirms transactions in under one second, supports the entirety of the Ethereum development toolkit, and enables millions of independent validators to participate as full block producers.

In addition to supporting sub-second finality, Avalanche is capable of throughput orders of magnitude greater than existing blockchain networks (4,500+ transactions/second), and safety thresholds well-above the 51% standards of other networks.

A key difference between Avalanche and other decentralized networks is the consensus protocol. Over time, people have come to a false understanding that blockchains have to be slow and not scalable after seeing the existing blockchains in action. The Avalanche protocol employs a novel approach to consensus to achieve its strong safety guarantees, quick finality, and high-throughput, without compromising decentralization.

What is the Avalanche (AVAX) Token? What is its function?

The Avalanche (AVAX) token is the native token of the Avalanche platform and is used to secure the network through staking, transact peer-to-peer, pay for fees, and provide a basic unit of account between the multiple subnetworks created on the Avalanche platform.

What makes Avalanche’s consensus protocol unique?

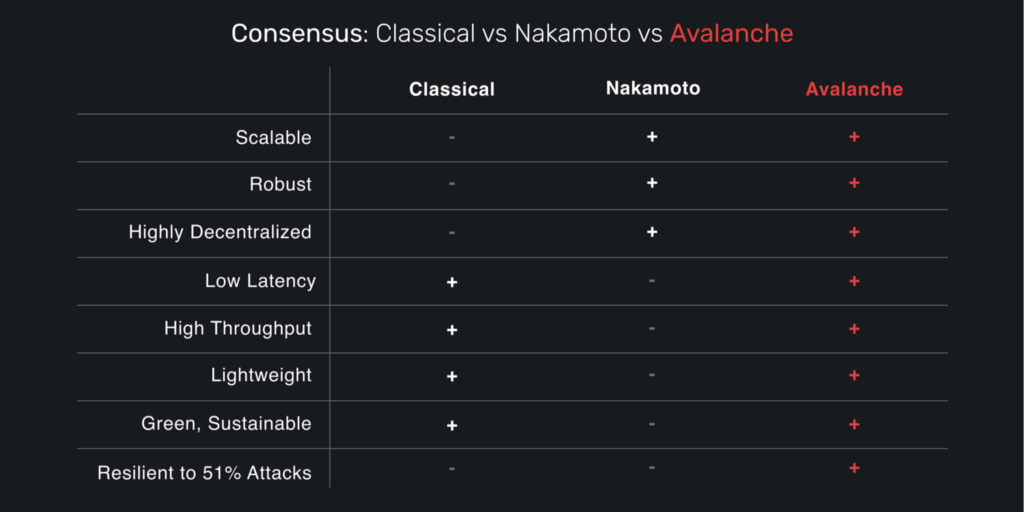

Over the 45-year history of distributed systems, there have only been three approaches to the consensus problem: Classical, Nakamoto, and Avalanche.

In the wake of Nakamoto’s work, the world still wanted a protocol with all of the benefits of Nakamoto consensus (robustness, decentralization) and all the benefits of Classical consensus (speed, scale, quick finality, and energy efficiency). Crypto’s own version of the proverbial, “have your cake and eat it too.”

Avalanche takes those revelations and combines them into a new protocol that attacks scaling, security, and speed at the absolute foundation of decentralized networks. Avalanche consensus shows that you can have the best of both Classical and Nakamoto without the downsides that come with either class of protocol.

This article contains high-level explanations. If you want to read detailed information on Avalanche, please check out Ava Labs’ whitepapers.

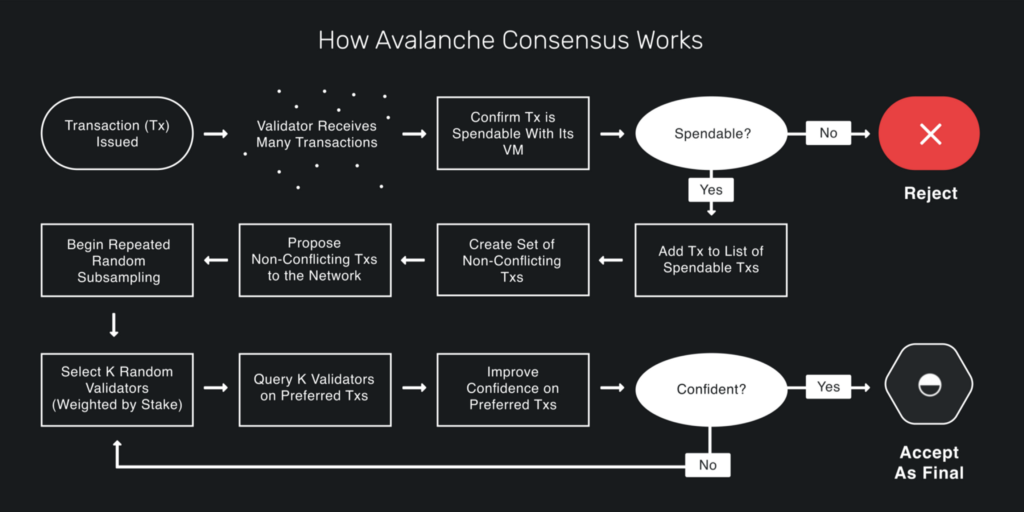

When a transaction is broadcast to the network, Avalanche validators undergo a process known as “repeated random subsampling” to independently poll other validators to determine if the transaction is valid.

Validators do this over and over again on new randomly selected nodes until it builds up enough data to determine that its probability of being correct is so high you may as well consider it impossible that it’s wrong. With enough confidence, a decision is finalized immediately in a process so fast that Avalanche rivals major payment systems in its ability to clear transactions in a network.

In addition to superior performance over existing consensus protocols, Avalanche doesn’t require expensive, specialized hardware to participate in the network as a validator. The computer you already use, or even the one gathering dust in a closet somewhere, can likely run an Avalanche node. Better yet, nodes only process transactions when there are transactions to be validated, so no wasted resources.

There’s no known cap on how many individuals can participate in the network at its deepest levels. Whereas Classical protocols’ performance degrades exponentially with greater participation (starting at ~100 nodes), Avalanche broke records with over 1,000 full, block-producing validators on public testnets and within a week of launch, had over 500 validators on mainnet.

The combination of those factors makes Avalanche nodes extremely green, economical, and accessible to individuals around the world.

How does the Avalanche platform work?

With Avalanche, we’ve innovated at every level of blockchain networks. Foundationally, with a breakthrough in consensus protocols, and then continuing, layer-by-layer, to evolve areas like network and virtual machine models that hadn’t been explored enough.

Unlike other networks that force terms and conditions of network participation uniformly across the system, Avalanche empowers individuals and enterprises to easily create powerful, reliable, and secure applications and custom blockchain networks with complex rulesets or build on existing private or public networks that fit their use case.

Take, for example, a regulated financial institution wanting to issue digital assets. In a system where the institution cannot control which nodes validate their network activity, it’s not possible for them to do so compliantly. In Avalanche, the same institution can achieve complete control over the virtual machine running their use case and the conditions of running a node on their custom sub-network.

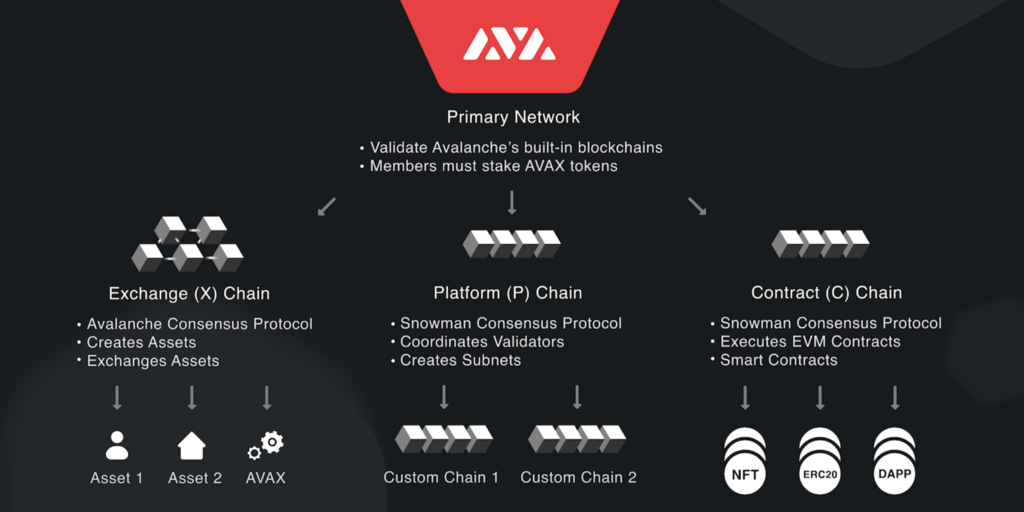

Avalanche employs a multi-chain framework with three blockchains that divide critical functions–and even employ different data structures–to give developers maximum flexibility and control over their applications.

First, there is the Exchange Chain (X-Chain). The X-Chain facilitates the creation and exchange of assets between individuals peer-to-peer, including Avalanche’s native token, AVAX. As opposed to a traditional blockchain where transactions are organized chronologically or by block height, Avalanche’s X-Chain is a directed acyclic graph (DAG).

DAGs link individual transactions to other transactions, rather than waiting for blocks of transactions to coalesce and be validated together. By optimizing for high volumes of transactions, DAGs have a significant advantage in scalability.

Second, there is the Contract Chain (C-Chain). The C-Chain is Avalanche’s default smart contract blockchain and a super-fast implementation of the Ethereum Virtual Machine. It is fully compatible with Solidity smart contracts and Ethereum tooling out of the box, so Ethereum developers can seamlessly port applications into the Avalanche ecosystem.

Whereas the X-Chain is a DAG, the C-Chain uses a modified version of Avalanche consensus that enables the traditional blockchain ordering required for smart contracts.

Finally, there is the Platform Chain (P-Chain). The P-Chain is responsible for staking, coordinating validators across networks, and creating custom subnets. Every Avalanche validator participates in staking on the P-Chain to help secure the core network, but these validators can then form dynamic or private sets of validators to operate subnets.

On these subnets, the validators have complete control over the data, economic model, virtual machine, and more. Meaning, a set of validators could port over virtual machines from any other blockchain network to effectively replace the underlying consensus mechanism, and optimize those networks’ performance and smart contract logic.

How does staking work on Avalanche?

Staking is a natural mechanism for participation in an open network and offers a direct economic argument: the probability of success of an attack is directly proportional to a well-defined monetary cost function. Staking nodes are economically motivated to act virtuously and avoid behavior that might hurt the value of their stake.

A node wishing to enter the network can freely do so by first putting up and locking a stake that cannot be moved for a defined period of time determined by the token holder. Once accepted, a stake cannot be reverted or unlocked to ensure that nodes share the same, stable view of the network. And better yet, for both the token holder and the network, is that this stake does not incur any additional upkeep costs.

Unlike other systems that also propose a proof-of-stake (PoS) mechanism, AVAX does not use slashing, and therefore, all stake is returned when the staking period expires.

Slashing is a protocol-driven action where a validator is forced to forfeit a proportion of its staked tokens because of behavior the network reads as dishonest or malfunctioning. These penalties are imposed without any human intervention and can be carried out for something as honest as a power failure taking a node offline.

There’s been significant debate around slashing, but the reality is that it makes staking unpredictable (which could discourage participation) and is more effective at punishing innocent bugs in client software or hardware than any security assurances.

We believe in building “calm technology” that is powerful, but predictable. In technology engineered for the challenges of the real-world, rather than overconfident in its adherence to perfect conditions.

With Avalanche, staked tokens are never at risk of a faulty network crackdown.

For more on how to stake AVAX with the Avalanche Wallet, please see this tutorial.

Who is the team behind Avalanche?

Ava Labs, the company behind the Avalanche platform, was co-founded by Cornell Professor Emin Gün Sirer, PhD candidate Kevin Sekniqi, and Maofan “Ted” Yin, first author of the HotStuff Protocol used in Facebook’s Libra.

It has grown into a world-class team of experts in computer science, business, economics, finance, and law with offices in New York City and Ithaca, New York, and team members around the world. We’re passionate individuals creating a frictionless world of financial services by redefining the way people build and use finance applications.

How is Avalanche different from Bitcoin & Bitcoin Cash?

When compared to Bitcoin, Bitcoin Cash, and other proof-of-work coins competing to replace fiat, Avalanche might look like an entirely different species, but we actually have some things in common.

Avalanche is a fixed cap asset, with a max of 720M AVAX in circulation. It employs Satoshi’s UTXO model for single-use credentials to facilitate payments, rather than an account model. Finally, Avalanche structures transactions like Segwit, without backward compatibility issues, and uses the Bech32 address format to minimize errors and maximize readability.

Unlike Bitcoin, however, Avalanche consensus is designed for speed, scalability, and flexibility in implementations.

- Bitcoin achieves transaction finality in 1 hour. Avalanche transactions achieve sub-second finality.

- Bitcoin’s blockchain production is centered around 2 dozen mining pools and solo miners. Avalanche can accommodate thousands to many millions of block producers without leaking value out of the system.

- Bitcoin can facilitate ~7 transactions per second. Avalanche has achieved 6,500 transactions per second, demonstrating that it can accommodate Visa-level throughput

Avalanche uses a proof-of-stake model for network security, which is both environmentally friendly and doesn’t require the highly-specialized (read: expensive) mining rigs that have led to centralization in mining. Meaning, thousands to even millions of individuals can fully participate in Avalanche with just a computer and internet connection — that’s real decentralization.

With Avalanche, we’re implementing some of our favorite qualities of Bitcoin, but optimizing the rest of the system for smart contracts and asset issuance.

How is Avalanche different from Ethereum?

When compared to Ethereum, Avalanche’s similarities are much more evident at the surface–after all, we do support the entirety of the Ethereum Virtual Machine (EVM) and its tooling–but under the hood, we approach our shared challenges in very different ways.

For now, Ethereum uses proof-of-work mining like Bitcoin and intends to migrate to proof-of-stake when it launches Ethereum 2.0. While proof-of-work is an excellent foundation for robust protocols, it achieves this stability by deliberately slowing down network actions and confirmations. A perfectly acceptable trade-off in Bitcoin’s “digital gold” thesis but a tough sell for the booming world of DeFi.

As long as Ethereum uses proof-of-work, it will struggle to scale participation without incurring massive fees and network congestion. Ethereum 2.0’s proof-of-stake approach will help, but it also introduces significant complexity and execution risk with its approach to scaling, “sharding”, which aims to process transactions simultaneously, rather than consecutively.

Avalanche attacks the scaling challenge from the absolute foundation for decentralized networks, consensus. Protocols in the Avalanche family are capable of achieving sub-second finality, supporting 4,500+ transactions per second, and scaling up to millions of full, block-producing validator nodes participating in consensus.

Unlike Ethereum, where applications have to compete for the same finite pool of network resources–which drives up fees for all participants–apps on Avalanche can run in their own independent blockchains validated by a dynamic, custom set of validators, known as subnets. These subnets are still connected to the broader ecosystem of chains on Avalanche, but now their relationships are purely value-adding (e.g. cross-network value transfer) rather than competitive.

Not only does this enable the creation of private subnets, it also allows developers to define the rules, economics, participants, and security of their implementation.

Similar to how we cherry-picked our favorite parts of Bitcoin, we’re implementing some of the amazing innovations of Ethereum and the EVM, while changing the core mechanics to make it faster, lighter, and cheaper to run.

How is Avalanche different from the “Ethereum Killers”?

We don’t see ourselves as an Ethereum Killer. Many of the people working on Avalanche took their first steps in crypto with Ethereum, and we still love the Ethereum community and what it’s achieved thus far. In fact, we believe we’re complementary to Ethereum as a sort of safety net as it transitions to Ethereum 2.0 with the risks of evolving the second-largest cryptocurrency by market cap.

Projects that are fine with being labeled Ethereum Killers have gathered around a family of classical consensus protocols whose limits are well-understood and heavily researched over the last 40 years.

These projects are often the most outspoken about transaction throughput and speeds, and suspiciously quiet about their decentralization — as characterized by the number of participants a network can accommodate or reliance on nominated leaders — and the resultant security tradeoffs of small cohorts having so much control.

Unlike these Ethereum Killers, Avalanche achieves sub-second finality, high throughput, and efficiency without sacrificing decentralization or security.

On Avalanche, validators conduct individual experiments when determining which nodes to sample. Each node samples without any consideration to the selections made by other nodes. No preferential treatment or enterprises buying special seats to peer down on nodes of lesser privilege.

To be clear, that’s not an easy needle to thread. It took the first major breakthrough in over a decade to make possible what scientists and researchers–our team included–long thought would never be achievable.

Avalanche Resources:

Avalanche on social media:

Whitepapers & documentation:

- Documentation (tutorials, guides, and more)

- Platform

- Consensus

- Token

Tools:

- Avalanche Wallet: a simple, secure, non-custodial wallet for storing Avalanche assets.

- Avalanche Explorer: an analytics tool that enables people to search the Avalanche network for transactions, addresses, and other platform activities

- Avascan: an independent blockchain explorer for Avalanche–backed by Avalanche-X

- VScout: an analytics tool for exploring Avalanche Subnets (Dynamic Validator Pools)

- AvaxMap: all active nodes running on Avalanche

Notable media coverage on Avalanche:

- Bloomberg — This Startup Aims to Prove Blockchain is Fast Enough for Finance

- The Block Crypto — Emin Gün Sirer says the AVA blockchain will scale better than Ethereum 2.0. Others say the problem is more complicated

- Forbes — Emin Gün Sirer As Digital Financier? United Kingdom’s Open Central Bank Digital Currency Project

- Coindesk — Ava Labs Seeks Wall Street Business After Open Sourcing ‘Avalanche’ Protocol

- Wired — These Researchers Are Trying to Build a Better Blockchain

Sampling of announced projects working with Avalanche:

- Chainlink

- Ledger

- Polyient Games

- Whiteblock

- LACChain Alliance

- Quanstamp

- BiLira

- Torus

- Figment Networks

- ablock

https://medium.com/media/b8a596544f943e3618682869c7e2f97a/href

About Avalanche

Avalanche is an open-source platform for launching decentralized finance applications and enterprise blockchain deployments in one interoperable, highly scalable ecosystem. Developers who build on Avalanche can easily create powerful, reliable, and secure applications and custom blockchain networks with complex rulesets or build on existing private or public subnets.

Website | Whitepapers | Twitter | Discord | GitHub | Documentation | Explorer | Avalanche-X | Telegram | Facebook | LinkedIn | Reddit | YouTube

![]()

Avalanche 101: An Overview of the Internet of Finance was originally published in Ava Labs on Medium, where people are continuing the conversation by highlighting and responding to this story.