KUU, an On-Chain Liquidity Underwriter, Integrates with Avalanche

KUU allows users to earn yield and partake in liquidations, arbitrage, and other profit seeking opportunities within Avalanche DeFi apps.

KUU, a decentralized protocol designed to maximize returns while providing backstop liquidity for decentralized apps, is now live on Avalanche.

- For liquidity providers, the integration provides a platform for parking idle assets and passively earning yields.

- For decentralized lending and synthetic asset applications, KUU will act to provide backstop liquidity, helping to keep the platforms healthy, especially during times of increased market volatility.

Users interested in depositing funds into KUU will be able to do so using single-asset communal pools (not subject to the risk of impermanent loss) that will be utilized by Keepers, on-chain bots that seek profit using flash loans. Keepers are responsible for finding arbitrage opportunities and performing liquidations on decentralized lending protocols.

In essence, Keepers ensure that market inefficiencies are resolved via arbitrage, and that lending platforms remain solvent by liquidating unhealthy loan positions.

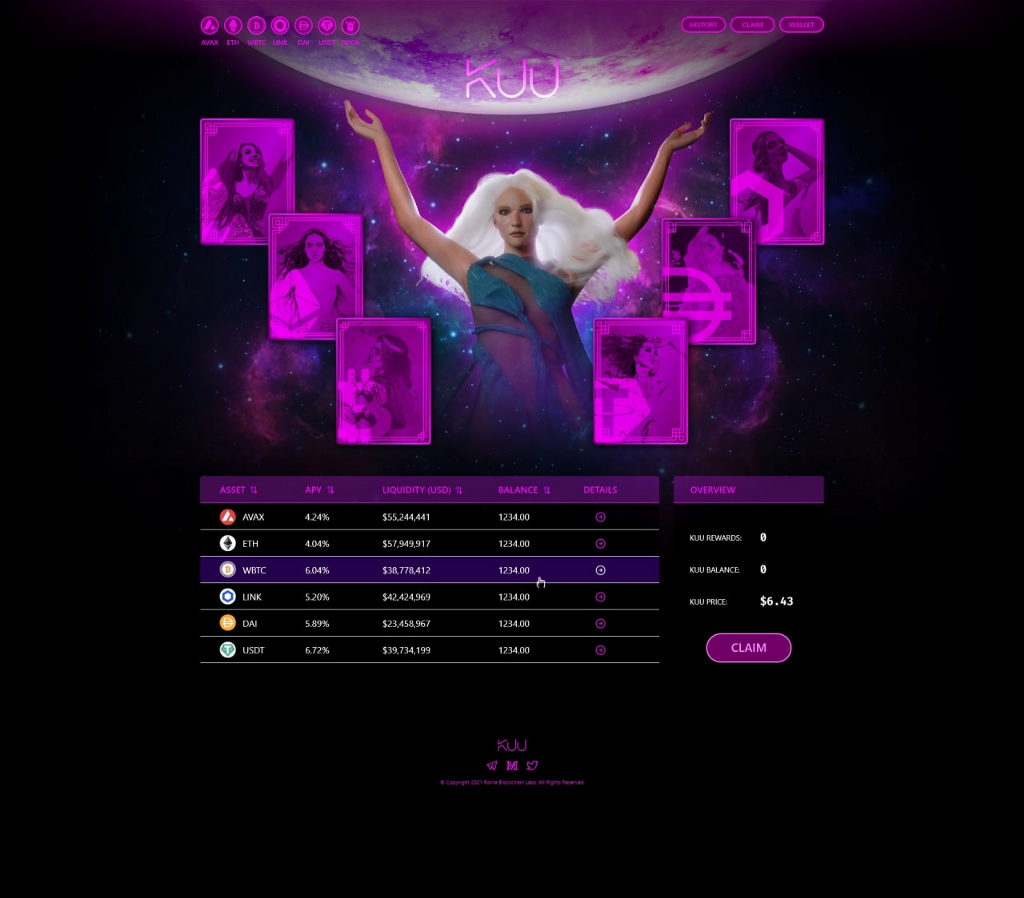

Decentralized finance (DeFi) users will be able to deposit into the single sided pools such as AVAX, LINK, ETH, WBTC, USDT, USDC, and DAI to earn a share of Keepers’ flash loan fees.

How KUU Works with Avalanche’s DeFi Apps

In DeFi, there are many ways to earn yields. Users participating in KUU’s protocols can expect higher yields during market uncertainties due to more frequent arbitrage and liquidation opportunities. During stable market conditions, underutilized assets are lent to other platforms, such as BENQI, to ensure that KUU is always earning yields for its liquidity providers.

In technical terms, KUU functions as a decentralized on-chain underwriter for Avalanche’s DeFi ecosystem, pooling user capital to fund smart contracts that collectively capture on-chain profits.

KUU’s on-chain Keepers are actors that borrow from its liquidity pool to efficiently manage liquidations, rebalances and arbitrage opportunities on DeFi applications spanning trading, lending, and exchange. More generally, Keepers are on-chain profit seekers who need capital, which is accessed via flash loans from KUU’s liquidity pool.

Flash loans enable Keepers to borrow large amounts of funds they do not own themselves, without having to provide collateral. In blockchain terms, a transaction does not have to be a single value transaction, as we know it in traditional finance. Smart contracts execute sequential actions within a transaction.

For example: lend AVAX, swap AVAX for ETH, swap ETH for DAI, swap DAI for AVAX and return the borrowed AVAX plus interest. As long as the actions between borrowing and returning yields enough profit for the Keeper to return the loan plus profit, it happened. If not, the loan never happened.

Built for Scaling Open Finance Through Avalanche

KUU benefits from Avalanche through its seamless, low cost access to decentralized financial services. Avalanche’s compatibility with the Ethereum Virtual Machine (EVM) makes it easy to port Ethereum applications to Avalanche with minimal friction for user mobility.

“For KUU to actively partake and solidify a foundation early, this presents an opportunity for the project to be at the forefront of Avalanche’s expansive DeFi development. KUU will support and provide vital integrations for the onboarding of over-collateralized lending platforms.

The KUU team is excited to showcase and explore all the possibilities of development in this technologically-robust ecosystem,” says Wilson Duarte, Co-Founder of KUU.

The protocol is inspired by the Finnish goddess of the moon, Kuutar. The name is derived from the Finnish word for moon, KUU.

https://medium.com/media/b8a596544f943e3618682869c7e2f97a/href

About KUU Finance

KUU protocol is a liquidity backstop for Decentralized Financial (DeFi) protocols within Avalanche by providing reinforcing liquidity to on-chain keepers maintaining the safety and efficiency of the protocols via liquidations and arbitrages.

Website | Twitter | Telegram | Discord | YouTube | Linkedln | Documentation

About Avalanche

Avalanche is the fastest smart contracts platform in the blockchain industry, as measured by time-to-finality, and has the most validators securing its activity of any proof-of-stake protocol. Avalanche is blazingly fast, low cost, and green. Any smart contract-enabled application can outperform its competition on Avalanche.

Website | Whitepapers | Twitter | Discord | GitHub | Documentation | Forum | Avalanche-X | Telegram | Facebook | LinkedIn | Reddit | YouTube

![]()

KUU, an On-Chain Liquidity Underwriter, Integrates with Avalanche was originally published in Avalanche on Medium, where people are continuing the conversation by highlighting and responding to this story.